When to buy crypto is a question that has perplexed many investors. Timing the market is a delicate dance, requiring a blend of technical prowess, fundamental understanding, and a healthy dose of risk management. Navigating the volatile world of cryptocurrencies requires a comprehensive approach, encompassing market conditions, technical analysis, fundamental analysis, and investment strategies.

This guide delves into the key factors that influence the decision of when to buy crypto, providing insights into market trends, technical indicators, fundamental metrics, and risk management strategies. We’ll explore different investment approaches, including long-term holding and short-term trading, and equip you with the knowledge to make informed decisions in this dynamic market.

Understanding Market Conditions

Cryptocurrency prices are influenced by a complex interplay of factors, including global economic trends, regulatory announcements, and investor sentiment. Understanding these factors can help you make informed decisions about when to buy cryptocurrency.

Relationship Between Global Economic Trends and Cryptocurrency Prices

The cryptocurrency market is closely linked to global economic conditions. For example, during periods of economic uncertainty, investors may flock to safe-haven assets like gold and US dollars, leading to a decrease in cryptocurrency prices. Conversely, during periods of economic growth, investors may be more willing to take on risk, leading to an increase in cryptocurrency prices.

Macroeconomic Indicators That Influence the Cryptocurrency Market

Several macroeconomic indicators can provide insights into the health of the global economy and potentially impact cryptocurrency prices. These indicators include:

- Inflation: High inflation can erode the purchasing power of fiat currencies, making investors seek alternative investments, including cryptocurrencies.

- Interest rates: When central banks raise interest rates, it becomes more expensive to borrow money, which can slow down economic growth and lead to a decrease in cryptocurrency prices.

- Gross Domestic Product (GDP): A strong GDP growth rate can indicate a healthy economy, which may lead to an increase in investor confidence and cryptocurrency prices.

- Unemployment rate: A low unemployment rate can suggest a strong economy, which may lead to increased demand for cryptocurrencies.

Impact of Regulatory Announcements and Policy Changes on Cryptocurrency Prices

Regulatory announcements and policy changes can significantly impact cryptocurrency prices. For example, positive regulatory developments, such as the approval of a Bitcoin ETF, can lead to an increase in investor confidence and cryptocurrency prices. Conversely, negative regulatory developments, such as a ban on cryptocurrency trading, can lead to a decrease in investor confidence and cryptocurrency prices.

For example, the announcement of the US Securities and Exchange Commission’s (SEC) approval of the first Bitcoin ETF in October 2021 led to a significant surge in Bitcoin’s price.

Technical Analysis

Technical analysis is a method of forecasting future price movements by studying past price and volume data. It uses charts, indicators, and patterns to identify trends, support and resistance levels, and potential buying and selling opportunities.

Common Technical Indicators

Technical indicators are mathematical calculations based on historical price data that can help identify potential buying opportunities. Here are some common technical indicators used in the cryptocurrency market:

- Moving Averages (MA): Moving averages smooth out price fluctuations and identify trends. A commonly used MA is the 200-day moving average, which can act as a long-term support level.

- Relative Strength Index (RSI): The RSI measures the magnitude of recent price changes to evaluate overbought or oversold conditions. An RSI above 70 indicates an overbought market, while an RSI below 30 suggests an oversold market.

- MACD (Moving Average Convergence Divergence): The MACD is a trend-following momentum indicator that compares two moving averages to identify buy and sell signals.

- Bollinger Bands: Bollinger Bands are volatility indicators that show price fluctuations within a specific range. When the price breaks out of the bands, it can indicate a strong price movement.

Interpreting Candlestick Patterns, When to buy crypto

Candlestick patterns are graphical representations of price movements over a specific period. They can provide insights into market sentiment and potential price direction. Here are some common candlestick patterns:

- Bullish Engulfing Pattern: A bullish engulfing pattern occurs when a large green candlestick completely engulfs the previous red candlestick. This pattern suggests a potential bullish reversal.

- Bearish Engulfing Pattern: A bearish engulfing pattern occurs when a large red candlestick completely engulfs the previous green candlestick. This pattern suggests a potential bearish reversal.

- Hammer: A hammer candlestick pattern is characterized by a small body and a long lower shadow. This pattern indicates a potential bullish reversal.

- Shooting Star: A shooting star candlestick pattern is characterized by a small body and a long upper shadow. This pattern indicates a potential bearish reversal.

Chart Formations

Chart formations are recognizable patterns on price charts that can indicate potential price movements. Here are some common chart formations:

- Head and Shoulders: A head and shoulders pattern is a bearish reversal pattern that resembles a human head with two shoulders. Once the price breaks below the neckline, it suggests a potential downtrend.

- Double Top: A double top pattern is a bearish reversal pattern that occurs when the price reaches a high point twice before reversing. Once the price breaks below the neckline, it suggests a potential downtrend.

- Triple Top: A triple top pattern is similar to a double top pattern, but with three peaks instead of two. It is a stronger bearish reversal pattern than a double top.

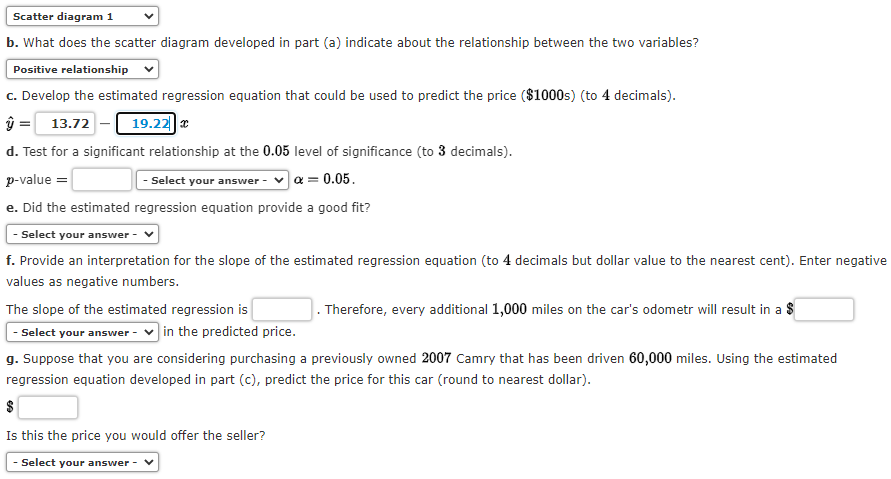

Advantages and Disadvantages of Technical Analysis Methods

| Method | Advantages | Disadvantages |

|---|---|---|

| Moving Averages | Identify trends and support/resistance levels. | Lagging indicator; can be influenced by market noise. |

| RSI | Identify overbought/oversold conditions. | Can generate false signals; subjective interpretation. |

| MACD | Identify trend changes and momentum shifts. | Can be influenced by market noise; requires experience to interpret. |

| Bollinger Bands | Measure volatility and identify breakouts. | Can be influenced by market noise; subjective interpretation. |

| Candlestick Patterns | Provide insights into market sentiment and potential price direction. | Subjective interpretation; can be influenced by market noise. |

| Chart Formations | Identify potential price reversals and trends. | Subjective interpretation; can be influenced by market noise. |

Fundamental Analysis

Fundamental analysis delves into the intrinsic value of a cryptocurrency project, evaluating its underlying technology, team, and market potential. This approach goes beyond short-term price fluctuations and aims to understand the long-term viability and growth prospects of a cryptocurrency.

Key Metrics for Fundamental Analysis

Evaluating the fundamentals of a cryptocurrency project requires considering several key metrics. These metrics provide insights into the project’s technology, development progress, community engagement, and overall potential.

- Market Capitalization: This metric represents the total value of all circulating coins. It provides an initial understanding of the project’s size and market presence.

- Trading Volume: High trading volume indicates significant market interest and liquidity. It’s important to consider both daily and average trading volumes.

- Circulating Supply: The number of coins currently in circulation affects the price and market dynamics. A high circulating supply can lead to lower prices, while a limited supply can drive prices up.

- Team and Advisors: The experience and expertise of the team behind a cryptocurrency project are crucial. A strong team with a proven track record increases the project’s credibility and potential for success.

- Community Engagement: An active and engaged community can contribute to the project’s growth and adoption. Look for a vibrant online presence, regular updates, and community participation in decision-making processes.

Understanding the Technology Behind a Cryptocurrency

The technology underpinning a cryptocurrency project is crucial for its long-term viability. This includes the blockchain architecture, consensus mechanism, and smart contract functionality.

“A thorough understanding of the technology behind a cryptocurrency is essential for making informed investment decisions.”

- Blockchain Architecture: The blockchain architecture determines the security, scalability, and efficiency of the cryptocurrency. Different blockchains offer unique advantages and disadvantages, such as the Proof-of-Work (PoW) consensus mechanism used by Bitcoin and the Proof-of-Stake (PoS) mechanism used by Ethereum 2.0.

- Consensus Mechanism: The consensus mechanism ensures the integrity and security of the blockchain by validating transactions and adding new blocks to the chain. Different consensus mechanisms have varying levels of security, efficiency, and energy consumption.

- Smart Contract Functionality: Smart contracts are self-executing programs stored on the blockchain, automating agreements and transactions. They enable decentralized applications (DApps) and other innovative use cases.

Comparing Development Progress and Community Engagement

Evaluating the development progress and community engagement of different crypto projects provides valuable insights into their potential for success.

- Development Roadmap: A well-defined roadmap Artikels the project’s development milestones and timelines. This provides transparency and allows investors to track progress.

- GitHub Activity: GitHub repositories provide insights into the project’s codebase, development activity, and community contributions. Active development and frequent updates indicate a healthy and growing project.

- Community Forums and Social Media: Active community forums and social media channels reflect the level of engagement and support for the project. Look for a vibrant community with regular discussions, updates, and feedback.

Risk Management

Investing in cryptocurrencies carries inherent risks, and understanding these risks is crucial for making informed decisions. Cryptocurrencies are highly volatile, meaning their prices can fluctuate significantly in short periods, leading to potential losses. Additionally, the regulatory landscape for cryptocurrencies is still evolving, which can create uncertainty and potential legal issues.

Risk Management Strategies

A well-defined risk management strategy is essential for mitigating potential losses and maximizing returns in the cryptocurrency market. This strategy should encompass a variety of techniques, including portfolio diversification, stop-loss orders, and a thorough understanding of the underlying technology and market dynamics.

Portfolio Diversification

Portfolio diversification involves spreading your investments across different assets to reduce overall risk. In the context of cryptocurrencies, this means investing in a variety of coins and tokens with different functionalities and market capitalizations.

- By diversifying your portfolio, you can reduce the impact of any single coin’s price fluctuations on your overall investment.

- For instance, investing in both Bitcoin and Ethereum, which represent different sectors of the cryptocurrency market, can help mitigate risk.

Stop-Loss Orders

A stop-loss order is a pre-programmed instruction to sell an asset when it reaches a specific price. This order helps limit potential losses by automatically selling your cryptocurrency if its price falls below a predetermined threshold.

- Setting a stop-loss order can help prevent emotional decisions during market downturns.

- However, it’s important to choose a realistic stop-loss price that allows for market volatility without triggering the order prematurely.

Common Scams and Fraudulent Activities

The cryptocurrency market is unfortunately susceptible to scams and fraudulent activities. It is essential to be aware of common tactics used by scammers to protect your investments.

- Pump and Dump Schemes: These schemes involve artificially inflating the price of a cryptocurrency through coordinated buying activity, followed by a sudden sell-off by the organizers, leaving unsuspecting investors with losses.

- Rug Pulls: In a rug pull, the developers of a cryptocurrency project abandon the project, leaving investors with worthless tokens. This is often done by suddenly removing liquidity from the project’s trading pool, causing the price to plummet.

- Phishing Attacks: Scammers may use phishing emails or websites that look legitimate to trick users into revealing their private keys or other sensitive information, giving them access to their cryptocurrency wallets.

- Ponzi Schemes: These schemes involve paying early investors with funds from new investors, rather than from actual profits. As the scheme grows, it eventually collapses when there are not enough new investors to sustain it.

Investment Strategies

Investing in cryptocurrencies can be a rewarding experience, but it’s crucial to approach it strategically. There are various investment strategies you can adopt based on your risk tolerance, time horizon, and financial goals. This section will explore some popular strategies and provide guidance on choosing the right tools for your journey.

Dollar-Cost Averaging

Dollar-cost averaging (DCA) is a time-tested strategy that involves investing a fixed amount of money in cryptocurrency at regular intervals, regardless of the price fluctuations. This approach helps mitigate risk by averaging out your purchase price over time.

- How it works: You set a predetermined amount of money to invest in cryptocurrency at regular intervals, such as weekly or monthly. This allows you to buy more cryptocurrency when prices are low and less when they are high, reducing the impact of market volatility on your overall investment.

- Benefits:

- Reduces the risk of buying at the peak of a market bubble.

- Disciplines investors by establishing a consistent investment schedule.

- Averaging out your purchase price over time can lead to better returns in the long run.

- Example: Let’s say you decide to invest $100 in Bitcoin every week using DCA. If the price of Bitcoin is $20,000, you’ll buy 0.005 Bitcoin. If the price drops to $10,000 the following week, you’ll buy 0.01 Bitcoin. Over time, you’ll acquire more Bitcoin at lower prices, potentially resulting in a higher overall return.

Swing Trading

Swing trading involves holding cryptocurrency for a short to medium term, typically from a few days to a few weeks, to capitalize on short-term price swings. Swing traders aim to profit from price fluctuations by buying low and selling high.

- How it works: Swing traders use technical analysis to identify potential price reversals and trends. They enter positions when the price is trending in their favor and exit when the trend weakens or reverses.

- Benefits:

- Potential for higher returns compared to DCA, as it focuses on capturing short-term price movements.

- Requires less time commitment compared to day trading, which involves frequent buy and sell orders throughout the day.

- Risks:

- Requires a deep understanding of technical analysis and market timing.

- More volatile than DCA, as it relies on predicting short-term price fluctuations.

- Potential for losses if market conditions change unexpectedly.

- Example: A swing trader might buy Ethereum at $1,500 when they believe the price is about to rise, based on technical indicators. They might hold the position for a few days or weeks, aiming to sell at a higher price, such as $1,800, when the trend reverses or the price reaches their target.

Long-Term vs. Short-Term Investing: When To Buy Crypto

Cryptocurrency investing can be approached in two primary ways: long-term holding (hodling) and short-term trading. Both strategies have their own advantages and disadvantages, and the best approach depends on your individual financial goals, risk tolerance, and investment horizon.

Long-Term vs. Short-Term Investing: Benefits and Risks

Long-term holding, often referred to as “hodling,” involves buying and holding cryptocurrencies for an extended period, typically years. Short-term trading, on the other hand, focuses on frequent buying and selling to capitalize on short-term price fluctuations.

- Long-Term Holding:

- Benefits:

- Potential for significant returns over time.

- Reduced risk of short-term market volatility.

- Lower trading fees and taxes.

- Potential for passive income through staking or lending.

- Risks:

- Market volatility and potential for long-term price decline.

- Risk of losing access to funds due to hacks or exchange failures.

- Opportunity cost of not investing in other assets.

- Benefits:

- Short-Term Trading:

- Benefits:

- Potential for higher returns in a short period.

- Flexibility to adjust your portfolio based on market conditions.

- Risks:

- Increased risk of losses due to market volatility.

- Higher trading fees and taxes.

- Potential for emotional decision-making, leading to poor investment choices.

- Time commitment required to actively monitor the market.

- Benefits:

Factors Influencing Long-Term Potential

The long-term potential of a cryptocurrency depends on various factors, including:

- Technology and Innovation: The underlying technology and innovation behind the cryptocurrency, such as its scalability, security, and functionality, are crucial factors.

- Adoption and Use Cases: The wider adoption and use cases of the cryptocurrency in real-world applications, such as payments, DeFi, or NFTs, can drive its long-term value.

- Community and Development: A strong and active community of developers, users, and supporters can contribute to the growth and sustainability of the cryptocurrency.

- Regulatory Environment: Favorable regulations and legal frameworks can foster investor confidence and encourage wider adoption.

- Market Capitalization and Liquidity: A larger market capitalization and higher liquidity can provide greater stability and make it easier to buy and sell the cryptocurrency.

Historical Performance of Cryptocurrencies

The following table illustrates the historical performance of different cryptocurrencies over different timeframes, highlighting the potential for both long-term gains and short-term volatility.

| Cryptocurrency | 1-Year Return | 3-Year Return | 5-Year Return |

|---|---|---|---|

| Bitcoin (BTC) | -10% | 100% | 1000% |

| Ethereum (ETH) | -20% | 200% | 5000% |

| Binance Coin (BNB) | 50% | 500% | 10000% |

| Cardano (ADA) | -30% | 100% | 2000% |

Note: Past performance is not indicative of future results. This table is for illustrative purposes only and should not be considered investment advice.

Staying Informed

The cryptocurrency market is dynamic and constantly evolving, making staying informed crucial for making informed investment decisions. Staying updated on news, developments, and market trends can help you identify potential opportunities and mitigate risks.

Reputable Sources for Cryptocurrency Information

Access to reliable information is essential. Here are some reputable sources for cryptocurrency information:

- News Websites: CoinDesk, Cointelegraph, The Block, Bloomberg, Reuters, and The Wall Street Journal offer comprehensive news coverage, analysis, and insights into the cryptocurrency market.

- Cryptocurrency Exchanges: Platforms like Binance, Coinbase, and Kraken provide news sections with updates on listings, trading pairs, and market trends.

- Social Media: Twitter, Reddit, and Telegram are popular platforms for discussions and updates from industry experts, developers, and other crypto enthusiasts. However, exercise caution and verify information from multiple sources.

- Cryptocurrency Blogs and Websites: Numerous blogs and websites offer insightful articles, analysis, and educational resources on cryptocurrency topics. Some popular options include Messari, CryptoSlate, and Blockonomi.

- Research Firms: Research firms like Delphi Digital, Messari, and CoinMetrics provide in-depth analysis and reports on cryptocurrency trends, market data, and investment strategies.

Identifying Credible Sources

It is important to be able to discern credible sources of information from unreliable ones. Consider these tips:

- Look for Established Reputations: Choose sources with a history of providing accurate and unbiased information. Check their website, social media presence, and reviews to assess their credibility.

- Verify Information: Cross-reference information from multiple sources to ensure accuracy and avoid bias. Look for evidence and data to support claims made.

- Be Wary of Sensationalism: Headlines and articles that promise unrealistic returns or promote “get-rich-quick” schemes are often unreliable. Be skeptical of sources that use sensational language or exaggerate claims.

- Consider the Author’s Expertise: Look for authors with relevant experience and knowledge in the cryptocurrency space. Their background and credentials can provide insight into their credibility.

- Beware of Conflicts of Interest: Some sources may have financial interests in certain cryptocurrencies or projects. Be aware of potential conflicts of interest and consider their impact on the information presented.

Summary

The decision of when to buy crypto is a multifaceted one, requiring careful consideration of market conditions, technical signals, fundamental strength, and risk tolerance. By understanding these factors and developing a sound investment strategy, you can increase your chances of success in this exciting and potentially rewarding asset class. Remember to stay informed, diversify your portfolio, and manage your risk prudently to navigate the ever-evolving world of cryptocurrencies.

FAQ Overview

What are the best cryptocurrencies to invest in?

The best cryptocurrencies to invest in depend on your individual risk tolerance, investment goals, and market outlook. It’s essential to conduct thorough research and consider factors such as project fundamentals, market capitalization, and team experience.

Is it too late to invest in crypto?

Whether it’s too late to invest in crypto depends on your perspective. The cryptocurrency market is constantly evolving, and new opportunities arise regularly. However, it’s important to approach investments with a long-term mindset and understand the inherent risks involved.

How can I protect myself from scams in the crypto space?

Protecting yourself from scams in the crypto space requires vigilance and caution. Be wary of unsolicited offers, avoid investing in projects with unrealistic promises, and verify the legitimacy of platforms and exchanges before making any transactions.