- Introduction to Online Bachelor’s Degrees in Accounting

- Program Structure and Curriculum

- Admission Requirements and Eligibility

- Learning Methods and Technologies

- Career Prospects and Job Market

- Accreditation and Program Quality

- Cost and Financial Aid

- Tips for Success in Online Accounting Programs

- Ending Remarks: Online Bachelor’s Degree In Accounting

- FAQ Section

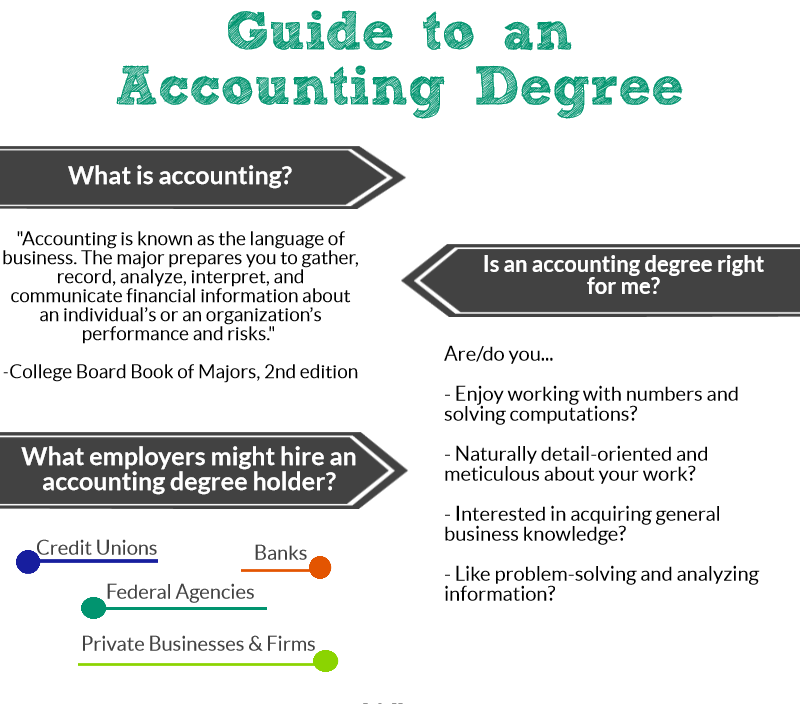

An online bachelor’s degree in accounting sets the stage for a fulfilling career, offering flexibility and access to a high-demand field. This program caters to individuals seeking a dynamic and rewarding profession, empowering them with the skills and knowledge needed to navigate the complexities of the modern business world.

The demand for skilled accountants is consistently high, and an online accounting degree provides a pathway to a variety of career opportunities. This program equips students with the necessary financial expertise, analytical skills, and technological proficiency to excel in diverse industries.

Introduction to Online Bachelor’s Degrees in Accounting

The demand for skilled accountants is steadily increasing, driven by the growing complexity of businesses and the expanding use of technology in financial management. Earning an online bachelor’s degree in accounting can equip you with the necessary skills and knowledge to succeed in this dynamic field.

Online accounting programs offer a flexible and convenient way to pursue a degree while balancing other commitments.

Benefits of an Online Accounting Degree

Online accounting programs offer numerous benefits, including:

- Flexibility and Convenience: Online programs allow you to study at your own pace and on your own schedule, making it easier to balance work, family, and other commitments.

- Accessibility: Online programs are accessible to students from all over the world, regardless of location or geographic limitations.

- Cost-Effectiveness: Online programs often have lower tuition fees compared to traditional on-campus programs.

- Technology Integration: Online programs utilize cutting-edge technologies, providing students with practical experience using industry-standard software and tools.

- Networking Opportunities: Online programs offer opportunities to connect with fellow students and professionals through online forums, discussion boards, and virtual events.

Key Skills and Knowledge Gained from an Online Accounting Program

Online accounting programs provide students with a comprehensive understanding of accounting principles and practices. Here are some key skills and knowledge gained:

- Financial Accounting: This area covers the recording, classifying, and summarizing financial transactions. Students learn about generally accepted accounting principles (GAAP), financial statement preparation, and analysis.

- Managerial Accounting: This area focuses on providing financial information to managers to aid in decision-making. Students learn about cost accounting, budgeting, performance evaluation, and financial forecasting.

- Taxation: This area covers federal, state, and local tax laws, regulations, and compliance requirements. Students learn about income tax, sales tax, property tax, and other relevant tax topics.

- Auditing: This area focuses on examining financial records to ensure accuracy and compliance with accounting standards. Students learn about audit procedures, risk assessment, and internal controls.

- Technology Skills: Online accounting programs emphasize technology skills, including proficiency in accounting software, spreadsheets, and data analysis tools.

Program Structure and Curriculum

An online accounting bachelor’s degree program typically follows a structured curriculum that equips students with the knowledge and skills necessary to excel in the field. The program structure usually consists of a series of core courses that provide a comprehensive foundation in accounting principles and practices, followed by elective courses that allow students to specialize in areas of interest.

Core Courses

Core courses form the foundation of an online accounting bachelor’s degree program, providing students with a comprehensive understanding of accounting principles, practices, and applications. These courses typically cover a wide range of topics, including:

- Financial Accounting: This course delves into the principles and procedures used to record, classify, and summarize financial transactions. Students learn how to prepare financial statements such as the balance sheet, income statement, and statement of cash flows.

- Managerial Accounting: This course focuses on providing internal management with relevant financial information for decision-making. Students learn about cost accounting, budgeting, performance analysis, and other tools used to enhance operational efficiency.

- Taxation: This course covers the principles of federal, state, and local taxation, including income tax, sales tax, and property tax. Students gain an understanding of tax laws, regulations, and compliance requirements.

- Auditing: This course explores the process of examining financial records and statements to ensure their accuracy and compliance with accounting standards. Students learn about auditing techniques, procedures, and reporting requirements.

- Accounting Information Systems: This course examines the role of technology in accounting, including the use of software, databases, and other tools to manage financial data. Students learn about systems design, implementation, and security.

Elective Courses

Elective courses offer students the opportunity to specialize in areas of accounting that align with their career goals and interests. These courses provide advanced knowledge and skills in specific areas of accounting, such as:

- Forensic Accounting: This course explores the use of accounting principles and techniques to investigate financial crimes, such as fraud and embezzlement. Students learn about investigative techniques, evidence gathering, and reporting procedures.

- International Accounting: This course examines the accounting standards, practices, and regulations used in different countries. Students learn about the challenges and opportunities associated with international business transactions.

- Government and Not-for-Profit Accounting: This course focuses on the unique accounting principles and practices used by government agencies and non-profit organizations. Students learn about budgeting, reporting, and compliance requirements.

- Financial Planning: This course explores the principles and practices of financial planning, including investment management, retirement planning, and estate planning. Students learn about financial planning tools and strategies.

Admission Requirements and Eligibility

Gaining admission to an online accounting program typically involves meeting specific requirements, demonstrating your readiness for the academic rigor of the program. These requirements ensure that you have the necessary foundation to succeed in the program and the accounting profession.

While specific requirements may vary across institutions, there are common elements that are typically considered.

Prerequisites for Online Accounting Programs

Prerequisites are essential for successful completion of an online accounting program. They ensure that you have the necessary knowledge and skills to handle the challenging coursework. Here are some common prerequisites:

- High School Diploma or GED: This is the foundation for any post-secondary education, demonstrating that you have the basic knowledge and skills required for college-level work.

- Minimum GPA: Many programs have a minimum GPA requirement, usually between 2.5 and 3.0, demonstrating your academic performance and ability to handle rigorous coursework.

- College-Level Math Courses: A solid foundation in math is crucial for accounting. Programs typically require completion of college-level math courses, such as College Algebra, Calculus, or Statistics.

- Business or Accounting Courses: Some programs may require you to have completed introductory business or accounting courses at the college level. This could include courses like Principles of Accounting, Business Law, or Introduction to Finance.

Applying to Online Accounting Programs

The application process for online accounting programs is generally similar to traditional programs. It involves several steps:

- Complete the Application Form: This usually involves providing personal information, academic history, and career goals.

- Submit Transcripts: You will need to provide official transcripts from all colleges or universities you have attended, showcasing your academic record.

- Take the Standardized Test (if required): Some programs may require you to take standardized tests, such as the GMAT or GRE, to assess your aptitude and readiness for the program.

- Submit Letters of Recommendation: You may need to provide letters of recommendation from professors, employers, or mentors who can attest to your skills and potential.

- Write an Essay or Personal Statement: This is an opportunity to showcase your interest in accounting, your career goals, and why you believe you are a good fit for the program.

Learning Methods and Technologies

Online accounting programs utilize a variety of learning methods and technologies to provide a comprehensive and engaging educational experience. These methods are designed to cater to the diverse learning styles of students and to ensure that they acquire the necessary skills and knowledge to succeed in the field of accounting.

Online Learning Platforms

Online learning platforms serve as the central hub for students to access course materials, interact with instructors and peers, and complete assignments. These platforms are typically user-friendly and accessible from any device with an internet connection.

- Learning Management Systems (LMS): Platforms like Canvas, Blackboard, and Moodle provide a structured environment for delivering course content, facilitating communication, and tracking student progress. They often include features such as online forums, chat rooms, and video conferencing tools.

- Specialized Accounting Software: Programs such as QuickBooks Online, Xero, and Sage Intacct are integrated into online accounting programs to provide students with hands-on experience using industry-standard software. This allows them to develop practical skills in areas like financial reporting, budgeting, and tax preparation.

Interactive Learning Methods

Online accounting programs employ various interactive learning methods to enhance student engagement and promote deeper understanding of concepts.

- Asynchronous Learning: This involves accessing pre-recorded lectures, videos, and other materials at the student’s own pace and time. It allows for flexibility and accommodates different schedules.

- Synchronous Learning: This involves real-time interaction with instructors and classmates through live video conferencing sessions, webinars, and online chat rooms. It provides a more immersive learning experience and facilitates immediate feedback and discussions.

- Case Studies and Simulations: These real-world scenarios allow students to apply their accounting knowledge to practical situations and develop critical thinking and problem-solving skills.

- Group Projects and Collaborative Learning: Students work together on projects and assignments, fostering teamwork and communication skills essential in the accounting profession.

Interaction between Students and Instructors

Online accounting programs prioritize student-instructor interaction to provide personalized support and guidance.

- Discussion Forums: These online platforms allow students to engage in discussions with instructors and peers, ask questions, and share insights on course topics.

- Email and Instant Messaging: Students can communicate directly with instructors through email or instant messaging for individual support and clarification.

- Virtual Office Hours: Scheduled online sessions allow students to meet with instructors one-on-one for personalized guidance and feedback.

Career Prospects and Job Market

An online accounting degree opens doors to a wide range of career paths, offering rewarding and stable employment opportunities. The demand for accounting professionals remains strong across various industries, making it a highly sought-after field.

Job Demand and Industry Outlook

The accounting profession is known for its stability and growth potential. The Bureau of Labor Statistics (BLS) projects a 7% increase in employment for accountants and auditors from 2020 to 2030, which is faster than the average for all occupations. This growth is driven by factors such as the increasing complexity of business operations, the need for financial transparency, and the growing importance of data analysis in decision-making.

Entry-Level Accounting Positions

An online accounting degree equips graduates with the foundational knowledge and skills needed to excel in various entry-level positions. Some common entry-level accounting roles include:

- Accountant I/II: Responsible for recording financial transactions, preparing financial statements, and assisting with budgeting and forecasting.

- Staff Accountant: Handles day-to-day accounting tasks, such as accounts payable, accounts receivable, and payroll.

- Bookkeeper: Maintains financial records, prepares invoices, and reconciles bank statements.

- Financial Analyst: Analyzes financial data, prepares reports, and provides insights to management.

Career Progression Opportunities, Online bachelor’s degree in accounting

With experience and continued education, accounting professionals can advance to more senior roles with greater responsibilities and higher salaries. Some potential career progression paths include:

- Senior Accountant: Supervises staff accountants, manages complex accounting projects, and provides financial guidance to management.

- Cost Accountant: Analyzes costs, identifies areas for improvement, and provides insights on pricing strategies.

- Tax Accountant: Prepares tax returns, advises on tax planning, and ensures compliance with tax regulations.

- Internal Auditor: Evaluates internal controls, identifies risks, and recommends improvements to financial processes.

- Financial Controller: Oversees all accounting functions, prepares financial reports, and provides financial guidance to senior management.

- Chief Financial Officer (CFO): The top financial executive in an organization, responsible for all financial operations and reporting.

Accreditation and Program Quality

Earning an online bachelor’s degree in accounting from an accredited institution is essential. Accreditation ensures the program meets rigorous academic standards, enhances career prospects, and increases the value of your degree.

Accreditation signifies that an independent body has evaluated the program’s curriculum, faculty, resources, and overall quality. It assures potential employers and other institutions that the program is credible and meets industry standards.

Reputable Accreditation Bodies

Accreditation bodies play a crucial role in upholding the quality of accounting programs. Here are some of the most respected accreditation organizations:

- Accreditation Council for Business Schools and Programs (ACBSP): ACBSP accredits business programs, including accounting, at both the undergraduate and graduate levels. It focuses on student learning outcomes, faculty qualifications, and program effectiveness.

- Association to Advance Collegiate Schools of Business (AACSB): AACSB is the premier accrediting body for business schools worldwide. It sets high standards for academic excellence, research, and engagement. AACSB accreditation is highly regarded in the accounting profession.

- International Accreditation Council for Business Education (IACBE): IACBE accredits business programs across various disciplines, including accounting. It emphasizes student-centered learning, ethical practices, and global perspectives.

Evaluating Program Quality

Beyond accreditation, consider these factors when evaluating online accounting programs:

- Faculty Expertise: Ensure the program faculty are experienced professionals with relevant industry knowledge and strong academic credentials.

- Curriculum Relevance: The curriculum should be current, comprehensive, and align with industry demands and evolving accounting standards.

- Technology and Support: The program should utilize effective online learning technologies, provide adequate technical support, and offer flexible learning options.

- Career Services: Look for programs that offer career guidance, job placement assistance, and networking opportunities.

- Student Success Rates: Explore the program’s graduation rates, job placement statistics, and student satisfaction levels.

Cost and Financial Aid

Pursuing an online bachelor’s degree in accounting can be a significant financial investment. However, understanding the typical costs and exploring available financial aid options can help you navigate the path to your degree effectively.

The cost of an online accounting bachelor’s degree varies depending on factors such as the institution, program length, and specific course requirements.

Tuition and Fees

Tuition and fees represent the primary cost of attending an online program. They are typically charged per credit hour, and the total cost depends on the number of credits required for graduation.

- Public Universities: Public universities generally offer lower tuition rates for in-state residents compared to out-of-state students. Online programs may have slightly higher tuition than on-campus programs.

- Private Universities: Private universities typically have higher tuition rates than public universities, but they often offer scholarships and grants to help offset the cost.

Financial Aid Options

Financial aid options are available to help students cover the cost of their education.

- Federal Grants: Federal grants are need-based financial aid that does not need to be repaid. Examples include the Pell Grant and the Federal Supplemental Educational Opportunity Grant (FSEOG).

- Federal Loans: Federal loans provide financial assistance that must be repaid with interest. Types of federal loans include subsidized and unsubsidized Stafford Loans, PLUS Loans, and Perkins Loans.

- Scholarships: Scholarships are merit-based or need-based financial aid that does not need to be repaid. They are often awarded based on academic achievement, extracurricular activities, or financial need. Many institutions and organizations offer scholarships specifically for accounting students.

- State Grants: Some states offer grants to students pursuing higher education within the state. These grants may have specific eligibility requirements, such as residency and academic performance.

- Institutional Aid: Many institutions offer their own scholarships and grants to students, which may be based on academic merit, financial need, or specific program requirements.

Applying for Scholarships and Grants

The process for applying for scholarships and grants varies depending on the specific program and funding source.

- Federal Grants: To apply for federal grants, students must complete the Free Application for Federal Student Aid (FAFSA) online.

- Scholarships: Many scholarships are available through online databases and search engines. It is important to research and apply for scholarships that align with your academic interests, achievements, and financial need.

- Institutional Aid: To apply for institutional aid, students should contact the financial aid office of the institution they are attending.

Tips for Success in Online Accounting Programs

Pursuing an online accounting degree requires discipline, effective time management, and a strategic approach to learning. Here are some tips to help you succeed in your online accounting program:

Time Management and Organization

Time management is crucial in an online program. Without the structure of a traditional classroom, it’s easy to fall behind. Here are some strategies for managing your time effectively:

- Create a Schedule: Dedicate specific times each day or week to study and complete assignments. This will help you stay on track and avoid last-minute rushes.

- Utilize a Planner: A physical or digital planner can help you keep track of deadlines, assignments, and important dates. Make sure to note down all due dates and exam schedules.

- Break Down Large Tasks: Large projects can seem daunting. Divide them into smaller, manageable chunks, and set realistic goals for each chunk.

- Minimize Distractions: Find a quiet, dedicated workspace where you can focus without interruptions. Turn off social media notifications and avoid distractions like television or phone calls.

- Prioritize Your Workload: Some assignments might be more important than others. Prioritize tasks based on their deadlines and weight in the overall grade.

Effective Study Habits for Online Learning

Online learning requires different study habits than traditional classrooms. Here are some effective strategies for online study:

- Active Engagement: Don’t just passively read course materials. Take notes, highlight key concepts, and ask questions when you’re unsure about something. Active engagement helps you retain information better.

- Practice Regularly: Accounting is a hands-on subject. Practice solving problems, working through examples, and applying concepts to real-world scenarios. Regular practice helps solidify your understanding.

- Utilize Online Resources: Many online programs offer additional resources like video lectures, tutorials, and practice quizzes. Take advantage of these resources to supplement your learning.

- Form Study Groups: Connect with fellow students in your program. Form study groups to discuss challenging concepts, share notes, and motivate each other. Online forums and discussion boards can also be valuable for connecting with classmates.

- Seek Help When Needed: Don’t hesitate to reach out to your instructors or teaching assistants if you need help with the material. Online programs often have dedicated support resources available. Remember, asking for help is a sign of strength, not weakness.

Building Relationships with Instructors and Peers

Building relationships with instructors and peers is important in any learning environment, but it can be particularly challenging in online programs. Here are some tips for fostering these connections:

- Participate Actively in Discussion Forums: Engage in online discussions, share your thoughts, and respond to your classmates’ posts. This helps build a sense of community and allows you to learn from different perspectives.

- Attend Virtual Office Hours: Most instructors hold virtual office hours. Take advantage of these opportunities to ask questions, get clarification, and build a rapport with your instructor.

- Reach Out to Your Peers: Use online platforms to connect with classmates outside of the classroom. Exchange notes, share resources, and offer support to each other. Networking with your peers can be beneficial for your career development.

- Consider Online Study Groups: Joining online study groups can provide a sense of camaraderie and allow you to connect with other students in your program. Many online learning platforms offer features for creating and joining study groups.

Ending Remarks: Online Bachelor’s Degree In Accounting

Pursuing an online bachelor’s degree in accounting is an investment in your future, opening doors to a rewarding and challenging career. This program empowers you with the knowledge and skills to navigate the dynamic world of finance and accounting, leading to a successful and fulfilling professional journey.

FAQ Section

Is an online accounting degree as valuable as a traditional degree?

Yes, online accounting degrees are often accredited and recognized by employers just like traditional degrees. Look for programs from reputable institutions with strong industry connections.

What are the job prospects after completing an online accounting degree?

Graduates with an online accounting degree can pursue roles such as Staff Accountant, Financial Analyst, Budget Analyst, Tax Preparer, and more. The demand for accountants is consistently high across various industries.

What are the typical costs associated with an online accounting program?

Tuition costs vary depending on the institution and program. Explore financial aid options like scholarships, grants, and student loans to help offset expenses.

How much time commitment is required for an online accounting degree?

Online programs typically require a significant time commitment, with coursework, assignments, and exams. Plan your schedule carefully and maintain a consistent study routine.