What’s the best crypto to buy? It’s a question that’s on the minds of many as the cryptocurrency market continues to evolve. With a wide range of options available, finding the right investment can be a daunting task. Understanding the fundamentals of the crypto market, including the factors influencing price fluctuations, the associated risks and rewards, and the diverse types of cryptocurrencies, is crucial.

Choosing the best crypto to buy involves a comprehensive assessment of various factors. You’ll need to compare and contrast different cryptocurrencies based on their market capitalization, trading volume, and historical price performance. Understanding each cryptocurrency’s unique features, functionalities, and the regulatory landscape surrounding it is essential for making informed decisions.

Understanding the Crypto Market: What’s The Best Crypto To Buy

The cryptocurrency market is a complex and dynamic ecosystem, influenced by a multitude of factors that can cause significant price fluctuations. It’s essential to understand these factors before investing, as the potential rewards come with significant risks.

Factors Influencing Cryptocurrency Prices, What’s the best crypto to buy

The price of cryptocurrencies is influenced by a complex interplay of factors, including:

- Supply and Demand: Like any other asset, the price of cryptocurrencies is determined by the interaction of supply and demand. When demand exceeds supply, the price tends to rise, and vice versa. This can be influenced by factors like investor sentiment, news events, and regulatory changes.

- Market Sentiment: The overall sentiment of the market, whether bullish or bearish, can have a significant impact on prices. Positive news and announcements tend to drive prices up, while negative news can lead to price declines.

- Adoption and Use Cases: The wider adoption and use of cryptocurrencies for payments, investments, and other applications can boost demand and drive up prices. Increased adoption can lead to more liquidity and greater market capitalization.

- Technological Developments: Advancements in blockchain technology, such as improvements in scalability, security, and efficiency, can have a positive impact on the market.

- Regulation: Government regulations and policies can significantly impact the cryptocurrency market. Clear and favorable regulations can encourage investment and adoption, while restrictive regulations can stifle growth.

Risks and Potential Rewards of Investing in Cryptocurrency

Investing in cryptocurrencies can be both rewarding and risky. It’s crucial to weigh the potential benefits against the risks involved before making any investment decisions.

- Volatility: Cryptocurrency prices are notoriously volatile, subject to significant fluctuations in a short period. This volatility can lead to substantial losses, particularly for short-term traders.

- Security Risks: Cryptocurrencies are susceptible to hacking and theft, especially if proper security measures are not in place. It’s essential to store your cryptocurrencies securely and be aware of potential scams.

- Regulatory Uncertainty: The regulatory landscape for cryptocurrencies is still evolving, and unclear regulations can create uncertainty and risk for investors.

- Market Manipulation: The cryptocurrency market is relatively small and can be susceptible to manipulation by large investors or whales.

- Potential Rewards: Despite the risks, investing in cryptocurrencies can offer significant potential rewards. Early adopters of successful cryptocurrencies have seen substantial returns on their investments.

Types of Cryptocurrencies

Cryptocurrencies can be categorized into different types based on their underlying technology, purpose, and features. Some common types include:

- Bitcoin (BTC): The first and most well-known cryptocurrency, Bitcoin is often considered the benchmark for the entire market. It is a decentralized digital currency based on blockchain technology.

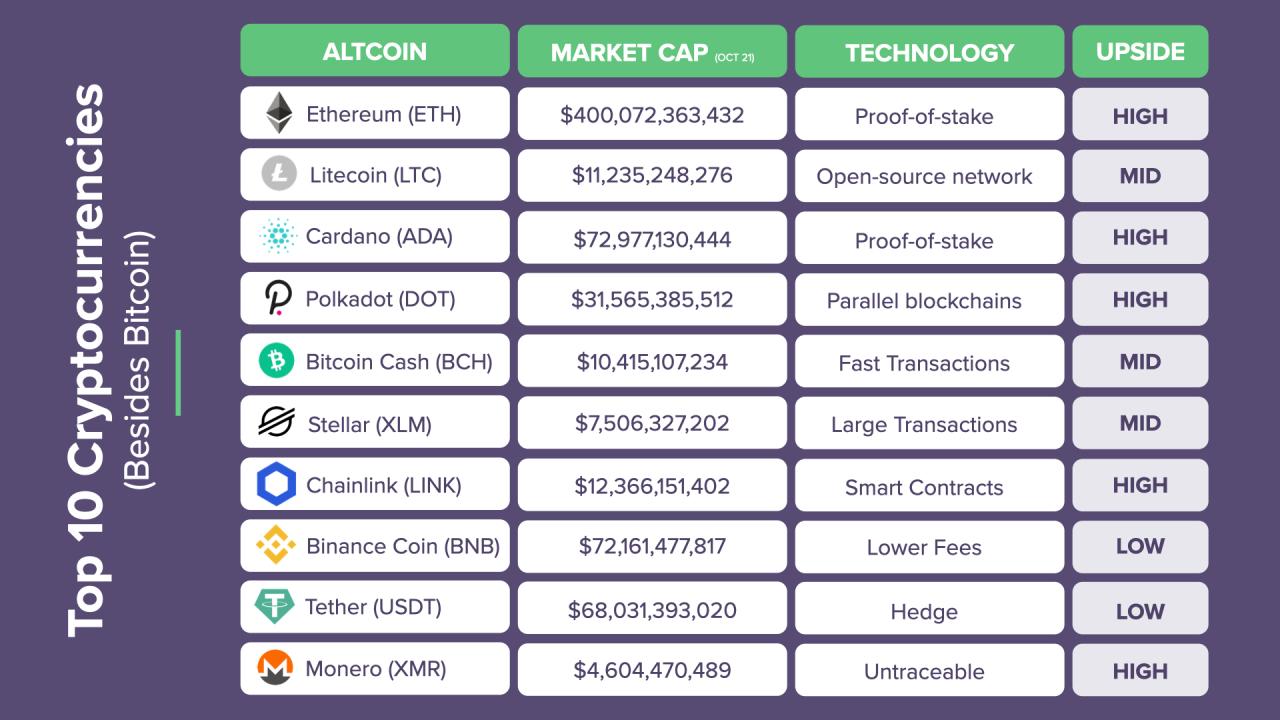

- Ethereum (ETH): Ethereum is a platform for decentralized applications (dApps) and smart contracts. It’s the second-largest cryptocurrency by market capitalization and is used for a wide range of purposes.

- Stablecoins: Stablecoins are cryptocurrencies designed to maintain a stable price, typically pegged to a fiat currency like the US dollar. They are often used for trading and to reduce volatility.

- Utility Tokens: Utility tokens are used to access services or products on a specific platform or blockchain. They can be used for payments, governance, or other purposes within the ecosystem.

- Meme Coins: Meme coins are cryptocurrencies that often gain popularity due to their association with internet memes or cultural trends. They can be highly volatile and speculative.

Factors to Consider When Choosing a Crypto

Choosing the right cryptocurrency can be daunting, given the vast and ever-expanding landscape. A thorough evaluation of several key factors is crucial to make informed investment decisions.

Market Capitalization, Trading Volume, and Price History

Market capitalization, trading volume, and price history offer insights into the overall health and performance of a cryptocurrency.

- Market Capitalization: This represents the total value of all circulating coins. A higher market capitalization generally indicates greater investor confidence and a more established project.

- Trading Volume: Trading volume reflects the amount of cryptocurrency bought and sold within a specific timeframe. High trading volume can signal strong interest and liquidity, making it easier to buy and sell the cryptocurrency.

- Price History: Examining the price history of a cryptocurrency can reveal its volatility, trends, and potential for growth. A consistent upward trend might indicate a promising project, while significant price fluctuations can suggest risk.

Key Features and Functionalities

Understanding the core features and functionalities of a cryptocurrency is essential to assess its potential.

- Use Case: What is the cryptocurrency designed to do? Is it used for payments, decentralized finance (DeFi), non-fungible tokens (NFTs), or other applications?

- Technology: What is the underlying technology behind the cryptocurrency? This includes the consensus mechanism (e.g., Proof-of-Work, Proof-of-Stake), the blockchain platform, and any unique features.

- Development Team: A strong and experienced development team is essential for the long-term success of a cryptocurrency. Look for a team with a proven track record and a clear roadmap for future development.

Regulatory Landscape

The regulatory environment surrounding cryptocurrencies can significantly impact their value and adoption.

- Government Regulations: Different countries have varying regulations on cryptocurrencies, ranging from outright bans to supportive frameworks.

- Legal Compliance: It is crucial to ensure that the cryptocurrency you invest in complies with all applicable regulations to avoid legal issues.

- Impact on Value: Positive regulatory developments can boost investor confidence and drive up the value of a cryptocurrency. Conversely, negative regulations can hinder its growth.

Researching and Evaluating Cryptocurrencies

Before diving into the world of cryptocurrency investments, it’s crucial to conduct thorough research and evaluate the potential of each cryptocurrency. This process involves understanding the underlying technology, analyzing market trends, and assessing the project’s team and community.

Research Methodology for Evaluating Cryptocurrencies

A comprehensive research methodology helps to evaluate the potential of a cryptocurrency investment. This approach involves multiple steps to assess the project’s fundamentals, market dynamics, and risk factors.

- Understanding the Technology: Delve into the technical aspects of the cryptocurrency, including the blockchain technology, consensus mechanism, and smart contract functionality. Assess the security, scalability, and efficiency of the underlying technology.

- Analyzing the Project’s Whitepaper: The whitepaper Artikels the project’s vision, goals, and technical specifications. Scrutinize the whitepaper for clarity, feasibility, and potential risks.

- Evaluating the Team and Community: Research the experience and expertise of the team behind the project. Examine the size and activity of the community surrounding the cryptocurrency. A strong team and engaged community can contribute to the project’s success.

- Analyzing Market Trends: Monitor the price history, trading volume, and market capitalization of the cryptocurrency. Consider the overall sentiment and investor confidence in the market.

- Assessing Risk Factors: Identify potential risks associated with the investment, such as regulatory uncertainty, technological vulnerabilities, and market volatility.

Resources and Tools for Researching Cryptocurrencies

Several resources and tools can assist in researching cryptocurrencies.

- Reputable Websites:

- CoinMarketCap: Provides real-time data on cryptocurrency prices, market capitalization, and trading volume.

- CoinGecko: Offers comprehensive information on cryptocurrencies, including price charts, market data, and developer activity.

- Messari: A platform for cryptocurrency research and analysis, providing insights on market trends and project fundamentals.

- Forums and Communities:

- Reddit: Active communities on Reddit discuss various cryptocurrencies, providing insights and perspectives from experienced users.

- BitcoinTalk: A forum dedicated to Bitcoin and other cryptocurrencies, offering a platform for discussions and news updates.

- Telegram: Many cryptocurrency projects have official Telegram channels where users can engage with the team and community.

- Analytical Platforms:

- TradingView: A platform for technical analysis, providing charting tools, indicators, and real-time data.

- Glassnode: Offers on-chain data analysis for Bitcoin and other cryptocurrencies, providing insights into network activity and market trends.

- Dune Analytics: A platform for analyzing blockchain data, providing insights into the usage and adoption of various cryptocurrencies.

Key Indicators to Track

Monitoring the performance of a cryptocurrency requires tracking key indicators.

- Price: The current price of the cryptocurrency reflects market sentiment and demand.

- Market Capitalization: The total value of all circulating coins, indicating the cryptocurrency’s overall market size.

- Trading Volume: The amount of cryptocurrency traded within a specific period, indicating market activity and liquidity.

- Social Media Sentiment: Analyze social media mentions and sentiment towards the cryptocurrency, gauging public opinion and investor interest.

- Developer Activity: Monitor the frequency of code updates and development milestones, indicating the project’s progress and commitment.

- Network Usage: Track the number of transactions, active addresses, and block size, indicating the cryptocurrency’s adoption and utilization.

Investing Strategies for Cryptocurrencies

Investing in cryptocurrencies can be an exciting and potentially lucrative endeavor, but it’s crucial to understand the different investment strategies available and their associated risks and rewards. Each approach has its own set of advantages and disadvantages, and choosing the right strategy depends on your individual financial goals, risk tolerance, and time horizon.

Dollar-Cost Averaging

Dollar-cost averaging (DCA) is a strategy that involves investing a fixed amount of money in a cryptocurrency at regular intervals, regardless of the market price. This approach helps to mitigate the risk of buying at a high price point by averaging out the cost of your investment over time.

- Pros: DCA helps to reduce the impact of market volatility, as you’re buying at different price points. This strategy is also relatively easy to implement, as you can automate your investments.

- Cons: DCA may not result in the highest potential returns if the market is consistently trending upwards. You might miss out on buying at lower prices, potentially limiting your profits.

Day Trading

Day trading involves buying and selling cryptocurrencies within a single trading day, aiming to profit from short-term price fluctuations. This strategy requires a high level of technical analysis, market knowledge, and risk tolerance.

- Pros: Day trading can generate significant returns if done successfully. It allows you to capitalize on short-term price movements and potentially make multiple trades in a single day.

- Cons: Day trading is extremely risky and requires significant time commitment and expertise. You need to constantly monitor the market and make quick decisions, which can be stressful and prone to errors.

Long-Term Holding

Long-term holding, also known as “hodling,” involves buying and holding cryptocurrencies for an extended period, typically months or years, with the expectation that their value will appreciate over time. This strategy relies on the belief that the underlying technology and adoption of cryptocurrencies will continue to grow.

- Pros: Long-term holding offers the potential for substantial returns, especially for cryptocurrencies with strong fundamentals and growing adoption. It’s a relatively low-maintenance strategy, as you don’t need to actively trade or monitor the market frequently.

- Cons: Long-term holding requires patience and the ability to weather market fluctuations. The value of cryptocurrencies can fluctuate significantly, and there’s no guarantee of profits.

Diversifying Your Cryptocurrency Portfolio

Diversification is a crucial element of any investment strategy, including cryptocurrency investing. It involves spreading your investments across different cryptocurrencies with varying risk profiles and market capitalizations. This helps to mitigate the risk of losing a significant portion of your portfolio if one particular cryptocurrency performs poorly.

“Don’t put all your eggs in one basket.” – Warren Buffett

- Example: Instead of investing solely in Bitcoin, consider diversifying your portfolio by allocating a portion of your funds to other promising cryptocurrencies like Ethereum, Solana, or Polkadot.

Responsible Crypto Investing

Investing in cryptocurrencies can be a lucrative opportunity, but it’s crucial to approach it responsibly. Understanding the risks and taking precautions to protect your investments is essential.

Thorough Due Diligence

Before investing in any cryptocurrency, conducting thorough due diligence is crucial. This involves researching the project’s fundamentals, team, technology, and market potential.

- Project Whitepaper: Analyze the whitepaper to understand the project’s goals, technology, and roadmap. Look for clear and detailed explanations of the project’s functionality and value proposition.

- Team and Background: Research the team behind the project, their experience, and their track record. A strong team with a proven history in the industry is a positive indicator.

- Technology and Innovation: Assess the project’s technology and its potential for innovation. Consider the project’s scalability, security, and potential for disruption in the market.

- Community and Adoption: Evaluate the project’s community engagement and adoption rate. A strong and active community can contribute to the project’s success.

- Market Analysis: Analyze the market potential for the cryptocurrency and its competitive landscape. Consider the project’s target market, potential for growth, and its position within the broader crypto ecosystem.

Risks Associated with Crypto Investing

Investing in cryptocurrencies comes with inherent risks. It’s important to understand these risks before making any investment decisions.

- Volatility: Cryptocurrencies are highly volatile, meaning their prices can fluctuate significantly in a short period. This volatility can lead to substantial losses if you’re not prepared for it.

- Security Breaches: Cryptocurrencies are vulnerable to security breaches, including hacking and theft. It’s crucial to use secure wallets and follow best practices to protect your investments.

- Scams and Fraud: The cryptocurrency market is prone to scams and fraud. Be wary of investment opportunities that seem too good to be true, and do your research before investing in any project.

- Regulation: The regulatory landscape for cryptocurrencies is still evolving, and changes in regulations can impact the value of your investments.

- Market Manipulation: Crypto markets can be susceptible to manipulation, which can lead to sudden price drops or spikes.

Protecting Your Crypto Investments

Taking precautions to protect your investments from potential threats is crucial.

- Secure Wallets: Use secure wallets to store your cryptocurrencies. Hardware wallets are considered the most secure option, while software wallets can be more convenient but may be less secure.

- Strong Passwords: Use strong and unique passwords for all your cryptocurrency accounts and wallets.

- Two-Factor Authentication: Enable two-factor authentication (2FA) for all your accounts to add an extra layer of security.

- Phishing Scams: Be wary of phishing scams that try to trick you into giving up your login credentials or private keys. Never click on suspicious links or provide your information to unknown sources.

- Diversification: Diversify your portfolio by investing in multiple cryptocurrencies across different sectors. This can help to mitigate risk.

- Risk Management: Develop a risk management strategy that Artikels your investment goals, risk tolerance, and exit plan.

Last Point

Investing in cryptocurrency requires careful research, evaluation, and a well-defined strategy. By understanding the crypto market, researching individual cryptocurrencies, and considering different investment approaches, you can navigate this dynamic landscape and make informed decisions that align with your financial goals. Remember, diversification is key to mitigating risk, and responsible investing practices, such as thorough due diligence and secure wallet management, are paramount to protecting your investments.

Question Bank

What is cryptocurrency?

Cryptocurrency is a digital or virtual currency that uses cryptography for security and operates independently of a central bank.

How does cryptocurrency work?

Cryptocurrencies utilize blockchain technology, a decentralized and distributed ledger that records transactions across a network of computers.

Is cryptocurrency safe?

The safety of cryptocurrency depends on various factors, including the security of the underlying blockchain, the security of your wallet, and the risks associated with scams and hacks.