- Introduction

- Understanding the Structure of Multi Level Insurance Companies

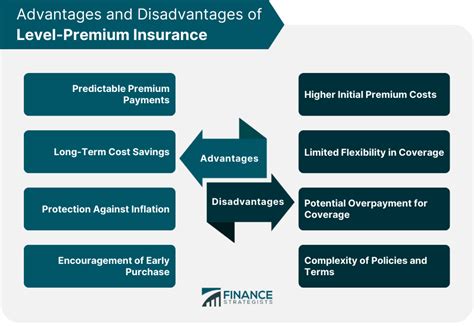

- Advantages and Disadvantages of Multi Level Insurance Companies

- Factors to Consider When Choosing a Multi Level Insurance Company

- Table: Comparison of Multi Level Insurance Companies

- Conclusion

-

FAQ about Multi-Level Insurance Companies

- What is a multi-level insurance company?

- How do MLICs work?

- What are the benefits of partnering with an MLIC?

- What are the drawbacks of MLICs?

- Are MLICs a scam?

- What should I look for when choosing an MLIC to partner with?

- How can I avoid scams related to MLICs?

- What are some common tricks used by fraudulent MLICs?

- How can I protect myself from losses related to MLIC scams?

- Where can I find more information about MLICs?

Introduction

Hey readers!

In the realm of insurance, navigating the complexities of different providers and policies can be a daunting task. Multi level insurance companies, with their unique structure and business practices, offer an intriguing alternative to traditional insurance models. This comprehensive guide will delve into the intricate world of multi level insurance companies, exploring their advantages, drawbacks, and the factors to consider when choosing one.

Understanding the Structure of Multi Level Insurance Companies

The Hierarchy

Multi level insurance companies are structured through a network of independent distributors or agents who sell insurance products to customers. These distributors earn commissions not only on their own sales but also on the sales made by their recruited team members. This hierarchical structure creates a tiered system of distributors, with each level earning a portion of the profits generated by their subordinates.

The Role of Distributors

Distributors in multi level insurance companies play a crucial role in the sales and marketing process. They are responsible for building relationships with customers, identifying their insurance needs, and providing tailored solutions. Their success depends on both their sales abilities and their ability to recruit and train new distributors, expanding the company’s reach and generating additional revenue streams.

Advantages and Disadvantages of Multi Level Insurance Companies

Advantages

- Lower overhead costs: Multi level insurance companies often have lower overhead costs compared to traditional insurers due to the reliance on independent distributors rather than employees. This can result in lower premiums for customers.

- Personalized service: Distributors in multi level insurance companies can provide highly personalized service to their clients, as they have a vested interest in building long-term relationships.

- Potential for higher earnings: Distributors in multi level insurance companies have the opportunity to earn significant income through commissions and bonuses, based on their sales performance and the efforts of their team.

Disadvantages

- Potential for conflicts of interest: As distributors earn commissions on their sales, there may be a potential conflict of interest when recommending products to customers.

- Regulatory compliance: Multi level insurance companies are subject to strict regulations and scrutiny due to their unique structure and compensation models. This can lead to additional compliance costs and operational challenges.

- Limited product offerings: Multi level insurance companies often offer a limited range of insurance products compared to traditional insurers.

Factors to Consider When Choosing a Multi Level Insurance Company

When evaluating multi level insurance companies, consider these key factors:

Financial Stability

Ensure the financial stability of the company by reviewing its financial statements and ratings from independent agencies.

Product Offerings

Confirm that the company offers the types of insurance coverage you need and that the policy features meet your requirements.

Compensation Model

Understand the compensation structure and the potential for earnings, as well as any potential conflicts of interest or hidden fees.

Distributor Reputation

Research the reputation of the distributors you will be working with, including their experience, customer feedback, and any regulatory actions.

Legal and Regulatory Compliance

Verify the company’s compliance with applicable laws and regulations, including licensing and consumer protection measures.

Table: Comparison of Multi Level Insurance Companies

| Company | Years in Business | Product Offerings | Compensation Model |

|---|---|---|---|

| XYZ Insurance | 20 | Life, health, auto | Commissions and bonuses |

| ABC Insurance | 15 | Auto, home, business | Multi-tier commission structure |

| DEF Insurance | 10 | Health, dental, vision | Percentage-based overrides |

Conclusion

Multi level insurance companies present both advantages and disadvantages that should be carefully considered before making a decision. By evaluating factors such as financial stability, product offerings, and distributor reputation, you can choose a multi level insurance company that aligns with your insurance needs and goals.

For further insights into the world of insurance, be sure to check out our articles on different types of insurance policies, insurance scams to avoid, and the latest trends in the industry.

FAQ about Multi-Level Insurance Companies

What is a multi-level insurance company?

Multi-level insurance companies (MLICs) sell insurance through independent agents who recruit new agents and earn commissions on the premiums generated by their downline.

How do MLICs work?

MLICs compensate their agents through a combination of commissions on policies sold and bonuses for recruiting new agents. Agents build their downlines by recruiting new agents who, in turn, recruit additional agents, and so on.

What are the benefits of partnering with an MLIC?

MLICs offer agents the potential for higher earnings through residual income and bonuses from downline sales. They also provide training, support, and marketing materials to help agents succeed.

What are the drawbacks of MLICs?

Critics argue that MLICs prioritize recruitment and sales over customer service. Agents may be incentivized to sell policies that are not in the best interests of their clients to earn commissions and bonuses.

Are MLICs a scam?

Not necessarily. While some MLICs have been involved in fraudulent practices, many are legitimate businesses operating within legal guidelines. It is essential to research and choose a reputable MLIC before signing up.

What should I look for when choosing an MLIC to partner with?

Consider the company’s reputation, financial stability, training and support programs, and the level of compensation offered. Due diligence and independent research are crucial.

How can I avoid scams related to MLICs?

Be wary of MLICs that promise unrealistic earnings potential or guarantee success. Seek references from other agents, check online reviews, and verify the company’s licensing and credentials.

What are some common tricks used by fraudulent MLICs?

Fraudulent MLICs may use misleading advertising, make false promises, or pressure potential agents to invest large sums of money. Always approach such opportunities with caution.

How can I protect myself from losses related to MLIC scams?

Do thorough research, consult with trusted financial advisors, and avoid investing more money than you can afford to lose. If you believe you have been scammed, contact the authorities and seek legal advice.

Where can I find more information about MLICs?

You can find additional information about MLICs from insurance regulators, consumer protection agencies, and reputable insurance industry organizations.