- Motorcycle Insurance Average Cost: A Comprehensive Guide

-

FAQ about Motorcycle Insurance Average Cost

- 1. What is the average cost of motorcycle insurance?

- 2. What factors affect the cost of motorcycle insurance?

- 3. How can I get a cheaper motorcycle insurance rate?

- 4. What is the minimum amount of motorcycle insurance I need?

- 5. What are the different types of motorcycle insurance coverage?

- 6. How much does it cost to add a passenger to my motorcycle insurance policy?

- 7. What happens if I am in an accident and I am not at fault?

- 8. What should I do if I am involved in a motorcycle accident?

- 9. How long does it take to get a motorcycle insurance policy?

- 10. Can I cancel my motorcycle insurance policy at any time?

Motorcycle Insurance Average Cost: A Comprehensive Guide

Introduction

Hey readers,

Are you considering hitting the open road on two wheels? If so, you’ll need to factor in the cost of motorcycle insurance. In this article, we’ll dive into the average cost of motorcycle insurance and everything you need to know to get the best coverage for your buck. So, grab your helmet, buckle up, and let’s get started!

Factors that Affect Motorcycle Insurance Average Cost

The cost of motorcycle insurance is not a one-size-fits-all situation. Here are some key factors that can influence your premium:

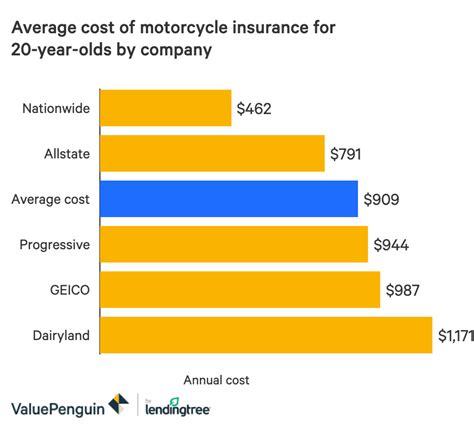

- Age: Younger riders typically pay higher premiums due to their higher risk of accidents.

- Experience: Riders with more experience usually qualify for lower rates.

- Type of motorcycle: Sports bikes and high-performance motorcycles often come with higher premiums.

- Riding history: A clean riding record with no accidents or violations can significantly lower your insurance costs.

- Location: The cost of insurance can vary depending on your state or region.

Coverage Options

When it comes to motorcycle insurance, you have a range of coverage options to choose from. Here’s a brief overview:

Liability coverage: This covers damage or injuries you cause to others while riding your motorcycle.

Collision coverage: This covers damage to your motorcycle in the event of an accident.

Comprehensive coverage: This provides coverage for theft, vandalism, and other non-collision incidents.

Uninsured/underinsured motorist coverage: This protects you if you’re in an accident with a driver who doesn’t have insurance or enough insurance.

Comparing Motorcycle Insurance Quotes

To get the best deal on motorcycle insurance, it’s essential to compare quotes from multiple insurance providers. Here are some tips:

Use an online insurance quote tool: These tools allow you to quickly and easily compare quotes from different companies.

Contact insurance agents: Independent insurance agents can help you shop around for the best rates.

Read reviews: Check online reviews to see what other riders say about their experiences with different insurance companies.

Motorcycle Insurance Average Cost in the US

According to the National Association of Insurance Commissioners (NAIC), the average cost of motorcycle insurance in the US is around $700 per year. However, this number can vary widely depending on the factors discussed earlier.

State-by-State Breakdown of Average Motorcycle Insurance Costs

The table below provides a state-by-state breakdown of average motorcycle insurance costs:

| State | Average Cost |

|---|---|

| California | $1,120 |

| Texas | $750 |

| Florida | $650 |

| New York | $950 |

| Pennsylvania | $800 |

Conclusion

Motorcycle insurance is a must-have for all riders. By understanding the factors that affect your premium and comparing quotes from multiple providers, you can get the best coverage for your needs at the most affordable price.

So, whether you’re a seasoned rider or just starting out, remember that motorcycle insurance is there to protect you. Check out our other articles on motorcycle safety and gear for more information on keeping yourself and your ride safe and insured.

FAQ about Motorcycle Insurance Average Cost

1. What is the average cost of motorcycle insurance?

The average cost of motorcycle insurance in the United States is $700 per year. However, rates can vary widely depending on factors such as your age, location, and riding experience.

2. What factors affect the cost of motorcycle insurance?

The most important factors that affect the cost of motorcycle insurance are:

- Age

- Location

- Riding experience

- Type of motorcycle

- Coverage limits

3. How can I get a cheaper motorcycle insurance rate?

There are a few things you can do to get a cheaper motorcycle insurance rate:

- Shop around and compare quotes from multiple insurance companies.

- Take a motorcycle safety course.

- Maintain a good driving record.

- Increase your deductible.

- Insure multiple motorcycles on the same policy.

4. What is the minimum amount of motorcycle insurance I need?

The minimum amount of motorcycle insurance required varies by state. However, most states require at least liability coverage, which protects you if you are at fault for an accident and cause injury or damage to others.

5. What are the different types of motorcycle insurance coverage?

There are a variety of different types of motorcycle insurance coverage available, including:

- Liability coverage

- Collision coverage

- Comprehensive coverage

- Uninsured/underinsured motorist coverage

- Medical payments coverage

6. How much does it cost to add a passenger to my motorcycle insurance policy?

The cost of adding a passenger to your motorcycle insurance policy varies depending on the insurance company and the coverage limits you choose. However, it is typically around $50 per year.

7. What happens if I am in an accident and I am not at fault?

If you are in an accident and you are not at fault, you may be entitled to compensation from the at-fault driver’s insurance company. This compensation can include coverage for your medical expenses, lost wages, and property damage.

8. What should I do if I am involved in a motorcycle accident?

If you are involved in a motorcycle accident, you should:

- Stop and check for injuries.

- Call the police.

- Exchange information with the other driver(s) involved.

- Take photos of the accident scene.

- Contact your insurance company.

9. How long does it take to get a motorcycle insurance policy?

You can typically get a motorcycle insurance policy within a few days. However, the process may take longer if you have a complex situation or if you need to provide additional documentation.

10. Can I cancel my motorcycle insurance policy at any time?

Yes, you can cancel your motorcycle insurance policy at any time. However, you may have to pay a cancellation fee.