- Introduction

- Understanding PMA Insurance Group’s Products and Services

- Financial Strength and Stability: A Cornerstone of PMA Insurance Group

- PMA Insurance Group’s Commitment to Customers: Above and Beyond

- Breakdown of PMA Insurance Group’s Offerings: A Comprehensive Summary

- Conclusion

-

FAQ about PMA Insurance Group

- What is PMA Insurance Group?

- What types of insurance does PMA Insurance Group offer?

- Who is eligible for PMA Insurance Group coverage?

- How much does PMA Insurance Group cost?

- How can I get a quote from PMA Insurance Group?

- How do I file a claim with PMA Insurance Group?

- What is PMA Insurance Group’s customer service like?

- What are PMA Insurance Group’s financial ratings?

- What is PMA Insurance Group’s claims handling process like?

- What are some of the benefits of choosing PMA Insurance Group?

Introduction

Readers, welcome to the ultimate guide to PMA Insurance Group, a leading provider of insurance solutions for businesses and individuals. With a rich history and a commitment to excellence, PMA Insurance Group has established itself as a trusted name in the insurance industry. This article delves into the various aspects of PMA Insurance Group, providing you with a comprehensive overview of its offerings, financial strength, and unwavering dedication to customer satisfaction.

Understanding PMA Insurance Group’s Products and Services

Commercial Insurance Solutions

PMA Insurance Group offers a wide range of commercial insurance products tailored to meet the unique needs of businesses. These include property and casualty insurance, workers’ compensation insurance, professional liability insurance, and more. With years of experience in underwriting commercial risks, PMA Insurance Group provides comprehensive coverage and tailored solutions to protect businesses from potential losses.

Personal Insurance Coverage

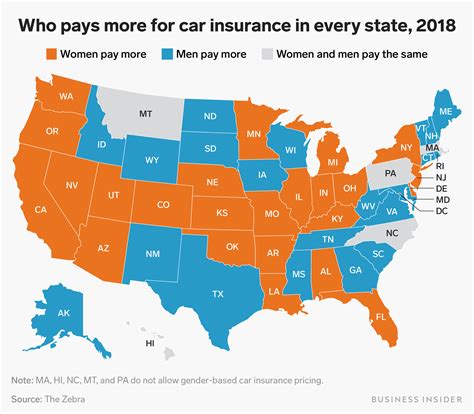

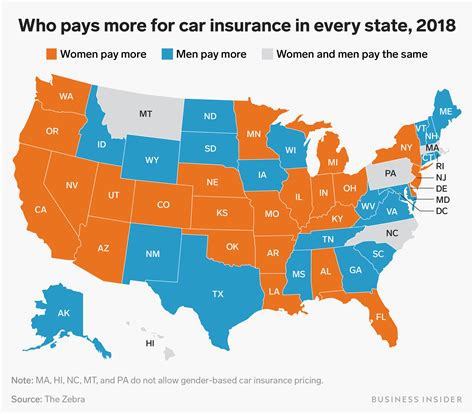

In addition to commercial insurance, PMA Insurance Group also provides a variety of personal insurance options, including homeowners insurance, auto insurance, life insurance, and disability insurance. By offering a full suite of personal insurance products, PMA Insurance Group becomes a one-stop shop for individuals and families seeking to safeguard their most valuable assets.

Financial Strength and Stability: A Cornerstone of PMA Insurance Group

Excellent Financial Ratings

PMA Insurance Group has consistently earned top financial ratings from leading independent rating agencies, such as A.M. Best and Standard & Poor’s. These ratings attest to the company’s strong financial foundation and ability to meet its obligations to policyholders. By partnering with PMA Insurance Group, businesses and individuals can rest assured that their insurance provider has the financial strength to provide reliable protection.

Robust Claims Handling Process

PMA Insurance Group prides itself on its exceptional claims handling process. The company’s experienced claims professionals are dedicated to resolving claims promptly and fairly, ensuring that policyholders receive the compensation they deserve. With a reputation for being responsive and customer-centric, PMA Insurance Group offers peace of mind to its clients in times of need.

PMA Insurance Group’s Commitment to Customers: Above and Beyond

Dedicated Client Service

PMA Insurance Group is committed to providing exceptional customer service throughout every interaction. The company’s team of insurance professionals is knowledgeable, friendly, and always willing to go the extra mile to meet client needs. By fostering strong relationships with its customers, PMA Insurance Group ensures that they feel valued and supported.

Tailored Insurance Solutions

PMA Insurance Group recognizes that every business and individual has unique insurance requirements. To address this, the company offers tailored insurance solutions that are specifically designed to meet the specific risks and coverage needs of each client. By providing customized insurance plans, PMA Insurance Group ensures that its clients receive optimal protection and value for their money.

Breakdown of PMA Insurance Group’s Offerings: A Comprehensive Summary

| Product | Coverage | Benefits |

|---|---|---|

| Commercial Property Insurance | Buildings, equipment, and inventory | Protection against fire, theft, and other covered perils |

| Commercial Casualty Insurance | Bodily injury, property damage, and product liability | Coverage for legal responsibilities arising from business operations |

| Workers’ Compensation Insurance | Employee injuries and illnesses | Financial protection for employees and businesses in the event of work-related incidents |

| Homeowners Insurance | Home, belongings, and personal liability | Comprehensive coverage for homeowners and renters |

| Auto Insurance | Vehicles and drivers | Liability, collision, and comprehensive coverage options to protect drivers and their vehicles |

| Life Insurance | Death benefits for beneficiaries | Financial security and peace of mind for loved ones |

| Disability Insurance | Income loss due to illness or injury | Protection against loss of income due to unforeseen circumstances |

Conclusion

Readers, we hope this comprehensive guide has provided you with valuable insights into PMA Insurance Group. From its diverse insurance offerings to its unwavering commitment to customers, PMA Insurance Group stands as a trusted provider of insurance solutions. By choosing PMA Insurance Group, you can rest assured that you are partnering with a financially strong and customer-centric insurance company that is dedicated to your protection and well-being.

For further information and to explore PMA Insurance Group’s complete range of products and services, we invite you to visit their website or contact their knowledgeable insurance professionals.

FAQ about PMA Insurance Group

What is PMA Insurance Group?

PMA Insurance Group is a commercial property and casualty insurance company that offers a wide range of products to businesses and individuals.

What types of insurance does PMA Insurance Group offer?

PMA Insurance Group offers a variety of insurance products, including:

- Commercial property insurance

- Commercial liability insurance

- Workers’ compensation insurance

- Personal insurance

Who is eligible for PMA Insurance Group coverage?

PMA Insurance Group offers coverage to businesses and individuals. Businesses of all sizes are eligible, from small businesses to large corporations.

How much does PMA Insurance Group cost?

The cost of PMA Insurance Group coverage varies depending on the type of coverage you need, the size of your business, and your individual risk profile.

How can I get a quote from PMA Insurance Group?

You can get a quote from PMA Insurance Group by contacting an independent agent or broker.

How do I file a claim with PMA Insurance Group?

To file a claim with PMA Insurance Group, you should contact your insurance agent or broker.

What is PMA Insurance Group’s customer service like?

PMA Insurance Group has a dedicated customer service team that is available to help you with any questions you have about your policy or claims.

What are PMA Insurance Group’s financial ratings?

PMA Insurance Group has financial strength ratings of A+ (Superior) from A.M. Best and AA (Very Strong) from Standard & Poor’s.

What is PMA Insurance Group’s claims handling process like?

PMA Insurance Group has a streamlined claims handling process that is designed to help you get your claim resolved quickly and efficiently.

What are some of the benefits of choosing PMA Insurance Group?

There are many benefits to choosing PMA Insurance Group, including:

- Financial strength and stability

- A wide range of insurance products

- Competitive rates

- Excellent customer service

- Streamlined claims handling process