- The Evolving Crypto Landscape

- Factors to Consider When Choosing a Cryptocurrency

- Popular Cryptocurrency Categories

- Investment Strategies and Risk Management: What Is The Best Crypto To Buy Right Now

- Research and Due Diligence

- Trading Platforms and Security Measures

- Understanding Market Sentiment and Technical Analysis

- The Future of Cryptocurrency

- Final Wrap-Up

- FAQ Explained

What is the best crypto to buy right now – What’s the best crypto to buy now? This question is on the minds of many, as the cryptocurrency market continues to evolve at a rapid pace. Navigating this dynamic landscape requires a careful understanding of key factors, investment strategies, and risk management. This guide aims to provide you with the information you need to make informed decisions in the exciting, yet often volatile, world of crypto.

The crypto market is characterized by its volatility, driven by a multitude of factors including regulatory changes, market sentiment, and technological advancements. It’s essential to approach crypto investing with a balanced perspective, recognizing both the potential for substantial returns and the inherent risks involved.

The Evolving Crypto Landscape

The cryptocurrency market has experienced a rollercoaster ride in recent years, characterized by periods of explosive growth followed by sharp corrections. This volatility is driven by a complex interplay of factors, including technological advancements, regulatory developments, and investor sentiment.

Recent Events and Investor Sentiment

Recent events have significantly impacted investor sentiment in the crypto market. The collapse of major cryptocurrency exchanges like FTX in 2022 has shaken confidence in the industry, leading to a decline in trading volumes and asset prices. The impact of these events extends beyond the immediate financial losses, as they raise concerns about the overall stability and maturity of the crypto ecosystem.

Regulatory Frameworks and Their Influence

Regulatory frameworks play a crucial role in shaping the future of the crypto market. Governments worldwide are grappling with how to regulate cryptocurrencies, with some countries embracing a more progressive approach while others remain cautious. The regulatory landscape is evolving rapidly, and its impact on the market is multifaceted.

“Regulation can create clarity and stability, fostering investor confidence and promoting responsible innovation.”

- Clear regulatory guidelines can attract institutional investors, leading to greater liquidity and price stability.

- Anti-money laundering (AML) and know-your-customer (KYC) regulations can help prevent illicit activities and enhance the integrity of the crypto market.

- Taxation policies can influence investment decisions and the overall attractiveness of the crypto market.

Factors to Consider When Choosing a Cryptocurrency

Investing in cryptocurrencies can be a rewarding venture, but it’s crucial to approach it with careful consideration. Before diving into the exciting world of digital assets, it’s essential to understand the key factors that influence their value and potential for growth.

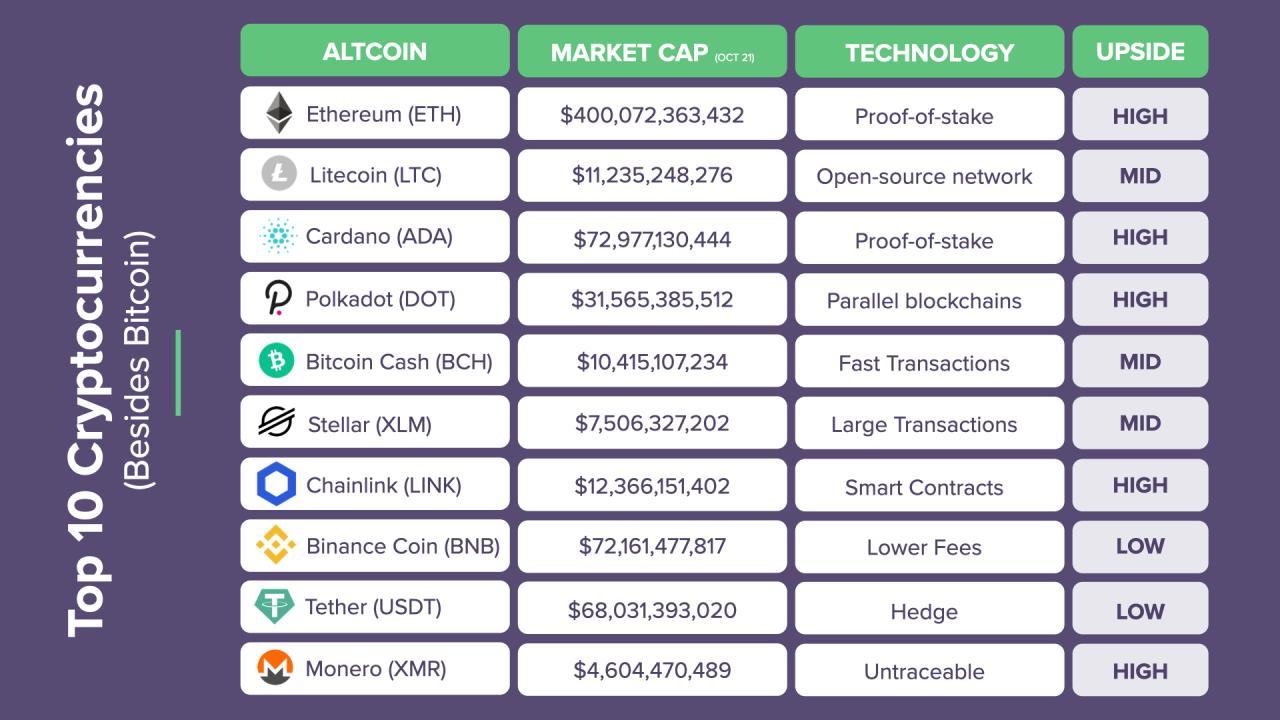

Market Capitalization

Market capitalization, often referred to as “market cap,” is a fundamental metric that reflects the total value of a cryptocurrency in circulation. It’s calculated by multiplying the current price of a cryptocurrency by its total circulating supply. Understanding market capitalization is crucial for investors as it provides insights into the overall size and potential of a project.

A cryptocurrency with a larger market cap generally signifies a more established and widely adopted project.

A higher market cap can indicate a stronger community, greater liquidity, and potentially higher resistance to price volatility. However, it’s important to note that market cap alone isn’t a guarantee of success. Emerging cryptocurrencies with smaller market caps may offer significant growth potential but also carry higher risks.

Trading Volume

Trading volume represents the amount of a cryptocurrency traded within a specific timeframe, typically 24 hours. It’s a measure of liquidity, which indicates how easily a cryptocurrency can be bought or sold without significantly impacting its price.

High trading volume suggests a robust market with ample buyers and sellers, potentially leading to greater price stability.

Conversely, low trading volume can indicate a lack of interest or limited liquidity, making it challenging to buy or sell large quantities without causing significant price fluctuations.

Developer Activity

Developer activity refers to the ongoing development and improvement of a cryptocurrency’s underlying technology and ecosystem. It’s crucial to evaluate the frequency of code updates, bug fixes, and the overall commitment of the development team.

Active development indicates a project that is constantly evolving, adapting to new challenges, and striving for improvement.

Conversely, stagnant development can signal a lack of innovation, potentially leading to decreased adoption and a decline in value. It’s essential to research the development team’s experience, track record, and the project’s roadmap to gauge the level of commitment and future potential.

Popular Cryptocurrency Categories

The cryptocurrency landscape is diverse, with numerous projects offering a range of functionalities and use cases. Understanding the various categories of cryptocurrencies is crucial for investors and users to make informed decisions.

This section explores the popular categories of cryptocurrencies, highlighting their key characteristics, strengths, weaknesses, and potential risks.

Bitcoin

Bitcoin is the first and most well-known cryptocurrency. It is a decentralized digital currency that operates on a blockchain, a distributed ledger that records all transactions.

Bitcoin’s key features include:

- Decentralization: Bitcoin is not controlled by any single entity, making it resistant to censorship and manipulation.

- Limited Supply: There will only ever be 21 million Bitcoins, creating scarcity and potential for value appreciation.

- Security: Bitcoin’s blockchain is highly secure due to its cryptographic algorithms and consensus mechanisms.

Bitcoin is primarily used as a store of value and a medium of exchange. It is often referred to as “digital gold” due to its limited supply and perceived value as a safe haven asset.

However, Bitcoin has its limitations:

- Limited Scalability: Bitcoin’s transaction throughput is relatively slow, leading to high fees during periods of high network activity.

- Energy Consumption: Bitcoin’s mining process consumes significant energy, raising environmental concerns.

- Volatility: Bitcoin’s price is highly volatile, making it a risky investment for some.

Ethereum

Ethereum is a decentralized platform that enables the creation and execution of smart contracts, which are self-executing agreements that operate on the blockchain. Ethereum also supports the creation of decentralized applications (dApps) and tokens.

- Smart Contracts: Ethereum’s smart contract functionality allows for the automation of agreements and processes, creating new possibilities for decentralized applications.

- DApp Development: Ethereum provides a platform for developers to build and deploy dApps, fostering innovation and new use cases for blockchain technology.

- Tokenization: Ethereum’s ERC-20 standard allows for the creation and issuance of tokens, representing various assets and functionalities.

Ethereum’s native cryptocurrency, Ether (ETH), is used to pay for transaction fees and interact with smart contracts.

However, Ethereum also faces challenges:

- Scalability: Ethereum’s network can become congested during periods of high activity, leading to increased transaction fees and slower processing times.

- Security Risks: Ethereum’s smart contracts are susceptible to vulnerabilities, which could lead to exploits and losses.

- Competition: Ethereum faces competition from other smart contract platforms, such as Solana and Cardano, which offer faster transaction speeds and lower fees.

Stablecoins

Stablecoins are cryptocurrencies designed to maintain a stable value, typically pegged to a fiat currency like the US dollar.

Stablecoins aim to mitigate the volatility of traditional cryptocurrencies and provide a more stable alternative for transactions and payments.

- Price Stability: Stablecoins are designed to maintain a stable price, making them suitable for payments and transactions that require predictable value.

- Reduced Volatility: Stablecoins help to reduce the risk associated with price fluctuations, making them attractive to users seeking stability.

- Ease of Use: Stablecoins are often integrated with fiat currency systems, making it easier for users to convert between crypto and fiat currencies.

Popular stablecoins include Tether (USDT), USD Coin (USDC), and Binance USD (BUSD).

However, stablecoins also have potential risks:

- Centralization: Many stablecoins are backed by centralized entities, which could pose risks to their stability and security.

- Regulatory Uncertainty: The regulatory landscape for stablecoins is evolving, which could impact their future development and adoption.

- Auditing and Transparency: Some stablecoins have faced scrutiny over their reserves and transparency, raising concerns about their stability and reliability.

Other Notable Categories

Beyond Bitcoin, Ethereum, and stablecoins, other notable categories of cryptocurrencies exist:

- Privacy Coins: Privacy coins, such as Monero (XMR) and Zcash (ZEC), prioritize user privacy by obscuring transaction details.

- Meme Coins: Meme coins, such as Dogecoin (DOGE) and Shiba Inu (SHIB), are often based on internet memes and have gained popularity through community support and social media hype.

- Layer-2 Scaling Solutions: Layer-2 scaling solutions, such as Polygon (MATIC) and Optimism (OP), aim to improve the scalability and efficiency of blockchain networks.

- Decentralized Finance (DeFi): DeFi projects, such as Aave (AAVE) and Compound (COMP), offer decentralized financial services, such as lending, borrowing, and trading.

- Non-Fungible Tokens (NFTs): NFTs, such as CryptoPunks and Bored Ape Yacht Club, represent unique digital assets that can be traded and collected.

Investment Strategies and Risk Management: What Is The Best Crypto To Buy Right Now

Investing in cryptocurrencies can be a rewarding but also a risky endeavor. Understanding different investment strategies and implementing robust risk management practices are crucial for navigating the volatile crypto market.

Cryptocurrency Investment Strategies

There are several popular investment strategies employed by cryptocurrency investors. Each approach has its own set of benefits, drawbacks, and risk profiles.

- Long-Term Holding (Hodling): This strategy involves buying and holding cryptocurrencies for an extended period, typically years, with the expectation that their value will appreciate over time. Hodlers believe in the long-term potential of cryptocurrencies and are willing to ride out short-term market fluctuations. This strategy is suitable for investors with a high risk tolerance and a long-term investment horizon.

- Day Trading: Day trading involves buying and selling cryptocurrencies within the same trading day, aiming to profit from short-term price fluctuations. Day traders often utilize technical analysis and market sentiment to identify trading opportunities. This strategy requires significant technical expertise, time commitment, and a high risk tolerance, as losses can occur quickly.

- Arbitrage: This strategy involves exploiting price discrepancies between different cryptocurrency exchanges. Arbitrageurs buy cryptocurrencies at a lower price on one exchange and simultaneously sell them at a higher price on another exchange, capturing the price difference as profit. This strategy requires quick execution and access to multiple exchanges.

Risk Management in Cryptocurrency Investing

Cryptocurrencies are known for their high volatility, which can lead to significant gains but also substantial losses. Therefore, effective risk management is crucial for any cryptocurrency investor.

- Diversification: Diversifying your portfolio across different cryptocurrencies can help mitigate risk. By investing in a range of projects with varying functionalities, you can reduce the impact of any single asset’s price fluctuations on your overall portfolio.

- Dollar-Cost Averaging (DCA): DCA involves investing a fixed amount of money in cryptocurrencies at regular intervals, regardless of market conditions. This strategy helps average out the purchase price over time, reducing the impact of market volatility.

- Stop-Loss Orders: Stop-loss orders are pre-set instructions to automatically sell a cryptocurrency if its price falls below a certain threshold. This helps limit potential losses and protect your investment from significant price drops.

- Cold Storage: Storing your cryptocurrencies in offline wallets, known as cold storage, reduces the risk of hacking and theft. Cold wallets are not connected to the internet, making them more secure than online wallets.

- Only Invest What You Can Afford to Lose: This fundamental principle of investing applies to cryptocurrencies as well. Never invest more than you can afford to lose, as the market can be unpredictable.

Practical Tips for Diversifying Portfolios and Mitigating Risks

Here are some practical tips to help you diversify your portfolio and manage risk effectively:

- Research Thoroughly: Before investing in any cryptocurrency, conduct thorough research on the project, its team, technology, and market potential.

- Understand the Risks: Recognize that cryptocurrency investments are highly speculative and carry significant risks. Be prepared for potential losses.

- Don’t Follow the Hype: Avoid investing in cryptocurrencies solely based on hype or social media trends. Make informed decisions based on fundamental analysis.

- Set Realistic Expectations: Cryptocurrency markets are volatile, and it’s important to set realistic expectations. Avoid expecting overnight riches or guaranteed returns.

- Seek Professional Advice: If you are unsure about cryptocurrency investing, consider consulting a financial advisor who specializes in digital assets.

Research and Due Diligence

The cryptocurrency market is volatile and complex, making thorough research and due diligence essential before investing in any cryptocurrency. Understanding the fundamentals of a project and its potential risks is crucial to making informed investment decisions.

Identifying Reputable Sources of Information

To conduct effective research, it is crucial to rely on reputable sources of information. Avoid relying solely on social media hype or unverified websites. Instead, focus on credible sources like:

- Official Project Websites: The official website should provide comprehensive information about the project’s goals, technology, team, and roadmap. Look for clear and concise language, detailed white papers, and active community forums.

- Reputable Crypto News Outlets: Platforms like CoinDesk, Cointelegraph, and The Block provide in-depth coverage of the cryptocurrency industry. Look for articles that offer unbiased analysis and insights from experienced journalists.

- Independent Crypto Research Firms: Firms like Messari, CoinGecko, and Glassnode provide data-driven research and analysis on cryptocurrencies. Their reports can offer valuable insights into project performance, market trends, and risk factors.

- Crypto Community Forums: Forums like Reddit’s r/Cryptocurrency and BitcoinTalk can provide valuable insights and discussions from experienced community members. However, exercise caution, as opinions can vary widely, and not all information is accurate.

Conducting Due Diligence

Once you have identified reputable sources of information, you can begin conducting due diligence on the cryptocurrency you are considering. This involves a comprehensive analysis of various factors:

- Analyzing White Papers: White papers are detailed documents that Artikel the project’s goals, technology, and economic model. Look for clear explanations of the technology, a strong team with relevant experience, and a realistic roadmap for development.

- Understanding Team Backgrounds: A strong team with experience in relevant fields is crucial for a project’s success. Research the team’s backgrounds, expertise, and track records to assess their capabilities and commitment.

- Evaluating Project Roadmaps: The roadmap Artikels the project’s development milestones and timelines. Assess the feasibility of the roadmap, the progress made so far, and the potential for future development. Look for projects with clear goals, achievable milestones, and a strong community following.

- Assessing Project Security: Security is paramount in the cryptocurrency space. Look for projects that use proven security measures, have undergone audits by reputable firms, and have a history of responsible development practices.

- Understanding Regulatory Landscape: The regulatory landscape for cryptocurrencies varies across jurisdictions. Research the legal and regulatory environment surrounding the project to assess potential risks and compliance issues.

Trading Platforms and Security Measures

Navigating the world of cryptocurrencies requires a reliable and secure trading platform. These platforms act as intermediaries, facilitating the buying, selling, and trading of digital assets. Choosing the right platform is crucial, as it directly impacts your trading experience, fees, and security.

Cryptocurrency Trading Platforms, What is the best crypto to buy right now

Choosing the right platform depends on your individual needs and preferences. Here’s a comparison of some popular platforms:

- Coinbase: User-friendly platform with a wide range of cryptocurrencies, suitable for beginners. Offers a simple interface and educational resources.

- Binance: Popular platform with a vast selection of cryptocurrencies and advanced trading features. Known for its low fees and high liquidity.

- Kraken: Known for its security features and advanced trading tools. Offers a professional platform with institutional-grade security.

- Gemini: Regulated platform with a focus on security and compliance. Offers a user-friendly interface and competitive fees.

- KuCoin: Popular platform with a wide selection of cryptocurrencies and advanced trading features. Known for its low fees and high liquidity.

Cryptocurrency Wallets

Cryptocurrency wallets are essential for storing and managing your digital assets. They act as secure containers for your private keys, which grant you access to your cryptocurrencies. Different types of wallets offer varying levels of security and convenience:

- Hot Wallets: These wallets are stored online and are accessible through internet-connected devices. They offer convenience but are more vulnerable to security threats.

- Cold Wallets: These wallets are stored offline and are not connected to the internet. They provide a higher level of security but are less convenient to use.

- Hardware Wallets: These wallets are physical devices that store your private keys offline. They are considered the most secure type of wallet and are highly recommended for storing large amounts of cryptocurrencies.

Security Measures

Protecting your private keys is paramount to safeguarding your cryptocurrencies. Here are some essential security measures:

- Enable Two-Factor Authentication (2FA): This adds an extra layer of security by requiring a second authentication factor, such as a code sent to your phone, in addition to your password.

- Use Strong Passwords: Choose unique and complex passwords that are difficult to guess. Avoid using common words or personal information.

- Store Private Keys Securely: Never share your private keys with anyone. Store them offline in a safe and secure location.

- Be Cautious of Phishing Scams: Be wary of emails or messages that ask for your private keys or personal information. Never click on suspicious links or download attachments from unknown sources.

- Keep Software Updated: Regularly update your wallet software and operating system to patch security vulnerabilities.

Understanding Market Sentiment and Technical Analysis

Market sentiment and technical analysis are crucial tools for navigating the volatile world of cryptocurrencies. Understanding how these factors influence price movements can help investors make informed decisions and potentially increase their chances of success.

Market Sentiment

Market sentiment refers to the overall feeling or attitude of investors towards a particular asset. It can be influenced by various factors, such as news events, regulatory changes, technological advancements, and social media trends. When sentiment is bullish, investors are optimistic about the future of the asset and are likely to buy, driving prices up. Conversely, bearish sentiment indicates pessimism, leading to selling pressure and price declines.

Technical Analysis Tools and Techniques

Technical analysis involves studying historical price data and trading volume to identify patterns and trends that can predict future price movements. Here are some commonly used tools and techniques:

Chart Patterns

Technical analysts use various chart patterns to identify potential buy and sell signals. Some popular patterns include:

- Head and Shoulders: A bearish pattern indicating a potential reversal of an uptrend. It is characterized by three peaks, with the middle peak being the highest (the “head”) and the two outer peaks being lower (the “shoulders”).

- Double Top: Another bearish pattern that suggests a reversal of an uptrend. It forms when the price reaches a high point twice, followed by a decline.

- Moving Averages: Moving averages are calculated by averaging the price of an asset over a specific period. They can help identify trends and provide support and resistance levels.

- Relative Strength Index (RSI): The RSI is a momentum indicator that measures the magnitude of recent price changes to evaluate overbought or oversold conditions in the market.

Indicators

Technical indicators are mathematical calculations that use price and volume data to generate signals about potential price movements. Some common indicators include:

- MACD (Moving Average Convergence Divergence): The MACD is a trend-following momentum indicator that shows the relationship between two moving averages of prices.

- Bollinger Bands: Bollinger Bands are volatility indicators that show the standard deviation of price movements over a certain period. They can help identify overbought or oversold conditions and potential breakout points.

Market Cycles and Buy/Sell Signals

Cryptocurrency markets, like other financial markets, often experience cyclical patterns. These cycles typically involve periods of growth, consolidation, and correction. Understanding these cycles can help investors identify potential buy and sell signals.

- Bull Market: A bull market is characterized by sustained price increases and investor optimism. This is a favorable period for buying cryptocurrencies.

- Bear Market: A bear market is characterized by declining prices and investor pessimism. This is a challenging period for investors, and it is generally recommended to be cautious or consider selling.

- Consolidation: Consolidation is a period of sideways price movement after a significant price increase or decrease. It can provide an opportunity to accumulate or sell at favorable prices.

The Future of Cryptocurrency

The cryptocurrency landscape is rapidly evolving, with exciting potential for innovation and disruption across various sectors. While it’s impossible to predict the future with certainty, examining current trends and technological advancements provides valuable insights into the potential trajectory of cryptocurrencies and their impact on the global economy.

Blockchain Technology’s Expanding Applications

Blockchain technology, the underlying foundation of cryptocurrencies, is poised to revolutionize various industries beyond finance. Its inherent features, such as transparency, immutability, and decentralization, offer significant advantages in diverse applications.

- Supply Chain Management: Blockchain can enhance supply chain transparency and efficiency by providing a secure and auditable record of goods movement, reducing fraud and counterfeiting. For example, Walmart uses blockchain to track the origin of its food products, ensuring consumer safety and traceability.

- Healthcare: Blockchain can securely store and share patient medical records, improving data privacy and interoperability between healthcare providers. For instance, the Medicalchain platform utilizes blockchain to enable secure and efficient patient data management.

- Voting Systems: Blockchain can create secure and transparent voting systems, reducing the risk of fraud and increasing voter confidence. The Estonian government has implemented a blockchain-based e-voting system, demonstrating its potential in enhancing democratic processes.

Final Wrap-Up

The best crypto to buy now is not a one-size-fits-all answer. It depends on your individual investment goals, risk tolerance, and understanding of the crypto landscape. By carefully considering the factors Artikeld in this guide, conducting thorough research, and employing sound risk management practices, you can navigate the crypto market with confidence and make informed investment decisions that align with your financial objectives.

FAQ Explained

Is cryptocurrency a good investment?

Cryptocurrency can be a good investment, but it comes with significant risks. The market is highly volatile, and prices can fluctuate rapidly. It’s crucial to conduct thorough research, understand the risks involved, and invest only what you can afford to lose.

How do I choose a cryptocurrency to invest in?

Consider factors such as market capitalization, trading volume, developer activity, and the project’s long-term vision. Research the underlying technology and assess the team behind the project.

What are the best cryptocurrency trading platforms?

There are many reputable cryptocurrency trading platforms available, each with its own features, fees, and security measures. Research and compare different platforms to find one that suits your needs.