Which crypto to buy today for long-term growth? This is a question that has been on the minds of many investors as the cryptocurrency market continues to evolve at a rapid pace. Navigating the volatile world of cryptocurrencies requires a strategic approach, blending a deep understanding of market trends with a careful consideration of long-term investment strategies.

This guide aims to provide a comprehensive overview of the key factors to consider when making long-term cryptocurrency investment decisions. We will explore the current state of the market, analyze potential investment opportunities, and delve into the crucial aspects of fundamental and technical analysis. Understanding risk management, diversification, and the regulatory landscape will be crucial for making informed investment choices in this dynamic environment.

Understanding the Cryptocurrency Market: Which Crypto To Buy Today For Long-term

The cryptocurrency market is a dynamic and constantly evolving landscape, characterized by high volatility and significant growth potential. Understanding the factors that influence market trends is crucial for investors seeking to navigate this complex space.

Current State of the Cryptocurrency Market, Which crypto to buy today for long-term

The cryptocurrency market has experienced a rollercoaster ride in recent years, with periods of explosive growth followed by sharp corrections. As of today, the total market capitalization of cryptocurrencies stands at approximately [insert current market cap data]. This represents a significant increase from the early days of cryptocurrencies, but it’s also considerably lower than the all-time high reached in [insert year].

Key Factors Influencing Market Trends

Several factors contribute to the fluctuating nature of the cryptocurrency market, including:

- Regulatory Landscape: Governments worldwide are still grappling with how to regulate cryptocurrencies. Regulatory clarity can boost investor confidence and lead to increased adoption, while uncertainty can create volatility and hinder growth.

- Adoption and Use Cases: The widespread adoption of cryptocurrencies for payments, investments, and other applications is crucial for long-term growth. Increasing adoption by businesses and consumers can drive demand and increase prices.

- Technological Advancements: The development of new technologies, such as blockchain scalability solutions and decentralized finance (DeFi) applications, can significantly impact the market. These innovations can create new opportunities and attract investors.

- Macroeconomic Factors: Global economic events, such as interest rate changes, inflation, and geopolitical tensions, can also influence cryptocurrency prices. For example, during periods of economic uncertainty, investors may seek refuge in safe-haven assets, including cryptocurrencies.

- Market Sentiment and Speculation: The cryptocurrency market is highly susceptible to sentiment and speculation. News events, social media trends, and investor psychology can all play a role in price fluctuations.

Recent Market Events

The cryptocurrency market has been impacted by several significant events in recent months, including:

- The collapse of [insert name of cryptocurrency exchange] in [insert year]: This event highlighted the risks associated with centralized exchanges and led to a period of market volatility.

- The rise of [insert name of cryptocurrency] in [insert year]: This cryptocurrency gained significant attention for its [insert reason for popularity] and experienced a rapid surge in price.

- The growing adoption of [insert name of cryptocurrency] by [insert company or industry]: This event signaled increased mainstream acceptance of cryptocurrencies and contributed to a positive market sentiment.

Long-Term Investment Strategies

Long-term investing in cryptocurrencies is a strategy that focuses on holding crypto assets for an extended period, typically years, with the expectation that their value will appreciate over time. It is distinct from short-term trading, which aims to profit from short-term price fluctuations.

This strategy is based on the belief that the underlying technology and adoption of cryptocurrencies will continue to grow, leading to increased demand and higher prices.

Key Principles of Long-Term Investment Strategies

Long-term investment strategies in cryptocurrencies are guided by several key principles. These principles aim to maximize returns while minimizing risk.

- Diversification: Investing in a variety of cryptocurrencies, rather than just one, helps to reduce overall portfolio risk. This is because different cryptocurrencies have different market dynamics and risk profiles.

- Fundamental Analysis: Thoroughly researching the underlying technology, adoption, and market potential of cryptocurrencies before investing is crucial. This helps investors make informed decisions based on the long-term viability of the project.

- Dollar-Cost Averaging: Investing a fixed amount of money in cryptocurrencies at regular intervals, regardless of market fluctuations, can help average out the purchase price and reduce the impact of market volatility.

- Long-Term Perspective: Maintaining a long-term perspective and avoiding emotional decisions is essential. Market fluctuations are inevitable, but focusing on the long-term potential of cryptocurrencies can help investors ride out short-term volatility.

Successful Long-Term Cryptocurrency Investments

Several examples illustrate the potential of long-term investments in cryptocurrencies.

- Bitcoin (BTC): Bitcoin, the first cryptocurrency, has demonstrated significant growth since its inception. Investors who purchased Bitcoin in its early stages have experienced substantial returns. For example, an investment of $100 in Bitcoin in 2011 would be worth over $1 million today.

- Ethereum (ETH): Ethereum, a platform for decentralized applications, has also seen significant growth. Investors who held Ethereum in its early stages have also benefited from its appreciation.

- Decentraland (MANA): Decentraland is a virtual reality platform where users can create, experience, and monetize content. Investors who purchased MANA in its early stages have seen their investments grow significantly.

“Long-term investing is a marathon, not a sprint. It requires patience, discipline, and a focus on the long-term potential of the underlying technology.”

Identifying Potential Investments

Now that you understand the basics of the cryptocurrency market and have a long-term investment strategy in mind, it’s time to explore potential cryptocurrencies to add to your portfolio. The key is to identify projects with strong fundamentals, a dedicated community, and a clear path for future growth.

Cryptocurrency Selection

Choosing the right cryptocurrencies for long-term investment requires careful research and consideration. You should assess factors such as:

- Market Capitalization: This metric represents the total market value of a cryptocurrency. Generally, larger market caps indicate greater adoption and stability, but smaller market caps may offer higher growth potential.

- Technology: The underlying technology of a cryptocurrency is crucial. Look for projects with innovative and robust technology that addresses real-world problems or offers unique solutions.

- Team and Development: A strong and experienced team is essential for a cryptocurrency’s success. Evaluate the team’s expertise, track record, and commitment to the project.

- Community: A vibrant and engaged community can provide valuable support and contribute to a cryptocurrency’s growth. Look for projects with active forums, social media channels, and developer communities.

- Use Cases: Understand the potential applications and use cases of a cryptocurrency. Projects with clear and practical use cases tend to have stronger long-term prospects.

Comparing Cryptocurrencies

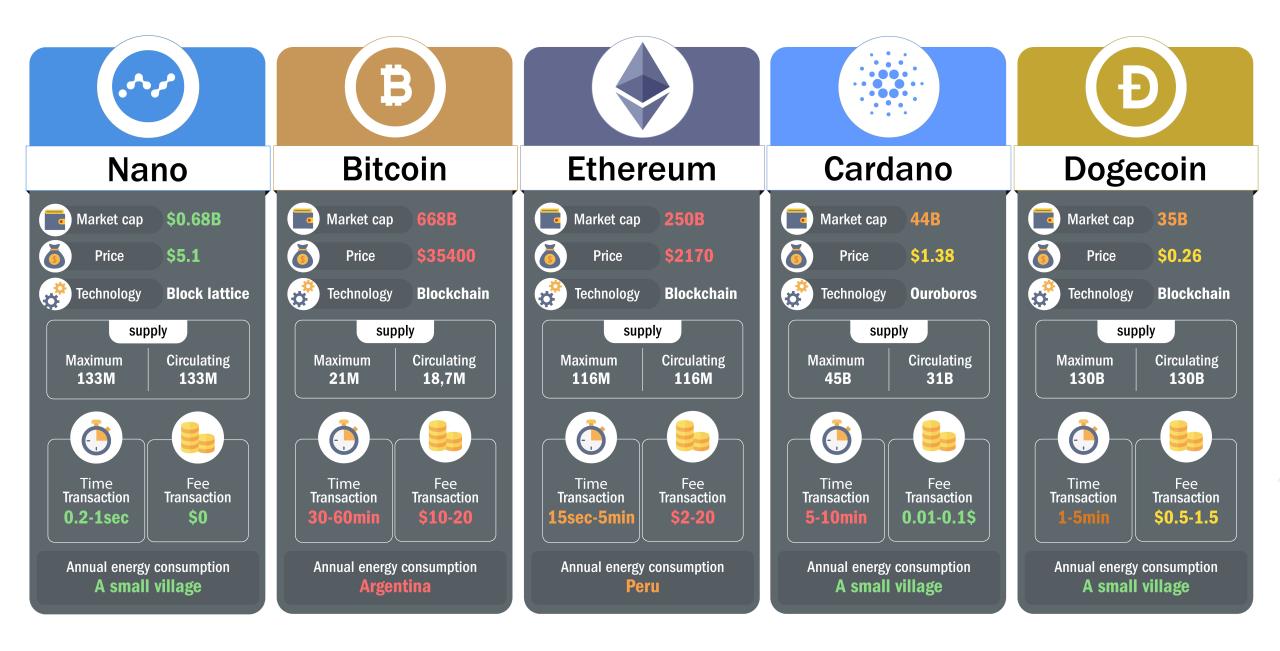

To make informed investment decisions, it’s helpful to compare different cryptocurrencies based on key metrics. Here’s a table comparing some popular cryptocurrencies:

| Cryptocurrency | Market Capitalization (USD) | Technology | Potential for Growth |

|---|---|---|---|

| Bitcoin (BTC) | $500 Billion | Blockchain technology | High, as it remains the dominant cryptocurrency with established infrastructure and widespread adoption. |

| Ethereum (ETH) | $200 Billion | Smart contracts and decentralized applications (DApps) | High, as Ethereum is the leading platform for decentralized finance (DeFi) and non-fungible tokens (NFTs). |

| Binance Coin (BNB) | $50 Billion | Native token of the Binance exchange | Medium, as BNB benefits from the Binance ecosystem’s growth and offers utility within the exchange. |

| Cardano (ADA) | $30 Billion | Proof-of-stake consensus mechanism and smart contracts | Medium, as Cardano focuses on scalability and sustainability, aiming to become a more efficient blockchain platform. |

| Solana (SOL) | $20 Billion | High-performance blockchain platform with fast transaction speeds | High, as Solana’s speed and efficiency make it attractive for DeFi and NFT applications. |

Market Share Visualization

Visualizing the relative market share of different cryptocurrencies can provide valuable insights into the market landscape. A pie chart, for example, could illustrate the market dominance of Bitcoin and Ethereum, while also showcasing the growing share of other prominent cryptocurrencies.

Note: This is just a sample table and visualization. It’s crucial to conduct your own research and consider your investment goals before making any investment decisions.

Fundamental Analysis of Cryptocurrencies

Fundamental analysis in the context of cryptocurrencies involves evaluating the intrinsic value of a cryptocurrency based on its underlying technology, market adoption, team, and other factors. This approach helps determine the long-term potential of a cryptocurrency by assessing its core functionalities, market demand, and overall viability.

Factors to Consider in Fundamental Analysis

Understanding the key factors influencing a cryptocurrency’s value is crucial for conducting a thorough fundamental analysis. These factors provide insights into the cryptocurrency’s potential for growth and long-term sustainability.

- Technology: Analyzing the underlying technology behind a cryptocurrency is essential. This includes evaluating the blockchain’s scalability, security, and efficiency. A strong technology foundation provides a solid basis for the cryptocurrency’s future development and adoption. For instance, Ethereum’s smart contract capabilities have driven its popularity and widespread adoption in decentralized finance (DeFi) and non-fungible tokens (NFTs).

- Team: The team behind a cryptocurrency plays a significant role in its success. Assessing the team’s experience, expertise, and track record in blockchain development and business operations is crucial. A strong team with a clear vision and proven abilities increases confidence in the cryptocurrency’s long-term viability. For example, Bitcoin’s anonymous founder, Satoshi Nakamoto, established a solid foundation for the cryptocurrency’s decentralized nature and security.

- Market Adoption: The level of market adoption is a key indicator of a cryptocurrency’s success. This includes the number of users, transactions, and businesses using the cryptocurrency. Higher adoption rates signify strong demand and potential for future growth. For example, Litecoin’s focus on fast transaction speeds has made it popular for merchants and businesses seeking faster payment processing.

- Competition: Analyzing the competitive landscape of cryptocurrencies is essential. Identifying key competitors and their strengths and weaknesses helps understand a cryptocurrency’s position in the market. For instance, Binance Coin (BNB) has gained popularity due to its utility within the Binance ecosystem, offering lower trading fees and access to various services.

- Regulation: Government regulations can significantly impact a cryptocurrency’s growth and development. Understanding the regulatory environment in different jurisdictions is essential for assessing the cryptocurrency’s potential for future adoption and expansion. For example, the regulatory framework for cryptocurrencies in Japan has been conducive to their growth and adoption, with clear guidelines for exchanges and investors.

Step-by-Step Guide to Conducting Fundamental Analysis

Following a structured approach to fundamental analysis ensures a comprehensive evaluation of a cryptocurrency’s potential. This step-by-step guide provides a framework for conducting a thorough analysis.

- Identify the Cryptocurrency: Begin by choosing the cryptocurrency you want to analyze. Consider factors like its market capitalization, trading volume, and overall popularity.

- Research the Technology: Dive into the underlying technology behind the cryptocurrency. Explore the blockchain’s consensus mechanism, security features, and scalability. Analyze white papers, technical documentation, and community discussions to gain a deeper understanding of the technology.

- Evaluate the Team: Research the team behind the cryptocurrency. Assess their experience, expertise, and track record in blockchain development and business operations. Explore their vision for the cryptocurrency and their commitment to its growth.

- Analyze Market Adoption: Investigate the level of market adoption. Examine the number of users, transactions, and businesses using the cryptocurrency. Assess the growth trajectory and potential for future adoption.

- Assess Competition: Identify key competitors in the cryptocurrency market. Analyze their strengths, weaknesses, and strategies. Compare the chosen cryptocurrency’s features and advantages against its competitors.

- Consider Regulation: Explore the regulatory environment surrounding the cryptocurrency. Analyze the potential impact of regulations on its future growth and development. Consider the cryptocurrency’s compliance with regulatory requirements in different jurisdictions.

- Evaluate Financial Performance: Analyze the cryptocurrency’s financial performance. Consider its market capitalization, trading volume, price history, and other relevant metrics. Assess its financial stability and potential for future growth.

- Analyze Community Engagement: Evaluate the cryptocurrency’s community engagement. Consider the size and activity of its online community, social media presence, and participation in forums and discussions. A strong community can contribute to the cryptocurrency’s growth and development.

- Conduct a SWOT Analysis: Conduct a SWOT analysis (Strengths, Weaknesses, Opportunities, Threats) to identify the cryptocurrency’s strengths, weaknesses, opportunities, and threats. This analysis helps gain a comprehensive understanding of the cryptocurrency’s potential and challenges.

Technical Analysis of Cryptocurrencies

Technical analysis plays a crucial role in identifying potential investment opportunities in the cryptocurrency market. It involves studying historical price and volume data to predict future price movements. Unlike fundamental analysis, which focuses on a company’s financial health, technical analysis relies on charts, patterns, and indicators to identify trends and make trading decisions.

Technical Indicators

Technical indicators are mathematical calculations based on historical price and volume data. They provide insights into market sentiment, momentum, and overbought/oversold conditions. Here are some commonly used technical indicators:

- Moving Averages (MAs): MAs smooth out price fluctuations and provide trend direction. Popular MAs include the 50-day MA and 200-day MA. A crossover between these MAs can signal a potential trend change.

- Relative Strength Index (RSI): The RSI measures the magnitude of recent price changes to evaluate overbought or oversold conditions. A reading above 70 suggests an overbought market, while a reading below 30 indicates an oversold market.

- MACD (Moving Average Convergence Divergence): The MACD identifies trend changes by comparing two moving averages. A bullish crossover occurs when the MACD line crosses above the signal line, while a bearish crossover occurs when the MACD line crosses below the signal line.

- Bollinger Bands: Bollinger Bands are a volatility indicator that shows price fluctuations around a moving average. When prices break out of the bands, it could indicate a significant price movement.

Chart Analysis

Technical analysis relies heavily on chart patterns, which are recognizable formations in price charts. These patterns can provide insights into market sentiment and potential price movements. Here are some common chart patterns:

- Head and Shoulders: A head and shoulders pattern is a bearish reversal pattern that indicates a potential trend change from an uptrend to a downtrend.

- Double Top/Bottom: Double top and bottom patterns are reversal patterns that indicate a potential change in trend direction.

- Triangles: Triangles are consolidation patterns that suggest a period of price indecision. They can be symmetrical, ascending, or descending, and can signal a breakout in either direction.

Example: Technical Analysis of Bitcoin

Let’s consider an example of how technical analysis can be applied to Bitcoin (BTC). The following chart shows the price of Bitcoin over the past year, along with various technical indicators.

Image: A chart showing the price of Bitcoin over the past year, with moving averages (50-day and 200-day), RSI, MACD, and Bollinger Bands. The chart shows a bullish crossover between the 50-day MA and 200-day MA, indicating a potential uptrend. The RSI is above 50, suggesting bullish momentum. The MACD is above the signal line, confirming the bullish trend. The price is trading within the Bollinger Bands, indicating normal volatility.

Based on these indicators, we can see that Bitcoin is currently in a bullish trend. The price is above the 50-day and 200-day moving averages, and the RSI and MACD are both indicating bullish momentum. The Bollinger Bands suggest normal volatility, which is expected during a bullish trend. However, it is important to remember that technical analysis is not a guarantee of future price movements. Market conditions can change rapidly, and it is crucial to use technical analysis in conjunction with other forms of analysis to make informed investment decisions.

Last Recap

In conclusion, choosing the right cryptocurrency for long-term investment requires a combination of thorough research, careful analysis, and a well-defined investment strategy. By understanding the market dynamics, identifying promising opportunities, and managing risk effectively, investors can position themselves for success in the evolving world of cryptocurrencies.

FAQ Explained

What are the biggest risks associated with investing in cryptocurrencies?

Cryptocurrency investments are known for their volatility and potential for rapid price fluctuations. Other risks include regulatory uncertainty, security breaches, and the potential for scams.

How do I choose the right cryptocurrency exchange for my needs?

Consider factors like fees, security features, supported cryptocurrencies, and user experience when selecting a cryptocurrency exchange. Research and compare different platforms to find one that aligns with your investment goals and risk tolerance.