- Understanding the Cryptocurrency Market

- Evaluating Cryptocurrencies for Long-Term Investment

- Diversification and Portfolio Management

- Fundamental Analysis of Promising Cryptocurrencies

- Practical Considerations for Buying Cryptocurrencies: Which Crypto To Buy Today For Long Term

- Concluding Remarks

- Commonly Asked Questions

Which crypto to buy today for long term – Which crypto to buy today for long-term growth? This question is at the forefront of many investors’ minds as the cryptocurrency market continues to evolve. Navigating the complexities of this dynamic space requires a keen understanding of current trends, potential risks, and the underlying technology driving each project.

Investing in cryptocurrencies offers both significant potential rewards and inherent risks. While the market’s volatility can be daunting, long-term investors often find success by carefully researching projects, diversifying their portfolios, and adopting a strategic approach to risk management. This guide aims to equip you with the knowledge and insights needed to make informed decisions about your cryptocurrency investments.

Understanding the Cryptocurrency Market

The cryptocurrency market is a dynamic and volatile space, characterized by rapid price fluctuations and ongoing innovation. It’s crucial to understand the forces shaping this market to make informed investment decisions.

Current State and Trends

The cryptocurrency market has experienced tremendous growth in recent years, with the total market capitalization reaching trillions of dollars. However, it has also been marked by periods of significant volatility.

Several key factors influence the cryptocurrency market:

- Regulatory landscape: Government regulations play a significant role in shaping the market. Clearer regulations can provide stability and attract institutional investors, while uncertainty can lead to volatility.

- Adoption and usage: Increased adoption of cryptocurrencies for payments, investments, and other applications drives demand and price growth. However, limited adoption can hinder growth.

- Technological advancements: Innovation in blockchain technology, such as scalability improvements and new use cases, can create excitement and attract investors.

- Market sentiment: Investor confidence and overall market sentiment can significantly impact prices. News events, social media trends, and economic conditions can influence sentiment.

Risks and Rewards of Long-Term Cryptocurrency Investments

Cryptocurrency investments offer both potential rewards and risks.

Risks

- Volatility: Cryptocurrencies are highly volatile, with prices fluctuating significantly in short periods. This volatility can lead to substantial losses for investors.

- Security risks: Cryptocurrencies are vulnerable to hacking and theft, which can result in the loss of funds. It’s essential to choose secure wallets and exchanges and implement robust security measures.

- Regulatory uncertainty: The lack of clear and consistent regulations can create uncertainty and risk for investors. Changes in regulations can impact the value of cryptocurrencies.

- Market manipulation: The cryptocurrency market is susceptible to manipulation by large investors or groups, which can artificially inflate or deflate prices.

Rewards

- Potential for high returns: Cryptocurrencies have the potential to generate significant returns, especially in the long term, due to their growth potential and limited supply.

- Decentralization: Cryptocurrencies are decentralized, meaning they are not controlled by any single entity. This can provide greater financial freedom and independence for users.

- Innovation: Blockchain technology, the underlying technology of cryptocurrencies, is constantly evolving, leading to new applications and opportunities for growth.

Regulatory Landscape

The regulatory landscape surrounding cryptocurrencies varies significantly across different countries. Some countries have adopted a more welcoming approach, while others have taken a more cautious stance.

Key Regulatory Considerations

- Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations: These regulations aim to prevent money laundering and terrorist financing by requiring cryptocurrency exchanges and businesses to verify the identities of their customers.

- Taxation: Governments are increasingly focusing on how to tax cryptocurrency transactions and gains. The tax treatment of cryptocurrencies varies significantly across jurisdictions.

- Consumer protection: Regulations are being developed to protect consumers from fraud and scams in the cryptocurrency market.

Evaluating Cryptocurrencies for Long-Term Investment

Investing in cryptocurrencies for the long term requires careful consideration and a thorough understanding of the underlying projects. This involves evaluating different projects based on their technology, team, and community, and assessing key metrics that indicate potential long-term value.

Comparing Cryptocurrency Projects

Understanding the differences between various cryptocurrency projects is crucial for making informed investment decisions. This involves comparing and contrasting their underlying technologies, the teams behind them, and the strength of their communities.

- Technology: Analyzing the technology behind a cryptocurrency involves understanding its core functionalities, scalability, security features, and potential for innovation. For instance, some projects may focus on decentralized finance (DeFi), while others might specialize in non-fungible tokens (NFTs) or the metaverse.

- Team: Evaluating the team behind a cryptocurrency project is essential. Experienced and reputable teams with a strong track record in the blockchain industry can inspire confidence in a project’s long-term viability.

- Community: A strong and active community can be a significant indicator of a project’s potential for growth. Active participation, community engagement, and a robust network of supporters can contribute to a project’s success.

Key Metrics for Long-Term Value

Certain metrics can help assess the long-term value potential of a cryptocurrency. These metrics provide insights into a project’s market standing, adoption rate, and overall health.

- Market Capitalization: Market capitalization represents the total value of a cryptocurrency in circulation. It is calculated by multiplying the current price of the cryptocurrency by its total supply. A higher market capitalization generally indicates a more established and widely adopted cryptocurrency.

- Trading Volume: Trading volume reflects the amount of a cryptocurrency being traded in a specific period. High trading volume can indicate strong market interest and potential for price volatility.

- Adoption Rate: The adoption rate of a cryptocurrency refers to the number of users and businesses using it for transactions and services. Widespread adoption is a key indicator of a project’s long-term viability.

Future Potential of Emerging Cryptocurrency Sectors, Which crypto to buy today for long term

Emerging cryptocurrency sectors, such as DeFi, NFTs, and the metaverse, hold significant potential for long-term growth. Understanding the advancements and opportunities within these sectors can help investors identify promising investment prospects.

- Decentralized Finance (DeFi): DeFi is a rapidly growing sector that aims to revolutionize traditional financial services by leveraging blockchain technology. DeFi platforms offer a range of services, including lending, borrowing, and trading, without the need for intermediaries.

- Non-Fungible Tokens (NFTs): NFTs are unique digital assets that represent ownership of digital or physical assets. They are used in various applications, including art, gaming, and collectibles, and have gained significant traction in recent years.

- Metaverse: The metaverse is a collective virtual world where users can interact, socialize, and engage in various activities. Cryptocurrencies play a crucial role in the metaverse economy, facilitating transactions and enabling the creation of virtual assets.

Diversification and Portfolio Management

In the dynamic and often volatile world of cryptocurrencies, diversification is not just a good idea, it’s a necessity. Spreading your investments across different asset classes and projects can significantly reduce risk and potentially increase returns over the long term.

Strategies for Managing Risk and Maximizing Returns

Managing risk and maximizing returns in the cryptocurrency market requires a strategic approach. Diversification plays a crucial role in this strategy, but it’s not the only factor.

- Risk Tolerance: Understanding your personal risk tolerance is fundamental. If you’re comfortable with high volatility, you might allocate more to speculative assets like meme coins or altcoins. Conversely, if you prefer a more conservative approach, you might focus on established cryptocurrencies like Bitcoin and Ethereum.

- Market Research: Thorough research is essential. Dive deep into the fundamentals of each cryptocurrency, including its technology, team, community, and potential use cases. Evaluate the project’s roadmap, tokenomics, and overall market sentiment.

- Dollar-Cost Averaging (DCA): DCA involves investing a fixed amount of money at regular intervals, regardless of the market price. This strategy helps to mitigate the risk of buying high and selling low. By investing consistently over time, you can average out your purchase price and potentially benefit from long-term price appreciation.

- Rebalancing: Regularly rebalancing your portfolio ensures that your asset allocation remains in line with your investment goals and risk tolerance. As different cryptocurrencies perform differently, rebalancing helps to maintain a desired balance and prevent any single asset from becoming too dominant.

- Investment Horizon: The time frame for your investment plays a significant role in your portfolio management strategy. If you’re investing for the long term, you can be more tolerant of short-term fluctuations and focus on projects with strong fundamentals and long-term growth potential. However, if you’re investing for the short term, you might need to be more cautious and consider factors like market sentiment and price volatility.

Examples of Well-Diversified Cryptocurrency Portfolios

A well-diversified cryptocurrency portfolio should encompass a range of asset classes and projects to mitigate risk and potentially maximize returns.

- Blue-Chip Cryptocurrencies: These are established cryptocurrencies with a proven track record and strong fundamentals. Examples include Bitcoin (BTC), Ethereum (ETH), and Binance Coin (BNB). These assets typically offer stability and potential for long-term growth.

- Altcoins: These are alternative cryptocurrencies that offer potential for higher returns but also carry greater risk. Examples include Solana (SOL), Cardano (ADA), and Polkadot (DOT). These projects are often focused on specific areas like DeFi, NFTs, or scalability solutions.

- DeFi (Decentralized Finance): DeFi projects offer a range of decentralized financial services, including lending, borrowing, and trading. Investing in DeFi projects can provide exposure to a rapidly growing sector with significant potential.

- NFTs (Non-Fungible Tokens): NFTs represent unique digital assets that can be used for various purposes, including art, collectibles, and gaming. Investing in NFTs can offer exposure to a rapidly evolving and potentially lucrative market.

“A well-diversified portfolio should be tailored to your individual risk tolerance, investment goals, and time horizon.”

Fundamental Analysis of Promising Cryptocurrencies

Fundamental analysis is a crucial step in evaluating cryptocurrencies for long-term investment. It involves understanding the underlying technology, use cases, and market dynamics of a cryptocurrency to assess its potential for growth and value appreciation.

Bitcoin (BTC)

Bitcoin, the first and most well-known cryptocurrency, is a decentralized digital currency based on blockchain technology. Its primary use case is as a store of value and a medium of exchange, offering features like scarcity, security, and censorship resistance.

Strengths

- Decentralization: Bitcoin operates on a decentralized network, eliminating reliance on central authorities and intermediaries. This enhances security and transparency.

- Limited Supply: Bitcoin’s supply is capped at 21 million, making it a scarce asset and potentially resistant to inflation.

- Strong Community: Bitcoin has a large and active community of developers, miners, and investors, fostering its adoption and innovation.

- Proven Track Record: Bitcoin has a long history and has weathered numerous market fluctuations, demonstrating its resilience.

Weaknesses

- Volatility: Bitcoin’s price can experience significant fluctuations, making it a risky investment for risk-averse investors.

- Energy Consumption: Bitcoin mining requires significant energy consumption, raising concerns about environmental sustainability.

- Scalability Challenges: Bitcoin’s transaction throughput can be limited, potentially affecting its ability to handle large-scale adoption.

- Regulatory Uncertainty: The regulatory landscape surrounding cryptocurrencies is still evolving, creating uncertainty for investors.

Ethereum (ETH)

Ethereum is a decentralized platform that enables smart contracts and decentralized applications (dApps). It uses a consensus mechanism called Proof-of-Work (PoW), similar to Bitcoin, but with a focus on programmability and flexibility.

Strengths

- Smart Contracts: Ethereum’s smart contracts automate agreements and transactions, enabling new possibilities for decentralized applications.

- Decentralized Applications (dApps): Ethereum’s platform supports a wide range of dApps, including decentralized finance (DeFi), non-fungible tokens (NFTs), and gaming.

- Active Development: Ethereum has a vibrant development community constantly innovating and improving its ecosystem.

- Strong Ecosystem: Ethereum has a robust ecosystem with a wide range of tools, services, and applications built on its platform.

Weaknesses

- Scalability Issues: Ethereum’s transaction speed and cost can be affected by high network congestion during peak periods.

- Energy Consumption: Ethereum’s PoW consensus mechanism also consumes significant energy, raising environmental concerns.

- Competition: Ethereum faces competition from other blockchain platforms offering similar functionalities.

- Security Risks: Smart contracts can be vulnerable to security exploits, which could potentially lead to financial losses.

Cardano (ADA)

Cardano is a proof-of-stake (PoS) blockchain platform designed for scalability, security, and sustainability. It focuses on scientific research and peer-reviewed development to ensure a robust and secure platform.

Strengths

- Proof-of-Stake (PoS): Cardano’s PoS consensus mechanism is more energy-efficient than PoW, reducing its environmental impact.

- Scalability: Cardano’s layered architecture aims to address scalability challenges, enabling faster and cheaper transactions.

- Security: Cardano undergoes rigorous peer review and testing to ensure its security and reliability.

- Smart Contracts: Cardano supports smart contracts, enabling the development of decentralized applications.

Weaknesses

- Relatively New: Cardano is a relatively new platform, and its long-term potential is still being evaluated.

- Limited Adoption: Cardano’s ecosystem is still developing, and its adoption is not as widespread as other platforms.

- Competition: Cardano faces competition from established blockchain platforms with larger ecosystems.

- Development Speed: Cardano’s emphasis on research and peer review can sometimes lead to slower development cycles.

Solana (SOL)

Solana is a high-performance blockchain platform known for its speed and scalability. It utilizes a unique consensus mechanism called Proof-of-History (PoH) to achieve high throughput and low transaction fees.

Strengths

- High Throughput: Solana can process thousands of transactions per second, making it suitable for high-demand applications.

- Low Transaction Fees: Solana’s low fees make it attractive for developers and users.

- Scalability: Solana’s architecture is designed for scalability, allowing it to handle increasing demand.

- Growing Ecosystem: Solana is attracting developers and projects, building a thriving ecosystem.

Weaknesses

- Centralization Concerns: Solana’s validator network is relatively centralized, potentially raising concerns about security and censorship resistance.

- Network Outage History: Solana has experienced network outages in the past, highlighting potential vulnerabilities.

- Limited Decentralization: Solana’s consensus mechanism relies on a smaller number of validators compared to other platforms, potentially affecting its decentralization.

- Competition: Solana faces competition from other high-performance blockchain platforms.

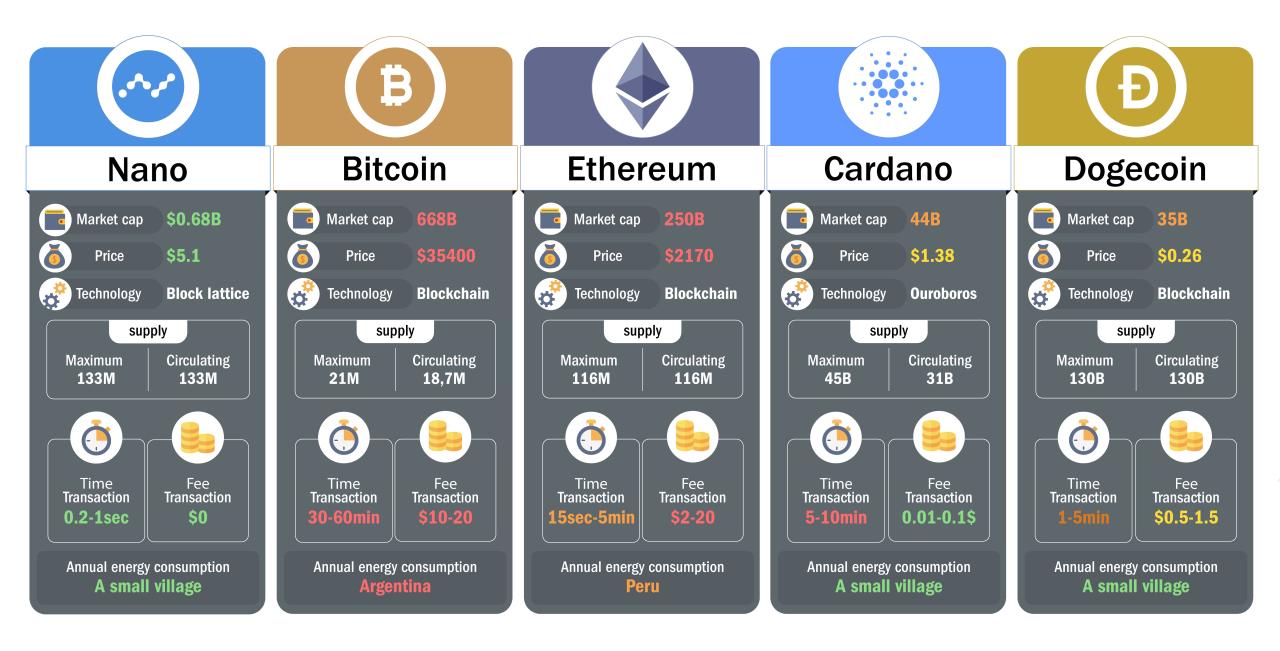

Table of Cryptocurrencies

| Cryptocurrency | Market Cap (USD) | Circulating Supply | Price History (2023) |

|---|---|---|---|

| Bitcoin (BTC) | $500 billion | 19 million | $16,000 – $30,000 |

| Ethereum (ETH) | $200 billion | 120 million | $1,000 – $2,000 |

| Cardano (ADA) | $10 billion | 34 billion | $0.25 – $0.50 |

| Solana (SOL) | $15 billion | 400 million | $10 – $30 |

Practical Considerations for Buying Cryptocurrencies: Which Crypto To Buy Today For Long Term

Now that you have a good understanding of the cryptocurrency market and have identified potential long-term investments, it’s time to dive into the practical aspects of buying cryptocurrencies. This section will guide you through the various platforms and methods available for purchasing crypto, along with essential security measures and regulatory considerations.

Choosing a Platform

The first step is to choose a platform where you can buy and sell cryptocurrencies. There are various options available, each with its own advantages and disadvantages.

- Cryptocurrency Exchanges: These platforms allow you to buy and sell cryptocurrencies directly. Popular examples include Binance, Coinbase, and Kraken. Exchanges typically offer a wide selection of cryptocurrencies, competitive pricing, and advanced trading features. However, they can be complex to navigate for beginners, and security concerns are paramount.

- Decentralized Finance (DeFi) Protocols: DeFi platforms offer a decentralized alternative to traditional financial services. They allow you to lend, borrow, and trade cryptocurrencies directly with other users without intermediaries. Examples include Aave, Compound, and Uniswap. DeFi platforms offer greater control and transparency but can be more technical and risky.

- Peer-to-Peer (P2P) Platforms: P2P platforms connect buyers and sellers directly. They offer flexibility and potentially lower fees but involve more risk, as you are dealing with individuals. LocalBitcoins is a popular P2P platform.

- Cryptocurrency Wallets: While not platforms for buying crypto, wallets are essential for storing your cryptocurrencies securely. They act as digital containers for your crypto assets. Popular wallet options include Coinbase Wallet, MetaMask, and Ledger Nano S.

Security Measures

Protecting your cryptocurrency investments from theft and fraud is crucial. Here are some essential security measures:

- Strong Passwords: Use strong and unique passwords for all your cryptocurrency accounts and wallets. Avoid using the same password for multiple accounts.

- Two-Factor Authentication (2FA): Enable 2FA for all your accounts. This adds an extra layer of security by requiring a code from your phone or email in addition to your password.

- Hardware Wallets: For long-term storage, consider using a hardware wallet. These physical devices store your private keys offline, making them much more secure than software wallets.

- Phishing Awareness: Be wary of phishing scams. Never click on suspicious links or provide your private keys to anyone.

Tax Implications and Regulations

Cryptocurrency trading can have tax implications, and regulations vary depending on your location. It’s essential to understand the tax rules and regulations in your jurisdiction.

- Capital Gains Tax: In many countries, profits from cryptocurrency trading are considered capital gains and are subject to tax. Consult with a tax professional to understand the specific rules in your region.

- Know Your Customer (KYC) and Anti-Money Laundering (AML) Regulations: Most cryptocurrency exchanges and platforms are required to comply with KYC and AML regulations. This involves providing personal information and verifying your identity.

Concluding Remarks

Ultimately, the decision of which crypto to buy today for long-term growth is a personal one. It’s crucial to conduct thorough research, understand your risk tolerance, and carefully consider the potential benefits and drawbacks of each investment. By combining a solid understanding of the cryptocurrency market with a well-defined investment strategy, you can position yourself for success in this exciting and evolving digital landscape.

Commonly Asked Questions

What are the best cryptocurrencies to invest in for long-term growth?

The “best” cryptocurrencies are subjective and depend on individual investment goals and risk tolerance. Research is crucial. Consider factors like technology, team, community, and market potential.

How can I protect my cryptocurrency investments from theft?

Use strong passwords, enable two-factor authentication, choose reputable exchanges and wallets, and stay informed about security best practices.

Is cryptocurrency investing suitable for everyone?

No, cryptocurrency investing carries inherent risks. It’s crucial to understand the market’s volatility and your own risk tolerance before investing. Consult with a financial advisor if needed.