Topper buy crypto, a term that sends shivers down the spines of some and sparks excitement in others, refers to the practice of large-scale cryptocurrency purchases designed to influence market prices. These strategic buys, often executed by whales or institutional investors, can dramatically impact the cryptocurrency market, leaving a trail of both opportunity and risk in their wake.

This phenomenon has become increasingly prevalent in the cryptocurrency market, prompting both curiosity and concern. Understanding the motivations behind topper buys, the strategies employed, and their impact on the market is crucial for navigating the complexities of this dynamic landscape. Whether you are a seasoned investor or just starting your crypto journey, comprehending the power of topper buys can provide valuable insights for making informed decisions.

Understanding Topper Buy Crypto

A “topper buy” in the cryptocurrency market refers to a large purchase of a cryptocurrency, often at or near its all-time high price. These purchases can significantly impact the price of the asset, pushing it even higher. Topper buys are typically executed by institutional investors, high-net-worth individuals, or whales, who possess substantial capital and influence the market.

Topper buys can be motivated by several factors. The most common motivation is profit maximization, as these large investors aim to capitalize on the potential for further price appreciation. They believe that by buying at the peak, they can secure a higher entry point and potentially sell at an even higher price in the future. Additionally, topper buys can be driven by market manipulation, where investors intentionally inflate the price of an asset to attract other buyers and create a sense of momentum. This can lead to a short-term price surge, allowing the manipulators to sell their holdings at a profit.

Examples of Historical Topper Buys

Topper buys have played a significant role in shaping the cryptocurrency market, particularly in the early days of Bitcoin and other prominent cryptocurrencies. One notable example is the infamous “Bitcoin Pizza” transaction in 2010, where a user named Laszlo Hanyecz purchased two pizzas for 10,000 Bitcoin. At the time, Bitcoin was trading at a fraction of a cent, making this purchase a relatively insignificant amount. However, as Bitcoin’s value skyrocketed over the years, this transaction became a symbol of the potential for immense wealth creation in the cryptocurrency market.

Another example is the 2017 Bitcoin bull run, which saw the price of Bitcoin surge from under $1,000 to over $19,000 in a matter of months. This surge was fueled in part by institutional investors and whales entering the market with significant capital, pushing the price higher. While the exact details of these topper buys are not publicly available, it is widely believed that large purchases played a significant role in driving the market’s momentum.

Topper buys can have a profound impact on the cryptocurrency market, as they can create a sense of momentum and attract other buyers. However, it is important to note that these purchases can also be highly speculative and risky, as the market is inherently volatile.

Analyzing Topper Buy Strategies

Topper buyers, also known as “whales,” are individuals or entities with significant financial resources who can influence cryptocurrency market prices through their large-scale transactions. Understanding their strategies is crucial for investors seeking to navigate the volatile cryptocurrency landscape.

Accumulation Strategies

Topper buyers often employ accumulation strategies, aiming to acquire a substantial amount of cryptocurrency before a price surge. This involves purchasing cryptocurrencies over a period of time, gradually building their holdings. This approach allows them to exert more control over the market and potentially profit from price fluctuations.

The Impact of Topper Buys on the Crypto Market

Topper buys, characterized by large-scale purchases of cryptocurrencies at or near the peak of a price surge, can significantly impact the crypto market, both in the short term and the long term. These purchases can influence price fluctuations, investor sentiment, and the overall health and stability of the market.

Short-Term Impact on Prices and Volatility

Topper buys can create a short-term surge in cryptocurrency prices due to increased demand. As large amounts of capital flow into the market, buying pressure pushes prices upward. However, this price increase is often temporary and unsustainable. Once the initial buying frenzy subsides, the market may experience a correction, leading to a sharp decline in prices. This volatility can create uncertainty for investors and discourage participation in the market.

Long-Term Impact on Prices and Volatility

While topper buys can cause short-term price spikes, their long-term impact on prices is less clear-cut. The effect depends on various factors, including the size of the purchase, the overall market sentiment, and the subsequent trading activity. If the topper buy is followed by sustained demand and adoption, it could contribute to a long-term price increase. However, if the purchase is seen as an isolated event, it may have a limited impact on the long-term price trajectory.

Influence on Investor Sentiment and Trading Activity

Topper buys can significantly influence investor sentiment. Seeing large purchases by prominent individuals or institutions can inspire confidence and encourage others to invest in the market. This can lead to a positive feedback loop, where increased buying activity further pushes prices upward. However, if the topper buy is followed by a price correction, it can create panic and lead to sell-offs, negatively impacting investor sentiment.

Potential Impact on Market Health and Stability

Topper buys can pose a risk to the overall health and stability of the cryptocurrency market. Large purchases can create artificial price bubbles that are unsustainable in the long run. When these bubbles burst, they can lead to market crashes and significant losses for investors. Moreover, topper buys can distort market dynamics, creating an environment where prices are not driven by fundamental factors, such as adoption and utility. This can undermine the long-term sustainability of the market.

Identifying and Tracking Topper Buys: Topper Buy Crypto

Identifying and tracking topper buys involves a combination of analytical techniques and tools to uncover large-scale cryptocurrency purchases that can potentially influence market movements. By analyzing transaction data and identifying these purchases, traders and investors can gain insights into potential price shifts and capitalize on market opportunities.

Analyzing Transaction Data

Analyzing transaction data is crucial for identifying potential topper buys. By examining blockchain data, traders can identify large transactions that might indicate significant purchases by whales or institutional investors.

Here are some methods for analyzing transaction data:

- On-chain analysis: This involves examining blockchain data to identify large transactions, transaction clusters, and changes in on-chain metrics such as the number of active addresses and transaction volume. Platforms like Glassnode and Santiment offer on-chain analysis tools that can help identify potential topper buys.

- Exchange data analysis: Analyzing order book data and trading volume on cryptocurrency exchanges can reveal large-scale purchases that might not be immediately visible on the blockchain. Platforms like CoinMarketCap and TradingView provide exchange data that can be analyzed for this purpose.

- Social media analysis: Monitoring social media platforms for discussions about potential topper buys or announcements from influential figures in the crypto space can provide valuable insights. Tools like LunarCrush and CryptoQuant offer social media sentiment analysis and tracking of key influencers.

Tracking the Movement of Cryptocurrency

Once a potential topper buy is identified, it is essential to track the movement of the cryptocurrency to assess its impact on the market. This involves monitoring price action, trading volume, and other market indicators to understand how the market is reacting to the potential buy.

Here are some methods for tracking cryptocurrency movements:

- Price charts: Analyzing price charts on platforms like TradingView and Binance can help identify patterns and trends in price movements that may indicate the influence of a topper buy. Technical indicators like moving averages and relative strength index (RSI) can also be used to assess price momentum and potential reversals.

- Trading volume: Monitoring trading volume can provide insights into the strength of a price move. A sudden increase in volume, particularly in conjunction with a price surge, could indicate a topper buy driving the market higher.

- Social media sentiment: Tracking social media sentiment around the cryptocurrency can help gauge market sentiment and the potential impact of a topper buy. Platforms like LunarCrush and CryptoQuant offer social media sentiment analysis tools.

Resources and Platforms

Several resources and platforms provide insights into topper buy activity. Here are some examples:

- Glassnode: This platform offers on-chain analytics and data visualization tools that can help identify large transactions and potential topper buys.

- Santiment: Santiment provides on-chain and social media sentiment analysis tools that can be used to track market movements and identify potential topper buys.

- TradingView: TradingView offers real-time charting and analysis tools, including order book data and trading volume, that can help identify large-scale purchases.

- CoinMarketCap: CoinMarketCap provides real-time market data and insights, including exchange data and trading volume, that can be used to track the movement of cryptocurrencies.

- LunarCrush: LunarCrush offers social media sentiment analysis and influencer tracking tools that can help gauge market sentiment and identify potential topper buys.

- CryptoQuant: CryptoQuant provides on-chain and social media analytics tools that can help track market movements and identify potential topper buys.

The Role of Topper Buys in Crypto Investment

Topper buys, a trading strategy involving purchasing a large amount of cryptocurrency at a specific price point, can be a powerful tool in the hands of experienced crypto investors. However, it’s essential to understand the potential advantages and disadvantages associated with this strategy before implementing it. This section delves into the complexities of topper buys and explores how they can be utilized to navigate the volatile world of cryptocurrency investment.

Advantages of Topper Buys

Topper buys can be advantageous in several ways. They allow investors to capitalize on market fluctuations and potentially achieve substantial returns.

- Price Manipulation: Topper buys can influence the market price by creating a sudden surge in demand, potentially pushing the price upwards. This can attract other investors, leading to a positive feedback loop and further price appreciation.

- Market Dominance: By accumulating a large position, investors can exert significant influence over the market. This can be beneficial in influencing price movements and potentially benefiting from future price increases.

- Strategic Positioning: Topper buys can be used to establish a strong position in a particular cryptocurrency, allowing investors to benefit from future price increases and potentially participate in significant market movements.

Disadvantages of Topper Buys

Despite the potential benefits, topper buys also come with inherent risks.

- Market Volatility: The cryptocurrency market is notoriously volatile, and price fluctuations can be unpredictable. Topper buys can be particularly risky if the market moves against the investor’s expectations, potentially leading to significant losses.

- Liquidity Risk: Large transactions can impact liquidity, making it challenging to exit a position quickly if the market turns unfavorable. This can result in significant losses if the investor is unable to sell their holdings at the desired price.

- Regulatory Scrutiny: Large-scale transactions can attract regulatory scrutiny, potentially leading to investigations or restrictions on trading activities.

Risk Management and Due Diligence

Risk management and due diligence are crucial when considering topper buy opportunities.

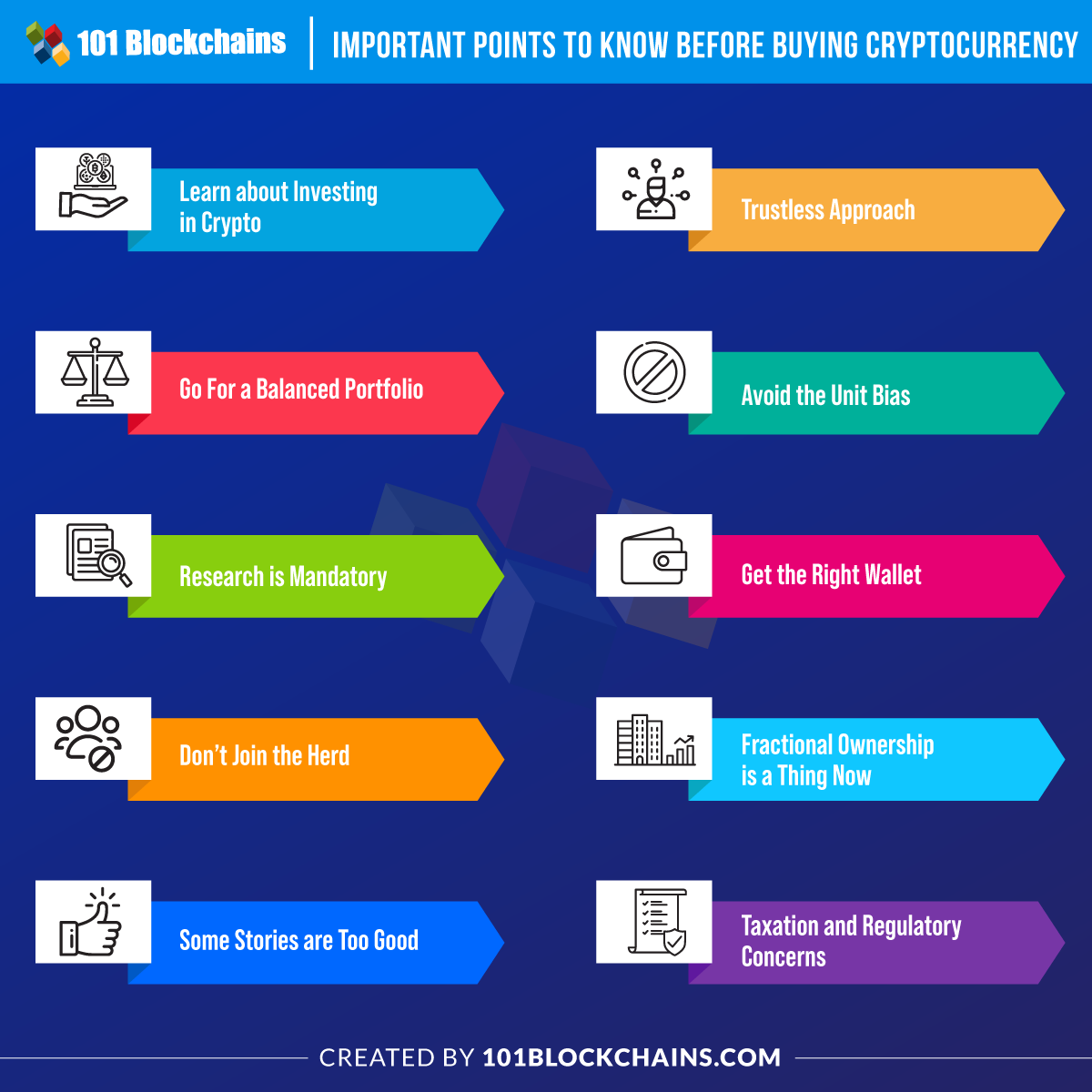

- Thorough Research: Investors should conduct extensive research on the cryptocurrency they are considering investing in, including its fundamentals, market trends, and potential risks.

- Diversification: To mitigate risk, investors should diversify their portfolio across multiple cryptocurrencies and asset classes. This can help reduce the impact of any single investment performing poorly.

- Stop-Loss Orders: Stop-loss orders can help limit potential losses by automatically selling a position if the price falls below a predetermined threshold.

- Risk Tolerance: Investors should carefully consider their risk tolerance and only invest an amount they are comfortable losing.

Navigating the Cryptocurrency Market, Topper buy crypto

Navigating the complexities of the cryptocurrency market requires a strategic approach.

- Stay Informed: Staying updated on market trends, regulatory developments, and technological advancements is crucial for making informed investment decisions.

- Seek Professional Advice: Consulting with experienced financial advisors or crypto experts can provide valuable insights and guidance on navigating the market.

- Patience and Discipline: Cryptocurrency investments require patience and discipline. Investors should avoid impulsive decisions and stick to their investment strategy.

- Long-Term Perspective: Investing in cryptocurrencies should be viewed as a long-term strategy. Market fluctuations are inevitable, and it’s important to stay focused on the long-term goals.

Conclusion

Topper buys are a powerful force in the cryptocurrency market, capable of driving both significant price fluctuations and market volatility. While they offer potential opportunities for savvy investors, it’s essential to approach them with caution and a comprehensive understanding of the risks involved. By staying informed about the latest trends, analyzing market data, and implementing sound risk management strategies, you can navigate the complexities of the cryptocurrency market and potentially capitalize on the opportunities presented by topper buys.

Questions and Answers

What are the legal implications of topper buy strategies?

The legality of topper buy strategies can vary depending on the jurisdiction and specific circumstances. In some cases, they may be considered market manipulation and subject to legal action. It’s crucial to consult with legal professionals to understand the specific regulations in your region.

How can I protect myself from the negative effects of topper buys?

While topper buys can create both opportunities and risks, you can mitigate potential negative impacts by diversifying your portfolio, setting stop-loss orders, and staying informed about market trends. It’s also essential to practice responsible risk management and avoid impulsive trading decisions.