Platform for trading forex, a gateway to the global currency market, provides a digital environment for traders to buy and sell currencies. This platform serves as a bridge between traders and the forex market, offering real-time market data, charting tools, and order execution capabilities. Whether you’re a seasoned trader or just starting, understanding the nuances of forex trading platforms is crucial for navigating this dynamic market.

Forex trading platforms are available in various formats, each catering to different preferences and needs. Desktop platforms offer advanced features and customization options, while web-based platforms provide accessibility from any device with an internet connection. Mobile platforms, designed for on-the-go trading, offer convenience and real-time market updates. These platforms empower traders with tools to analyze market trends, execute trades, and manage their risk effectively.

Understanding Forex Trading Platforms

A forex trading platform is the essential tool that connects you to the global currency market. It provides a user-friendly interface for placing trades, monitoring market movements, and managing your account.

Platform Types

The choice of platform depends on your individual trading style and preferences.

- Desktop platforms offer advanced features and customization options. These platforms are usually downloaded and installed on your computer, providing a more robust and stable trading experience.

- Web-based platforms are accessible from any device with an internet connection, offering convenience and flexibility. These platforms are often lighter and faster, but may have limited functionality compared to desktop platforms.

- Mobile platforms allow you to trade on the go, providing instant access to the market from your smartphone or tablet. These platforms are designed for simplicity and ease of use, often offering essential features for quick trading decisions.

Essential Features

All forex trading platforms offer a core set of functionalities, which are essential for successful trading:

- Order types: Forex trading platforms allow you to execute different types of orders, such as market orders, limit orders, and stop-loss orders, to manage your risk and maximize your potential profits.

- Charting tools: These tools allow you to visualize price movements and identify trends, patterns, and support/resistance levels. They often include technical indicators and drawing tools to enhance your analysis.

- Market analysis: Many platforms offer real-time news feeds, economic calendars, and technical analysis tools to provide you with insights into market conditions and potential trading opportunities.

- Account management: You can manage your trading account, view your balance, deposit and withdraw funds, and track your trading history.

Popular Forex Trading Platforms

Here are some of the most popular forex trading platforms, known for their user-friendliness, features, and reliability:

- MetaTrader 4 (MT4): A widely used platform known for its advanced charting tools, automated trading features, and vast library of indicators. MT4 is available as a desktop, web-based, and mobile platform.

- MetaTrader 5 (MT5): The successor to MT4, MT5 offers even more features, including advanced order types, a wider range of technical indicators, and a more sophisticated charting package. It is also available across desktop, web, and mobile platforms.

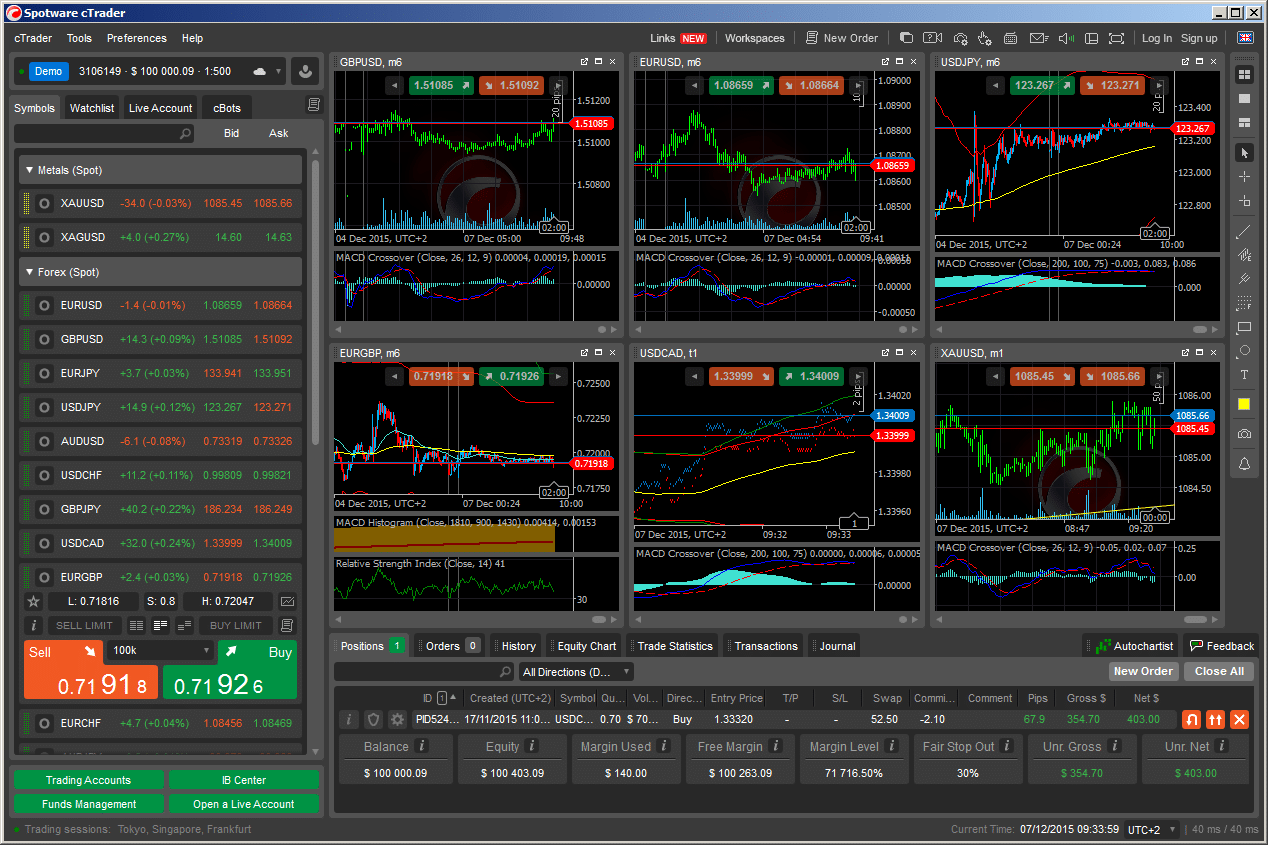

- cTrader: A platform designed for professional traders, cTrader offers advanced charting tools, a wide range of order types, and deep market liquidity. It is primarily a desktop platform, but a web-based version is also available.

- TradingView: A popular charting platform that offers real-time data, technical indicators, and drawing tools. While TradingView is not a full-fledged trading platform, it is a valuable tool for market analysis and can be integrated with various brokers.

Key Features of Forex Trading Platforms

A user-friendly forex trading platform is crucial for successful trading. It should provide a seamless and efficient experience, allowing traders to access the market, execute trades, and manage their positions effectively. Here are some of the essential features that contribute to a platform’s usability and overall performance:

Real-time Market Data and Price Feeds

Real-time market data is essential for informed trading decisions. Forex trading platforms must provide accurate and up-to-the-minute price feeds, enabling traders to monitor market movements and identify potential trading opportunities. These price feeds should be sourced from reputable providers and should be updated with minimal latency.

Charting Tools and Technical Indicators

Charting tools and technical indicators play a vital role in forex trading. They allow traders to analyze market trends, identify patterns, and generate trading signals. A robust platform should offer a wide range of charting tools, including line charts, candlestick charts, and bar charts. Technical indicators, such as moving averages, MACD, and RSI, provide additional insights into market momentum and sentiment.

Order Execution Speed and Slippage

The speed at which orders are executed is crucial for forex traders. Delays in order execution can result in missed trading opportunities or unfavorable price changes. A platform with fast order execution speeds minimizes the risk of slippage, which occurs when the actual execution price differs from the intended price due to market fluctuations. Slippage can be detrimental to trading profits, especially in volatile market conditions.

Choosing the Right Platform

Navigating the world of forex trading platforms can feel overwhelming, with numerous options vying for your attention. Choosing the right platform is crucial for a seamless and successful trading journey. This section will guide you through the process of selecting a platform that aligns with your trading style and goals.

Step-by-Step Guide to Selecting a Platform

To ensure a smooth and successful trading experience, follow these steps when selecting a forex trading platform:

- Define Your Trading Needs: Before diving into platform options, assess your trading goals and preferences. Consider factors like trading style (scalping, day trading, swing trading), desired leverage, and preferred trading instruments (currency pairs, commodities, indices). This clarity will help you narrow down platform choices.

- Research and Compare Platforms: Explore different platforms available in the market. Consider features like user interface, charting tools, order execution speed, educational resources, and customer support. Read reviews and compare platforms based on your specific requirements.

- Evaluate Platform Features: Pay close attention to the platform’s features, such as order types (market, limit, stop-loss), charting tools (technical indicators, drawing tools), real-time data feeds, and analysis tools. Ensure the platform offers features that align with your trading strategy.

- Consider Pricing and Fees: Different platforms have varying pricing models. Some platforms charge a commission per trade, while others may have spread-based pricing or subscription fees. Analyze the cost structure and ensure it aligns with your budget and trading volume.

- Test Drive the Platform: Most platforms offer demo accounts. This allows you to experiment with the platform’s interface, features, and trading tools without risking real money. Use this opportunity to familiarize yourself with the platform and assess its suitability.

- Prioritize Security and Regulation: Choose a platform regulated by reputable financial authorities, such as the Financial Conduct Authority (FCA) or the National Futures Association (NFA). This ensures the platform adheres to industry standards and safeguards your funds. Check for encryption protocols and two-factor authentication for enhanced security.

- Read Reviews and Testimonials: Gather insights from other traders’ experiences by reading reviews and testimonials. Look for feedback on platform reliability, customer support, and overall user satisfaction.

- Contact Customer Support: Before making a final decision, contact the platform’s customer support team. Assess their responsiveness, helpfulness, and ability to address your concerns. This interaction can provide valuable insights into the platform’s customer service quality.

Platform Comparison Table, Platform for trading forex

The following table provides a comparison of key features and pricing models of popular forex trading platforms:

| Platform | Features | Pricing Model | Regulation |

|---|---|---|---|

| MetaTrader 4 (MT4) | Advanced charting tools, wide range of indicators, automated trading capabilities, mobile app | Spread-based, commission-free | Regulated by various financial authorities |

| MetaTrader 5 (MT5) | Enhanced features over MT4, including multiple order types, economic calendar, and hedging capabilities | Spread-based, commission-free | Regulated by various financial authorities |

| cTrader | Intuitive user interface, advanced charting tools, fast order execution, institutional-grade technology | Spread-based, commission-free | Regulated by the Cyprus Securities and Exchange Commission (CySEC) |

| TradingView | Social trading platform, comprehensive charting tools, real-time data feeds, and analysis tools | Subscription-based, free plan available | Not regulated as a trading platform |

Platform Security and Regulatory Compliance

Security and regulatory compliance are paramount when choosing a forex trading platform.

Ensure the platform is regulated by reputable financial authorities and adheres to industry standards.

This provides peace of mind and safeguards your funds from potential risks. Look for platforms that implement robust security measures, such as encryption protocols, two-factor authentication, and firewalls.

Choosing a Platform Based on Trading Experience and Goals

The right forex trading platform should align with your trading experience and goals.

For beginners, platforms with user-friendly interfaces, educational resources, and demo accounts are ideal.

Experienced traders may prefer platforms with advanced features, such as automated trading capabilities and charting tools.

Using a Forex Trading Platform

Navigating the world of Forex trading starts with understanding how to use a trading platform effectively. This section delves into the practical aspects of using a Forex trading platform, encompassing account management, order placement, position management, and utilizing advanced trading tools.

Opening and Managing a Trading Account

Opening a Forex trading account is the first step towards engaging in the market. Most platforms offer a straightforward process, often requiring basic personal information and proof of identity.

The account opening process typically involves these steps:

- Choose a Forex broker and platform that aligns with your trading needs and preferences. Consider factors like fees, features, and customer support.

- Complete the application form, providing accurate personal details, contact information, and financial details. This may include proof of identity and address verification.

- Fund your account with the desired currency. Most platforms offer various deposit methods, including bank transfers, credit/debit cards, and e-wallets.

- Familiarize yourself with the platform’s interface and features. Explore the account dashboard, trading tools, and educational resources.

Once your account is active, you can manage it effectively by:

- Monitoring your account balance, trading history, and open positions.

- Setting up alerts for price movements, stop-loss orders, and other crucial trading parameters.

- Adjusting your account settings, such as margin levels, leverage, and trading limits.

- Accessing customer support for any questions or assistance.

Placing Orders and Managing Positions

Placing orders is the core of Forex trading, allowing you to execute trades based on your analysis and strategies. Most platforms provide various order types to cater to different trading styles and risk tolerance.

Here’s a breakdown of common order types:

- Market Orders: Executed immediately at the current market price, suitable for quick entries and exits. This order type provides the best execution speed but might not guarantee the desired price.

- Limit Orders: Executed at a specific price or better. You set a target price, and the order is only filled if the market reaches your desired price. This allows you to control your entry and exit points but might not be filled if the market does not reach your price.

- Stop Orders: Triggered when the market reaches a specific price. They can be used to limit losses (stop-loss orders) or secure profits (take-profit orders). Stop orders help manage risk and protect your capital.

Managing positions effectively is crucial for maximizing profits and minimizing losses.

Here are key aspects of position management:

- Monitoring your open positions regularly, tracking their performance, and adjusting your strategy accordingly.

- Setting stop-loss orders to limit potential losses on open positions. Stop-loss orders automatically close your position if the price moves against your trade by a predetermined amount.

- Setting take-profit orders to lock in profits when the price reaches your target. Take-profit orders automatically close your position when the price reaches a specific level, securing your gains.

- Adjusting your position size based on your risk tolerance and market conditions. It is important to manage your risk effectively and avoid overexposing your capital.

Using Advanced Trading Tools and Indicators

Many platforms offer advanced trading tools and indicators to enhance your analysis and decision-making. These tools provide valuable insights into market trends, sentiment, and volatility.

Here are some commonly used tools and indicators:

- Technical Indicators: Moving averages, MACD, RSI, Bollinger Bands, and Stochastic Oscillator are popular technical indicators used to identify trends, momentum, and overbought/oversold conditions.

- Charting Tools: Candlestick patterns, trend lines, support and resistance levels, and Fibonacci retracements provide visual representations of price action and market dynamics.

- Economic Calendars: This tool helps traders stay informed about upcoming economic releases that can significantly impact currency movements. By understanding economic data releases, traders can anticipate potential price fluctuations.

- News Feeds: Access to real-time news feeds from reputable sources provides valuable insights into market sentiment and events that could affect currency prices. Staying informed about geopolitical events, economic announcements, and central bank decisions is crucial for successful trading.

Important Note: While advanced tools and indicators can be helpful, it’s crucial to use them wisely and avoid over-reliance. Always remember that market analysis involves multiple factors, and no tool can guarantee success.

Optimizing Platform Settings and User Interface

Customizing your platform settings and user interface can significantly enhance your trading experience.

Here are some tips for optimizing your platform:

- Choose a layout that suits your trading style. Most platforms offer customizable layouts, allowing you to arrange charts, indicators, and other tools according to your preferences.

- Set up alerts for important events and price movements. This can help you stay informed about market activity and react quickly to opportunities or potential risks.

- Customize your chart settings. Choose the timeframes, indicators, and color schemes that best suit your analysis and trading style.

- Explore platform features and tutorials. Familiarize yourself with all the platform’s features, including order types, risk management tools, and educational resources.

Trading with Forex Platforms: Platform For Trading Forex

Forex trading platforms are essential tools for navigating the dynamic world of currency exchange. They provide a centralized hub for accessing market data, executing trades, and managing your portfolio.

Advantages and Disadvantages of Using a Forex Trading Platform

Forex trading platforms offer several advantages, but it’s crucial to understand the potential drawbacks as well.

- Advantages:

- Access to Global Markets: Forex platforms provide access to the world’s largest financial market, open 24 hours a day, five days a week.

- Real-time Market Data: Trading platforms offer real-time updates on currency prices, charts, and market news, enabling informed trading decisions.

- Advanced Trading Tools: Many platforms offer advanced tools like technical indicators, charting tools, and automated trading strategies to enhance trading capabilities.

- Security and Regulation: Reputable platforms are regulated by financial authorities, ensuring the security of your funds and the platform’s integrity.

- Educational Resources: Some platforms provide educational resources, articles, and tutorials to help traders learn about forex trading.

- Disadvantages:

- Platform Fees and Commissions: Forex platforms may charge fees for trading, account maintenance, or data access.

- Potential for Technical Glitches: Platforms can experience technical issues, leading to delays in trade execution or data inaccuracies.

- Security Risks: Despite regulation, security breaches are always a possibility. Choose platforms with robust security measures.

- Overreliance on Technology: Excessive reliance on platform features can lead to poor trading decisions if traders fail to develop their own analysis skills.

Potential Risks Associated with Trading Forex

Forex trading involves inherent risks, and it’s essential to understand these risks before engaging in any trading activity.

- Market Volatility: Currency exchange rates can fluctuate significantly, leading to potential losses.

- Leverage: Forex trading often involves leverage, amplifying both potential profits and losses.

- Counterparty Risk: There’s a risk that your broker or counterparty may not be able to fulfill their obligations.

- Geopolitical Events: Global events like wars, political instability, or economic crises can impact currency values.

- Economic Indicators: Unexpected changes in economic indicators, such as interest rates or inflation, can affect currency prices.

The Role of Platform Technology in Managing Risk

Forex trading platforms offer various tools and features that can help traders manage risk.

- Stop-Loss Orders: These orders automatically close a trade when a currency pair reaches a predetermined price, limiting potential losses.

- Take-Profit Orders: These orders automatically close a trade when a currency pair reaches a predetermined profit target, securing gains.

- Trailing Stop-Loss Orders: These orders adjust the stop-loss price based on market movements, protecting profits while allowing trades to continue moving in a favorable direction.

- Risk Management Tools: Some platforms offer tools for setting position limits, managing margin requirements, and monitoring overall trading risk.

Best Practices for Responsible and Profitable Forex Trading

Responsible forex trading involves a combination of knowledge, discipline, and risk management.

- Thorough Research and Education: Invest time in learning about forex markets, fundamental and technical analysis, and risk management strategies.

- Develop a Trading Plan: Create a clear trading plan that Artikels your goals, risk tolerance, entry and exit strategies, and money management rules.

- Practice with a Demo Account: Use a demo account to practice your trading strategies and get familiar with the platform’s features before risking real money.

- Start Small and Scale Gradually: Begin with a small investment amount and gradually increase your capital as you gain experience and confidence.

- Manage Your Emotions: Avoid trading based on emotions like fear or greed. Stick to your trading plan and make rational decisions.

- Monitor Your Performance: Regularly review your trading results and identify areas for improvement. Track your wins, losses, and overall profitability.

Conclusion

Navigating the forex market can be complex, but with the right platform, you can gain a competitive edge. By understanding the functionalities, features, and risks associated with forex trading platforms, you can make informed decisions, optimize your trading strategy, and potentially achieve profitable outcomes. As you embark on your forex trading journey, remember that choosing the right platform is a crucial step towards success.

User Queries

What are the main types of forex trading platforms?

Forex trading platforms come in three main types: desktop platforms, web-based platforms, and mobile platforms. Desktop platforms offer comprehensive features and customization, web-based platforms provide accessibility from any device, and mobile platforms allow for on-the-go trading.

What are some popular forex trading platforms?

Some popular forex trading platforms include MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, and TradingView. These platforms offer a range of features, including charting tools, technical indicators, and order execution capabilities.

How do I choose the right forex trading platform?

Choosing the right platform depends on your trading experience, goals, and preferences. Consider factors like platform features, pricing models, security, regulatory compliance, and ease of use.