- Introduction: Get a Permanent Assurance

- Understanding Permanent Life Insurance

- Factors Influencing Your Quote

- Premium and Cash Value Breakdown

- Conclusion: Secure Your Future

-

FAQ about Permanent Life Insurance Quote

- What is a permanent life insurance quote?

- How do I get a permanent life insurance quote?

- What information do I need to provide to get a quote?

- How much does permanent life insurance cost?

- What is the difference between permanent life insurance and term life insurance?

- What are the benefits of permanent life insurance?

- What are the drawbacks of permanent life insurance?

- Is permanent life insurance right for me?

- How do I choose the right permanent life insurance policy?

- Where can I find more information about permanent life insurance?

Introduction: Get a Permanent Assurance

Hello readers! When it comes to safeguarding your loved ones and your lifetime, acquiring a permanent life insurance quote is a decision of utmost significance. Unlike term life insurance policies, which provide coverage for a specified duration, permanent life insurance policies remain in force for your entire lifetime, offering lifelong security. Today, we’ll embark on a journey to explore the intricacies of permanent life insurance quotes, empowering you with knowledge to make an informed choice.

Understanding Permanent Life Insurance

Key Features: A Lifetime of Security

Permanent life insurance policies offer unparalleled protection, providing lifetime coverage regardless of your age. They consist of two vital components: a death benefit, which is paid to your beneficiaries upon your passing, and a cash value component. The cash value component grows over time, allowing you to borrow against it or withdraw funds for various purposes.

Types: Tailored to Your Needs

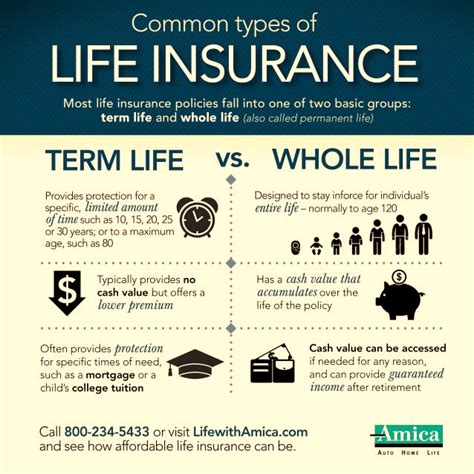

Permanent life insurance policies come in two primary types: whole life insurance and universal life insurance.

Whole Life Insurance: With whole life insurance, your premiums remain constant throughout your lifetime, and your cash value component grows at a fixed rate.

Universal Life Insurance: Universal life insurance provides more flexibility, offering adjustable premiums and death benefits. Its cash value component is linked to market performance, potentially providing higher returns.

Factors Influencing Your Quote

Age and Health: Vital Considerations

Your age and health play crucial roles in determining your permanent life insurance quote. Younger and healthier individuals typically secure lower premiums, as they pose less risk to insurers.

Coverage Amount: Balancing Needs and Premiums

The amount of coverage you require impacts your premium. Higher coverage amounts lead to higher premiums. It’s essential to carefully consider your family’s financial needs and long-term goals while determining the appropriate coverage amount.

Payment Schedule: Shaping Your Payments

You can choose how often you pay your premiums, with monthly and annual options available. More frequent payments may result in lower premiums over the long run.

Premium and Cash Value Breakdown

| Feature | Whole Life Insurance | Universal Life Insurance |

|---|---|---|

| Premiums | Fixed | Adjustable |

| Death Benefit | Guaranteed | Adjustable |

| Cash Value Growth | Fixed | Market-Linked |

| Loan and Withdrawal Options | Available | Available |

Conclusion: Secure Your Future

Getting a permanent life insurance quote is a crucial step towards ensuring your loved ones’ financial security and your peace of mind. By understanding the key factors that influence your quote and the different policy options available, you can make an informed decision that meets your specific needs.

Check out our other articles for more in-depth information on life insurance policies and financial planning. Together, let’s navigate the world of insurance and secure your financial future.

FAQ about Permanent Life Insurance Quote

What is a permanent life insurance quote?

- A permanent life insurance quote is an estimate of the cost of permanent life insurance coverage. It takes into account factors such as your age, health, and the amount of coverage you want.

How do I get a permanent life insurance quote?

- You can get a permanent life insurance quote by contacting an insurance agent or by using an online quote tool.

What information do I need to provide to get a quote?

- To get a permanent life insurance quote, you will need to provide information such as your name, age, gender, occupation, health history, and smoking status.

How much does permanent life insurance cost?

- The cost of permanent life insurance varies depending on the factors listed above. However, as a general rule, permanent life insurance is more expensive than term life insurance.

What is the difference between permanent life insurance and term life insurance?

- Permanent life insurance provides coverage for your entire life, while term life insurance provides coverage for a specific period of time. Permanent life insurance also has a cash value component that grows over time.

What are the benefits of permanent life insurance?

- Permanent life insurance provides several benefits, including:

- Death benefit: Your beneficiaries will receive a death benefit if you die while the policy is in force.

- Cash value: The cash value component of permanent life insurance grows over time and can be used for various purposes, such as retirement planning or paying for educational expenses.

- Tax advantages: The cash value component of permanent life insurance grows tax-deferred and is not subject to income tax when withdrawn.

What are the drawbacks of permanent life insurance?

- The main drawback of permanent life insurance is that it is more expensive than term life insurance.

Is permanent life insurance right for me?

- Permanent life insurance may be right for you if you want lifelong coverage and the potential for cash value growth.

How do I choose the right permanent life insurance policy?

- To choose the right permanent life insurance policy, you should consider factors such as your age, health, financial needs, and investment goals.

Where can I find more information about permanent life insurance?

- You can find more information about permanent life insurance by contacting an insurance agent or by visiting the website of the National Association of Insurance Commissioners (NAIC).