Oanda vs forex com – Oanda vs Forex.com, two of the most popular online trading platforms, offer a wide range of features and services to both novice and experienced traders. Choosing the right platform can be a daunting task, as each platform has its own strengths and weaknesses. This comprehensive comparison aims to provide you with all the information you need to make an informed decision.

From trading platforms and instruments to spreads, fees, and customer support, we’ll delve into the key aspects of each platform to help you understand which one aligns better with your trading style and goals.

Oanda vs Forex.com: A Comprehensive Comparison

Choosing the right online brokerage platform for forex trading can be a daunting task, especially with the abundance of options available. Two popular contenders in the market are Oanda and Forex.com. This comparison delves into the key features, strengths, and weaknesses of each platform, helping you make an informed decision.

Key Features and Differences

Oanda and Forex.com share some common features, but also exhibit distinct differences that cater to diverse trader preferences. This section Artikels these features and differences, providing a clear picture of what each platform offers.

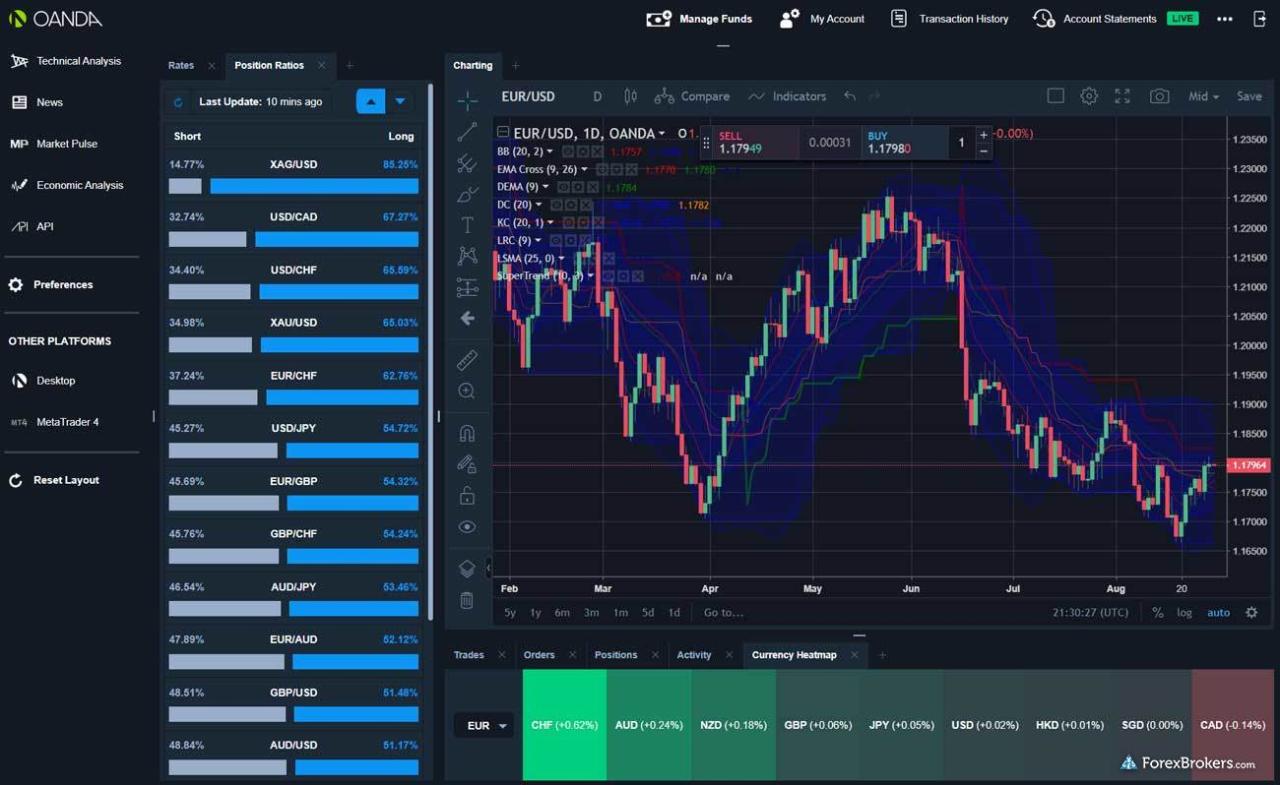

- Trading Platforms: Oanda offers its proprietary platform, Oanda Trade, and integrates with MetaTrader 4 (MT4). Forex.com, on the other hand, provides its own platform, Trading Station, and also supports MT4. Both platforms offer advanced charting tools, technical indicators, and order types.

- Spreads and Commissions: Both platforms offer variable spreads, which fluctuate based on market volatility. Oanda typically has tighter spreads, while Forex.com might have lower commissions on certain account types.

- Account Types: Oanda offers various account types, including a standard account with zero commission and a Pro account with lower spreads but a commission per trade. Forex.com also provides multiple account types, including a standard account with commissions and a commission-free account with wider spreads.

- Leverage: Both platforms offer high leverage, allowing traders to control larger positions with a smaller investment. However, leverage can amplify both profits and losses, so it’s crucial to understand the risks involved.

- Regulation and Security: Both Oanda and Forex.com are regulated by reputable financial authorities, ensuring the safety of your funds. They also employ advanced security measures to protect your account information.

Oanda: Strengths and Weaknesses

Oanda stands out with its competitive spreads, advanced platform features, and commitment to transparency. However, it also has some limitations that traders should consider.

- Strengths:

- Tight Spreads: Oanda consistently offers some of the tightest spreads in the industry, especially for major currency pairs.

- Advanced Platform Features: Oanda Trade and MT4 integration provide comprehensive charting tools, technical indicators, and order types to meet the needs of experienced traders.

- Transparency: Oanda is known for its transparent pricing structure and clear disclosure of fees and commissions.

- Weaknesses:

- Limited Educational Resources: Oanda’s educational resources are relatively limited compared to other platforms.

- Customer Support: While Oanda offers 24/5 customer support, some users have reported occasional delays in response times.

Forex.com: Strengths and Weaknesses

Forex.com is known for its user-friendly platform, extensive educational resources, and strong customer support. However, its spreads might be wider than Oanda’s, and some traders might find its platform less sophisticated.

- Strengths:

- User-Friendly Platform: Trading Station is intuitive and easy to navigate, making it suitable for both beginners and experienced traders.

- Extensive Educational Resources: Forex.com provides a wealth of educational materials, including articles, videos, and webinars, to help traders enhance their knowledge and skills.

- Excellent Customer Support: Forex.com offers responsive and helpful customer support via phone, email, and live chat.

- Weaknesses:

- Wider Spreads: Forex.com’s spreads can be wider than Oanda’s, especially for less-traded currency pairs.

- Less Sophisticated Platform: While Trading Station is user-friendly, it might lack some of the advanced features found in Oanda Trade and MT4.

Conclusion, Oanda vs forex com

The choice between Oanda and Forex.com ultimately depends on your individual trading needs and preferences. Oanda excels in spreads and platform features, while Forex.com shines in its user-friendliness, educational resources, and customer support. Carefully consider your priorities and research each platform thoroughly before making a decision.

End of Discussion

Ultimately, the best trading platform for you depends on your individual needs and preferences. If you value a user-friendly platform with a wide range of tradable assets and competitive fees, Oanda might be a good choice. If you prioritize access to advanced trading tools and resources, Forex.com could be a better fit. By carefully considering the factors discussed in this comparison, you can make an informed decision and choose the platform that will empower your trading journey.

FAQ Explained: Oanda Vs Forex Com

What is the minimum deposit required for Oanda and Forex.com?

The minimum deposit requirement varies depending on the account type. Both platforms offer micro accounts with low minimum deposits, making them accessible to traders with limited capital.

Do Oanda and Forex.com offer demo accounts?

Yes, both platforms offer free demo accounts that allow you to practice trading without risking real money. This is a valuable tool for beginners to familiarize themselves with the platform and test different trading strategies.

Are Oanda and Forex.com regulated?

Both platforms are regulated by reputable financial authorities, ensuring the safety and security of your funds. Oanda is regulated by the Financial Conduct Authority (FCA) in the UK and the Australian Securities and Investments Commission (ASIC) in Australia. Forex.com is regulated by the Commodity Futures Trading Commission (CFTC) in the US and the Financial Conduct Authority (FCA) in the UK.