- Life Term Life Insurance: The Ultimate Guide

- Introduction

- Understanding Life Term Life Insurance

- Different Types of Life Term Life Insurance

- How to Choose the Right Life Term Life Insurance

- Comparing Life Term Life Insurance vs. Other Options

- Benefits of Life Term Life Insurance as Part of a Financial Plan

- Conclusion

-

FAQ about Whole Life Insurance

- What is whole life insurance?

- What are the benefits of whole life insurance?

- What are the drawbacks of whole life insurance?

- How much does whole life insurance cost?

- What is the cash value of whole life insurance?

- How do I choose the right whole life insurance policy?

- What are the tax implications of whole life insurance?

- What happens if I stop paying the premiums on my whole life insurance policy?

- What are the alternatives to whole life insurance?

Life Term Life Insurance: The Ultimate Guide

Introduction

Hey there, readers!

Welcome to the definitive guide to life term life insurance. Whether you’re a seasoned insurance pro or just starting to explore your options, we’ve got everything you need to make an informed decision about this important financial tool. Life term life insurance is a critical component of any financial plan, providing peace of mind and financial security for you and your loved ones. In this comprehensive guide, we’ll dive deep into the ins and outs of life term life insurance, covering everything from the basics to advanced strategies.

Understanding Life Term Life Insurance

What is Life Term Life Insurance?

Life term life insurance is a type of life insurance that provides coverage for a specific period, or term. Unlike whole life insurance, which covers you for your entire life, life term life insurance offers protection for a set number of years, such as 10, 20, or 30 years. This type of insurance is designed to provide temporary financial protection during specific life stages, such as when you have a mortgage or young children.

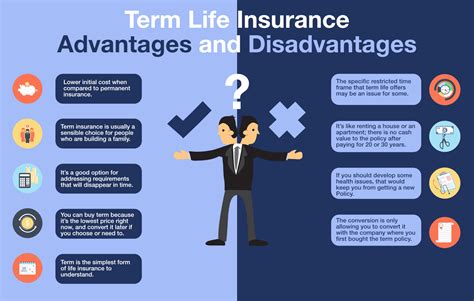

Benefits of Life Term Life Insurance

- Flexibility: Life term life insurance allows you to customize the coverage period to meet your specific needs and budget.

- Affordability: Compared to whole life insurance, life term life insurance is generally more affordable, making it a suitable option for those on a budget.

- Simplicity: The terms and conditions of life term life insurance are straightforward, making it easy to understand and manage.

Different Types of Life Term Life Insurance

Level Term Life Insurance

Level term life insurance provides coverage for the same amount throughout the policy period. The premiums remain constant, making it easier to budget for.

Decreasing Term Life Insurance

Decreasing term life insurance lowers the coverage amount over time, typically corresponding to a decreasing mortgage balance or other financial obligation. This type of insurance is designed to provide financial protection as your financial needs change.

Annual Renewable Term Life Insurance

Annual renewable term life insurance offers coverage for one year at a time, with premiums that may increase each year. This type of insurance provides flexibility but can become more expensive over time.

How to Choose the Right Life Term Life Insurance

Determine Your Coverage Needs

Assess your financial obligations and the amount of financial support your loved ones would need in the event of your death. This includes debts, expenses, and income replacement.

Consider Your Age and Health

Your age and health status will impact the premium you pay for life term life insurance. Younger and healthier individuals typically qualify for lower premiums.

Compare Quotes from Multiple Providers

Shop around and compare quotes from different insurance companies to find the best combination of coverage, price, and features.

Comparing Life Term Life Insurance vs. Other Options

| Insurance Type | Coverage | Premium | Flexibility |

|---|---|---|---|

| Life Term Life Insurance | Temporary | Lower | Customizable |

| Whole Life Insurance | Permanent | Higher | Limited |

| Universal Life Insurance | Flexible | Variable | Moderate |

| Variable Life Insurance | Investments | Variable | Moderate |

Benefits of Life Term Life Insurance as Part of a Financial Plan

- Protects Your Family’s Financial Future: Life term life insurance provides financial security for your loved ones in the event of your untimely death.

- Mortgage Protection: Life term life insurance can help pay off your mortgage in the event of your death, ensuring your family remains in your home.

- Education Funding: Life term life insurance can be used to fund your children’s education, giving them a head start in life.

- Supplemental Retirement Income: Life term life insurance can provide additional income during retirement years, supplementing your pension or investments.

Conclusion

Life term life insurance is an essential financial tool that provides peace of mind and financial security for you and your loved ones. By understanding the different types of life term life insurance available, you can choose the right policy to meet your specific needs and budget. When coupled with other financial planning strategies, life term life insurance can play a crucial role in ensuring your family’s financial well-being, no matter what life throws your way.

Check out our other articles for more information on financial planning:

- Managing Debt Effectively

- Investing for the Future

- Retirement Planning Simplified

FAQ about Whole Life Insurance

What is whole life insurance?

Whole life insurance is a type of permanent life insurance that provides coverage for your entire life, as long as you continue to pay the premiums. It also has a cash value component that grows over time, which you can borrow against or withdraw from.

What are the benefits of whole life insurance?

Whole life insurance provides a number of benefits, including:

- Death benefit: Your beneficiaries will receive a death benefit if you die, regardless of when you die.

- Cash value: The cash value component of whole life insurance grows over time, and you can borrow against it or withdraw from it.

- Tax-deferred growth: The cash value of whole life insurance grows tax-deferred, which means you don’t have to pay taxes on the growth until you withdraw it.

- Death benefit protection: Whole life insurance provides death benefit protection for your entire life, as long as you continue to pay the premiums.

What are the drawbacks of whole life insurance?

Whole life insurance can be more expensive than other types of life insurance, and the cash value component may not grow as quickly as you expect.

How much does whole life insurance cost?

The cost of whole life insurance will vary depending on a number of factors, including your age, health, and the amount of coverage you need.

What is the cash value of whole life insurance?

The cash value of whole life insurance is the amount of money that has accumulated in the policy over time. You can borrow against the cash value or withdraw it, but doing so will reduce the death benefit.

How do I choose the right whole life insurance policy?

When choosing a whole life insurance policy, it is important to consider your individual needs and financial situation. You should also compare policies from different insurance companies to find the best deal.

What are the tax implications of whole life insurance?

The death benefit of whole life insurance is not taxable, but the cash value is. Withdrawals from the cash value are taxed as ordinary income, and loans from the cash value are not taxed.

What happens if I stop paying the premiums on my whole life insurance policy?

If you stop paying the premiums on your whole life insurance policy, the policy will lapse. You may have a grace period during which you can reinstate the policy, but if you do not reinstate the policy, you will lose the death benefit and the cash value.

What are the alternatives to whole life insurance?

There are a number of alternatives to whole life insurance, including:

- Term life insurance: Term life insurance provides coverage for a specific period of time, such as 10 or 20 years. It is typically less expensive than whole life insurance, but it does not have a cash value component.

- Universal life insurance: Universal life insurance is a type of permanent life insurance that provides flexible premiums and death benefits. It also has a cash value component, but the cash value may not grow as quickly as the cash value of whole life insurance.

- Variable life insurance: Variable life insurance is a type of permanent life insurance that invests the cash value in stocks and other investments. The cash value of variable life insurance can grow faster than the cash value of whole life insurance, but it is also subject to market risk.