- Forex Trading Platforms

- Top 10 Forex Trading Platforms

- Factors to Consider When Choosing a Forex Trading Platform

- Types of Forex Trading Platforms

- Key Features of a Top Forex Trading Platform

- Security and Regulation

- Trading Resources and Education

- Customer Support and Accessibility

- Conclusion

- Summary

- Helpful Answers: Top 10 Forex Trading Platforms

Navigating the world of Forex trading can be daunting, especially for beginners. With top 10 forex trading platforms at the forefront, this article provides a comprehensive guide to help you choose the best platform for your trading journey. The Forex market, the largest and most liquid financial market globally, offers immense opportunities for investors and traders. This article will explore the key features, advantages, and disadvantages of the top 10 Forex trading platforms, guiding you towards making an informed decision.

This article will delve into the intricacies of Forex trading platforms, covering everything from platform types and essential features to security considerations and educational resources. We’ll also provide insights into factors to consider when choosing a platform, ensuring you find one that aligns with your trading goals and risk tolerance.

Forex Trading Platforms

The world of finance is vast and complex, with various markets and instruments offering opportunities for investors and traders. One of the most dynamic and accessible markets is the Forex market, which stands for Foreign Exchange. This market, operating 24 hours a day, five days a week, allows individuals and institutions to trade currencies, seeking to profit from fluctuations in their exchange rates. To navigate this intricate market effectively, traders rely on Forex trading platforms, which act as their gateways to the global currency exchange. These platforms provide essential tools and functionalities that empower traders to execute orders, analyze market trends, and manage their trading activities.

The Importance of Forex Trading Platforms

Forex trading platforms are crucial for traders in the Forex market, facilitating their interactions with the global currency exchange. These platforms provide a range of features and functionalities that streamline trading operations, enhance trading efficiency, and empower traders with the necessary tools for informed decision-making. The significance of Forex trading platforms can be summarized as follows:

- Access to the Forex Market: Forex trading platforms act as the primary interface between traders and the global Forex market, providing access to real-time currency quotes and enabling the execution of trading orders.

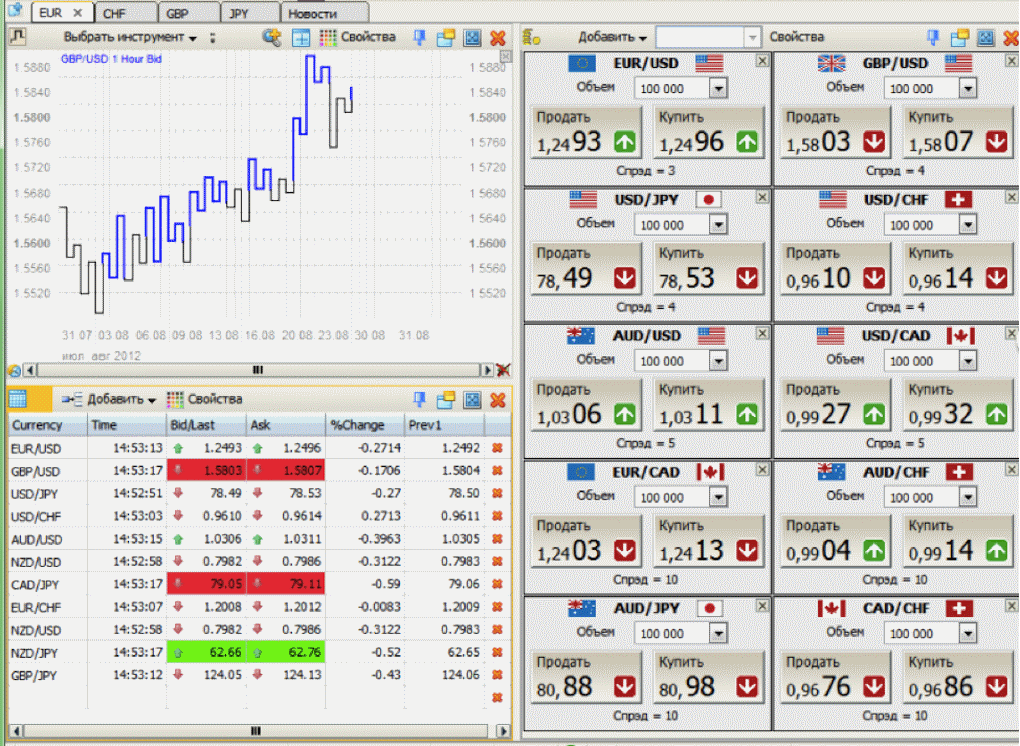

- Trading Tools and Features: Platforms offer a suite of tools and features designed to support traders in their decision-making processes. These include charting tools for technical analysis, indicators for identifying market trends, and order types for customizing trade execution.

- Security and Reliability: Reputable Forex trading platforms prioritize security and reliability, employing advanced technologies to protect user accounts and ensure seamless trading operations.

- Account Management: Forex trading platforms facilitate account management, allowing traders to deposit and withdraw funds, monitor account balances, and manage their trading positions.

Top 10 Forex Trading Platforms

Navigating the world of forex trading can be overwhelming, especially for beginners. Choosing the right trading platform is crucial for success. This guide will help you identify the top 10 platforms, highlighting their features, benefits, and considerations.

Top 10 Forex Trading Platforms

This table lists the top 10 forex trading platforms, ranked by a combination of factors such as popularity, user reviews, and overall reputation.

| Platform Name | Company Website Link | Key Features and Benefits | Minimum Deposit Requirement | Trading Fees and Commissions | Regulation and Licensing |

|---|---|---|---|---|---|

| MetaTrader 4 (MT4) | https://www.metatrader4.com/ | – Extensive charting and technical analysis tools – Automated trading (Expert Advisors) – Large community and resources – Wide range of trading instruments |

Varies by broker | Varies by broker | Regulated by various financial authorities worldwide |

| MetaTrader 5 (MT5) | https://www.metatrader5.com/ | – Advanced trading platform with more features than MT4 – Supports multiple asset classes (stocks, futures, etc.) – Depth of market (DOM) for order book visibility – Economic calendar and news feeds |

Varies by broker | Varies by broker | Regulated by various financial authorities worldwide |

| cTrader | https://www.ctrader.com/ | – Fast execution speeds and low latency – Advanced order types and risk management tools – Customizable charts and indicators – Built-in copy trading feature |

Varies by broker | Varies by broker | Regulated by various financial authorities worldwide |

| Thinkorswim | https://www.tdameritrade.com/ | – Powerful charting and analysis tools – Paper trading and backtesting capabilities – Extensive educational resources – Access to a wide range of financial instruments |

$0 | Varies by broker | Regulated by the Financial Industry Regulatory Authority (FINRA) and the Securities Investor Protection Corporation (SIPC) |

| NinjaTrader | https://www.ninjatrader.com/ | – Customizable trading platform with a focus on automation – Advanced order types and charting tools – Supports multiple asset classes – Strong community and support |

Varies by broker | Varies by broker | Regulated by the National Futures Association (NFA) |

| eToro | https://www.etoro.com/ | – User-friendly platform with social trading features – Copy trading functionality to follow experienced traders – Wide range of assets, including forex, stocks, and cryptocurrencies – Educational resources and market analysis |

$200 | Spreads and commissions vary by asset | Regulated by the Cyprus Securities and Exchange Commission (CySEC) and the Financial Conduct Authority (FCA) |

| FXCM | https://www.fxcm.com/ | – Reliable platform with a focus on education and customer support – Advanced charting and analysis tools – Multiple account types to suit different trading styles – Competitive trading conditions |

$50 | Varies by account type and trading volume | Regulated by the Financial Conduct Authority (FCA) and the National Futures Association (NFA) |

| Oanda | https://www.oanda.com/ | – Award-winning platform with a focus on transparency and innovation – Advanced charting and analysis tools – Multiple account types, including a demo account – Competitive spreads and low trading fees |

$0 | Varies by account type and trading volume | Regulated by the Financial Conduct Authority (FCA) and the Commodity Futures Trading Commission (CFTC) |

| Saxo Bank | https://www.saxobank.com/ | – Comprehensive platform with a wide range of financial instruments – Advanced charting and analysis tools – Multiple account types and trading strategies – Strong reputation and customer support |

Varies by account type | Varies by account type and trading volume | Regulated by the Danish Financial Supervisory Authority (FSA) and other financial authorities worldwide |

| IG | https://www.ig.com/ | – User-friendly platform with a focus on education and research – Wide range of financial instruments, including forex, CFDs, and options – Multiple account types and trading strategies – Competitive spreads and low trading fees |

$250 | Varies by account type and trading volume | Regulated by the Financial Conduct Authority (FCA) and the Australian Securities and Investments Commission (ASIC) |

Factors to Consider When Choosing a Forex Trading Platform

Choosing the right forex trading platform is crucial for success in the forex market. A well-suited platform provides the tools, features, and resources necessary for efficient trading and informed decision-making. Here are some key factors to consider when selecting a forex trading platform:

Regulation and Security

It is essential to prioritize trading with regulated and secure platforms. Regulation ensures that the platform adheres to industry standards and protects traders’ funds. Look for platforms that are licensed and regulated by reputable financial authorities such as the Financial Conduct Authority (FCA) in the UK, the Securities and Exchange Commission (SEC) in the US, or the Australian Securities and Investments Commission (ASIC) in Australia. A secure platform safeguards your personal and financial information through encryption, two-factor authentication, and other security measures.

Trading Platform Features

The features offered by a trading platform play a significant role in your trading experience. Here are some key features to consider:

- Trading Tools and Indicators: A comprehensive set of trading tools and indicators is essential for technical analysis and informed trading decisions. Look for platforms that offer charting tools, technical indicators, and other analytical resources.

- Order Types: Different order types allow you to execute trades in various ways. Choose a platform that offers a variety of order types, such as market orders, limit orders, stop-loss orders, and trailing stop orders.

- Trading Platform Interface: A user-friendly interface is crucial for efficient and stress-free trading. Look for a platform with a clean and intuitive layout, easy navigation, and customizable features.

- Mobile Trading App: A mobile trading app allows you to access your trading account and execute trades from your smartphone or tablet. Choose a platform that offers a reliable and feature-rich mobile app.

- Educational Resources: Some platforms provide educational resources such as tutorials, webinars, and articles to help traders learn about forex trading. This can be particularly beneficial for beginners.

Trading Costs and Fees

Trading costs and fees can significantly impact your profitability. Consider the following:

- Spreads: The spread is the difference between the bid and ask price of a currency pair. Look for platforms with tight spreads, as this will reduce your trading costs.

- Commissions: Some platforms charge commissions on trades. Choose a platform with transparent and competitive commission fees.

- Account Minimums: Some platforms require a minimum deposit to open an account. Choose a platform with a minimum deposit that aligns with your budget.

Customer Support

Reliable customer support is essential for addressing any questions or issues you may encounter. Choose a platform with responsive and knowledgeable customer support available through multiple channels, such as phone, email, and live chat.

Demo Account

A demo account allows you to practice trading in a risk-free environment. It’s a valuable tool for beginners to familiarize themselves with the platform and its features. Choose a platform that offers a demo account with realistic market conditions.

Account Types, Top 10 forex trading platforms

Forex brokers offer different account types to cater to various trader needs and experience levels. Consider the following account types:

- Standard Account: This is a basic account type suitable for beginners. It typically has a fixed spread and may include commission fees.

- ECN Account: ECN accounts offer access to the interbank market, providing tighter spreads and lower commission fees. ECN accounts are suitable for experienced traders.

- Islamic Account: This account type complies with Islamic financial laws by prohibiting interest-based charges.

Types of Forex Trading Platforms

Forex trading platforms are essential tools for traders to access and execute trades in the foreign exchange market. Different platforms offer a variety of features and functionalities, catering to the needs of various traders. Understanding the different types of platforms available can help you choose the one that best suits your trading style and requirements.

Web-Based Platforms

Web-based platforms are accessible through any internet browser and do not require any software downloads. They are generally user-friendly and convenient, as they can be accessed from any device with an internet connection.

- Advantages:

- Accessibility: Accessible from any device with an internet connection.

- User-friendliness: Generally easy to use and navigate.

- No downloads required: Convenient and saves storage space.

- Regular updates: Platforms are automatically updated with the latest features and security patches.

- Disadvantages:

- Limited functionality: May offer fewer features compared to desktop platforms.

- Slower performance: Can be slower than desktop platforms, especially during high-volume trading periods.

- Internet connectivity dependency: Requires a stable internet connection for optimal performance.

Mobile Trading Apps

Mobile trading apps are designed for smartphones and tablets, providing traders with on-the-go access to their accounts and the forex market. They offer a streamlined experience, allowing traders to manage their positions, monitor charts, and execute trades from anywhere.

- Advantages:

- Portability: Allows trading from anywhere with an internet connection.

- Real-time access: Provides access to live market data and trading opportunities.

- Notifications: Alerts traders about important market events and price movements.

- Disadvantages:

- Limited screen size: May have limited functionality and charting capabilities compared to desktop platforms.

- Touchscreen interface: Can be challenging for complex trading strategies.

- Battery life: Can drain battery quickly, especially with constant use.

Desktop Platforms

Desktop platforms are software applications that are downloaded and installed on a computer. They offer advanced features and functionalities, providing traders with a more comprehensive trading experience.

- Advantages:

- Advanced features: Offer a wider range of tools and indicators for technical analysis.

- Customization: Allow traders to personalize the platform according to their preferences.

- Faster performance: Generally faster and more responsive than web-based platforms.

- Disadvantages:

- Downloads and installation: Requires downloading and installing software on a computer.

- Compatibility issues: May not be compatible with all operating systems.

- Updates: Requires regular updates to ensure compatibility and security.

Comparison Table

Here is a table comparing the different types of forex trading platforms based on key features, usability, and compatibility:

| Feature | Web-Based Platforms | Mobile Trading Apps | Desktop Platforms |

|---|---|---|---|

| Accessibility | Any device with internet connection | Smartphones and tablets | Computers |

| Usability | User-friendly and intuitive | Streamlined and mobile-optimized | Advanced and customizable |

| Functionality | Basic to advanced | Limited compared to desktop platforms | Comprehensive and advanced |

| Performance | Can be slower than desktop platforms | Fast and responsive | Fastest and most responsive |

| Compatibility | Compatible with all browsers | Compatible with iOS and Android devices | May have compatibility issues with different operating systems |

Key Features of a Top Forex Trading Platform

A top-tier Forex trading platform is more than just a gateway to the global currency market. It’s a comprehensive tool that empowers traders with the necessary features to succeed. These features go beyond basic trading functionality, encompassing tools, resources, and security measures that contribute to a smooth, efficient, and secure trading experience.

Trading Tools and Indicators

Trading tools and indicators are crucial for analyzing market trends, identifying potential trading opportunities, and making informed decisions. A robust platform will offer a diverse selection of tools and indicators, enabling traders to customize their trading strategies based on their individual needs and preferences.

- Technical Indicators: These indicators use mathematical formulas to analyze price data and generate signals about potential price movements. Examples include moving averages, MACD, RSI, and Bollinger Bands. Platforms like MetaTrader 4 (MT4) and TradingView offer a wide array of technical indicators, allowing traders to tailor their analysis to their specific trading styles.

- Fundamental Analysis Tools: These tools provide access to economic data, news releases, and other information that can influence currency prices. Platforms like FXCM and Oanda offer economic calendars, news feeds, and fundamental analysis reports, helping traders stay informed about market-moving events.

- Trading Strategies and Alerts: Some platforms provide pre-built trading strategies or allow traders to create their own. These strategies can automate trading decisions based on specific criteria, freeing traders from constant monitoring. Additionally, platforms can send alerts when pre-defined market conditions are met, helping traders capitalize on opportunities or manage risk.

Order Execution Speed and Reliability

Fast and reliable order execution is paramount in Forex trading, where markets fluctuate rapidly. A top-tier platform will prioritize speed and accuracy, ensuring that orders are executed promptly and at the desired price.

- Slippage: This refers to the difference between the expected execution price and the actual price at which the order is filled. Platforms with advanced order execution algorithms and strong infrastructure minimize slippage, ensuring traders get the best possible price. For instance, platforms like Interactive Brokers and Saxo Bank are known for their fast order execution and low slippage rates.

- Order Types: A comprehensive platform will offer various order types, such as market orders, limit orders, stop-loss orders, and trailing stops. These order types provide flexibility in managing trades, allowing traders to set price targets, manage risk, and execute trades based on specific market conditions.

Charting and Analysis Capabilities

Charting and analysis are essential for visualizing price trends, identifying patterns, and developing trading strategies. A top-notch platform will provide advanced charting tools and technical analysis features, allowing traders to gain insights from market data.

- Chart Types: Platforms should offer various chart types, including line charts, bar charts, candlestick charts, and Heikin-Ashi charts. Each chart type presents price data in a different way, allowing traders to choose the format that best suits their analysis needs.

- Drawing Tools: Platforms should provide a comprehensive set of drawing tools, such as trend lines, Fibonacci retracements, and support/resistance levels. These tools help traders identify potential price patterns and forecast future price movements.

- Customizable Indicators: Advanced platforms allow traders to create and customize their own indicators, enabling them to develop unique trading strategies based on specific market parameters.

Educational Resources and Customer Support

A reputable Forex trading platform recognizes the importance of education and support for traders of all levels. Platforms that prioritize these aspects offer valuable resources and dedicated customer service to enhance the trading experience.

- Educational Content: Top platforms provide a range of educational materials, such as articles, tutorials, webinars, and video lessons, covering various Forex trading concepts, strategies, and risk management techniques. Platforms like Babypips and Forex Factory offer extensive educational resources for beginners and experienced traders alike.

- Customer Support: Platforms should provide responsive and helpful customer support, available through various channels, such as email, phone, and live chat. This ensures that traders can get timely assistance with any issues or questions they may have.

Security Measures and Account Protection

Security is paramount in Forex trading, as traders entrust their funds and personal information to the platform. A top-tier platform will implement robust security measures to safeguard user accounts and prevent unauthorized access.

- Data Encryption: Platforms should use industry-standard encryption protocols to protect sensitive data, such as account details and trading activity, from unauthorized access. This ensures that user information remains confidential and secure.

- Two-Factor Authentication: This security measure requires users to provide two forms of authentication, such as a password and a code sent to their mobile device, before accessing their account. This adds an extra layer of security, making it more difficult for unauthorized individuals to gain access.

- Regulation and Compliance: Reputable platforms are regulated by financial authorities, such as the Financial Conduct Authority (FCA) in the UK or the Commodity Futures Trading Commission (CFTC) in the US. This ensures that platforms adhere to specific standards and regulations, promoting transparency and accountability.

Security and Regulation

In the world of Forex trading, where substantial sums of money are constantly in motion, security and regulation are paramount. Choosing a regulated and secure Forex trading platform is crucial to protect your funds and ensure fair trading practices.

Importance of Regulation and Security

Regulatory bodies play a vital role in safeguarding traders’ interests. They establish and enforce rules that promote transparency, accountability, and fair play within the Forex market. These regulations help to minimize risks for traders and foster a more stable and trustworthy trading environment.

Role of Regulatory Bodies

- Protecting Traders’ Funds: Regulatory bodies often require Forex brokers to maintain segregated accounts for client funds, meaning these funds are kept separate from the broker’s own operating funds. This separation ensures that even if the broker encounters financial difficulties, client funds remain protected.

- Ensuring Fair Trading Practices: Regulatory bodies establish rules regarding order execution, transparency in pricing, and conflict of interest management. These rules aim to prevent market manipulation and ensure that all traders have access to fair and transparent trading conditions.

- Monitoring and Oversight: Regulatory bodies conduct regular audits and inspections of Forex brokers to ensure compliance with regulations. They also investigate complaints from traders and take appropriate action against brokers that violate the rules.

Reputable Regulatory Authorities

Several reputable regulatory authorities oversee Forex trading worldwide. These authorities have strict standards and enforcement mechanisms to ensure the integrity of the market. Here are some prominent examples:

- Financial Conduct Authority (FCA) – United Kingdom: The FCA is a well-respected regulatory body known for its robust rules and stringent oversight.

- Australian Securities and Investments Commission (ASIC) – Australia: ASIC is another reputable regulator with a strong focus on consumer protection and market integrity.

- Cyprus Securities and Exchange Commission (CySEC) – Cyprus: CySEC is a leading regulator in the European Union, known for its comprehensive regulations and strong enforcement mechanisms.

- National Futures Association (NFA) – United States: The NFA is a self-regulatory organization (SRO) that oversees the futures and options markets, including Forex trading in the United States.

Trading Resources and Education

The Forex market is vast and complex, requiring a solid understanding of trading strategies, technical analysis, and fundamental factors. Top Forex trading platforms recognize the importance of continuous learning and provide a range of resources to support traders at all levels.

These resources empower traders to enhance their knowledge, develop their skills, and make informed trading decisions. They range from beginner-friendly tutorials to advanced analysis tools and real-time market insights.

Types of Educational Resources

The availability of educational resources is a key differentiator among Forex trading platforms. Here are some common types of resources you might encounter:

- Tutorials and Guides: These platforms offer step-by-step guides, articles, and video tutorials covering various aspects of Forex trading, including basic concepts, technical analysis, fundamental analysis, and risk management.

- Webinars and Seminars: Regular webinars and seminars hosted by experienced traders and financial analysts provide insights into market trends, trading strategies, and current events that impact the Forex market.

- Trading Simulators: Trading simulators allow traders to practice their strategies in a risk-free environment using virtual funds. This helps them gain experience and confidence before risking real capital.

- Glossary of Terms: Forex trading involves a specialized vocabulary. Platforms provide comprehensive glossaries that define key terms and concepts, making it easier for traders to understand the market language.

- Market Analysis and Research: Some platforms offer in-depth market analysis, economic calendars, and research reports to help traders understand current market conditions and potential trading opportunities.

Examples of Platforms with Comprehensive Resources

Several Forex trading platforms stand out for their commitment to providing comprehensive educational resources. Here are a few examples:

- MetaTrader 4 (MT4): MT4 is a popular platform known for its extensive library of trading indicators, expert advisors (EAs), and customizable charts. It also offers educational resources, including tutorials, webinars, and a community forum for traders to share knowledge and insights.

- MetaTrader 5 (MT5): MT5, the successor to MT4, offers similar features with enhanced capabilities. It includes a built-in economic calendar, advanced charting tools, and a wider range of order types.

- FXTM: FXTM provides a comprehensive education center with various resources, including video tutorials, articles, webinars, and trading guides. They cater to both beginners and experienced traders.

- XM: XM offers a comprehensive educational platform with a wide range of resources, including video tutorials, webinars, and a dedicated learning center. They also provide educational materials in multiple languages.

- AvaTrade: AvaTrade offers a dedicated AvaTrade Academy with a wealth of educational resources, including video tutorials, webinars, articles, and an interactive glossary.

Importance of Ongoing Education

The Forex market is dynamic and constantly evolving. Staying ahead of the curve requires continuous learning and skill development. Ongoing education helps traders:

- Adapt to Market Changes: The Forex market is influenced by global events, economic data, and geopolitical factors. Staying informed about these changes helps traders adjust their strategies and make better trading decisions.

- Improve Trading Strategies: Continuous learning allows traders to refine their trading strategies, identify new opportunities, and minimize risks.

- Stay Competitive: The Forex market is competitive, with many traders vying for profits. Continuous learning helps traders stay ahead of the competition and develop a winning edge.

- Manage Risk Effectively: Risk management is crucial in Forex trading. Ongoing education helps traders understand and manage risk effectively, minimizing potential losses and protecting their capital.

Customer Support and Accessibility

In the fast-paced world of forex trading, having reliable customer support and easy accessibility to assistance is paramount. When dealing with financial markets, traders need prompt and efficient support to address any technical issues, resolve queries, and receive guidance when needed. A platform with strong customer support fosters trust and confidence, ensuring a smooth and secure trading experience.

Customer Support Channels and Response Time

The availability and responsiveness of customer support are crucial factors to consider when choosing a forex trading platform. Different platforms offer various channels for reaching their support teams, including:

- Live Chat: This option provides instant communication with a support agent, ideal for quick queries and technical troubleshooting. Platforms like MetaTrader 4 (MT4) and eToro offer 24/5 live chat support, enabling traders to get immediate assistance whenever required.

- Email: Email support is suitable for less urgent inquiries or detailed questions requiring a written response. Platforms typically provide response times within 24-48 hours for email queries.

- Phone Support: Some platforms offer phone support for more complex issues or when immediate assistance is needed. However, phone support might not be available 24/7, and wait times can vary depending on the platform and time of day.

- FAQ Section: Platforms often have a comprehensive FAQ section that covers common questions and issues. This can be a valuable resource for traders seeking quick answers to basic inquiries.

- Knowledge Base: A robust knowledge base provides detailed information about platform features, trading tools, and account management. It serves as a valuable resource for self-service support, allowing traders to find answers independently.

The response time of customer support is another critical factor. A platform with a quick response time ensures timely resolution of issues and prevents potential losses due to delays. Look for platforms that offer 24/5 support, especially if you are trading in global markets with different time zones.

Multilingual Support and Accessibility

For global traders, multilingual support is essential for effective communication and understanding. Platforms with multilingual support cater to a wider audience and provide a seamless trading experience for international clients. They offer customer support in various languages, including English, Spanish, French, German, Chinese, and Japanese, ensuring that traders can access information and assistance in their native tongue.

Accessibility is also vital for traders with disabilities. Platforms should offer features that enhance accessibility, such as screen reader compatibility, keyboard navigation, and customizable interface settings. This ensures that all traders, regardless of their abilities, can access and use the platform effectively.

Conclusion

Choosing the right Forex trading platform is crucial for success in the Forex market. A suitable platform will provide you with the tools and resources necessary to execute trades effectively and manage your risk.

This article has explored the key factors to consider when choosing a Forex trading platform, including trading platform types, essential features, security and regulation, trading resources and education, customer support and accessibility, and the reputation of the broker. By understanding these factors, you can narrow down your options and find a platform that aligns with your individual trading needs and goals.

The Importance of Research and Comparison

Before settling on a Forex trading platform, it is essential to conduct thorough research and compare different options. Consider the following steps:

- Identify your trading needs and goals: Determine your trading style, risk tolerance, and the level of support and education you require.

- Compare platform features and fees: Evaluate the available trading tools, research resources, and pricing structure of each platform.

- Read reviews and testimonials: Gain insights from other traders’ experiences with different platforms.

- Test platforms with demo accounts: Many platforms offer free demo accounts that allow you to practice trading without risking real money.

By taking the time to research and compare different platforms, you can increase your chances of finding a platform that empowers you to succeed in the Forex market.

Summary

Choosing the right Forex trading platform is a crucial step in your trading journey. By considering the factors discussed in this article, you can make an informed decision that empowers you to navigate the Forex market effectively. Remember, successful Forex trading requires a well-rounded approach that encompasses platform selection, risk management, and continuous learning. This article has provided a solid foundation for your research, enabling you to choose a platform that meets your individual needs and aspirations.

Helpful Answers: Top 10 Forex Trading Platforms

What is the minimum deposit requirement for Forex trading platforms?

Minimum deposit requirements vary widely between platforms. Some platforms offer low minimum deposits, while others may require a larger initial investment. It’s important to research and compare the deposit requirements of different platforms to find one that aligns with your budget.

How do I choose the best Forex trading platform for me?

Choosing the best Forex trading platform depends on your individual needs and trading goals. Consider factors such as platform features, trading tools, security, regulation, customer support, and educational resources. It’s also important to assess your trading style and risk tolerance.

What are the risks associated with Forex trading?

Forex trading involves significant risks, including the potential for losing your investment. Currency exchange rates fluctuate constantly, and market volatility can lead to rapid price changes. It’s crucial to understand and manage your risk effectively to minimize potential losses.

Is Forex trading suitable for beginners?

Forex trading can be challenging for beginners. It requires a solid understanding of financial markets, trading strategies, and risk management. It’s advisable to start with a demo account to practice trading without risking real money. Consider seeking guidance from experienced traders or financial advisors.