- Monthly Car Insurance Cost: Unraveling the Factors

- Introduction

- Factors Influencing Monthly Car Insurance Cost

- Breaking Down Your Monthly Car Insurance Cost

- Tips to Reduce Monthly Car Insurance Cost

- Conclusion

-

FAQ about Monthly Car Insurance Cost

- What factors affect the cost of monthly car insurance?

- How can I lower my monthly car insurance cost?

- What is the average cost of monthly car insurance?

- What is the best way to pay for car insurance?

- What happens if I miss a car insurance payment?

- What is the penalty for driving without car insurance?

- How often should I review my car insurance policy?

- What should I do if I’m involved in a car accident?

- How can I file a claim with my car insurance company?

- What is an insurance premium?

Monthly Car Insurance Cost: Unraveling the Factors

Introduction

Hey readers! In the world of automobiles, navigating the realm of car insurance can be a bumpy road. One crucial aspect that often keeps us up at night is the monthly car insurance cost. Unveiling the mystery behind this number can empower you to make informed decisions about your insurance coverage. In this comprehensive guide, we’ll delve into the factors that shape your monthly car insurance cost and provide valuable tips to help you keep those premiums in check.

Factors Influencing Monthly Car Insurance Cost

1. Vehicle Type and Age

The type and age of your car play a significant role in determining your insurance costs. Newer cars with advanced safety features tend to have lower insurance rates. Conversely, older cars with higher mileage are more susceptible to accidents and breakdowns, resulting in higher premiums. Additionally, sports cars and luxury vehicles typically come with higher insurance costs due to their perceived high-risk nature.

2. Driving History and Location

Your driving record can greatly influence your insurance premiums. Drivers with a clean record, free from accidents or traffic violations, will generally qualify for lower rates. However, those with a history of accidents or violations may face higher insurance costs. Furthermore, the location where you live also impacts your premiums. Urban areas with higher accident rates tend to have higher insurance costs compared to rural areas.

3. Coverage Level and Deductible

The coverage level you select plays a crucial role in your monthly car insurance cost. Comprehensive and collision coverage offer more protection but come with higher premiums. In contrast, liability coverage is less expensive but provides less protection. Additionally, choosing a higher deductible can lower your monthly premiums, but it also means you’ll pay more out-of-pocket in the event of an accident.

Breaking Down Your Monthly Car Insurance Cost

| Coverage | Percentage of Premium |

|---|---|

| Liability | 40% |

| Collision | 25% |

| Comprehensive | 20% |

| Personal Injury Protection (PIP) | 10% |

| Uninsured Motorist Coverage (UMC) | 5% |

Tips to Reduce Monthly Car Insurance Cost

1. Maintain a Clean Driving Record

The key to lower car insurance premiums lies in maintaining a clean driving record. Avoid accidents, traffic violations, and reckless driving behaviors. Attending defensive driving courses can also demonstrate your commitment to safe driving and potentially earn you discounts.

2. Increase Your Deductible

Raising your deductible can significantly lower your monthly car insurance cost. However, it’s crucial to choose a deductible that you can comfortably afford to pay in the event of an accident.

3. Bundle Your Insurance Policies

Bundling your car insurance with other policies, such as renters or homeowners insurance, can often qualify you for discounts from your insurance company.

Conclusion

Understanding the factors that influence your monthly car insurance cost empowers you to make informed decisions about your coverage. By considering your vehicle type, driving history, coverage level, and deductible, you can tailor your insurance policy to meet your needs and budget. Remember to stay on top of your driving habits and explore ways to reduce your premiums over time. For further insights into car insurance and other financial topics, be sure to check out our other articles.

FAQ about Monthly Car Insurance Cost

What factors affect the cost of monthly car insurance?

- Age and gender of driver

- Driving history

- Type of car

- Location

- Amount of coverage

How can I lower my monthly car insurance cost?

- Shop around for different quotes

- Increase your deductible

- Bundle your insurance with other policies (e.g., home insurance)

- Take a defensive driving course

- Maintain a good credit history

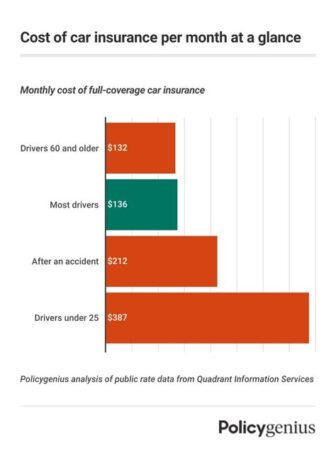

What is the average cost of monthly car insurance?

- The average cost of monthly car insurance in the United States is $107.

What is the best way to pay for car insurance?

- Most insurance companies allow you to pay monthly, semi-annually, or annually.

- Paying annually is typically the cheapest option, but it may not be feasible for everyone.

What happens if I miss a car insurance payment?

- Your insurance policy may be canceled and you may be charged a late payment fee.

- A missed payment may also affect your credit score.

What is the penalty for driving without car insurance?

- Driving without car insurance is illegal in most states.

- Penalties can include fines, license suspension, and even jail time.

How often should I review my car insurance policy?

- It’s a good idea to review your car insurance policy annually to make sure you have the right amount of coverage and are getting the best possible rate.

What should I do if I’m involved in a car accident?

- Stay calm and contact the police.

- Exchange information with the other driver(s) involved.

- Take pictures of the damage and get the names and contact information of any witnesses.

- Report the accident to your insurance company as soon as possible.

How can I file a claim with my car insurance company?

- Most insurance companies have a claims department that you can contact.

- Be prepared to provide the date, time, and location of the accident, as well as the names and contact information of any witnesses.

What is an insurance premium?

- An insurance premium is the amount of money you pay to your insurance company for coverage.