- Workers Comp Insurance PA: A Comprehensive Guide for Employers and Employees

-

FAQ about Workers’ Compensation Insurance PA

- 1. What is workers’ compensation insurance?

- 2. Who is required to have workers’ compensation insurance in Pennsylvania?

- 3. How much does workers’ compensation insurance cost?

- 4. What are the benefits of having workers’ compensation insurance?

- 5. How do I file a workers’ compensation claim?

- 6. What if my workers’ compensation claim is denied?

- 7. How long do I have to file a workers’ compensation claim?

- 8. What is the maximum amount of benefits I can receive under workers’ compensation?

- 9. What happens if I am injured at work but not in Pennsylvania?

- 10. Where can I get more information about workers’ compensation insurance?

Workers Comp Insurance PA: A Comprehensive Guide for Employers and Employees

Introduction

Greetings, readers! Welcome to our comprehensive guide on workers’ compensation insurance in Pennsylvania. This guide aims to provide both employers and employees with a thorough understanding of this essential coverage. We will delve into the various aspects of workers’ comp insurance, including coverage details, responsibilities of employers and employees, and how to navigate the claims process.

Section 1: Understanding Workers’ Comp Insurance PA

What is Workers’ Comp Insurance?

Workers’ compensation insurance is a type of insurance that provides benefits to employees who suffer work-related injuries or illnesses. These benefits can include medical expenses, lost wages, and disability benefits. In Pennsylvania, workers’ comp insurance is mandatory for employers with one or more employees.

Who is Covered by Workers’ Comp Insurance?

In Pennsylvania, all employees are covered by workers’ comp insurance, regardless of their immigration status or citizenship. However, independent contractors and self-employed individuals are not covered.

Section 2: Employer Responsibilities

Securing Workers’ Comp Insurance Coverage

Employers are required by law to secure workers’ comp insurance coverage from an approved insurance carrier. Failure to do so can result in significant penalties, including fines and imprisonment.

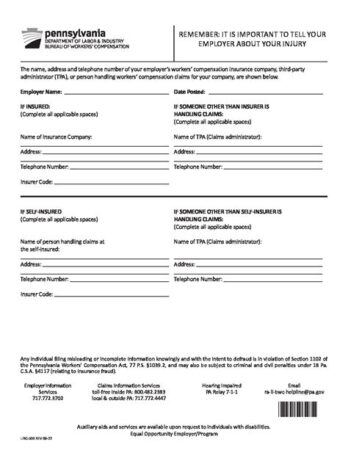

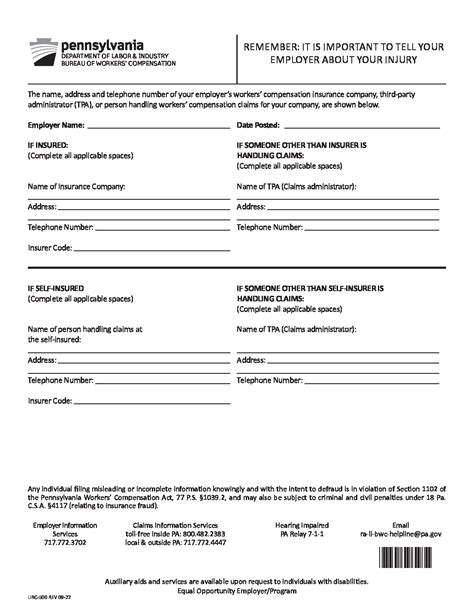

Posting Notice of Coverage

Employers must conspicuously post a notice of workers’ comp insurance coverage in their workplace. This notice must include the name and contact information of the insurance carrier.

Reporting Work-Related Injuries and Illnesses

Employers are required to report work-related injuries and illnesses to their insurance carrier within a specified time frame. The specific time frame varies depending on the severity of the injury or illness.

Section 3: Employee Rights and Responsibilities

Reporting Injuries and Illnesses

Employees who suffer work-related injuries or illnesses should immediately report them to their supervisor. Delay in reporting can result in a delay in benefits.

Filing a Workers’ Comp Claim

If an employee sustains a work-related injury or illness, they must file a workers’ comp claim with their employer’s insurance carrier. The insurance carrier will investigate the claim and determine eligibility for benefits.

Attending Medical Appointments

Injured employees must attend all scheduled medical appointments for treatment and evaluation. Failure to do so can jeopardize their benefits.

Section 4: Navigating the Claims Process

Settling Claims

Most workers’ comp claims are settled through negotiation between the insurance carrier and the employee. Attorneys can assist employees in negotiating settlements.

Appealing Denials

If an insurance carrier denies a workers’ comp claim, the employee can appeal the decision with the Pennsylvania Workers’ Compensation Appeal Board.

Returning to Work

Injured employees who are able to return to work may be entitled to partial disability benefits. These benefits are designed to supplement lost wages during the recovery period.

Section 5: Breakdown of Benefits

| Benefit Type | Description |

|---|---|

| Medical Expenses | Covers all necessary medical treatment related to the work-related injury or illness |

| Lost Wages | Provides compensation for lost income due to the injury or illness |

| Disability Benefits | Provides a percentage of lost wages if the employee is unable to work due to permanent disability |

| Death Benefits | Provides financial assistance to the employee’s family in case of a work-related death |

Conclusion

Workers’ compensation insurance in Pennsylvania is a complex topic, but it is essential for employers and employees to understand. This guide has provided a comprehensive overview of the various aspects of workers’ comp insurance, including coverage details, responsibilities of employers and employees, and how to navigate the claims process. By understanding their rights and obligations, both employers and employees can ensure a fair and equitable workers’ compensation system.

For further information and assistance, we encourage you to check out the following resources:

- Pennsylvania Workers’ Compensation Appeal Board

- Pennsylvania Department of Labor & Industry

- National Council on Compensation Insurance

Stay informed and protected!

FAQ about Workers’ Compensation Insurance PA

1. What is workers’ compensation insurance?

Workers’ compensation insurance provides coverage for employees who are injured or become ill due to their work. It covers medical expenses, lost wages, and other benefits.

2. Who is required to have workers’ compensation insurance in Pennsylvania?

All employers in Pennsylvania with one or more employees are required to have workers’ compensation insurance.

3. How much does workers’ compensation insurance cost?

The cost of workers’ compensation insurance varies depending on the size and industry of the business.

4. What are the benefits of having workers’ compensation insurance?

Workers’ compensation insurance provides several benefits, including:

- Coverage for medical expenses

- Lost wage replacement

- Death benefits

- Vocational rehabilitation

5. How do I file a workers’ compensation claim?

To file a workers’ compensation claim, you must notify your employer of your injury or illness within 21 days. You will then need to file a claim with the Pennsylvania Workers’ Compensation Board.

6. What if my workers’ compensation claim is denied?

If your workers’ compensation claim is denied, you can appeal the decision. You will need to file an appeal with the Pennsylvania Workers’ Compensation Board within 30 days of the denial.

7. How long do I have to file a workers’ compensation claim?

You have three years from the date of your injury or illness to file a workers’ compensation claim.

8. What is the maximum amount of benefits I can receive under workers’ compensation?

The maximum amount of benefits you can receive under workers’ compensation is $1,000 per week.

9. What happens if I am injured at work but not in Pennsylvania?

If you are injured at work but not in Pennsylvania, you may still be eligible for workers’ compensation benefits. You should contact the workers’ compensation board in the state where you were injured.

10. Where can I get more information about workers’ compensation insurance?

You can get more information about workers’ compensation insurance from the Pennsylvania Workers’ Compensation Board website: https://www.wcb.pa.gov/