- Introduction

- What Is Workman’s Comp Insurance?

- Benefits of Workman’s Comp Insurance

- Finding Workman’s Comp Insurance Near You

- Comparison of Workman’s Comp Insurance Providers

- Conclusion

-

FAQ about Workmans Comp Insurance Near Me

- 1. What is workers’ compensation insurance?

- 2. Who needs workers’ compensation insurance?

- 3. How much does workers’ compensation insurance cost?

- 4. What are the benefits of workers’ compensation insurance?

- 5. What are the benefits of workers’ compensation insurance to employees?

- 6. How can I find a workers’ compensation insurance provider near me?

- 7. What should I look for when choosing a workers’ compensation insurance provider?

- 8. How can I file a workers’ compensation claim?

- 9. What happens if my workers’ compensation claim is denied?

- 10. How can I get help with workers’ compensation insurance?

Introduction

Hey readers,

Are you a business owner seeking comprehensive protection against workplace accidents and liabilities? If so, understanding workman’s comp insurance is crucial. This article will delve deep into the intricacies of workman’s comp insurance, helping you navigate the complexities and make informed decisions for your business. By the end, you’ll have a clear understanding of what workman’s comp insurance entails, why it’s essential, and how to find the best coverage near you.

What Is Workman’s Comp Insurance?

Workman’s comp insurance, also known as workers’ compensation insurance, is a legal requirement in most states. It provides financial protection for employees who suffer work-related injuries or illnesses. The insurance covers medical expenses, lost wages, and other benefits to help injured workers recover and return to work.

Who Needs Workman’s Comp Insurance?

Any business with employees, regardless of size or industry, is required to carry workman’s comp insurance. Failure to do so can result in significant legal and financial penalties. It’s essential to note that self-employed individuals are not typically covered by workman’s comp insurance.

Benefits of Workman’s Comp Insurance

Protects Employees

Workman’s comp insurance ensures that injured employees receive necessary medical care and income replacement without facing financial burdens. It provides peace of mind for both employees and employers.

Reduces Business Liability

In the event of a work-related accident or illness, workman’s comp insurance limits the employer’s legal liability by providing a specific set of benefits to injured employees. This helps protect businesses from costly lawsuits and financial ruin.

Improves Employee Morale

Knowing they are protected in case of workplace accidents or illnesses can boost employee morale and productivity. Employees feel valued and have a sense of security when they know their employer has their back.

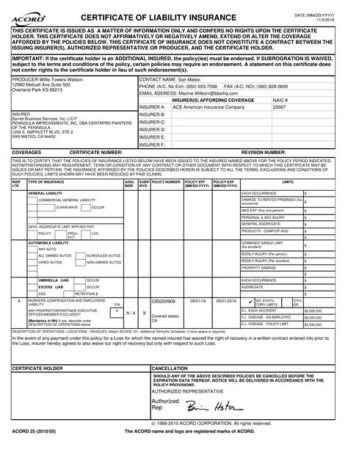

Finding Workman’s Comp Insurance Near You

Finding the right workman’s comp insurance policy for your business is crucial. Here are some tips to help you find the best coverage near you:

1. Determine Your Coverage Needs

Assess the risks your business faces and determine the appropriate level of coverage. Consider factors such as the number of employees, industry, and potential hazards.

2. Shop Around for Quotes

Don’t settle for the first quote you receive. Compare multiple quotes from different insurance providers to find the best combination of coverage and price.

3. Check Reviews and Testimonials

Read online reviews and testimonials from other businesses to gain insights into the reputation and customer service of potential insurance providers.

4. Consider Local Agents

Working with a local insurance agent can provide personalized service and tailored recommendations based on your specific needs. They can also assist with claims processing and ongoing support.

Comparison of Workman’s Comp Insurance Providers

| Provider | Coverage | Price | Customer Service |

|---|---|---|---|

| Provider A | Comprehensive coverage options | Competitive rates | Excellent reviews |

| Provider B | Customizable policies | Slightly higher rates | Average customer service |

| Provider C | Limited coverage options | Low rates | Poor customer support |

Note: This table provides a general overview of different providers. Contact individual providers for specific quotes and details.

Conclusion

Workman’s comp insurance is an essential investment for any business. It protects employees, reduces business liability, and improves employee morale. By understanding the basics of workman’s comp insurance and following the tips provided in this article, you can find the best coverage near you and safeguard your business against workplace accidents and illnesses.

For more information on business protection and risk management, check out our other articles on related topics.

FAQ about Workmans Comp Insurance Near Me

1. What is workers’ compensation insurance?

Workers’ compensation insurance provides financial benefits to employees who are injured or become ill due to work-related accidents or illnesses. It covers medical expenses, lost wages, and other costs related to the injury or illness.

2. Who needs workers’ compensation insurance?

Most employers are required by law to have workers’ compensation insurance. The specific requirements vary by state.

3. How much does workers’ compensation insurance cost?

The cost of workers’ compensation insurance varies depending on a number of factors, including the type of business, the number of employees, and the state in which the business is located.

4. What are the benefits of workers’ compensation insurance?

Workers’ compensation insurance provides a number of benefits to employers, including:

- Protection from lawsuits by injured employees

- Reduced costs associated with workplace injuries and illnesses

- Improved employee morale

5. What are the benefits of workers’ compensation insurance to employees?

Workers’ compensation insurance provides a number of benefits to employees, including:

- Medical expenses

- Lost wages

- Disability benefits

- Death benefits

6. How can I find a workers’ compensation insurance provider near me?

There are a number of ways to find a workers’ compensation insurance provider near you. You can:

- Search online for "workmans comp insurance near me"

- Contact your state’s workers’ compensation board

- Ask your business insurance agent

7. What should I look for when choosing a workers’ compensation insurance provider?

When choosing a workers’ compensation insurance provider, you should consider the following factors:

- The provider’s financial stability

- The provider’s experience and reputation

- The provider’s customer service

8. How can I file a workers’ compensation claim?

If you are injured or become ill due to a work-related accident or illness, you should file a workers’ compensation claim with your employer. Your employer will then provide you with a form to complete and submit to the insurance company.

9. What happens if my workers’ compensation claim is denied?

If your workers’ compensation claim is denied, you have the right to appeal the decision. You can do this by contacting your state’s workers’ compensation board.

10. How can I get help with workers’ compensation insurance?

If you have any questions about workers’ compensation insurance, you can contact your state’s workers’ compensation board or an attorney who specializes in workers’ compensation law.