Nvda where to buy crypto – NVIDIA, a powerhouse in graphics processing, has a surprising connection to the world of cryptocurrency. NVIDIA GPUs are the backbone of cryptocurrency mining, a process that involves solving complex mathematical problems to verify transactions and earn digital coins. This guide explores the world of NVIDIA and cryptocurrency, covering everything from where to buy crypto to the best platforms for trading and securing your digital assets.

With the rise of cryptocurrency, NVIDIA has become a key player in this rapidly evolving industry. The demand for powerful GPUs for mining has driven up prices and created a whole new market for NVIDIA products. Understanding this relationship is crucial for anyone looking to enter the world of cryptocurrency, whether you’re a seasoned investor or just starting out.

Understanding NVIDIA and Cryptocurrency: Nvda Where To Buy Crypto

NVIDIA, a leading technology company known for its graphics processing units (GPUs), has become intricately intertwined with the world of cryptocurrency. This connection stems from the computational power of NVIDIA GPUs, which are highly sought after by cryptocurrency miners.

The Role of NVIDIA GPUs in Cryptocurrency Mining

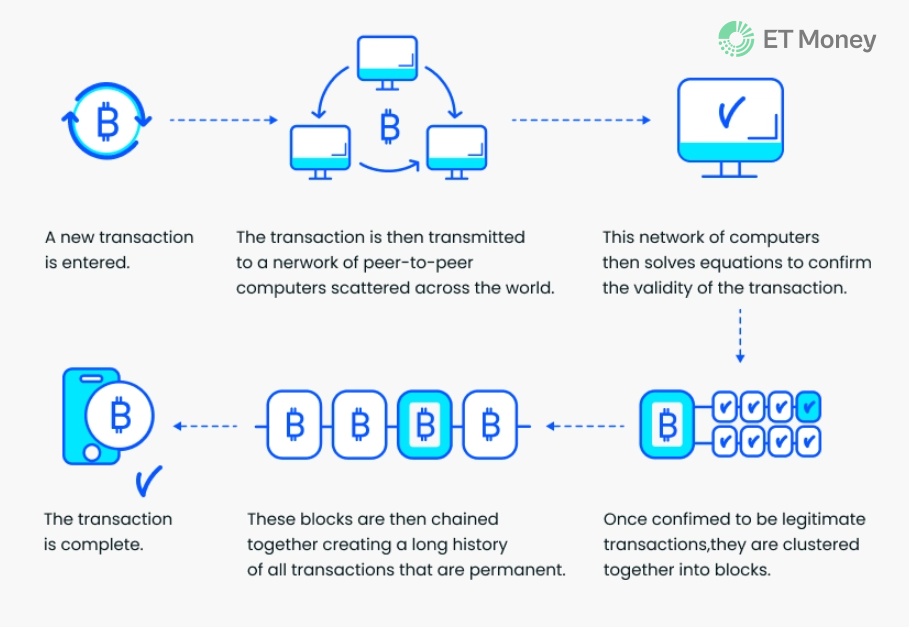

NVIDIA GPUs are designed to handle complex calculations, making them ideal for cryptocurrency mining. Mining involves solving complex mathematical problems to verify transactions on a blockchain. The more powerful the GPU, the faster it can solve these problems, leading to higher mining rewards.

The computational power of NVIDIA GPUs is crucial for cryptocurrency mining.

NVIDIA GPUs have become essential tools for cryptocurrency miners, enabling them to participate in the mining process and earn rewards. The demand for these GPUs has surged due to the growing popularity of cryptocurrency, particularly Bitcoin and Ethereum.

Impact of NVIDIA’s Products on the Cryptocurrency Market

NVIDIA’s GPUs have significantly impacted the cryptocurrency market in various ways.

- Increased Mining Efficiency: NVIDIA GPUs have boosted mining efficiency, allowing miners to process transactions faster and earn higher rewards. This has led to a more competitive mining landscape, with miners constantly seeking the latest and most powerful GPUs.

- Growth of Mining Pools: The availability of high-performance GPUs has facilitated the emergence of mining pools, where miners combine their resources to increase their chances of solving blocks and earning rewards. This has led to a more centralized mining ecosystem.

- Fluctuations in GPU Prices: The demand for NVIDIA GPUs from cryptocurrency miners has significantly impacted their prices. During periods of high cryptocurrency prices and mining activity, GPU prices have soared. Conversely, when cryptocurrency prices decline, GPU prices tend to fall as well.

Exploring Cryptocurrency Exchanges

Once you’ve grasped the fundamentals of cryptocurrency and NVIDIA’s role in the space, the next step is to choose a platform to buy and sell crypto. This is where cryptocurrency exchanges come into play. They act as marketplaces where individuals can trade digital currencies.

Reputable Cryptocurrency Exchanges for NVIDIA Users

A variety of exchanges cater to different needs and preferences. Here are some reputable platforms where NVIDIA users can buy crypto:

- Coinbase: Known for its user-friendly interface and robust security features, Coinbase is a great option for beginners. It offers a wide range of cryptocurrencies, including Bitcoin, Ethereum, and Litecoin.

- Binance: One of the world’s largest cryptocurrency exchanges, Binance offers a vast selection of cryptocurrencies and trading pairs, along with advanced trading tools for experienced traders.

- Kraken: Kraken is renowned for its high level of security and advanced trading features, making it a popular choice for professional traders.

- Crypto.com: Crypto.com offers a user-friendly platform, competitive fees, and a wide range of cryptocurrencies, including its native token, CRO.

Comparing Exchange Features

When selecting a cryptocurrency exchange, consider factors like supported cryptocurrencies, deposit methods, trading fees, and security measures.

| Exchange | Supported Cryptocurrencies | Deposit Methods | Trading Fees | Security Features |

|---|---|---|---|---|

| Coinbase | Bitcoin, Ethereum, Litecoin, and many more | Bank transfers, debit cards, credit cards | Variable, depending on trading volume and payment method | Two-factor authentication (2FA), cold storage, insurance |

| Binance | Over 600 cryptocurrencies | Bank transfers, debit cards, credit cards, cryptocurrency deposits | Low trading fees, maker/taker fee structure | 2FA, cold storage, security audits |

| Kraken | Bitcoin, Ethereum, Litecoin, and others | Bank transfers, wire transfers, cryptocurrency deposits | Variable, depending on trading volume and currency pair | 2FA, cold storage, security audits |

| Crypto.com | Bitcoin, Ethereum, Litecoin, CRO, and more | Bank transfers, debit cards, credit cards, cryptocurrency deposits | Low trading fees, tiered fee structure based on CRO holdings | 2FA, cold storage, security audits |

Key Considerations When Choosing an Exchange

When choosing an exchange, it’s essential to consider the following:

- Security: Look for exchanges that prioritize security with measures like 2FA, cold storage, and regular security audits.

- Fees: Compare trading fees, deposit fees, and withdrawal fees to minimize costs.

- Supported Cryptocurrencies: Ensure the exchange supports the cryptocurrencies you’re interested in trading.

- User Experience: Choose an exchange with a user-friendly interface and intuitive features.

- Customer Support: Look for an exchange with responsive and helpful customer support.

Selecting the Right Cryptocurrency

With so many cryptocurrencies available, choosing the right one for your NVIDIA-related needs can be challenging. This section will explore some popular cryptocurrencies that align with NVIDIA’s focus on gaming, artificial intelligence, and high-performance computing, along with their potential benefits and risks.

Cryptocurrencies for NVIDIA Users, Nvda where to buy crypto

This section examines some of the most prominent cryptocurrencies relevant to NVIDIA users.

- Ethereum (ETH): Ethereum is a leading blockchain platform known for its smart contracts and decentralized applications (dApps). It powers a wide range of applications, including gaming, NFTs, and decentralized finance (DeFi). Ethereum’s scalability and flexibility make it a popular choice for developers building innovative projects.

- Bitcoin (BTC): Bitcoin, the first and most established cryptocurrency, has a robust infrastructure and a large, active community. Its value has historically been relatively stable, making it a potential store of value for NVIDIA users who want to diversify their investments.

- Polygon (MATIC): Polygon is a layer-2 scaling solution for Ethereum that addresses its scalability limitations. It offers faster transaction speeds and lower fees, making it an attractive option for gamers and other users who require efficient transactions.

- Solana (SOL): Solana is a high-performance blockchain known for its speed and scalability. Its ecosystem supports a variety of applications, including NFTs, gaming, and DeFi, making it a potential alternative to Ethereum.

- Flow (FLOW): Flow is a blockchain specifically designed for the gaming and digital asset industries. It aims to provide a seamless and scalable platform for creating and trading NFTs, making it a potential choice for NVIDIA users interested in the metaverse.

Comparing Cryptocurrency Features

The following table provides a comparison of the key features of these cryptocurrencies:

| Cryptocurrency | Market Capitalization (USD) | Volatility | Potential Use Cases for NVIDIA Users |

|---|---|---|---|

| Ethereum (ETH) | $150 billion | High | Gaming, NFTs, DeFi, dApps, Metaverse |

| Bitcoin (BTC) | $450 billion | Moderate | Store of value, Investment, Decentralized finance |

| Polygon (MATIC) | $8 billion | High | Gaming, NFTs, DeFi, Scalable Ethereum transactions |

| Solana (SOL) | $10 billion | High | Gaming, NFTs, DeFi, High-performance blockchain |

| Flow (FLOW) | $2 billion | High | Gaming, NFTs, Digital assets, Metaverse |

Understanding Cryptocurrency Risks

Investing in cryptocurrencies involves significant risks. It is crucial to understand these risks before investing:

- Volatility: Cryptocurrencies are highly volatile, meaning their prices can fluctuate rapidly and unpredictably. This volatility can lead to significant losses for investors.

- Security: Cryptocurrencies are susceptible to hacking and theft. It is essential to use secure wallets and follow best practices to protect your assets.

- Regulation: The regulatory landscape for cryptocurrencies is still evolving, which can create uncertainty and risks for investors.

- Scams: The cryptocurrency market is prone to scams. It is crucial to be cautious and do your research before investing in any cryptocurrency.

Benefits of Cryptocurrency

Cryptocurrencies offer potential benefits for NVIDIA users:

- Decentralization: Cryptocurrencies operate on decentralized networks, which can provide greater transparency and security than traditional financial systems.

- Innovation: Cryptocurrencies are driving innovation in various industries, including gaming, finance, and supply chain management.

- Accessibility: Cryptocurrencies can provide access to financial services for individuals and businesses in underserved communities.

Understanding Cryptocurrency Wallets

A cryptocurrency wallet is a software program that allows you to store, manage, and send your digital assets. It doesn’t actually hold your crypto; instead, it stores the private keys that give you access to your coins on the blockchain. Think of it like a digital bank account for your crypto.

Types of Cryptocurrency Wallets

There are several types of cryptocurrency wallets, each with its own set of advantages and disadvantages.

- Hardware Wallets: These are physical devices that store your private keys offline. They are considered the most secure type of wallet because they are not connected to the internet, making them less vulnerable to hacking. Examples include Ledger Nano S and Trezor Model T.

- Software Wallets: These wallets are software programs that you install on your computer or mobile device. They are more convenient than hardware wallets but also more susceptible to hacking if your device is compromised. Examples include Exodus and Electrum.

- Exchange Wallets: These wallets are provided by cryptocurrency exchanges, allowing you to store your coins on the exchange platform. They are convenient for trading, but you give up control of your private keys, meaning the exchange has access to your funds. Examples include Binance and Coinbase.

Pros and Cons of Different Wallet Options

Each type of wallet has its own advantages and disadvantages.

| Wallet Type | Pros | Cons |

|---|---|---|

| Hardware Wallets | Highly secure as they store private keys offline. | Can be inconvenient to use, require physical access, and may be expensive. |

| Software Wallets | Convenient to use and often offer more features than hardware wallets. | More vulnerable to hacking if your device is compromised. |

| Exchange Wallets | Easy to use for trading, and you don’t need to manage your private keys. | You give up control of your private keys, making your funds vulnerable to exchange security breaches. |

Securing Your Cryptocurrency Wallet

Protecting your cryptocurrency wallet is crucial to prevent theft or loss of your funds. Here are some key security measures:

- Use a Strong Password: Choose a long and complex password that is difficult to guess. Avoid using common words or personal information.

- Enable Two-Factor Authentication (2FA): This adds an extra layer of security by requiring a code from your phone or email in addition to your password.

- Keep Your Software Up to Date: Regularly update your wallet software to patch security vulnerabilities.

- Be Aware of Phishing Scams: Be cautious of emails or websites that ask for your private keys or login information. Never share this information with anyone.

- Store Your Backup Seed Phrase Securely: Your seed phrase is a list of words that allows you to recover your wallet if you lose your device. Keep it in a safe and secure location, and never share it with anyone.

“The security of your cryptocurrency wallet is your responsibility. Always take precautions to protect your funds from theft or loss.”

Navigating the Cryptocurrency Market

The cryptocurrency market is dynamic and volatile, influenced by a complex interplay of factors. Understanding these factors is crucial for making informed decisions about buying, selling, and managing your cryptocurrency investments.

Factors Influencing Cryptocurrency Prices

Cryptocurrency prices are driven by a variety of factors, including:

- Market Sentiment: Investor sentiment and overall market trends play a significant role in price fluctuations. Positive news and developments can lead to price increases, while negative news or events can cause declines.

- Adoption and Use Cases: As more businesses and individuals adopt cryptocurrencies for payments, transactions, and other applications, demand increases, potentially driving up prices.

- Government Regulations: Government policies and regulations can impact the cryptocurrency market. Favorable regulations can boost investor confidence and encourage adoption, while restrictive measures can create uncertainty and volatility.

- Technological Advancements: Innovations and advancements in blockchain technology can influence the value of cryptocurrencies. New features, improved security, and enhanced scalability can lead to increased demand and higher prices.

- Economic Conditions: Macroeconomic factors, such as inflation, interest rates, and global economic events, can also impact cryptocurrency prices. During periods of economic uncertainty, investors may seek safe haven assets, potentially driving up demand for cryptocurrencies.

Strategies for Buying and Selling Cryptocurrencies

There are various strategies for buying and selling cryptocurrencies, each with its own risks and rewards. Some common strategies include:

- Dollar-Cost Averaging (DCA): This strategy involves investing a fixed amount of money in a cryptocurrency at regular intervals, regardless of price fluctuations. DCA helps to mitigate risk by averaging out the purchase price over time.

- Trading: Short-term trading involves buying and selling cryptocurrencies frequently to capitalize on price movements. This strategy requires a high level of market knowledge and risk tolerance.

- Hodling: Hodling is a long-term investment strategy where investors buy and hold cryptocurrencies for an extended period, regardless of short-term price fluctuations. This strategy is based on the belief that the value of the cryptocurrency will increase over time.

Managing Risk and Diversifying Your Cryptocurrency Portfolio

Managing risk and diversifying your cryptocurrency portfolio are crucial for protecting your investments. Some strategies include:

- Risk Assessment: Carefully evaluate the risks associated with each cryptocurrency before investing. Consider factors such as volatility, market capitalization, and the underlying technology.

- Diversification: Invest in a range of cryptocurrencies across different sectors and market capitalizations. This helps to reduce the impact of any single cryptocurrency’s price fluctuations on your overall portfolio.

- Stop-Loss Orders: Set stop-loss orders to automatically sell a cryptocurrency if its price falls below a certain level. This helps to limit potential losses.

- Cold Storage: Store your cryptocurrencies offline in a cold wallet to protect them from hacking and theft.

Last Point

Navigating the world of cryptocurrency can be both exciting and daunting. By understanding the role of NVIDIA, exploring reputable exchanges, and selecting the right cryptocurrency, you can confidently take your first steps into this digital landscape. Remember, research is key, and securing your digital assets is paramount. With the right tools and knowledge, you can unlock the potential of cryptocurrency and its future.

Quick FAQs

What are the best cryptocurrency exchanges for NVIDIA users?

Some popular and reputable exchanges include Coinbase, Binance, Kraken, and Gemini. Each offers different features, fees, and security measures, so it’s important to compare and choose the platform that best suits your needs.

How do I choose the right cryptocurrency to invest in?

Consider factors like market capitalization, volatility, potential use cases, and your own investment goals. Research and understand the fundamentals of different cryptocurrencies before making any investment decisions.

Is it safe to buy cryptocurrency?

Cryptocurrency investing involves inherent risks, including price volatility and security concerns. It’s essential to research and understand these risks before investing any funds you can’t afford to lose.