- Defining “Riders” in Insurance Policies

- Benefits and Drawbacks of Riders

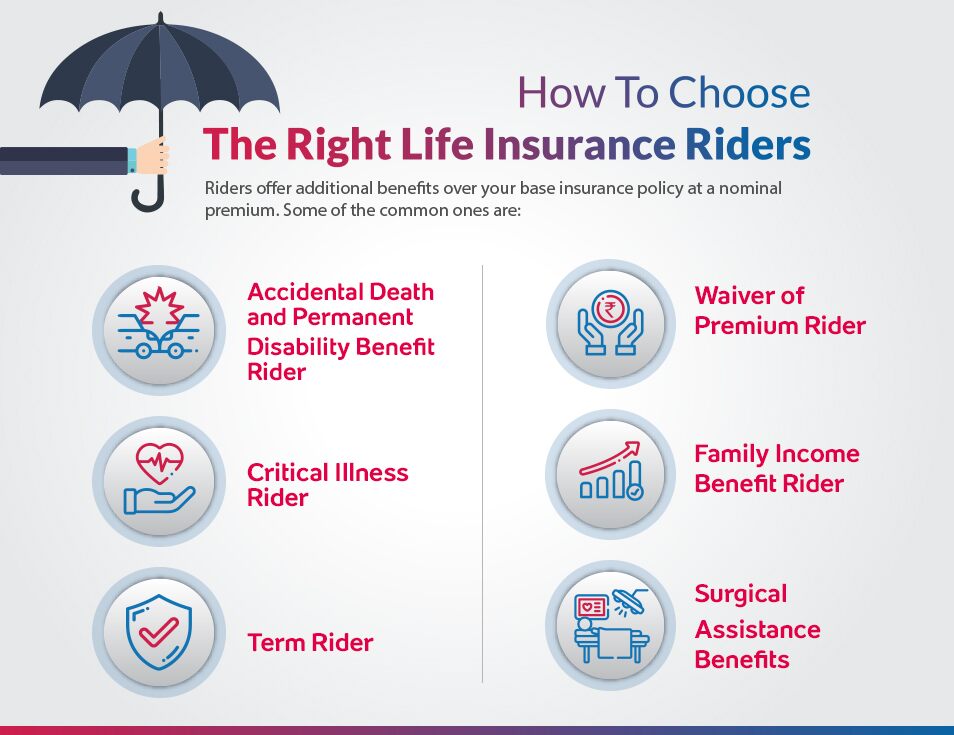

- Types of Riders and Their Applications: Riders (policy Add-ons)

- Legal and Regulatory Aspects of Riders

- Illustrative Examples of Rider Usage

- Comparing Riders Across Different Insurance Providers

- Ultimate Conclusion

- Detailed FAQs

Riders (policy add-ons) represent a crucial aspect of insurance planning, offering opportunities to customize coverage and bolster protection against unforeseen circumstances. These supplemental policies, attached to existing insurance plans, provide tailored benefits that extend beyond the core policy’s scope, addressing specific needs and vulnerabilities. Understanding the nuances of riders is essential for maximizing the value and effectiveness of your insurance portfolio.

This exploration delves into the intricacies of riders, examining their various types, benefits, limitations, and legal implications. We will explore how riders function across different insurance categories—life, health, home, and auto—and provide practical examples to illustrate their real-world impact on claims and financial security. By understanding the advantages and potential drawbacks, you can make informed decisions to secure your financial future.

Defining “Riders” in Insurance Policies

Insurance riders are supplemental contracts added to an existing insurance policy, enhancing its coverage or adding specific benefits. They provide a way to customize your insurance protection to better meet your individual needs and circumstances, often at an additional cost. Understanding riders is crucial for maximizing the value of your insurance policy.

Riders as Supplemental Coverage

Riders function as add-ons to your primary insurance policy, extending its scope beyond the standard coverage. They are distinct from the core policy itself, offering specialized protection for specific events or situations. Think of them as optional modules you can attach to a base product to increase its functionality. The core policy remains the foundation, while riders augment it with additional benefits.

Examples of Common Riders

Several types of riders are available depending on the core policy. For instance, life insurance policies may offer riders such as accidental death benefit riders (paying out extra if death results from an accident), waiver of premium riders (waiving future premiums if the policyholder becomes disabled), or long-term care riders (covering long-term care expenses). Health insurance might include riders for critical illness coverage or specific disease coverage. Home insurance could have riders for earthquake coverage or flood insurance. Auto insurance may offer riders for roadside assistance or rental car reimbursement.

Key Differences Between Riders and Core Policies

Riders are distinct from the main insurance policy in several key aspects. Firstly, they are optional additions, not mandatory components. Secondly, they typically come with an additional premium, reflecting the increased coverage they provide. Thirdly, the terms and conditions of a rider are separate from those of the core policy, although they are often linked. Finally, the benefits provided by a rider are specifically defined and limited to the terms Artikeld in the rider agreement.

Rider Types, Benefits, and Limitations

| Rider Type | Description | Benefits | Limitations |

| Accidental Death Benefit Rider (Life Insurance) | Pays an additional sum if the insured dies due to an accident. | Provides extra financial security for beneficiaries in case of accidental death. | Only pays out if death is accidental; specific exclusions may apply (e.g., suicide). |

| Waiver of Premium Rider (Life Insurance) | Waives future premiums if the insured becomes disabled. | Protects the policy from lapsing due to disability, ensuring continued coverage. | Disability must meet the specific definition Artikeld in the rider; a waiting period may apply. |

| Critical Illness Rider (Health Insurance) | Provides a lump-sum payment upon diagnosis of a specified critical illness. | Offers financial assistance to cover medical expenses and other costs associated with a critical illness. | Covers only specified critical illnesses; pre-existing conditions may be excluded. |

| Earthquake Coverage Rider (Home Insurance) | Covers damage to the home caused by earthquakes. | Protects the home from earthquake-related damage, a peril often excluded from standard policies. | May have a separate deductible and coverage limits; may not cover all earthquake-related damages. |

Benefits and Drawbacks of Riders

Insurance riders offer a valuable way to customize your policy and enhance its coverage, but it’s crucial to understand both their advantages and potential limitations before adding them to your plan. Weighing the pros and cons carefully will help you make an informed decision about whether a rider is the right choice for your specific needs.

Advantages of Purchasing Riders

Riders provide a convenient and often cost-effective method of extending your existing insurance policy’s coverage without the need to purchase a completely separate policy. This streamlined approach simplifies your insurance management and potentially saves you time and administrative effort. The specific benefits depend heavily on the type of rider and the underlying policy, but common advantages include increased coverage for specific risks at a relatively lower premium than purchasing separate insurance. For instance, a critical illness rider might offer a lump-sum payment upon diagnosis of a serious illness, providing financial assistance during a difficult time. Similarly, an accidental death benefit rider can offer additional financial security to your beneficiaries in the event of an unexpected death.

Disadvantages and Limitations of Riders

While riders offer numerous benefits, it’s important to be aware of potential drawbacks. One key consideration is that riders typically increase your overall premium. While often less expensive than separate policies, the added cost needs to be factored into your budget. Furthermore, the terms and conditions of a rider are usually tied to the main policy. If your main policy is cancelled or lapses, the rider will also be terminated. This interconnectedness means that careful consideration should be given to the long-term implications of adding a rider. Additionally, riders might have limitations on the amount of coverage they provide, or they may exclude certain conditions or circumstances. It’s essential to read the policy documents carefully to fully understand these limitations.

Cost-Effectiveness of Riders versus Separate Policies

The cost-effectiveness of riders compared to separate policies is highly dependent on the specific type of coverage and the insurer. In many cases, riders offer a more affordable way to obtain additional coverage. For example, adding a waiver of premium rider to a life insurance policy might be significantly cheaper than purchasing a separate disability income policy that offers similar protection. However, a detailed comparison of premiums and coverage amounts is necessary to determine the most cost-effective option in each individual circumstance. Always obtain quotes for both options before making a decision.

Scenarios Where Riders Are Particularly Beneficial

Riders are particularly valuable in specific situations where there is a heightened need for targeted protection. For example, a young family with a mortgage might benefit from adding a critical illness rider to their life insurance policy to help cover their mortgage payments in case of a serious illness. Similarly, individuals with high-risk occupations might find an accidental death benefit rider beneficial to provide additional financial security for their loved ones. The value of a rider is also significantly increased when it addresses specific vulnerabilities or risks that are not adequately covered by the base policy. A comprehensive review of personal circumstances and risk profiles is vital to determine if specific riders are needed.

Types of Riders and Their Applications: Riders (policy Add-ons)

Insurance riders offer a valuable way to customize policies and enhance coverage beyond the standard plan. Understanding the various types available and their applications is crucial for tailoring insurance protection to individual needs and circumstances. This section categorizes different riders based on their function and provides examples across various insurance types.

Life Insurance Riders

Life insurance riders primarily augment the death benefit or add supplementary coverage. Choosing the right rider depends heavily on your specific financial goals and risk tolerance.

- Accidental Death Benefit Rider: This rider increases the death benefit if the insured dies due to an accident. The payout is typically a multiple of the base policy’s death benefit.

- Critical Illness Rider: Provides a lump-sum payment upon diagnosis of a specified critical illness, such as cancer, heart attack, or stroke, allowing for expenses related to treatment and recovery.

- Waiver of Premium Rider: If the insured becomes totally disabled, this rider waives future premium payments while maintaining the policy’s coverage.

- Guaranteed Insurability Rider: Allows the policyholder to increase their coverage amount at specific intervals without undergoing further medical examinations, protecting against future increases in premiums or insurability issues.

Health Insurance Riders

Health insurance riders extend or modify the basic health insurance policy’s coverage. They address specific needs or concerns that are not fully covered by the standard policy.

- Hospital Cash Benefit Rider: Provides a daily cash benefit during hospitalization, covering expenses not covered by the standard health insurance policy, such as daily living expenses.

- Critical Illness Rider (Health): Similar to the life insurance version, this rider provides a lump-sum payment upon diagnosis of a specified critical illness.

- Personal Accident Rider: Covers accidental injuries and disabilities, providing financial support for medical expenses and loss of income.

Home Insurance Riders

Home insurance riders offer protection against specific perils or losses not typically included in standard home insurance policies. These riders enhance coverage based on unique risks or valuable possessions.

- Earthquake Rider: Covers damage to the home caused by earthquakes, a peril often excluded from standard policies.

- Flood Rider: Provides coverage for damage caused by floods, another peril frequently excluded from standard policies.

- Jewelry Rider: Offers additional coverage for valuable jewelry, extending the coverage beyond the standard policy’s limits for personal belongings.

Auto Insurance Riders

Auto insurance riders provide additional coverage or protection beyond the standard auto insurance policy. They address specific needs or risks related to vehicle ownership and operation.

- Rental Reimbursement Rider: Covers the cost of a rental car while the insured vehicle is being repaired after an accident.

- Roadside Assistance Rider: Provides coverage for roadside assistance services such as towing, jump starts, and lockout services.

- Uninsured/Underinsured Motorist Rider: Provides coverage for injuries or damages caused by an uninsured or underinsured driver.

Scenario Illustrating Rider Usage

Imagine Sarah, a 35-year-old professional, purchased a life insurance policy with a critical illness rider. Several years later, she was diagnosed with breast cancer. The critical illness rider in her policy provided her with a lump-sum payment of $50,000. This allowed her to cover medical expenses, ongoing treatment costs, and time off work without incurring significant financial strain. Without the rider, she would have had to bear these substantial expenses solely from her savings.

Legal and Regulatory Aspects of Riders

Insurance riders, while enhancing policy coverage, are subject to a complex web of legal and regulatory requirements designed to protect policyholders. These regulations vary across jurisdictions but generally aim to ensure transparency, fair practices, and consumer protection. Understanding these aspects is crucial for both insurers and policyholders.

Legal Requirements and Regulations Governing Riders

The sale and use of riders are governed by various insurance regulations, often mirroring those applicable to the underlying insurance policy itself. These regulations typically address aspects such as the clarity and accuracy of rider descriptions, the approval process for new rider offerings, and the requirements for disclosure to consumers. Specific regulations may cover areas like suitability of riders for individual policyholders, the permissible terms and conditions within a rider contract, and the methods for handling complaints or disputes arising from rider-related issues. Compliance with these regulations is vital for insurers to avoid penalties and maintain their operational licenses. For example, in many jurisdictions, insurers are required to file rider forms and related documentation with regulatory bodies before offering them to the public, ensuring that these additions to the core policy meet specific standards of clarity and fairness.

Disclosure of Riders to Policyholders

Transparency is paramount in the sale of insurance riders. Regulations typically mandate that insurers provide clear and concise disclosures to potential policyholders, explaining the features, benefits, limitations, and costs associated with each rider. This disclosure often takes the form of a separate rider document, integrated into the main policy document, or presented as part of a comprehensive policy illustration. The language used must be easily understandable by the average consumer, avoiding technical jargon or misleading statements. Crucially, the disclosure should highlight any exclusions or limitations that may affect the rider’s coverage. For example, a rider providing critical illness coverage might exclude certain pre-existing conditions, and this exclusion must be explicitly stated in the disclosure.

Potential Disputes and Conflicts Related to Rider Claims

Disputes related to rider claims can arise from various sources, including disagreements over eligibility, the interpretation of policy terms, or the adequacy of the claim payout. These disputes often stem from ambiguities in the rider’s language, a lack of clear understanding on the part of the policyholder, or situations where the circumstances of a claim don’t perfectly align with the rider’s stated conditions. The resolution of such disputes may involve internal insurer review processes, mediation, arbitration, or litigation, depending on the nature of the disagreement and the applicable jurisdiction’s legal framework. Robust record-keeping by the insurer is vital in such cases, to demonstrate the transparency and fairness of the claim handling process.

Standard Clauses in Rider Agreements

Rider agreements typically include standard clauses mirroring those found in the main insurance policy, but also contain clauses specific to the rider’s particular coverage. Common clauses include definitions of key terms used in the rider, descriptions of the coverage provided, details of exclusions and limitations, procedures for filing claims, provisions for premium payments, and conditions related to termination or cancellation. Furthermore, clauses outlining the insurer’s responsibilities, the policyholder’s obligations, and dispute resolution mechanisms are often incorporated. For example, a clause might specify the time limit within which a claim must be filed, or it might Artikel the process for appealing a claim decision. These standard clauses ensure consistency and protect both the insurer and the policyholder, establishing a clear framework for the rider’s operation.

Illustrative Examples of Rider Usage

Understanding how riders function in practice is crucial for appreciating their value. The following examples illustrate how riders can enhance a basic insurance policy, providing additional coverage and financial protection beyond the core policy’s limits.

Rider Impact on Claim Payout

Let’s consider a life insurance policy with a death benefit of $500,000. The policyholder, John, adds a Accidental Death Benefit rider for an additional 50% of the death benefit. Tragically, John dies in an accident. The base policy pays out the $500,000 death benefit. The Accidental Death Benefit rider then pays an additional $250,000 (50% of $500,000), resulting in a total payout to John’s beneficiaries of $750,000. This clearly demonstrates how a rider can significantly increase the financial compensation received by the beneficiaries in specific circumstances.

Rider Covering Risks Not in Base Policy

Suppose Sarah has a basic homeowner’s insurance policy that covers fire damage but excludes flood damage. She lives in a coastal area at risk of flooding. By adding a flood insurance rider, Sarah gains protection against flood damage, a risk specifically not covered by her original policy. If a flood were to damage her home, the rider would cover the costs of repairs or rebuilding, up to the rider’s coverage limit, providing crucial financial protection against a significant potential loss.

Case Study: The Benefits of a Critical Illness Rider, Riders (policy add-ons)

Imagine Michael, a 45-year-old entrepreneur, with a comprehensive health insurance policy. He adds a Critical Illness rider to his policy, which provides a lump-sum payout upon diagnosis of a specified critical illness, such as cancer or heart attack. Several months later, Michael is diagnosed with cancer. The critical illness rider pays out $100,000, a substantial sum that helps Michael cover medical expenses, lost income due to his inability to work, and other associated costs. This financial assistance significantly reduces the financial burden of his illness and allows him to focus on his recovery, demonstrating the real-world benefit of a well-chosen rider.

Comparing Riders Across Different Insurance Providers

Choosing the right insurance policy often involves considering additional coverage options, known as riders. A crucial aspect of this decision-making process is comparing the riders offered by different insurance providers. This comparison should focus on cost, coverage details, and any limitations imposed. Understanding these variations allows policyholders to make informed choices that best suit their individual needs and financial circumstances.

Rider Comparison: Provider A vs. Provider B

This section presents a comparison of riders offered by two hypothetical major insurance providers, Provider A and Provider B. Note that specific rider offerings and costs can vary significantly depending on individual circumstances, location, and policy type. The data below is for illustrative purposes and should not be considered definitive financial advice. Always consult directly with the insurance provider for the most up-to-date information.

| Provider | Rider Type | Cost (Illustrative Annual Premium) | Coverage Details |

|---|---|---|---|

| Provider A | Accidental Death Benefit Rider | $100 | Pays a lump sum benefit upon accidental death of the insured, typically equal to the policy’s death benefit. May have exclusions for certain types of accidents. |

| Provider B | Accidental Death Benefit Rider | $120 | Similar to Provider A’s rider, but includes coverage for accidental death while engaging in certain high-risk activities (subject to specific terms and conditions). |

| Provider A | Critical Illness Rider | $200 | Provides a lump sum benefit upon diagnosis of a specified critical illness, such as cancer, heart attack, or stroke. The specific illnesses covered may vary. |

| Provider B | Critical Illness Rider | $180 | Offers a similar benefit to Provider A, but the payout may be structured as a percentage of the sum assured rather than a fixed lump sum. The list of covered illnesses is slightly different. |

| Provider A | Waiver of Premium Rider | $50 | Waives future premiums if the insured becomes totally and permanently disabled. Specific definitions of disability apply. |

| Provider B | Waiver of Premium Rider | $60 | Similar to Provider A’s rider, but may offer a shorter waiting period before the waiver takes effect. |

Ultimate Conclusion

Ultimately, the strategic use of riders (policy add-ons) can significantly enhance the overall protection afforded by your insurance policies. By carefully considering your individual needs and risk profile, you can tailor your coverage to mitigate specific vulnerabilities and achieve greater peace of mind. Remember to thoroughly review the terms and conditions of any rider before purchasing to ensure it aligns with your financial goals and expectations. Proactive insurance planning, incorporating the strategic use of riders, is a crucial element of responsible financial management.

Detailed FAQs

What happens if my base policy lapses, but I still have a rider?

Generally, the rider will also lapse unless it’s designed to continue independently under specific circumstances. Always check the rider’s terms and conditions.

Can I add riders to my policy at any time?

This depends on your insurer and the specific rider. Some can be added later, while others may only be available during the initial policy purchase or within a specific timeframe.

Are riders always more expensive than increasing the base policy coverage?

Not necessarily. The cost-effectiveness depends on the specific rider, the base policy, and the overall level of coverage desired. A comparison is crucial before making a decision.

Can I remove a rider after it’s added to my policy?

Yes, usually, but there may be limitations or fees associated with removing a rider. Check with your insurer for their specific policy.