Sum assured forms the cornerstone of any insurance policy, representing the financial protection offered by the insurer. Understanding its nuances is crucial for securing adequate coverage tailored to individual needs and circumstances. This guide will delve into the intricacies of sum assured, exploring its calculation, influencing factors, and impact on various insurance products and claim scenarios.

From life insurance to health plans, the sum assured dictates the maximum payout in case of a covered event. We’ll unpack the differences between sum assured and policy value, examining how factors like age, health, and lifestyle influence the final amount. We will also explore how riders and different policy types affect your overall sum assured and final payout.

Defining “Sum Assured”

Sum assured is a crucial concept in insurance policies, representing the predetermined amount an insurance company agrees to pay out upon the occurrence of a specified event, such as death in a life insurance policy or a covered illness in a health insurance policy. Understanding sum assured is vital for choosing the right policy and ensuring adequate financial protection.

Sum assured differs from the policy value. The policy value reflects the current financial worth of the insurance contract, which can fluctuate based on factors like investment performance (in some policies) or the remaining coverage period. Conversely, the sum assured remains constant throughout the policy’s term, representing the guaranteed payout amount upon the triggering event. It’s a fixed promise from the insurer, irrespective of the policy’s changing market value.

Sum Assured Calculation in Different Insurance Types

The method of calculating sum assured varies across different insurance products. Life insurance policies often allow for a choice of sum assured, often based on individual needs and financial goals, while health insurance policies typically have a pre-defined sum assured per illness or injury.

In life insurance, the sum assured is usually a fixed amount chosen by the policyholder, often based on their financial obligations, such as mortgage repayment or dependents’ financial security. For example, a policyholder might choose a sum assured of $500,000 to cover their mortgage and provide for their family in the event of their death. The calculation is primarily determined by the policyholder’s needs.

For health insurance, the sum assured is typically defined by the policy itself, and it’s the maximum amount the insurer will pay for medical expenses related to a covered illness or injury. This can vary depending on the type of health plan, with some offering higher sum assured for comprehensive coverage. A health insurance policy might have a sum assured of $100,000 per year, meaning the insurer will cover up to that amount in medical expenses during that year.

Sum Assured Across Various Insurance Products

The following table compares the sum assured across various insurance products. Note that the minimum and maximum sum assured can vary greatly depending on the insurer, policy type, and individual circumstances.

| Product Type | Sum Assured Calculation | Minimum Sum Assured | Maximum Sum Assured |

|---|---|---|---|

| Term Life Insurance | Policyholder’s choice, often based on financial needs | $50,000 | $5,000,000+ |

| Whole Life Insurance | Policyholder’s choice, often with a cash value component | $25,000 | $10,000,000+ |

| Health Insurance | Pre-defined by the policy, typically per year or per illness | $50,000 | $1,000,000+ |

| Critical Illness Insurance | Pre-defined benefit amount per specified illness | $25,000 | $1,000,000+ |

Factors Influencing Sum Assured

Determining the appropriate sum assured in a life insurance policy is a crucial step, ensuring adequate financial protection for your dependents in the event of your untimely demise. Several interconnected factors play a significant role in this calculation, impacting the final amount you’re insured for. Understanding these factors empowers you to make informed decisions about your coverage.

Age

Age is a primary factor influencing sum assured calculations. Generally, younger individuals are considered to have a longer life expectancy and therefore a higher potential for future earnings. This translates to a higher sum assured being offered, as insurers assess a greater potential for financial loss in case of death. Conversely, older applicants might receive a lower sum assured due to a shorter projected lifespan. Insurers use actuarial tables and sophisticated models to estimate life expectancy and adjust sum assured accordingly. For example, a 30-year-old might qualify for a significantly higher sum assured than a 60-year-old, even with similar income levels, reflecting the difference in expected remaining lifespan.

Health and Lifestyle

An individual’s health and lifestyle significantly impact the risk assessment process and consequently the sum assured. Pre-existing medical conditions, such as heart disease or diabetes, can increase the likelihood of early mortality, leading to a potentially lower sum assured or even a rejection of the application. Similarly, unhealthy lifestyle choices like smoking or excessive alcohol consumption are associated with higher mortality rates and can negatively influence the offered sum assured. Insurers use detailed health questionnaires and medical examinations to assess the risk profile, ultimately influencing the final sum assured. A person with a history of heart problems might receive a lower sum assured compared to a healthy individual of the same age and income.

Risk Assessment

Risk assessment is the cornerstone of sum assured determination. Insurers employ rigorous underwriting processes to evaluate the risk associated with insuring an individual. This involves analyzing various factors, including age, health, occupation, lifestyle, and family history. A comprehensive risk assessment helps insurers determine the likelihood of a claim and enables them to price the policy appropriately. High-risk individuals might face higher premiums or lower sum assured compared to low-risk individuals. For example, a skydiver would likely face a more stringent underwriting process and potentially a lower sum assured than an accountant, reflecting the inherent differences in occupational risk.

Underwriting Approaches

Different insurers may employ varying underwriting approaches, leading to variations in sum assured calculations. Some insurers might focus heavily on health factors, while others might give more weight to income and financial responsibilities. These differences can lead to different sum assured offers for the same individual from different insurers. A more stringent underwriting approach might result in a lower sum assured, whereas a more lenient approach might offer a higher amount. For instance, one insurer might prioritize medical history, while another might place greater emphasis on the applicant’s financial stability and future earning potential. Comparing offers from multiple insurers is therefore crucial to secure the most suitable coverage.

Sum Assured and Policy Benefits

The sum assured is the cornerstone of any life insurance policy, directly impacting the financial protection it offers. Understanding its role in determining payouts under different circumstances is crucial for choosing the right policy and ensuring adequate coverage. This section explores the relationship between the sum assured and the benefits received under various claim scenarios.

Sum Assured’s Impact on Death Benefits

In life insurance, the sum assured represents the amount payable to the nominee or beneficiary upon the death of the insured individual. For instance, if a policy has a sum assured of $100,000, the beneficiary will receive this amount upon the insured’s death, provided all policy terms and conditions are met. This death benefit provides financial security to the dependents, helping them cope with the loss of income and cover expenses such as funeral costs, outstanding debts, and ongoing living expenses. A higher sum assured translates directly to a larger death benefit, offering greater financial protection. Conversely, a lower sum assured means a smaller payout, potentially leaving the family financially vulnerable.

Sum Assured and Maturity Benefits in Endowment Plans

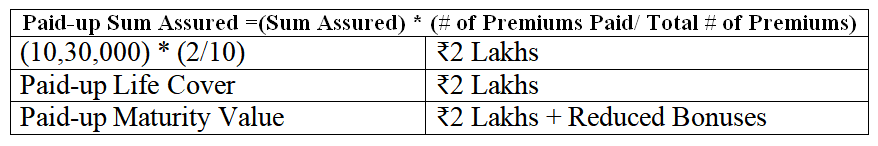

Endowment plans offer a dual benefit: a death benefit and a maturity benefit. The sum assured plays a vital role in determining both. In case of death during the policy term, the beneficiary receives the sum assured as a death benefit. If the policyholder survives until the maturity date, they receive the sum assured, along with any accumulated bonuses or profits, as a maturity benefit. For example, if a policy has a sum assured of $50,000 and accumulates $10,000 in bonuses over the policy term, the policyholder will receive $60,000 upon maturity. The sum assured forms the base amount, while the bonuses add to the final payout.

Sum Assured’s Influence on Payout Amounts in Various Claim Scenarios

The sum assured is the foundation upon which various claim payouts are calculated. While the death benefit is a direct reflection of the sum assured, other claim scenarios might involve partial or additional payouts depending on the policy terms and specific circumstances. For instance, some policies offer critical illness cover, where a percentage of the sum assured is paid out upon diagnosis of a specified critical illness. Accidental death benefits may also provide a multiple of the sum assured in case of death due to an accident.

| Claim Type | Sum Assured | Payout Amount | Conditions |

|---|---|---|---|

| Death Benefit | $100,000 | $100,000 | Death of the insured during the policy term |

| Maturity Benefit (Endowment Plan) | $50,000 | $60,000 | Policyholder survives until maturity, including $10,000 bonus |

| Critical Illness Benefit (50% of Sum Assured) | $75,000 | $37,500 | Diagnosis of a covered critical illness |

| Accidental Death Benefit (Double Sum Assured) | $25,000 | $50,000 | Death due to an accident |

Sum Assured and Policy Riders

Policy riders are additional benefits that can be attached to your life insurance policy, modifying the core sum assured in various ways. Understanding their impact on your final payout is crucial for making informed decisions about your coverage. These riders essentially customize your policy to better suit your specific needs and risk profile.

Rider Impact on Sum Assured

Riders can either increase or decrease the overall sum assured, depending on the type of rider and the specific terms and conditions. Some riders add to the payout, providing additional financial protection, while others may reduce it, usually in exchange for a lower premium. It’s essential to carefully consider the implications of each rider before adding it to your policy.

Examples of Riders Affecting Sum Assured

Several riders directly impact the final sum assured. For instance, an Accidental Death Benefit rider typically increases the payout if death results from an accident. This means that in addition to the base sum assured, a specified percentage (often double or triple) is paid out. Conversely, a waiver of premium rider, while valuable in protecting your policy during illness or disability, doesn’t directly affect the final sum assured itself; it merely protects your policy from lapsing due to non-payment of premiums. A critical illness rider provides a lump-sum payout upon diagnosis of a specified critical illness, but this payment is in addition to, not in place of, the death benefit sum assured.

Scenario: Total Payout with and without Riders

Let’s consider a scenario with a base sum assured of $500,000.

Without riders, the death benefit would simply be $500,000.

Now, let’s add two riders: an Accidental Death Benefit rider that doubles the sum assured in case of accidental death and a Critical Illness rider that pays out $250,000 upon diagnosis of a covered critical illness.

Scenario 1: Death due to natural causes. The payout remains $500,000.

Scenario 2: Death due to an accident. The payout becomes $500,000 (base sum assured) + $500,000 (Accidental Death Benefit) = $1,000,000.

Scenario 3: Diagnosis of a covered critical illness (survives). The payout is $250,000 (Critical Illness Benefit), with the $500,000 death benefit payable upon death.

Scenario 4: Diagnosis of a covered critical illness followed by death due to natural causes. The payout would be $250,000 (Critical Illness Benefit) + $500,000 (Death Benefit) = $750,000.

Scenario 5: Diagnosis of a covered critical illness followed by death due to an accident. The payout would be $250,000 (Critical Illness Benefit) + $1,000,000 (Death Benefit including Accidental Death Benefit) = $1,250,000.

This illustrates how riders significantly impact the total payout, offering increased financial security in specific circumstances. The added cost of riders needs to be weighed against the potential increase in benefits.

Understanding Sum Assured in Different Contexts

The concept of sum assured, while seemingly straightforward, varies depending on the type of life insurance policy. Understanding these nuances is crucial for making informed decisions about your financial protection. This section will explore how sum assured functions in different insurance contexts and highlight the importance of regular review and adjustment.

The implications of selecting a sum assured are significant and directly impact the level of financial security provided by the policy. Careful consideration of individual needs and future projections is vital in determining the appropriate amount.

Sum Assured in Term Life Insurance versus Whole Life Insurance

Term life insurance provides coverage for a specified period, offering a payout only if the insured dies within that term. The sum assured remains constant throughout the policy’s duration. Whole life insurance, conversely, offers lifelong coverage, and the sum assured may grow over time, often reflecting cash value accumulation within the policy. This growth can influence the final payout. The difference lies in the duration of coverage and the potential for the sum assured to increase in value. In term life insurance, the sum assured is a fixed amount paid upon death within the policy term; in whole life insurance, the sum assured might include accumulated cash value, potentially exceeding the initial amount.

Implications of Choosing a Higher or Lower Sum Assured

Choosing a higher sum assured provides greater financial protection for beneficiaries in the event of the insured’s death. This can cover outstanding debts, replace lost income, fund children’s education, or maintain the family’s lifestyle. However, higher sum assured typically translates to higher premiums. Conversely, a lower sum assured reduces premiums but offers less financial security. The optimal sum assured represents a balance between affordability and adequate financial protection for dependents. For example, a family with significant mortgage debt and young children might benefit from a higher sum assured compared to a single individual with minimal financial obligations.

Importance of Reviewing and Adjusting Sum Assured Periodically

Life circumstances change—marriage, childbirth, career advancements, increased debt, or changes in family structure all influence the appropriate sum assured. Regular review, at least annually or every few years, is essential to ensure the policy continues to meet evolving financial needs. Failing to adjust the sum assured upward as responsibilities increase could leave beneficiaries underinsured. Conversely, maintaining an excessively high sum assured when needs have diminished might result in unnecessary premium payments. For instance, a couple who paid off their mortgage and whose children are financially independent might consider reducing their sum assured to align with their current needs.

Steps to Determine an Appropriate Sum Assured

Determining the right sum assured requires careful consideration of several factors. The following steps can help in this process:

- Assess Current Liabilities: List all outstanding debts, including mortgages, loans, and credit card balances.

- Estimate Future Expenses: Project future expenses, such as children’s education costs, funeral expenses, and ongoing living expenses for dependents.

- Calculate Replacement Income: Determine the amount of income needed to replace the insured’s earnings for a specified period (e.g., until children reach adulthood).

- Consider Inflation: Account for the impact of inflation on future expenses to ensure the sum assured maintains its purchasing power.

- Consult a Financial Advisor: Seek professional advice to personalize the calculation and ensure the sum assured adequately addresses individual circumstances.

Illustrative Examples of Sum Assured

Understanding the appropriate sum assured is crucial for securing your family’s financial future. Let’s explore several scenarios illustrating how different life circumstances and financial goals impact the necessary sum assured.

A Family’s Need for Sum Assured

The Sharma family, comprising Mr. and Mrs. Sharma and their two children, aged 8 and 12, want to ensure their children’s education and maintain their current lifestyle in case of an unforeseen event. Mr. Sharma earns an annual salary of $100,000, while Mrs. Sharma earns $60,000. Their monthly expenses are approximately $6,000, including mortgage payments, school fees, and daily living costs. They estimate that their children’s education will cost $50,000 per child. Considering their current lifestyle and future educational expenses, they need a sum assured that covers their annual expenses for at least 15 years (until the youngest child completes their education), along with the children’s education costs. This translates to a required sum assured of approximately $1,080,000 ($6,000/month * 12 months/year * 15 years + $100,000). This calculation assumes a constant annual expense and does not factor in inflation or potential investment returns.

Impact of Marriage and Children on Sum Assured

Consider Sarah, a single professional earning $80,000 annually. Her living expenses are $3,000 monthly. After marriage and having a child, her expenses increase significantly. Her husband’s income is $70,000 annually. Combined household expenses rise to $5,000 monthly, including childcare costs, mortgage payments, and increased daily living expenses. Furthermore, they plan for their child’s education and future financial needs. The additional financial responsibilities require a higher sum assured compared to Sarah’s pre-marriage status. The combined income is $150,000, and considering future expenses and inflation, a sum assured of around $1,500,000 might be appropriate. This figure accounts for their lifestyle, child’s education, and long-term financial security.

Calculating Required Sum Assured Based on Income and Expenses

An individual can calculate their required sum assured using a simplified method focusing on income replacement and outstanding liabilities. Let’s consider John, who earns $90,000 annually and has outstanding debts totaling $50,000. John’s monthly expenses are $4,000.

To calculate his required sum assured, we can follow these steps:

1. Calculate annual expenses: $4,000/month * 12 months/year = $48,000/year

2. Determine the number of years of income replacement needed: Let’s assume 10 years.

3. Calculate the required income replacement: $48,000/year * 10 years = $480,000

4. Add outstanding debts: $480,000 + $50,000 = $530,000

Therefore, John’s estimated required sum assured is $530,000. This calculation is a simplification and doesn’t account for inflation or potential investment income. A more comprehensive approach would consider these factors for a more accurate assessment.

Closing Summary

Ultimately, securing an appropriate sum assured is a crucial step in financial planning, offering peace of mind and protecting loved ones against unforeseen circumstances. By understanding the factors that influence this key element of insurance policies and diligently reviewing your coverage, you can ensure your financial security is well-protected. Remember to consult with a financial advisor to determine the optimal sum assured based on your unique circumstances and financial goals.

Quick FAQs: Sum Assured

What happens if I die before my policy matures?

The nominated beneficiaries will receive the sum assured as a death benefit.

Can I increase my sum assured after the policy is issued?

Generally, yes, but it might involve a new underwriting process and increased premiums.

How is the sum assured calculated for critical illness cover?

It varies depending on the insurer and the specific policy, often a percentage of the sum assured or a lump sum.

What if my claim is partially approved?

You’ll receive a payout proportionate to the approved portion of your claim, relative to the sum assured.