- Introduction

- Understanding Workers Compensation Insurance

- The Importance of Workers Compensation Insurance Certificates

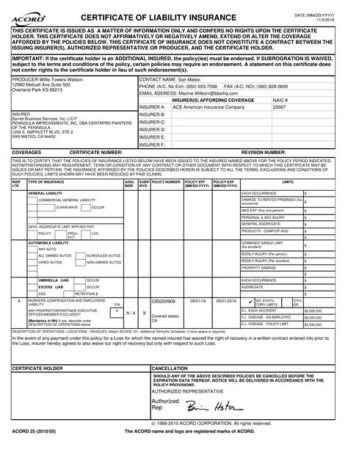

- Obtaining a Workers Compensation Insurance Certificate

- Maintaining Workers Compensation Insurance Coverage

- Table: Workers Compensation Insurance Certificate Breakdown

- Conclusion

-

FAQ about Workers Compensation Insurance Certificate

- 1. What is a Workers Compensation Insurance Certificate?

- 2. Why do I need a certificate?

- 3. What information does a certificate contain?

- 4. How long is a certificate valid?

- 5. Who should I provide a certificate to?

- 6. What happens if I don’t have a certificate?

- 7. How do I obtain a certificate?

- 8. What if I lose my certificate?

- 9. Are there different types of certificates?

- 10. Who is responsible for paying for the certificate?

Introduction

Hey there, readers! Today, we’re diving into the world of workers compensation insurance certificates. These seemingly mundane documents hold immense importance, safeguarding both employees and employers. So, whether you’re a business owner or an employee, buckle up and let’s unravel the intricacies of workers compensation insurance certificates!

Understanding Workers Compensation Insurance

Definition

Imagine if one of your employees gets injured on the job. In such unfortunate situations, workers compensation insurance steps in as a safety net, providing financial support to injured employees.

Coverage

Workers compensation insurance covers a wide range of expenses, including:

- Medical bills

- Lost wages

- Disability benefits

- Death benefits

The Importance of Workers Compensation Insurance Certificates

Proof of Coverage

A workers compensation insurance certificate is a legal document that proves that your business has obtained the required insurance coverage.

Protection for Employees

Employees have the right to a safe work environment. A workers compensation insurance certificate ensures that if they are injured on the job, they will receive the necessary medical care and financial support.

Protection for Employers

Workers compensation insurance also protects employers from potential lawsuits and financial liability arising from workplace injuries.

Obtaining a Workers Compensation Insurance Certificate

Step 1: Find an Insurance Provider

Shop around for insurance providers who offer workers compensation coverage. Compare premiums, deductibles, and coverage options to find the best fit for your business.

Step 2: Complete an Application

Once you’ve selected an insurance provider, complete an application that includes information about your business, number of employees, and payroll.

Step 3: Undergo an Inspection

Some insurance providers may require an inspection of your workplace to assess potential risks and determine the appropriate premium.

Step 4: Pay the Premium

After the policy is finalized, you will need to pay the premium to activate your coverage.

Maintaining Workers Compensation Insurance Coverage

Keep the Certificate Displayed

Once you receive your workers compensation insurance certificate, keep it prominently displayed in the workplace where employees can easily access it.

Review Regularly

Insurance policies can change over time, and it’s important to review your policy documents annually to ensure that you have adequate coverage.

Adjust Your Coverage as Needed

As your business grows or changes, you may need to adjust your workers compensation insurance coverage to reflect those changes.

Table: Workers Compensation Insurance Certificate Breakdown

| Field | Description |

|---|---|

| Certificate Number | Unique identifier for your insurance policy |

| Effective Date | Date when coverage begins |

| Expiration Date | Date when coverage ends |

| Employer Name | Name of the business or employer |

| Policy Number | Number associated with your insurance policy |

| Carrier | Insurance company providing coverage |

| Limits of Liability | Maximum amounts payable for claims |

| Deductible | Amount you pay before insurance coverage kicks in |

Conclusion

Understanding and obtaining a workers compensation insurance certificate is crucial for ensuring a safe and compliant workplace. By following the steps outlined above, you can protect both your business and your employees from financial hardship in the event of a workplace injury.

And while you’re here, don’t forget to check out our other comprehensive articles on various insurance topics to stay informed and protected!

FAQ about Workers Compensation Insurance Certificate

1. What is a Workers Compensation Insurance Certificate?

A Workers Compensation Insurance Certificate is a document that proves that an employer has purchased workers compensation insurance, which provides coverage for employees who are injured or become ill due to their work.

2. Why do I need a certificate?

Many states require employers to have workers compensation insurance, and it is often required by clients and contractors as proof of coverage.

3. What information does a certificate contain?

A certificate contains essential information, such as the employer’s name, policy number, effective dates of coverage, and the amount of coverage.

4. How long is a certificate valid?

The validity period is typically one year from the effective date of the policy.

5. Who should I provide a certificate to?

You should provide a certificate to any party that requests it, such as clients, contractors, or government agencies.

6. What happens if I don’t have a certificate?

Failure to provide a certificate may result in penalties or the inability to work with certain clients or government agencies.

7. How do I obtain a certificate?

You can request a certificate from your insurance company or agent.

8. What if I lose my certificate?

Contact your insurance company or agent to request a replacement certificate.

9. Are there different types of certificates?

Yes, there are two main types: an Acord 125 Certificate, which is the standard format, and an Evidence of Coverage, which is a simplified version.

10. Who is responsible for paying for the certificate?

Typically, the employer is responsible for the cost of the certificate.