Thinkorswim Forex presents a powerful platform for traders seeking to navigate the dynamic world of foreign exchange markets. With its intuitive interface and robust features, Thinkorswim empowers traders of all experience levels to analyze, execute, and manage Forex trades effectively. This comprehensive guide will delve into the platform’s core functionalities, exploring its advantages and disadvantages, and comparing it to other popular Forex trading platforms.

From understanding the available Forex trading instruments and order types to mastering technical and fundamental analysis tools, this exploration will equip you with the knowledge needed to leverage Thinkorswim for successful Forex trading.

Thinkorswim Platform Overview

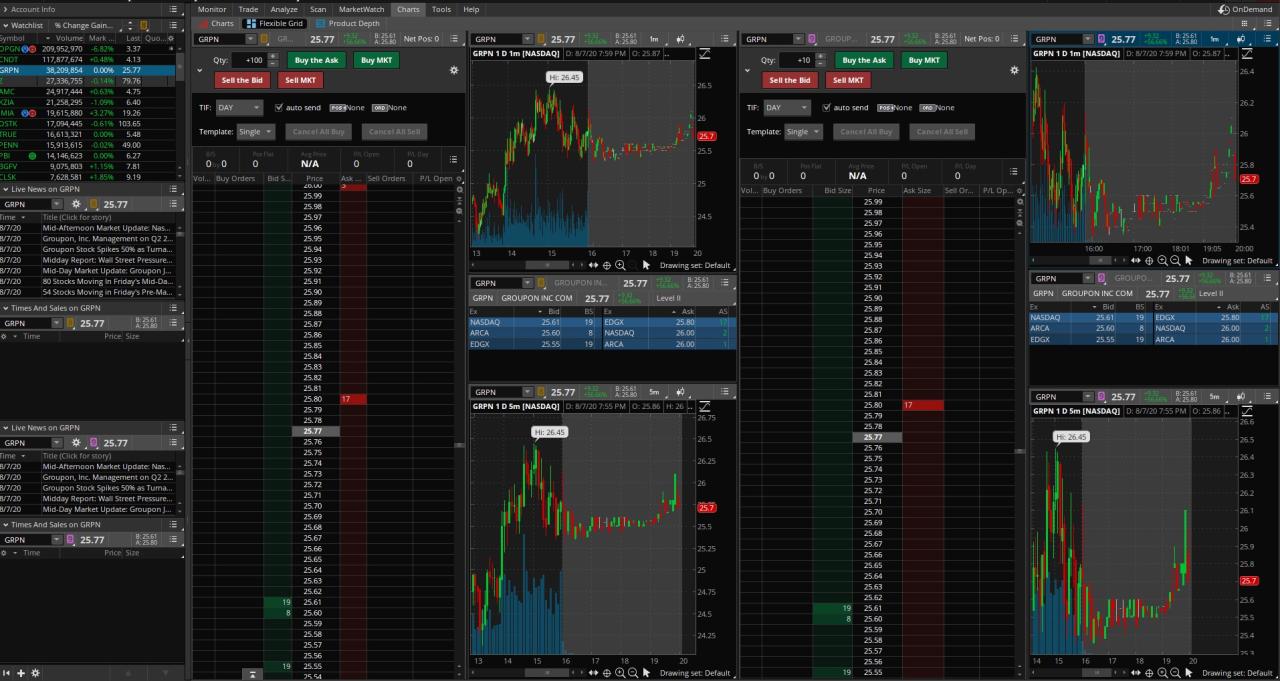

Thinkorswim is a powerful trading platform developed by TD Ameritrade, offering a comprehensive suite of tools for traders of all levels. While initially designed for stock and options trading, Thinkorswim has gained popularity among Forex traders due to its advanced charting capabilities, real-time data, and diverse analytical tools.

Core Features of Thinkorswim for Forex Trading

Thinkorswim provides a robust set of features specifically designed for Forex trading, catering to both beginners and experienced traders.

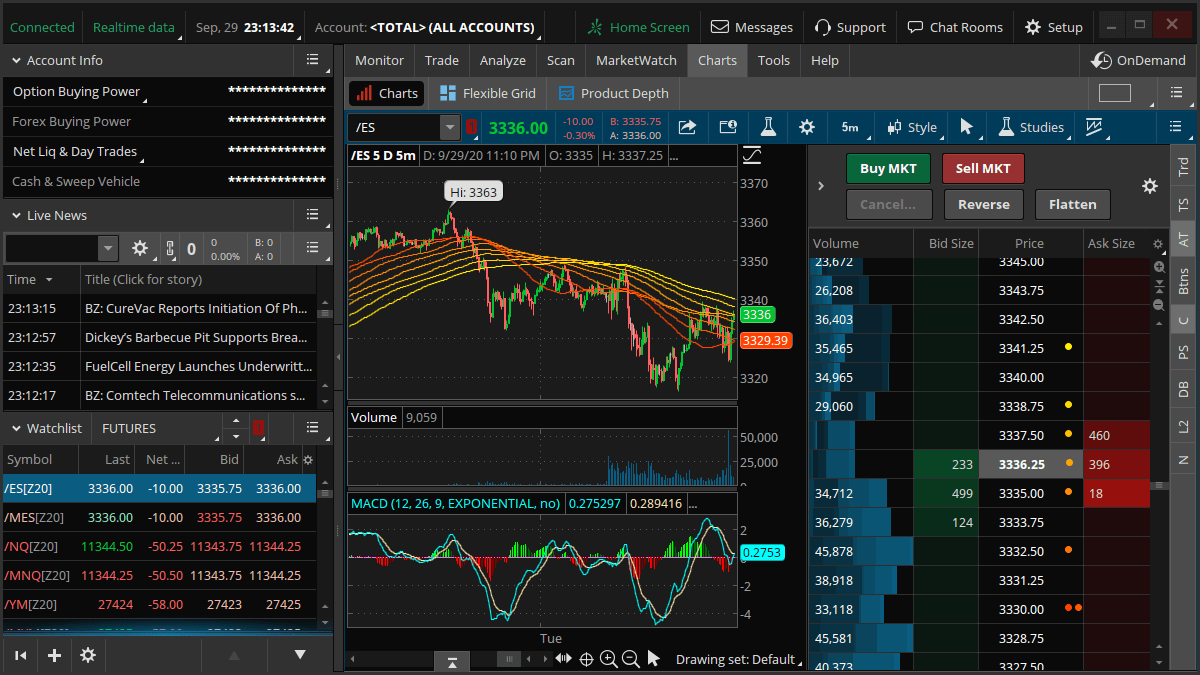

- Advanced Charting: Thinkorswim offers a wide range of customizable chart types, including candlestick, bar, and line charts. Traders can access a multitude of technical indicators, drawing tools, and real-time market data, enabling comprehensive analysis and strategic decision-making.

- Real-time Data and News: Thinkorswim integrates real-time Forex quotes, news feeds, and economic calendar events, providing traders with up-to-the-minute market information. This allows traders to stay informed about market movements and react quickly to news events.

- Trading Strategies and Backtesting: The platform supports the creation and backtesting of trading strategies, allowing traders to evaluate the performance of their ideas before risking real capital. This feature is particularly valuable for developing and refining trading systems.

- Order Types and Execution: Thinkorswim provides a variety of order types, including market orders, limit orders, stop orders, and trailing stops, enabling traders to execute trades effectively and manage risk. The platform offers fast order execution and competitive pricing.

- Multi-asset Trading: Thinkorswim is not limited to Forex trading; it supports trading across multiple asset classes, including stocks, options, futures, and ETFs. This allows traders to diversify their portfolios and manage risk effectively.

Advantages of Using Thinkorswim for Forex

Thinkorswim presents several advantages for Forex traders, making it a popular choice among seasoned and aspiring traders.

- Comprehensive Platform: Thinkorswim offers a wide range of features, catering to traders of all levels. Its advanced charting capabilities, real-time data, and analytical tools provide a comprehensive trading experience.

- User-friendly Interface: Despite its extensive features, Thinkorswim boasts a user-friendly interface, making it accessible to traders with varying levels of technical expertise. The platform offers customizable layouts and intuitive navigation.

- Strong Community Support: Thinkorswim has a vibrant online community, providing access to forums, tutorials, and educational resources. This fosters a collaborative environment where traders can share knowledge and learn from each other.

- Free Access: Thinkorswim is offered free of charge, making it an attractive option for budget-conscious traders. However, it’s important to note that while the platform itself is free, brokerage fees apply to trades.

Disadvantages of Using Thinkorswim for Forex

While Thinkorswim offers a comprehensive suite of features, it also has some drawbacks that traders should consider.

- Steep Learning Curve: Due to its extensive features and complexity, Thinkorswim can have a steep learning curve for beginners. Mastering the platform’s functionalities requires time and effort.

- Limited Mobile App Functionality: While Thinkorswim offers a mobile app, it does not provide the full functionality of the desktop platform. Some advanced features, such as backtesting and strategy development, are not available on the mobile app.

- No Direct Forex Account Access: Thinkorswim is a trading platform provided by TD Ameritrade. To trade Forex using Thinkorswim, traders need to open a TD Ameritrade account, which may not offer the same level of Forex-specific features as dedicated Forex brokers.

Comparison of Thinkorswim’s Forex Trading Tools to Other Popular Platforms

Thinkorswim’s Forex trading tools are comparable to other popular platforms, such as MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

- MT4 and MT5: MT4 and MT5 are widely used platforms known for their user-friendliness and extensive customization options. They offer a vast library of indicators, expert advisors (EAs), and trading robots. However, Thinkorswim offers more advanced charting features and a wider range of analytical tools.

- TradingView: TradingView is a popular charting platform that focuses on technical analysis and social trading. It offers real-time data, a vast library of indicators, and a vibrant community. However, Thinkorswim provides a more comprehensive trading platform with integrated order execution and backtesting capabilities.

Forex Trading Functionality

Thinkorswim offers a robust suite of tools and features specifically designed for Forex trading, catering to both beginners and experienced traders. This section will explore the Forex trading instruments, order types, and execution methods available on the platform, along with a guide on how to set up and manage Forex trading orders.

Forex Trading Instruments

Thinkorswim provides access to a wide range of Forex currency pairs, allowing traders to capitalize on various market opportunities. These currency pairs are grouped into major, minor, and exotic categories, each with unique characteristics and trading dynamics.

- Major Currency Pairs: These pairs involve the US dollar (USD) against other major global currencies, such as the Euro (EUR), Japanese Yen (JPY), British Pound (GBP), Australian Dollar (AUD), Canadian Dollar (CAD), Swiss Franc (CHF), and New Zealand Dollar (NZD). These pairs are generally the most liquid and volatile, offering frequent trading opportunities.

- Minor Currency Pairs: These pairs consist of two currencies that are not the US dollar. Examples include EUR/GBP, GBP/JPY, and AUD/CAD. These pairs tend to be less volatile than major pairs, but can still provide opportunities for traders seeking less risk.

- Exotic Currency Pairs: These pairs involve the US dollar or other major currencies against currencies from emerging markets, such as the South African Rand (ZAR), Mexican Peso (MXN), or Turkish Lira (TRY). These pairs are typically less liquid and more volatile than major and minor pairs, presenting both higher potential rewards and risks.

Order Types and Execution Methods

Thinkorswim offers a variety of order types and execution methods to suit different trading styles and risk tolerances.

- Market Orders: These orders are executed immediately at the best available price in the market. They are suitable for traders who prioritize speed and certainty of execution but may not get the desired price, especially in volatile markets.

- Limit Orders: These orders are placed at a specific price or better. They allow traders to control the entry or exit price but may not be filled if the market does not reach the desired price level. Limit orders are useful for traders seeking to minimize losses or maximize profits.

- Stop Orders: These orders are placed at a specific price level and are triggered when the market reaches that price. Stop orders are used to limit potential losses or to enter a trade when a specific price level is breached. They are particularly useful in managing risk.

- Trailing Stop Orders: These orders are similar to stop orders, but they adjust automatically based on the price movement of the underlying asset. They help traders lock in profits and manage risk dynamically, ensuring that their stop-loss levels are always at a predetermined distance from the current market price.

Setting Up and Managing Forex Trading Orders

Setting up and managing Forex trading orders on Thinkorswim is straightforward and intuitive.

- Select the Forex Instrument: Choose the currency pair you wish to trade from the list of available instruments.

- Choose the Order Type: Select the appropriate order type based on your trading strategy and risk tolerance. This could be a market order, limit order, stop order, or trailing stop order.

- Specify Order Details: Enter the necessary order details, such as the order quantity, entry or exit price, and stop-loss or take-profit levels.

- Place the Order: Click on the “Place Order” button to submit your order. The order will be placed on the market, and you will receive a confirmation notification.

- Monitor and Manage Orders: You can monitor the status of your open orders and manage them as needed. This includes modifying order details, canceling orders, or closing positions.

Technical Analysis and Charting: Thinkorswim Forex

Technical analysis is an essential tool for Forex traders, allowing them to identify trends, predict future price movements, and make informed trading decisions. Thinkorswim provides a comprehensive suite of technical indicators and charting tools specifically designed to empower traders with the insights they need to navigate the dynamic Forex market.

Technical Indicators

Technical indicators are mathematical calculations based on historical price data, providing insights into market sentiment, momentum, and overbought/oversold conditions. Thinkorswim offers a vast library of technical indicators, categorized by their purpose and application.

- Trend Indicators: Moving averages, MACD, and ADX help identify the direction and strength of trends.

- Momentum Indicators: RSI, Stochastic Oscillator, and Rate of Change measure the speed and magnitude of price changes, indicating potential overbought or oversold conditions.

- Volatility Indicators: Bollinger Bands, Average True Range (ATR), and Chandelier Exit provide insights into price volatility and potential breakout opportunities.

- Volume Indicators: On-Balance Volume (OBV), Chaikin Money Flow, and Accumulation/Distribution help assess buying and selling pressure based on trading volume.

Charting Tools

Thinkorswim’s charting tools are designed to visualize price data, identify patterns, and analyze market trends. The platform offers various chart types, drawing tools, and customization options to create personalized trading setups.

- Chart Types: Line, bar, candlestick, and Heikin-Ashi charts provide different visual representations of price data, each offering unique insights.

- Drawing Tools: Trend lines, support and resistance levels, Fibonacci retracements, and channels help identify potential price targets and reversal points.

- Customization Options: Traders can customize chart colors, timeframes, indicators, and other settings to tailor the platform to their specific analysis needs.

Technical Analysis Strategies

Technical analysis strategies combine technical indicators and charting tools to identify trading opportunities. Here are a few commonly used strategies in Forex trading:

- Trend Following: Traders identify the prevailing trend using moving averages or other trend indicators and place trades in the direction of the trend. For example, a trader might buy a currency pair when the price crosses above a 200-day moving average.

- Breakout Trading: Traders look for price breakouts from support and resistance levels or Bollinger Bands, indicating a potential shift in market momentum. For example, a trader might buy a currency pair when it breaks above a key resistance level.

- Mean Reversion: Traders believe that prices tend to revert to their historical average. They use indicators like the RSI or Stochastic Oscillator to identify overbought or oversold conditions and place trades in the opposite direction of the current trend.

Fundamental Analysis Tools

Fundamental analysis in Forex trading involves understanding the economic factors that influence currency values. Thinkorswim provides integrated tools and resources to help traders make informed decisions based on economic data and news.

Economic Data and News Sources

Thinkorswim offers access to a wide range of economic data and news sources, allowing traders to stay informed about global economic events.

- Economic Calendar: The economic calendar provides a schedule of upcoming economic releases, such as interest rate decisions, inflation data, and employment reports. Traders can use this calendar to anticipate potential market movements based on expected economic data.

- News Feeds: Thinkorswim integrates news feeds from reputable sources, providing real-time updates on market-moving events. These news feeds can help traders stay informed about geopolitical developments, economic policies, and other factors that can impact currency values.

- Market Snapshot: The Market Snapshot feature provides a comprehensive overview of current market conditions, including key economic indicators, major currency pairs, and market sentiment. This information can help traders assess the overall market environment and identify potential trading opportunities.

Using Fundamental Analysis Tools

Fundamental analysis tools help traders understand the underlying economic factors driving currency movements.

- Economic Indicators: Analyzing economic indicators, such as GDP growth, inflation, and unemployment rates, can provide insights into the health of a country’s economy. These indicators can influence a currency’s value, as strong economic fundamentals typically support a currency’s appreciation.

- Central Bank Policies: Central bank decisions on interest rates and monetary policy can significantly impact currency values. For example, a central bank raising interest rates to combat inflation can attract foreign investment and strengthen the currency.

- Geopolitical Events: Political instability, trade wars, and other geopolitical events can also influence currency movements. Traders need to be aware of these events and their potential impact on global markets.

Key Economic Indicators

| Indicator | Description | Impact on Currency |

|---|---|---|

| Gross Domestic Product (GDP) | Measures the total value of goods and services produced in a country. | Higher GDP growth generally supports a currency’s appreciation. |

| Inflation Rate | Measures the rate at which prices for goods and services increase. | High inflation can weaken a currency, as it erodes purchasing power. |

| Unemployment Rate | Measures the percentage of the labor force that is unemployed. | Low unemployment rates typically indicate a strong economy, which can support a currency’s value. |

| Interest Rates | The rate at which central banks lend money to commercial banks. | Higher interest rates can attract foreign investment and strengthen a currency. |

| Current Account Balance | Measures the difference between a country’s exports and imports. | A surplus in the current account balance generally indicates a strong economy, which can support a currency’s value. |

Risk Management and Trading Strategies

In the dynamic world of Forex trading, managing risk effectively is paramount to achieving consistent profitability. Thinkorswim provides a robust suite of tools and features to help you implement sound risk management practices and execute well-defined trading strategies. This section delves into key aspects of risk management and explores popular Forex trading strategies that can be implemented on Thinkorswim.

Setting Up Stop-Loss and Take-Profit Orders, Thinkorswim forex

Stop-loss and take-profit orders are essential tools for limiting potential losses and securing profits in Forex trading. They allow you to automate your exit strategy, ensuring that your trades are closed at predetermined price levels.

- Stop-Loss Orders: Stop-loss orders are placed below the entry price for long positions and above the entry price for short positions. They automatically close your trade when the market reaches the specified price level, limiting your potential losses. Stop-loss orders should be set at a level that aligns with your risk tolerance and the market’s volatility. For example, if you buy EUR/USD at 1.1000, you might set a stop-loss order at 1.0950, limiting your potential loss to 50 pips.

- Take-Profit Orders: Take-profit orders are placed above the entry price for long positions and below the entry price for short positions. They automatically close your trade when the market reaches the specified price level, securing your profits. Take-profit orders should be set at a level that reflects your profit target based on your trading strategy and market analysis. For instance, if you buy EUR/USD at 1.1000, you might set a take-profit order at 1.1050, targeting a 50-pip profit.

Popular Forex Trading Strategies

Thinkorswim empowers you to implement various Forex trading strategies, each tailored to different market conditions and risk profiles.

- Trend Following: Trend-following strategies capitalize on the momentum of a prevailing trend. They aim to identify and ride the trend, aiming for consistent gains as the market moves in a specific direction. Thinkorswim’s advanced charting tools and technical indicators, such as moving averages and MACD, can assist in identifying and confirming trends.

- Breakout Trading: Breakout strategies focus on trading at the point where a price breaks out of a defined range or consolidation pattern. These strategies seek to capitalize on the momentum of a price move after a period of relative price stability. Thinkorswim’s chart patterns and indicators, such as Bollinger Bands and support/resistance levels, can help identify potential breakout points.

- Scalping: Scalping involves capturing small profits from rapid price fluctuations. Scalpers typically use short-term timeframes and aim to make multiple small profits throughout the day. Thinkorswim’s real-time charting and order execution capabilities are crucial for scalping strategies.

- News Trading: News trading involves leveraging the impact of economic news releases on currency prices. Traders may capitalize on price movements that occur in response to news events. Thinkorswim’s economic calendar and news feeds can help traders stay informed about upcoming news releases.

Position Sizing and Risk Management

Position sizing and risk management are integral to Forex trading success. Determining the appropriate position size and managing risk effectively can help mitigate losses and maximize profitability.

- Position Sizing: Position sizing refers to determining the amount of capital to allocate to each trade. A key concept in position sizing is the risk-reward ratio, which compares the potential profit to the potential loss. A favorable risk-reward ratio, such as 2:1 or 3:1, indicates that the potential profit is significantly higher than the potential loss.

- Risk Management: Risk management involves implementing strategies to protect your trading capital from significant losses. This includes setting appropriate stop-loss orders, diversifying your trades, and avoiding overtrading. Thinkorswim offers various tools to support risk management, such as portfolio margining, margin requirements, and account alerts.

Trading Education and Resources

Thinkorswim offers a comprehensive suite of educational resources designed to empower Forex traders of all experience levels. From interactive tutorials and webinars to insightful articles and expert analysis, the platform provides a wealth of knowledge to enhance your trading skills and understanding of the Forex market.

Educational Resources on Thinkorswim

Thinkorswim provides a diverse range of educational materials to help traders improve their skills and knowledge. These resources are accessible through the platform’s user interface, allowing traders to learn at their own pace and convenience.

- Interactive Tutorials: Thinkorswim offers a series of interactive tutorials that guide users through various aspects of Forex trading, covering topics such as order types, risk management, and technical analysis. These tutorials are designed to be engaging and informative, providing step-by-step instructions and real-world examples.

- Webinars: Thinkorswim hosts regular webinars featuring industry experts who share their insights and strategies on Forex trading. These webinars cover a wide range of topics, including market analysis, trading psychology, and advanced trading techniques. They provide valuable information and opportunities for traders to learn from experienced professionals.

- Articles and Blog Posts: The Thinkorswim platform features a library of articles and blog posts covering various Forex trading topics. These resources provide in-depth analysis, market commentary, and insights from experienced traders. They can help traders stay informed about current market trends and develop a deeper understanding of Forex trading concepts.

- Trading Simulator: Thinkorswim offers a trading simulator that allows users to practice their Forex trading skills in a risk-free environment. The simulator provides a realistic trading experience, enabling traders to experiment with different strategies and refine their trading techniques without risking real capital. This is a valuable tool for both novice and experienced traders to test their strategies and build confidence.

Recommended Forex Trading Books and Articles

Supplementing the resources available on Thinkorswim, there are numerous Forex trading books and articles that can enhance your understanding of the market and improve your trading skills.

- “Trading in the Zone” by Mark Douglas: This book focuses on the psychological aspects of trading and emphasizes the importance of discipline, risk management, and emotional control. It provides practical strategies for developing a winning trading mindset.

- “Japanese Candlestick Charting Techniques” by Steve Nison: This book explores the history and principles of Japanese candlestick charting, providing insights into identifying patterns and predicting market movements. It is a valuable resource for traders who want to improve their technical analysis skills.

- “The Forex Trading Bible” by Greg Michalowski: This comprehensive guide covers all aspects of Forex trading, from fundamental analysis to technical analysis, risk management, and trading psychology. It is a great starting point for beginners and a valuable resource for experienced traders.

- “Day Trading and Swing Trading the Currency Market” by Kathy Lien: This book focuses on day trading and swing trading strategies in the Forex market, providing practical insights and techniques for profiting from short-term and intermediate-term market movements.

- “The Complete Guide to Forex Trading” by Ian Wyatt: This book provides a comprehensive overview of Forex trading, covering topics such as market fundamentals, technical analysis, risk management, and trading psychology. It is a great resource for beginners who want to learn the basics of Forex trading.

Accessing and Utilizing Thinkorswim’s Educational Materials

Thinkorswim makes it easy for traders to access and utilize its educational resources. Here is a step-by-step guide:

- Log in to your Thinkorswim account: The first step is to log in to your Thinkorswim account. If you don’t have an account, you can create one for free.

- Navigate to the “Education” section: Once you are logged in, look for the “Education” section in the Thinkorswim platform. This section usually contains a dedicated area for educational resources.

- Explore the available resources: The “Education” section will display a variety of educational materials, including tutorials, webinars, articles, and blog posts. You can browse through the resources and select those that are relevant to your interests and learning goals.

- Access and utilize the resources: Once you have selected a resource, you can access and utilize it directly from the Thinkorswim platform. The resources are typically presented in an interactive and user-friendly format, making it easy to learn and apply the information.

Final Summary

As you embark on your Forex trading journey with Thinkorswim, remember that consistent learning and practice are key to success. Utilize the platform’s educational resources, refine your trading strategies, and prioritize risk management. With the right approach and dedication, Thinkorswim can become your trusted companion in navigating the complexities of the Forex market.

Quick FAQs

Is Thinkorswim suitable for beginners?

Thinkorswim offers a user-friendly interface and educational resources that can be beneficial for beginners. However, Forex trading involves risks, and it’s essential to understand the basics before trading live.

What are the fees associated with Thinkorswim Forex trading?

Thinkorswim’s fees vary depending on your trading activity and account type. It’s crucial to review the fee structure and commission rates before opening an account.

Does Thinkorswim offer demo accounts for Forex trading?

Yes, Thinkorswim provides a demo account that allows you to practice Forex trading with virtual funds before risking real money.