- The Ultimate Guide to North Carolina Liability Insurance

- Types of North Carolina Liability Insurance

- Understanding Liability Coverage Limits

- Exclusions and Endorsements

- Table: Common Liability Insurance Scenarios and Coverage

- Finding the Right North Carolina Liability Insurance

- Conclusion

-

FAQ about NC Liability Insurance

- What is NC liability insurance?

- How much liability insurance do I need?

- What does liability insurance cover?

- What doesn’t liability insurance cover?

- Do I need liability insurance if I don’t own a car?

- What are the penalties for driving without liability insurance in NC?

- How can I get liability insurance?

- How much does liability insurance cost?

- What should I do if I’m involved in an accident and don’t have liability insurance?

- Do I need to carry proof of insurance in NC?

The Ultimate Guide to North Carolina Liability Insurance

Introduction

Hey there, readers! This comprehensive guide will equip you with everything you need to know about North Carolina liability insurance. Let’s dive into the nitty-gritty to ensure you find the coverage that meets your unique needs and protects you against unexpected liabilities.

North Carolina liability insurance safeguards individuals and businesses from financial repercussions resulting from bodily injury, property damage, or other losses caused due to negligence. By securing this insurance, you mitigate the risk of personal assets, such as your home or savings, being depleted to cover such liabilities.

Types of North Carolina Liability Insurance

Personal Liability Insurance

- Homeowners Insurance: Protects homeowners from liabilities linked to accidents or injuries on their property.

- Renters Insurance: Provides liability coverage for tenants, protecting their belongings and covering potential liabilities arising from incidents within the rented premises.

- Personal Umbrella Insurance: Extends liability coverage beyond the limits of primary policies, offering an additional layer of financial protection.

Business Liability Insurance

- General Liability Insurance: Covers common liabilities encountered by businesses, including bodily injury, property damage, and other related costs.

- Professional Liability Insurance: Protects professionals from claims of negligence or errors in service provision.

- Product Liability Insurance: Protects businesses from liabilities associated with injuries or damages caused by their products.

Understanding Liability Coverage Limits

Liability insurance policies typically have two coverage limits:

- Occurrence Coverage Limit: The maximum amount the insurance company will pay for each occurrence or claim.

- Aggregate Coverage Limit: The maximum amount the insurance company will pay over the policy period, regardless of the number of claims.

It’s crucial to assess your potential risks and determine the appropriate coverage limits that align with your needs.

Exclusions and Endorsements

Exclusions

Liability insurance policies generally exclude coverage for certain events, such as:

- Intentional acts or willful misconduct

- Criminal activities

- Pollution or environmental damage

- Workers’ compensation claims

Endorsements

Endorsements can be added to liability policies to expand coverage and address specific risks, such as:

- Additional insured coverage

- Increased limits for specific types of liability

- Coverage for specific types of property or activities

Table: Common Liability Insurance Scenarios and Coverage

| Scenario | Coverage |

|---|---|

| Guest slips and falls in your home | Homeowners Insurance |

| Customer injures themselves at your business | General Liability Insurance |

| Doctor makes a medical error during surgery | Professional Liability Insurance |

| Defective product causes injury to a consumer | Product Liability Insurance |

| Renter accidentally damages the landlord’s property | Renters Insurance |

| Employee sustains an injury on the job | Workers’ Compensation Insurance (not liability insurance) |

Finding the Right North Carolina Liability Insurance

To secure the best liability insurance coverage for your needs, consider the following steps:

- Evaluate your potential risks and determine your coverage requirements.

- Compare quotes from multiple insurance providers.

- Read policy details thoroughly to understand coverage limits, exclusions, and endorsements.

- Consult with an insurance agent for guidance.

Conclusion

North Carolina liability insurance is essential for safeguarding your financial well-being. Whether you’re an individual, a homeowner, a renter, or a business owner, the right liability coverage can provide peace of mind and protect you from unexpected liabilities.

Explore our other articles to learn more about different types of insurance, risk management strategies, and how to find the best coverage for your unique needs. Stay informed and protected in the ever-changing world of insurance.

FAQ about NC Liability Insurance

What is NC liability insurance?

Answer: Liability insurance protects you against financial responsibility for injuries or property damage you cause to others in an accident. It’s required in North Carolina by law for all drivers.

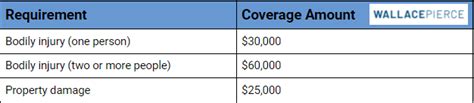

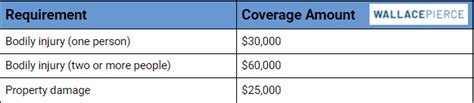

How much liability insurance do I need?

Answer: North Carolina requires a minimum of $30,000/$60,000 liability insurance, but higher limits are recommended.

What does liability insurance cover?

Answer: Liability insurance covers medical expenses, lost wages, and pain and suffering if you cause an accident that injures someone else. It also covers damage to other people’s property, such as vehicles or buildings.

What doesn’t liability insurance cover?

Answer: Liability insurance does not cover damage to your own vehicle or property, injuries to you or your passengers, or expenses related to criminal charges.

Do I need liability insurance if I don’t own a car?

Answer: Yes, liability insurance is required for all drivers in North Carolina, even if you don’t own a car. You can purchase non-owner liability insurance to cover you when you drive other people’s vehicles.

What are the penalties for driving without liability insurance in NC?

Answer: Driving without liability insurance in North Carolina is a misdemeanor and can result in fines, license suspension, and even jail time.

How can I get liability insurance?

Answer: You can purchase liability insurance through insurance companies, brokers, or online insurance marketplaces.

How much does liability insurance cost?

Answer: The cost of liability insurance varies depending on your age, driving history, and location. However, it is typically affordable and can save you from significant financial liability.

What should I do if I’m involved in an accident and don’t have liability insurance?

Answer: If you’re involved in an accident and don’t have liability insurance, you will be personally responsible for any damages. It is important to contact a lawyer and explore your options for compensation.

Do I need to carry proof of insurance in NC?

Answer: Yes, you must carry proof of insurance in your vehicle at all times in North Carolina. You can display an insurance card, electronic proof, or the MyNCDMV mobile app.