- Motor Insurance Costs: Understanding the Factors That Impact Your Premiums

- Factors Influencing Motor Insurance Costs

- Table: Factors Influencing Motor Insurance Costs

- Conclusion

-

FAQ about Motor Insurance Costs

- What factors affect my motor insurance premium?

- How can I reduce my motor insurance costs?

- What is a deductible?

- What is comprehensive coverage?

- What types of coverage are required by law?

- How often should I review my motor insurance policy?

- What should I do if I get into an accident?

- What happens if I can’t afford my motor insurance?

- What are the risks of driving without motor insurance?

- How do I make a claim on my motor insurance policy?

Motor Insurance Costs: Understanding the Factors That Impact Your Premiums

Introduction

Hey readers! Are you curious about how much it costs to insure your prized possession? Motor insurance is a crucial aspect of car ownership that protects you financially in case of accidents or theft. But navigating the world of insurance costs can be a bit of a maze. In this article, we’ll take a comprehensive look at the factors that influence motor insurance costs and provide you with tips to save some money.

Factors Influencing Motor Insurance Costs

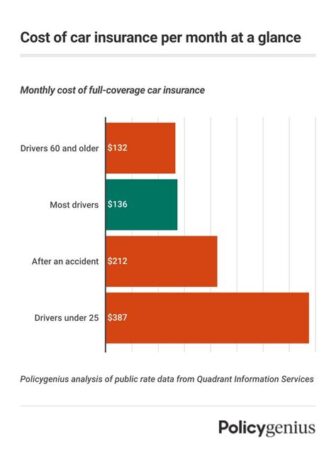

Age and Experience

Buckle up, readers! Your age and driving experience play a significant role in determining your insurance premiums. Young drivers, especially those under 25, typically pay higher premiums due to their limited experience and higher risk of accidents. With each year of safe driving, you accumulate a clean record, leading to lower insurance costs.

Vehicle Make and Model

Not all cars are created equal in the eyes of insurance companies. The make, model, and value of your vehicle significantly impact your insurance costs. High-performance vehicles, luxurious cars, and those with expensive parts tend to attract higher premiums due to their increased risk of accidents and repair costs.

Driving History

Your driving record is like a crystal ball for insurance companies. A history of accidents, traffic violations, or convictions can result in hefty surcharges on your premiums. Maintaining a clean driving record is essential for keeping your insurance costs under control.

Location and Mileage

Where you live and how much you drive also affect your insurance costs. Urban areas with higher traffic density and crime rates typically have higher insurance premiums. Similarly, drivers who commute long distances or use their vehicles frequently pay more for insurance.

Coverage Level

The extent of coverage you choose for your motor insurance policy directly impacts the cost. Comprehensive coverage, which includes protection against accidents, theft, and natural disasters, comes with a higher premium compared to basic liability coverage that only covers third-party damage.

Discounts and Savings

The good news is that many insurance companies offer discounts and savings to help you reduce your premiums. These can include discounts for safe driving, bundling multiple policies, and installing safety features like anti-lock brakes. Be sure to ask your insurer about available discounts to minimize your insurance costs.

Table: Factors Influencing Motor Insurance Costs

| Factor | Impact on Premium |

|---|---|

| Age and Experience | Younger drivers pay higher premiums |

| Vehicle Make and Model | High-performance and luxurious vehicles cost more to insure |

| Driving History | Accidents and violations increase premiums |

| Location and Mileage | Urban areas and high mileage result in higher costs |

| Coverage Level | Comprehensive coverage premiums are higher than basic liability |

| Discounts and Savings | Discounts for safe driving and safety features reduce premiums |

Conclusion

Readers, now you’re equipped with the knowledge to navigate the world of motor insurance costs. Remember, insurance is not just about protecting you financially; it also gives you peace of mind knowing that you’re covered in case of unforeseen events.

If you’re looking for more insights into car ownership, be sure to check out our other articles on car maintenance, fuel efficiency, and the latest automotive trends. Stay tuned, and happy driving!

FAQ about Motor Insurance Costs

What factors affect my motor insurance premium?

Your driving history, age, location, type of vehicle, and amount of coverage you choose all influence the cost of your premium.

How can I reduce my motor insurance costs?

Shop around for the best deals, maintain a good driving record, consider a higher deductible, and ask about discounts.

What is a deductible?

A deductible is the amount you pay out of pocket before your insurance coverage kicks in. A higher deductible typically lowers your premium.

What is comprehensive coverage?

Comprehensive coverage protects your vehicle from events other than collisions, such as theft, vandalism, and weather damage.

What types of coverage are required by law?

Most states require liability coverage, which covers damages you cause to others in an accident.

How often should I review my motor insurance policy?

Review your policy annually to ensure your coverage still meets your needs and budget.

What should I do if I get into an accident?

Contact your insurance company as soon as possible to file a claim. Provide them with all necessary details and cooperate with the investigation process.

What happens if I can’t afford my motor insurance?

Contact your insurance company to discuss payment options. Some companies offer payment plans or assistance programs.

What are the risks of driving without motor insurance?

Driving without insurance is illegal and could result in fines, license suspension, and financial liability in the event of an accident.

How do I make a claim on my motor insurance policy?

Contact your insurance company and provide them with details of the accident or incident. They will guide you through the claims process.