Regulated forex brokers stand as guardians of the financial markets, offering a secure and transparent environment for traders of all levels. These brokers are subject to strict regulations, ensuring that your funds are protected and your trading experience is fair and reliable. This guide delves into the world of regulated forex brokers, explaining their significance, key features, and how to choose the right one for your trading needs.

From understanding the importance of regulatory oversight to exploring the benefits of trading with a regulated broker, this comprehensive guide provides a roadmap for navigating the complex world of forex trading. We’ll uncover the essential elements that distinguish regulated brokers from unregulated ones, emphasizing the importance of client fund protection, transparency, and compliance with international standards.

Choosing a Regulated Forex Broker

Choosing the right forex broker is crucial for a successful trading experience. A regulated forex broker provides a secure and reliable platform for trading currencies. By choosing a regulated broker, you can have peace of mind knowing that your funds are protected and that the broker operates according to industry standards.

Factors to Consider When Selecting a Regulated Broker

When choosing a regulated forex broker, it’s essential to consider several factors to ensure a secure and reliable trading experience.

- Regulation: Ensure the broker is regulated by a reputable financial authority, such as the Financial Conduct Authority (FCA) in the UK, the Australian Securities and Investments Commission (ASIC) in Australia, or the National Futures Association (NFA) in the US. This ensures that the broker operates within a legal framework and adheres to specific standards.

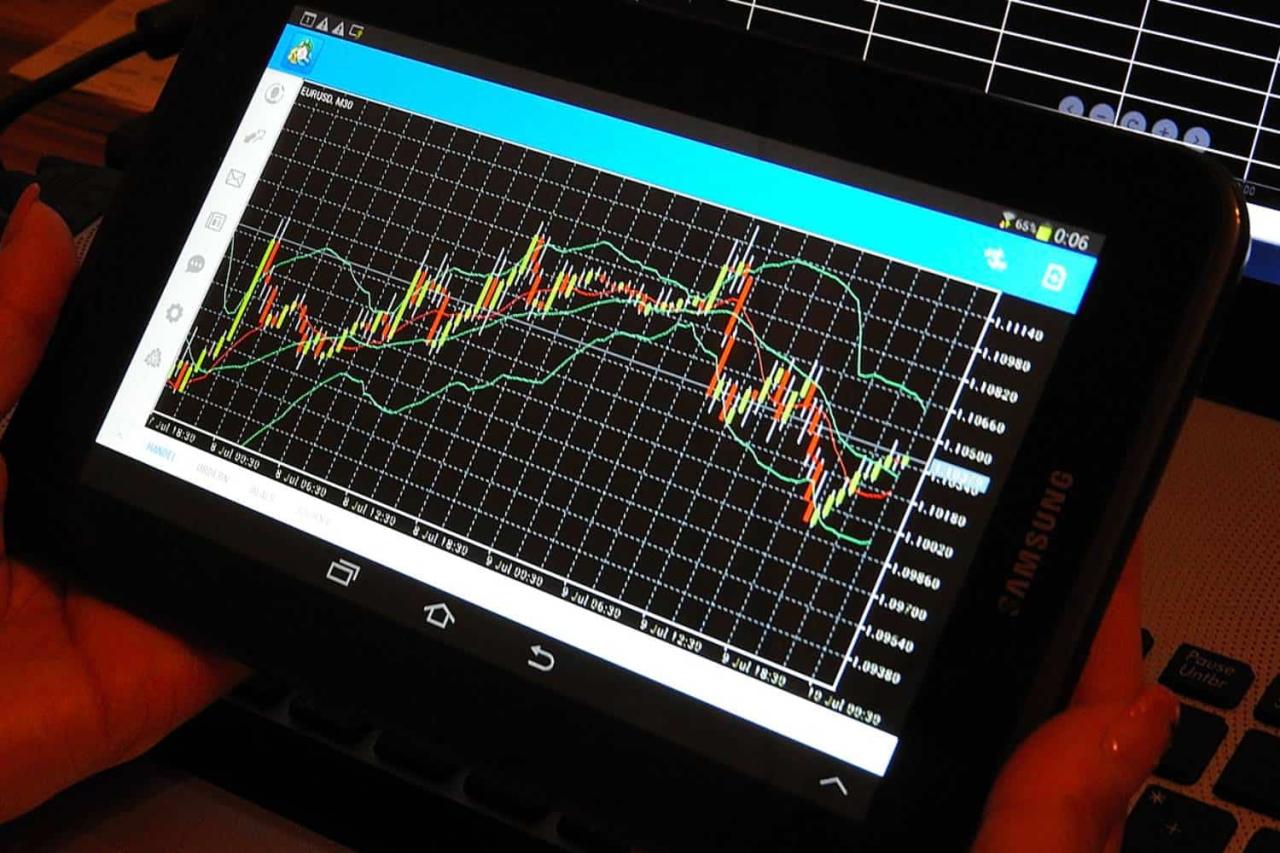

- Trading Platforms: Evaluate the broker’s trading platforms, considering factors like user-friendliness, features, and availability on different devices. Popular platforms include MetaTrader 4 (MT4) and MetaTrader 5 (MT5), which offer advanced charting tools, indicators, and order execution capabilities.

- Spreads and Fees: Compare the broker’s spreads, which represent the difference between the buy and sell prices of a currency pair. Lower spreads are generally more favorable for traders. Also, consider other fees, such as commissions, inactivity fees, and withdrawal fees.

- Leverage: Understand the leverage offered by the broker. Leverage allows traders to control larger positions with a smaller amount of capital. However, it also amplifies both profits and losses. Choose a leverage level that aligns with your risk tolerance and trading strategy.

- Customer Support: Evaluate the broker’s customer support channels, such as phone, email, and live chat. Responsive and knowledgeable customer support is essential for resolving issues and receiving assistance when needed.

- Deposit and Withdrawal Methods: Consider the deposit and withdrawal methods offered by the broker, ensuring they are convenient and secure. Check for any associated fees or processing times.

- Educational Resources: Some brokers provide educational resources, such as webinars, tutorials, and market analysis, which can be valuable for beginners and experienced traders alike.

Comparison of Regulated Forex Brokers

Different regulated brokers offer a range of features and services. Here’s a comparison of some popular brokers:

| Broker | Trading Platforms | Spreads (Average) | Leverage | Customer Support |

|---|---|---|---|---|

| FXTM | MT4, MT5, WebTrader | 1.3 pips | 1:1000 | 24/5 multi-lingual support |

| XM | MT4, MT5, WebTrader | 0.8 pips | 1:888 | 24/5 multi-lingual support |

| IC Markets | MT4, MT5, cTrader | 0.0 pips (Raw Spread) | 1:500 | 24/5 multi-lingual support |

| AvaTrade | MT4, MT5, AvaTradeGO | 0.9 pips | 1:400 | 24/5 multi-lingual support |

Opening an Account with a Regulated Forex Broker

Opening an account with a regulated forex broker typically involves the following steps:

Step 1: Choose a regulated forex broker based on your needs and preferences.

Step 2: Visit the broker’s website and click on the “Open Account” or “Sign Up” button.

Step 3: Complete the account application form, providing your personal and financial information.

Step 4: Verify your identity by providing documents such as a passport or driver’s license.

Step 5: Fund your account using the available deposit methods.

Step 6: Download and install the broker’s trading platform.

Step 7: Familiarize yourself with the platform’s features and start trading.

The Regulatory Landscape of Forex Trading

The forex market is a vast and complex ecosystem, and its sheer size and global nature necessitate robust regulatory frameworks to ensure fairness, transparency, and investor protection. These regulations are essential for maintaining market integrity, fostering trust, and mitigating risks associated with forex trading.

Types of Regulatory Frameworks

Different jurisdictions employ various regulatory frameworks to oversee forex trading activities. These frameworks can be categorized into three main types:

- Self-regulation: This approach relies on industry associations or organizations to establish and enforce rules and standards among their members. While self-regulation can provide a degree of oversight, it may lack the same level of independence and enforcement power as government agencies.

- National Regulation: This framework involves government agencies, such as central banks or financial regulators, setting and enforcing rules for forex brokers and traders operating within their jurisdiction. This approach typically provides a higher level of investor protection and market oversight.

- International Regulation: International organizations like the International Organization of Securities Commissions (IOSCO) and the Financial Stability Board (FSB) play a role in coordinating and harmonizing regulatory standards across different countries. While they lack direct enforcement powers, their recommendations and guidelines influence national regulations.

Role of Financial Authorities, Regulated forex brokers

Financial authorities play a crucial role in overseeing forex brokers and ensuring a fair and transparent trading environment. Their responsibilities include:

- Licensing and Registration: Financial authorities typically require forex brokers to obtain licenses or registrations before they can operate within their jurisdiction. This process involves a thorough assessment of the broker’s financial stability, compliance with regulations, and operational procedures.

- Supervision and Monitoring: Once licensed, forex brokers are subject to ongoing supervision and monitoring by financial authorities. This involves regular audits, inspections, and reviews of the broker’s activities to ensure compliance with regulations and identify potential risks.

- Investor Protection: Financial authorities establish rules and mechanisms to protect investors from fraud, misrepresentation, and unfair trading practices. These measures may include requirements for client funds segregation, dispute resolution processes, and compensation schemes for investors who suffer losses due to broker misconduct.

- Market Integrity: Financial authorities strive to maintain the integrity of the forex market by preventing manipulation, market abuse, and other activities that could undermine fair trading practices. This may involve setting rules for market access, order execution, and transparency of trading data.

Examples of Regulations and Guidelines

Major jurisdictions have implemented various regulations and guidelines to govern forex trading activities. Some prominent examples include:

- United States: The Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA) regulate forex brokers and trading activities in the US. They require forex brokers to register with the CFTC and comply with regulations related to client funds segregation, risk management, and anti-money laundering (AML) practices.

- European Union: The European Securities and Markets Authority (ESMA) oversees forex brokers and trading activities within the EU. ESMA has implemented regulations, such as the Markets in Financial Instruments Directive (MiFID II), which require forex brokers to provide clear and concise information to clients, ensure fair and transparent trading practices, and implement robust risk management procedures.

- United Kingdom: The Financial Conduct Authority (FCA) regulates forex brokers in the UK. The FCA requires forex brokers to hold licenses, comply with regulations regarding client funds segregation, and provide adequate risk warnings to clients.

- Australia: The Australian Securities and Investments Commission (ASIC) regulates forex brokers in Australia. ASIC requires forex brokers to hold licenses, comply with regulations regarding client funds segregation, and provide clear and concise information to clients.

Impact of Regulatory Changes

Regulatory changes can have a significant impact on the forex industry. These changes may lead to:

- Increased Compliance Costs: Forex brokers may face increased compliance costs due to new regulations, such as enhanced reporting requirements, stricter KYC/AML procedures, and investment in technology to meet regulatory standards.

- Changes in Trading Practices: Regulations may lead to changes in trading practices, such as limitations on leverage, restrictions on certain trading strategies, and increased transparency in order execution.

- Consolidation of the Industry: Regulatory changes can create a more challenging environment for smaller brokers, potentially leading to consolidation within the industry as smaller players struggle to meet compliance requirements.

- Enhanced Investor Protection: Regulatory changes can improve investor protection by providing clearer rules, increased transparency, and better dispute resolution mechanisms.

Risks and Considerations for Regulated Forex Brokers

While regulated Forex brokers offer a layer of protection and security for traders, it’s crucial to understand that trading Forex inherently involves risk. This section delves into the potential risks associated with Forex trading, even when using regulated brokers, and provides insights into managing these risks effectively.

Understanding Leverage and Margin Requirements

Leverage allows traders to control larger positions with a smaller initial investment, amplifying potential profits. However, it also magnifies losses. Understanding leverage and margin requirements is essential for managing risk.

- Leverage: Leverage is expressed as a ratio, such as 1:100. This means that for every $1 deposited, a trader can control $100 worth of currency. While leverage can increase potential profits, it can also lead to significant losses if the market moves against the trader.

- Margin: Margin is the initial deposit required to open a trade. Brokers require margin to cover potential losses. The higher the leverage, the lower the margin requirement. A lower margin requirement means traders can control larger positions with less capital, increasing their exposure to risk.

For example, if a trader uses 1:100 leverage and deposits $100, they can control $10,000 worth of currency. A 1% move in the market against the trader’s position would result in a $100 loss, wiping out their entire initial deposit.

Stop-Loss Orders and Risk Management Strategies

Stop-loss orders are crucial for managing risk in Forex trading. They automatically close a trade when the price reaches a predetermined level, limiting potential losses.

- Stop-Loss Orders: Stop-loss orders are essential risk management tools. They allow traders to set a specific price point at which their trade will automatically close, limiting potential losses. This helps prevent significant losses if the market moves against the trader’s position.

- Risk Management Strategies: Effective risk management involves various strategies, such as:

- Position Sizing: Determine the appropriate amount of capital to allocate to each trade based on your risk tolerance and account balance.

- Diversification: Spread your investments across different currency pairs to reduce the impact of any single trade’s outcome.

- Trailing Stop-Loss Orders: These orders automatically adjust the stop-loss level as the trade moves in your favor, locking in profits while limiting losses.

Minimizing Trading Risks and Protecting Investments

Minimizing trading risks is a continuous process that involves education, discipline, and responsible trading practices.

- Thorough Research and Analysis: Before entering any trade, conduct in-depth research on the currency pair, market conditions, and potential risks. Utilize fundamental and technical analysis tools to support your trading decisions.

- Develop a Trading Plan: Create a clear trading plan that Artikels your risk tolerance, entry and exit points, and profit targets. Stick to your plan and avoid impulsive trading decisions.

- Stay Informed and Adapt: The Forex market is dynamic, and conditions can change rapidly. Stay informed about market news, economic data, and geopolitical events that could impact your trades. Be prepared to adapt your strategies as needed.

- Emotional Control: Trading involves emotional highs and lows. Avoid making decisions based on fear or greed. Stay disciplined and stick to your trading plan.

The Future of Regulated Forex Brokers

The forex market is constantly evolving, driven by technological advancements and changing regulatory landscapes. This dynamic environment presents both challenges and opportunities for regulated forex brokers. This section explores the key trends shaping the future of regulated forex brokers, examining the impact of technology, the evolving regulatory landscape, and the potential challenges and opportunities that lie ahead.

Technological Advancements and Their Impact

Technological advancements are profoundly reshaping the forex industry. The adoption of artificial intelligence (AI), machine learning (ML), and blockchain technology is transforming how brokers operate and how traders interact with the market.

- Automated Trading and Algorithmic Strategies: AI and ML are enabling the development of sophisticated trading algorithms that can analyze vast amounts of data, identify trading opportunities, and execute trades automatically. This trend is leading to increased automation in forex trading, with algorithms playing a growing role in decision-making. This trend can benefit both brokers and traders, offering greater efficiency and potentially improved returns.

- Personalized Trading Experiences: Brokers are using AI and ML to personalize trading experiences, providing tailored recommendations, risk management tools, and educational resources based on individual trader profiles and preferences. This trend can enhance trader satisfaction and improve engagement.

- Blockchain Technology and Decentralized Finance (DeFi): Blockchain technology is emerging as a potential disruptor in the forex market. DeFi platforms are offering decentralized trading options, potentially reducing reliance on traditional brokers. However, the regulatory landscape surrounding DeFi is still evolving, and its impact on the future of regulated brokers remains to be seen.

Final Conclusion

In conclusion, navigating the forex market with confidence requires choosing a regulated broker. By understanding the regulatory landscape, recognizing the key features of regulated brokers, and following our checklist for selection, you can embark on your trading journey with peace of mind. Remember, choosing a regulated forex broker is not just about finding the best trading conditions; it’s about safeguarding your investments and ensuring a secure and transparent trading experience.

FAQ Guide: Regulated Forex Brokers

What are the risks associated with trading forex?

Forex trading involves inherent risks, including market volatility, leverage, and the possibility of losing your invested capital. It’s crucial to understand these risks and implement proper risk management strategies to protect your investments.

How do I know if a forex broker is regulated?

Check the broker’s website for information about their regulatory status. Reputable brokers will display licenses and registration details from recognized financial authorities. You can also verify this information on the websites of regulatory bodies.

What are the benefits of trading with a regulated forex broker?

Trading with a regulated broker offers several benefits, including client fund protection, transparent trading conditions, and access to reliable customer support. You can also be assured of a fair and secure trading environment.

How do I choose the right regulated forex broker?

Consider factors such as regulatory status, trading platforms, spreads, leverage, customer support, and deposit/withdrawal options. Compare different brokers and choose one that best aligns with your trading needs and risk tolerance.