- Introduction

- New York Car Insurance Requirements

- Choosing the Right Car Insurance Company

- Popular New York Car Insurance Companies

- Understanding Your Car Insurance Policy

- Cost of Car Insurance in New York

- Table: New York Car Insurance Companies by Coverage and Rates

- Conclusion

-

FAQ about New York Car Insurance Companies

- Q: Which car insurance companies operate in New York?

- Q: How do I choose the right car insurance company for me?

- Q: What coverage is required by law in New York?

- Q: How much does car insurance cost in New York?

- Q: How can I get discounts on my car insurance?

- Q: What should I do if I’m in a car accident?

- Q: How do I file a claim with my car insurance company?

- Q: Can I cancel my car insurance?

- Q: What happens if I don’t have car insurance?

- Q: How can I get help choosing or filing a claim with a New York car insurance company?

Introduction

Hey readers! Are you looking for car insurance in the concrete jungle that is New York City? Navigating the maze of insurance companies and policies can be a daunting task, but fear not! We’ve put together this comprehensive guide to New York car insurance companies to help you find the perfect coverage for your needs.

New York Car Insurance Requirements

Before we dive into the insurance companies, let’s go over the legal requirements for car insurance in New York. All drivers in the state must carry:

- Liability coverage: This covers damage to other people or their property if you cause an accident. The minimum coverage required is $25,000 for bodily injury per person, $50,000 for bodily injury per accident, and $10,000 for property damage.

- Uninsured/underinsured motorist coverage: This protects you if you’re hit by a driver who doesn’t have insurance or doesn’t have enough insurance to cover your damages. The minimum coverage required is $25,000 for bodily injury per person and $50,000 for bodily injury per accident.

Choosing the Right Car Insurance Company

Now that you know the basics, it’s time to choose an insurance company. Here are some factors to consider:

Financial Stability

You want to make sure your insurance company is financially stable and will be there when you need them. Check the company’s ratings from independent rating agencies like AM Best and Moody’s.

Coverage Options

Make sure the company offers the coverage options you need, such as liability, uninsured motorist, and collision coverage. Also, consider any additional features or discounts you may be eligible for.

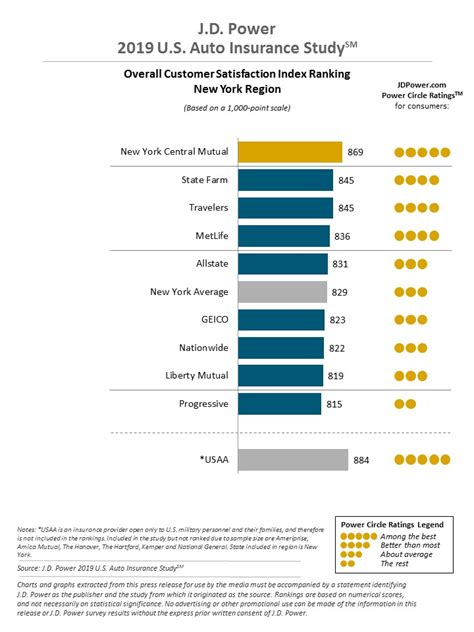

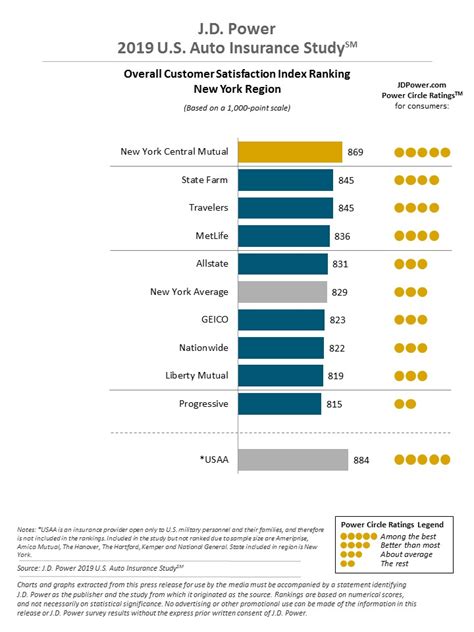

Customer Service

Good customer service is essential when you have a claim or need assistance. Look for companies with a reputation for excellent customer support.

Popular New York Car Insurance Companies

There are many reputable car insurance companies in New York. Here are a few of the most popular:

State Farm

State Farm is the largest auto insurer in the country, known for its low rates and extensive coverage options.

Geico

Geico is another major insurer that offers a wide range of discounts and coverage options. They’re also known for their humorous commercials.

Progressive

Progressive is known for its innovative insurance products, such as Snapshot, which uses a device in your car to monitor your driving habits and potentially lower your rates.

Liberty Mutual

Liberty Mutual is a well-respected insurer that offers a variety of coverage options and discounts. They also have a strong reputation for customer service.

Allstate

Allstate is another popular insurer in New York. They offer a wide range of coverage options and discounts, as well as 24/7 customer support.

Understanding Your Car Insurance Policy

Once you’ve chosen an insurance company, it’s important to understand your policy. Here are some key terms to know:

- Premium: This is the amount you pay for your insurance policy.

- Deductible: This is the amount you have to pay out of pocket before your insurance coverage kicks in.

- Limits of liability: These are the maximum amounts your insurance company will pay for damages.

- Exclusions: These are situations or events that are not covered by your policy.

Cost of Car Insurance in New York

The cost of car insurance in New York varies depending on a number of factors, including:

- Your age and driving history

- The type of car you drive

- The amount of coverage you need

On average, drivers in New York can expect to pay between $1,000 and $2,000 per year for car insurance. However, it’s important to shop around and compare quotes from multiple companies to find the best deal.

Table: New York Car Insurance Companies by Coverage and Rates

| Company | Liability Coverage | Uninsured/Underinsured Motorist Coverage | Collision Coverage | Comprehensive Coverage | Rates |

|---|---|---|---|---|---|

| State Farm | $25,000/$50,000/$10,000 | $25,000/$50,000 | $500 deductible | $100 deductible | $1,200 per year |

| Geico | $25,000/$50,000/$10,000 | $25,000/$50,000 | $500 deductible | $100 deductible | $1,000 per year |

| Progressive | $25,000/$50,000/$10,000 | $25,000/$50,000 | $250 deductible | $100 deductible | $1,100 per year |

| Liberty Mutual | $25,000/$50,000/$10,000 | $25,000/$50,000 | $500 deductible | $100 deductible | $1,200 per year |

| Allstate | $25,000/$50,000/$10,000 | $25,000/$50,000 | $500 deductible | $100 deductible | $1,100 per year |

Conclusion

Finding the right car insurance company in New York is essential to protect yourself and your loved ones. By following the tips in this guide, you can make an informed decision and find the perfect coverage for your needs.

And hey, while you’re here, be sure to check out our other articles on car insurance and personal finance. We’ve got everything you need to know to stay protected on the road and in life.

FAQ about New York Car Insurance Companies

Q: Which car insurance companies operate in New York?

A: New York has over 100 car insurance companies, including national carriers like State Farm, Geico, and Progressive, as well as local insurers such as New York Central Mutual and Allstate.

Q: How do I choose the right car insurance company for me?

A: Consider factors like coverage options, price, customer service, and financial stability when researching companies. Get quotes from multiple insurers to compare their offerings.

Q: What coverage is required by law in New York?

A: New York requires liability insurance (bodily injury and property damage) with minimum limits of 25/50/10. Personal Injury Protection (PIP) and uninsured/underinsured motorist coverage are also mandatory.

Q: How much does car insurance cost in New York?

A: Premiums vary depending on factors such as age, driving history, location, and vehicle type. The average annual cost of car insurance in New York is around $1,500.

Q: How can I get discounts on my car insurance?

A: Most insurers offer discounts for:

- Good driving record

- Multiple cars insured

- Safety features on your vehicle

- Completing defensive driving courses

Q: What should I do if I’m in a car accident?

A: Stay calm and ensure your safety. Call the police, exchange information with the other driver, and take photos of the accident scene. Report the accident to your insurance company promptly.

Q: How do I file a claim with my car insurance company?

A: Contact your insurance company and provide details about the accident, including the date, time, and location. They will guide you through the claims process and assign an adjuster.

Q: Can I cancel my car insurance?

A: Yes, but you must notify your insurer in writing. You may need to pay a cancellation fee. Remember, it’s illegal to drive without insurance in New York.

Q: What happens if I don’t have car insurance?

A: Driving without insurance in New York can result in fines, license suspension, and financial penalties. You may also be held liable for damages if you’re involved in an accident.

Q: How can I get help choosing or filing a claim with a New York car insurance company?

A: You can contact the New York State Department of Financial Services (DFS) for assistance. They can provide guidance and connect you with resources: https://www.dfs.ny.gov/