- Introduction

- What is a No Car Insurance Penalty?

- Mitigation Strategies for No Car Insurance Penalties

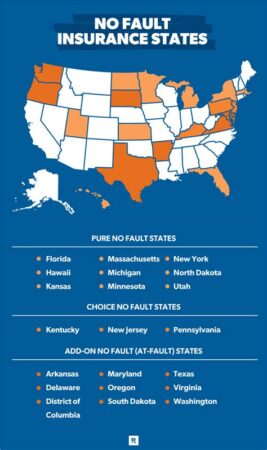

- Understanding the Differences Between States

- Conclusion

-

FAQ about No Car Insurance Penalty

- What is a no car insurance penalty?

- Why do I have to pay a no car insurance penalty?

- How much is the no car insurance penalty?

- How long does the no car insurance penalty last?

- What happens if I don’t pay the no car insurance penalty?

- How can I avoid paying a no car insurance penalty?

- What if I can’t afford car insurance?

- What if I have a suspended driver’s license?

- What if I get into an accident without car insurance?

Introduction

Hey readers,

Navigating the complexities of car insurance can be a daunting task. When you’re caught driving without insurance, it may seem like the end of the world. Fear not, my friends! In this comprehensive guide, we’ll delve into the intricacies of the "no car insurance penalty," explaining what it entails, its potential consequences, and the steps you can take to avoid or mitigate them. Get ready to shield yourself from the financial and legal repercussions of driving without insurance.

What is a No Car Insurance Penalty?

Simply put, a no car insurance penalty is a consequence imposed on individuals caught driving a vehicle without valid car insurance coverage. This penalty varies significantly from state to state, ranging from hefty fines and license suspensions to vehicle impoundment and even jail time.

Why is Car Insurance Mandatory?

Car insurance plays a crucial role in protecting drivers, passengers, and other individuals on the road. It provides financial coverage for accidents, injuries, and property damage, ensuring that those affected are not left with overwhelming expenses. Mandatory car insurance laws aim to encourage responsible driving, deter uninsured motorists, and ultimately enhance safety on our roadways.

Consequences of Driving Without Insurance

Financial Penalties:

- Fines ranging from hundreds to thousands of dollars

- Increased insurance premiums upon reinstatement of coverage

- Restitution for damages caused in an accident

Legal Penalties:

- License suspension or revocation

- Vehicle impoundment

- Jail time in extreme cases

Exceptions to the No Car Insurance Penalty

Certain circumstances may exempt drivers from the no car insurance penalty. These exceptions vary by state but typically include:

- Driving a borrowed vehicle with the owner’s permission

- Operating a vehicle in a state that does not require car insurance

- Reporting a stolen vehicle within a specified time frame

Mitigation Strategies for No Car Insurance Penalties

Acquiring Car Insurance

The most straightforward way to avoid the no car insurance penalty is to obtain car insurance coverage. Shop around for affordable options that meet your needs and budget.

Payment Plans and Installments

Many insurance companies offer payment plans or installment options to make insurance more manageable. Contact your insurer to discuss flexible payment solutions.

Low-Income Assistance Programs

If you qualify as low-income, you may be eligible for government-sponsored assistance programs that provide affordable car insurance options.

Driver Education and Traffic School

Participating in driver education or traffic school programs can demonstrate your commitment to responsible driving and may result in reduced penalties or insurance premiums.

Understanding the Differences Between States

Table Breakdown of No Car Insurance Penalties by State

| State | Penalty |

|---|---|

| Alabama | Fines up to $1,000, license suspension |

| California | Fines up to $2,000, vehicle impoundment |

| Florida | Fines up to $500, license suspension |

| Texas | Fines up to $1,000, license suspension |

| New York | Fines up to $1,500, license suspension |

Conclusion

Driving without car insurance is a serious offense that can lead to severe financial and legal repercussions. To safeguard yourself from these penalties, make obtaining car insurance a top priority. Explore payment plans, investigate assistance programs, and take advantage of driver education opportunities to mitigate potential consequences. Remember, being a responsible driver includes not only following traffic laws but also ensuring you have adequate insurance coverage.

Check out some of our other articles for more insights on car insurance and related topics:

- How to Choose the Right Car Insurance Policy

- Navigating the Complexities of SR-22 Insurance

- Understanding the Basics of No-Fault Insurance

FAQ about No Car Insurance Penalty

What is a no car insurance penalty?

A no car insurance penalty is a fee or surcharge imposed by the government on drivers who are caught driving without car insurance.

Why do I have to pay a no car insurance penalty?

Driving without car insurance is illegal in most states. The penalty is meant to discourage drivers from driving uninsured and to help cover the costs of accidents caused by uninsured drivers.

How much is the no car insurance penalty?

The amount of the penalty varies from state to state. In some states, the penalty is a flat fee, while in others it is a percentage of the driver’s annual income.

How long does the no car insurance penalty last?

The length of time the penalty lasts also varies from state to state. In some states, the penalty lasts for a few months, while in others it can last for several years.

What happens if I don’t pay the no car insurance penalty?

If you don’t pay the no car insurance penalty, you may face further penalties, such as a driver’s license suspension or even jail time.

How can I avoid paying a no car insurance penalty?

The best way to avoid paying a no car insurance penalty is to make sure you have car insurance at all times. You can get car insurance from an insurance company or through a government program.

What if I can’t afford car insurance?

If you can’t afford car insurance, you may be eligible for a low-cost insurance program through your state. You can also try to find a job that offers employee benefits, such as health insurance and car insurance.

What if I have a suspended driver’s license?

If you have a suspended driver’s license, you will need to get it reinstated before you can get car insurance. You can do this by paying all of your outstanding fines and fees and by completing any required driving courses.

What if I get into an accident without car insurance?

If you get into an accident without car insurance, you will be responsible for paying for all of the damages. You may also be sued by the other driver or passengers in the other car.