Webull forex trading offers a platform for navigating the dynamic world of foreign exchange markets. This guide provides a comprehensive overview of Webull’s forex trading platform, exploring its features, benefits, and potential drawbacks. We’ll delve into popular trading strategies, fee structures, security measures, and customer support options to help you make informed decisions.

Whether you’re a seasoned trader or just starting, understanding the intricacies of forex trading is crucial. Webull provides a user-friendly platform with a range of tools and resources designed to empower traders of all levels. This guide aims to demystify the process and equip you with the knowledge you need to confidently navigate the world of forex trading.

Webull Forex Trading Introduction

Forex trading, also known as foreign exchange trading, involves buying and selling currencies to profit from fluctuations in their exchange rates. Webull, a popular online brokerage platform, offers forex trading services, allowing users to access the global currency market.

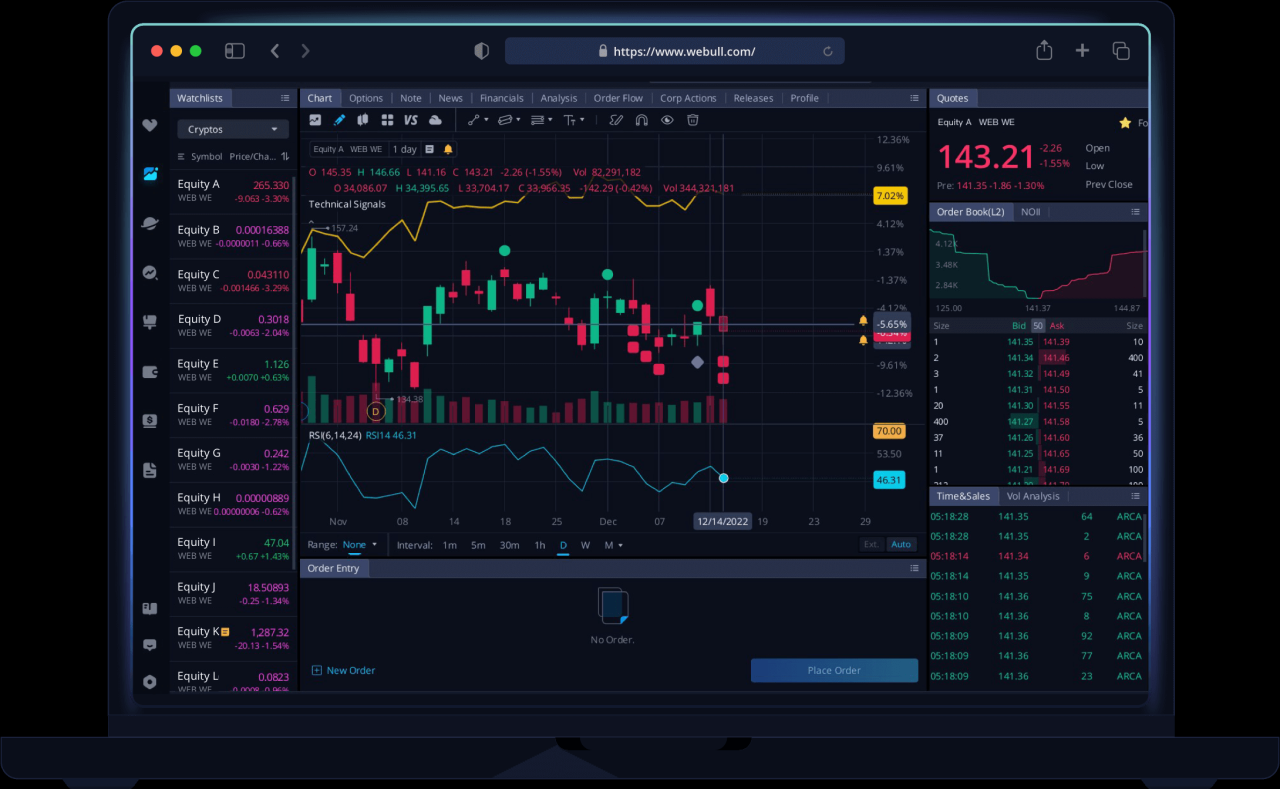

Webull’s forex trading platform provides a user-friendly interface with features designed to cater to both novice and experienced traders. It offers access to a wide range of currency pairs, competitive spreads, real-time market data, and various charting tools for technical analysis.

Benefits of Using Webull for Forex Trading

Webull offers several benefits for forex traders, including:

- User-friendly platform: Webull’s platform is intuitive and easy to navigate, making it suitable for beginners.

- Competitive spreads: Webull offers competitive spreads, which are the difference between the buy and sell prices of a currency pair, allowing traders to maximize their profits.

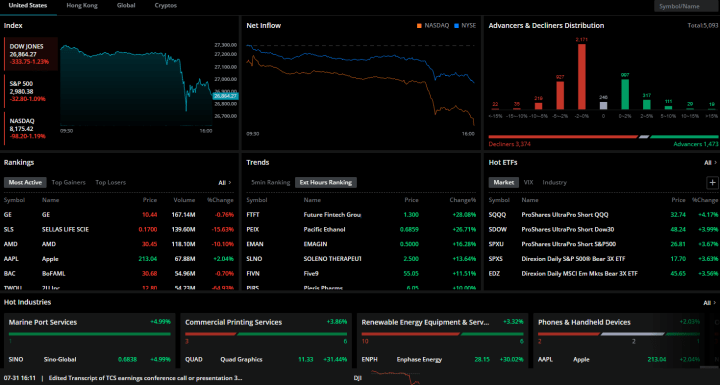

- Real-time market data: Webull provides access to real-time market data, including price quotes, charts, and news, allowing traders to stay informed about market movements.

- Charting tools: Webull offers a variety of charting tools, including technical indicators and drawing tools, which help traders analyze market trends and make informed trading decisions.

- Mobile trading app: Webull’s mobile trading app allows traders to access the platform and manage their trades on the go.

Drawbacks of Using Webull for Forex Trading

While Webull offers several advantages, it also has some drawbacks:

- Limited forex offerings: Webull’s forex offerings are limited compared to other forex brokers, with fewer currency pairs available.

- No forex education resources: Webull does not offer dedicated forex education resources, such as webinars or articles, which can be beneficial for beginners.

- Limited research tools: Webull’s research tools for forex are limited, lacking advanced features like fundamental analysis tools or expert opinions.

- Customer support: While Webull provides customer support, some users have reported issues with response times and resolution.

Webull Forex Trading Features

Webull’s forex trading platform is designed to empower traders of all levels with the tools and resources they need to navigate the dynamic foreign exchange market. The platform offers a comprehensive suite of features that cater to both beginners and experienced traders.

Charting Capabilities

Webull provides traders with a robust charting package that allows for in-depth analysis of forex price movements. The platform offers a wide range of chart types, including candlestick, line, and bar charts. Traders can customize these charts with various technical indicators and drawing tools to identify patterns and trends.

Technical Indicators

Webull offers a wide array of technical indicators that traders can use to gain insights into market sentiment and identify potential trading opportunities. These indicators can be grouped into several categories:

- Trend Indicators: Moving averages, MACD, and ADX help traders identify the overall direction of the market.

- Momentum Indicators: RSI, Stochastic Oscillator, and Momentum help traders gauge the strength of price movements.

- Volatility Indicators: Bollinger Bands, Average True Range (ATR), and Keltner Channels help traders assess the level of price volatility.

Order Types

Webull offers a variety of order types that allow traders to execute trades in a manner that suits their trading style and risk tolerance. Some of the most commonly used order types include:

- Market Orders: These orders are executed immediately at the best available market price.

- Limit Orders: These orders are executed only when the market price reaches a specified price level.

- Stop Orders: These orders are triggered when the market price reaches a specified price level and are executed at the best available market price.

Educational Resources

Webull recognizes the importance of education in forex trading and provides a wealth of resources to help traders learn and improve their skills. The platform offers:

- Forex Education Center: This section provides articles, videos, and webinars covering a wide range of forex trading topics.

- Trading Glossary: This glossary defines key forex trading terms and concepts.

- Market Analysis: Webull provides daily and weekly market analysis reports that offer insights into current market conditions and potential trading opportunities.

Customer Support

Webull offers dedicated customer support to assist traders with any questions or concerns they may have. Traders can contact customer support through various channels, including email, phone, and live chat.

Forex Trading Strategies on Webull

Webull provides a platform for forex trading, and there are numerous strategies that traders can employ to achieve their goals. These strategies can be categorized into two main types: technical analysis and fundamental analysis.

Technical Analysis, Webull forex trading

Technical analysis involves using price charts and indicators to identify patterns and trends in the market. Traders can use this information to make informed trading decisions. Here are some common technical analysis techniques:

- Trend Following: Identifying the direction of the trend, whether uptrend, downtrend, or sideways, and trading in the direction of the trend.

- Support and Resistance: Identifying price levels where the price has historically reversed or bounced off, and using these levels as potential entry or exit points.

- Moving Averages: Using moving averages, which are calculated averages of past prices, to identify trend direction and potential support or resistance levels.

- Oscillators: Using oscillators, which measure the momentum of price movements, to identify overbought or oversold conditions and potential reversal points.

Fundamental Analysis

Fundamental analysis focuses on examining the economic and political factors that can influence currency values. This involves analyzing macroeconomic indicators, such as inflation, interest rates, and GDP growth, to understand the underlying strength or weakness of a currency.

- Economic Data: Analyzing economic releases, such as inflation data, interest rate decisions, and employment reports, to assess the overall health of an economy and its impact on currency values.

- Political Events: Monitoring political events, such as elections, government policies, and international relations, which can significantly influence currency movements.

- Central Bank Policies: Understanding the monetary policies of central banks, such as interest rate adjustments and quantitative easing, which can directly impact currency values.

Risk Management

Risk management is crucial in forex trading, and it involves strategies to limit potential losses.

- Stop-Loss Orders: Setting stop-loss orders, which automatically close a position when the price reaches a predetermined level, to limit potential losses on a trade.

- Position Sizing: Determining the appropriate size of a trade based on risk tolerance and account balance, to avoid risking too much capital on a single trade.

- Diversification: Spreading trades across different currency pairs to reduce overall risk and exposure to any single currency.

Webull Forex Trading Fees and Costs

Understanding the fees associated with forex trading on Webull is crucial for maximizing your profitability. Webull offers a competitive fee structure, but it’s essential to consider all the costs involved to make informed trading decisions.

Webull Forex Trading Fees

Webull’s forex trading fees are primarily determined by the spread, which is the difference between the bid and ask prices of a currency pair. The spread represents the profit made by the broker, Webull in this case, for facilitating the trade. Webull does not charge any commissions on forex trades.

- Spread: Webull’s spreads are generally competitive, but they can vary depending on the currency pair, market volatility, and trading volume. It’s essential to compare Webull’s spreads with other brokers to ensure you’re getting a good deal.

- Inactivity Fee: Webull does not charge any inactivity fees for forex trading accounts.

- Other Fees: There may be other fees associated with forex trading on Webull, such as fees for using certain trading tools or features. It’s crucial to review Webull’s fee schedule for complete details.

Comparison with Other Platforms

Webull’s forex trading fees are generally competitive compared to other platforms. However, it’s important to compare fees across different brokers, considering factors like spreads, commissions, and other fees.

- Spread Comparison: Some brokers may offer tighter spreads than Webull, especially for popular currency pairs.

- Commission Comparison: While Webull does not charge commissions, some brokers may offer commission-free forex trading.

- Other Fee Comparison: It’s essential to compare the overall cost of trading on different platforms, including fees for account maintenance, withdrawals, and other services.

Impact of Fees on Profitability and Trading Strategies

Trading fees can significantly impact your forex trading profitability. Understanding how fees affect your trading strategy is crucial for maximizing your returns.

- Spread Impact: Wider spreads can eat into your profits, especially for short-term trades or trades with small profit margins.

- Commission Impact: Commissions can add to the overall cost of trading, especially for high-frequency traders or traders making multiple trades.

- Trading Strategy Adjustment: It’s essential to adjust your trading strategy to minimize the impact of fees. For example, you may choose to trade larger lots or focus on higher-probability trades to offset the cost of fees.

Webull Forex Trading Security and Regulations

Webull prioritizes the security of its users’ accounts and funds. The platform implements robust security measures and operates within a well-defined regulatory framework to ensure a secure and trustworthy trading environment.

Security Measures Implemented by Webull

Webull employs several security measures to protect user accounts and funds. These measures are designed to prevent unauthorized access, data breaches, and financial losses.

- Two-Factor Authentication (2FA): Webull requires users to enable 2FA, adding an extra layer of security by requiring a second authentication factor, typically a code sent to the user’s mobile device, in addition to the password. This significantly reduces the risk of unauthorized access even if someone obtains the user’s password.

- Encryption: All user data, including financial information, is encrypted both in transit and at rest. This means that even if data is intercepted, it is unreadable without the proper decryption key.

- Secure Login: Webull utilizes secure login protocols, such as HTTPS, to protect user credentials and prevent unauthorized access during login attempts.

- Regular Security Audits: Webull conducts regular security audits to identify and address potential vulnerabilities in its systems and infrastructure.

- Fraud Detection Systems: Webull has sophisticated fraud detection systems in place to monitor account activity for suspicious transactions and patterns. This helps prevent fraudulent activities and protect users’ funds.

Regulatory Framework Governing Webull’s Forex Trading Operations

Webull’s forex trading operations are subject to the regulations of the Financial Industry Regulatory Authority (FINRA) in the United States. FINRA is a non-governmental organization that regulates broker-dealers and other financial institutions in the US.

- FINRA Regulation: FINRA regulations ensure that Webull complies with specific requirements for financial reporting, capital adequacy, customer protection, and other aspects of its operations. This includes requirements for maintaining adequate capital reserves, segregating customer funds, and providing clear disclosures about its services and fees.

- Customer Protection: Webull is required to maintain a certain level of net capital to protect customers in case of financial losses. This ensures that customers have a financial cushion if Webull faces financial difficulties.

- Dispute Resolution: FINRA provides a dispute resolution process for customers who have complaints or disagreements with Webull. This process allows for fair and impartial resolution of disputes.

Risks Associated with Forex Trading and How Webull Addresses Them

Forex trading involves inherent risks, and it’s crucial to understand these risks before engaging in trading. Webull acknowledges these risks and provides resources and tools to help users mitigate them.

- Market Volatility: The forex market is highly volatile, and prices can fluctuate rapidly. This can lead to significant losses if traders are not careful. Webull’s solution: Webull offers tools and resources, such as market analysis, charting tools, and educational materials, to help users understand market dynamics and make informed trading decisions.

- Leverage: Forex trading involves leverage, which allows traders to control a larger position with a smaller amount of capital. While leverage can amplify profits, it can also amplify losses. Webull’s solution: Webull provides users with information about leverage and its risks, and allows users to set their own leverage levels based on their risk tolerance.

- Counterparty Risk: Counterparty risk refers to the risk that the other party to a trade may not fulfill their obligations. Webull’s solution: Webull partners with reputable financial institutions to ensure that its customers are trading with reliable counterparties.

- Liquidity Risk: Liquidity risk refers to the risk that it may be difficult to exit a trade quickly at a desired price. Webull’s solution: Webull provides access to a deep and liquid forex market, which helps to minimize liquidity risk.

Webull Forex Trading Customer Support

Webull’s customer support is an essential aspect of the trading experience, offering assistance to traders with various inquiries and issues. The platform provides a range of support options, aiming to ensure traders have access to the necessary help when needed.

Customer Support Options

Webull offers multiple channels for forex traders to seek assistance. These options provide flexibility and cater to different preferences.

- Help Center: Webull’s Help Center serves as a comprehensive resource for frequently asked questions, tutorials, and articles covering various topics, including forex trading. This self-service option allows traders to find answers quickly and efficiently.

- Email Support: Traders can reach out to Webull’s customer support team via email for inquiries requiring more detailed assistance. This option provides a written record of the interaction, ensuring clarity and documentation.

- Live Chat: Webull offers live chat support for immediate assistance. This feature enables traders to connect with a customer support representative in real-time, addressing urgent questions or issues promptly.

Responsiveness and Effectiveness

Webull’s customer support team is generally responsive and effective in addressing trader concerns. The platform strives to provide timely assistance, acknowledging inquiries and offering solutions within a reasonable timeframe.

User Experience with Webull’s Customer Support

Traders have generally reported positive experiences with Webull’s customer support. The team is known for its professionalism, helpfulness, and ability to resolve issues efficiently.

Webull Forex Trading Alternatives

Webull is a popular platform for forex trading, but it’s not the only option available. Several other platforms offer competitive features and services, catering to different trader preferences. Choosing the right platform depends on individual needs and trading styles. This section compares Webull with other popular forex trading platforms, highlighting their strengths and weaknesses.

Comparison of Forex Trading Platforms

A comparison of Webull with other popular forex trading platforms can help traders identify the best fit for their trading needs. Here’s a table that compares Webull with other platforms based on key features, fees, and pros/cons:

| Platform | Key Features | Fees | Pros | Cons |

|---|---|---|---|---|

| Webull |

|

|

|

|

| TD Ameritrade |

|

|

|

|

| Interactive Brokers |

|

|

|

|

| Oanda |

|

|

|

|

Outcome Summary

As you embark on your forex trading journey with Webull, remember that the key to success lies in a well-defined strategy, proper risk management, and continuous learning. By understanding the nuances of the platform, leveraging available resources, and staying informed about market trends, you can maximize your potential and achieve your financial goals. Webull’s forex trading platform offers a valuable gateway to the global financial markets, providing you with the tools and knowledge to navigate this exciting and potentially lucrative world.

FAQ Explained

Is Webull forex trading suitable for beginners?

Yes, Webull offers a user-friendly platform with educational resources and tools that can help beginners navigate the forex market. However, it’s crucial to understand the risks involved and start with a demo account to practice before trading with real money.

What are the minimum deposit requirements for Webull forex trading?

There is no minimum deposit requirement for opening a Webull forex trading account. However, you’ll need sufficient funds to cover your trades and any potential losses.

What are the trading hours for Webull forex?

Webull forex trading is available 24 hours a day, 5 days a week, as the forex market operates globally.