- Life Insure: A Comprehensive Guide to Protecting Your Loved Ones

-

FAQ about Life Insurance

- What is life insurance?

- Why do I need life insurance?

- How much life insurance do I need?

- What types of life insurance are available?

- How much does life insurance cost?

- What are the benefits of life insurance?

- What are the disadvantages of life insurance?

- How do I get life insurance?

- What should I look for when choosing a life insurance company?

- How can I make sure my beneficiaries receive my death benefit?

Life Insure: A Comprehensive Guide to Protecting Your Loved Ones

Introduction

Welcome, readers!

Life insurance is a crucial aspect of financial planning that offers peace of mind and safeguards the financial well-being of your loved ones. This comprehensive guide will delve into the intricacies of life insurance, providing you with essential information to make informed decisions.

Understanding Life Insurance: The Basics

What is Life Insurance?

Life insurance is a contract between an individual (the insured) and an insurance company. Upon the insured’s death, the company provides a payout (the death benefit) to the beneficiaries designated by the insured.

Types of Life Insurance:

- Term Life Insurance: Coverage for a specified period, such as 10, 20, or 30 years.

- Whole Life Insurance: Coverage for the insured’s entire life, regardless of when they pass away.

Coverage and Benefits of Life Insurance

Coverage:

Life insurance provides financial protection against the unexpected loss of income and helps cover expenses such as:

- Funeral costs

- Outstanding debts

- Mortgage payments

- Education expenses for children

Benefits:

- Tax advantages: Death benefits are typically tax-free to beneficiaries.

- Peace of mind: Life insurance alleviates the financial burden on loved ones after the insured’s passing.

- Flexibility: Policies can be tailored to meet individual needs and budgets.

Choosing the Right Life Insurance Policy

Determining Coverage Amount:

The appropriate coverage amount depends on various factors, including:

- Income and earning potential

- Outstanding debts and expenses

- Number and age of dependents

Choosing a Policy:

Consider the following factors when selecting a policy:

- Type of coverage: Term or whole life

- Coverage amount

- Premium costs

- Company reputation

Table: Life Insurance Coverage Options

| Coverage Type | Details |

|---|---|

| Term Life Insurance | Coverage for a specific period. Premiums are typically lower than whole life insurance. |

| Whole Life Insurance | Coverage for the entire life of the insured. Premiums are typically higher than term life insurance. |

| Universal Life Insurance | A flexible policy that allows adjustments to coverage amount and premiums over time. |

| Variable Life Insurance | A policy that invests a portion of premiums in stocks and bonds, offering potential growth. |

Conclusion

Life insurance plays a vital role in securing your loved ones’ financial future. By understanding the basics, choosing the right policy, and ensuring adequate coverage, you can protect your family from the financial consequences of your passing. Explore our other articles for more insights on personal finance and insurance.

FAQ about Life Insurance

What is life insurance?

- Life insurance is a contract between you and an insurance company, where the company agrees to pay a death benefit to your beneficiaries when you die.

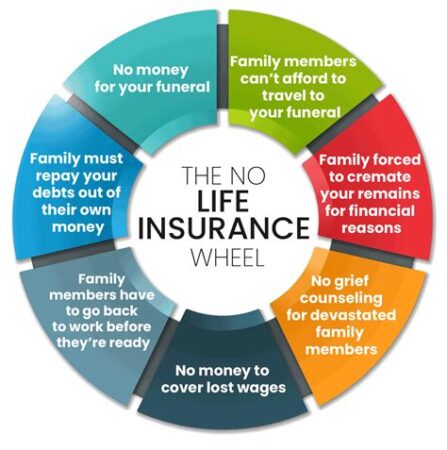

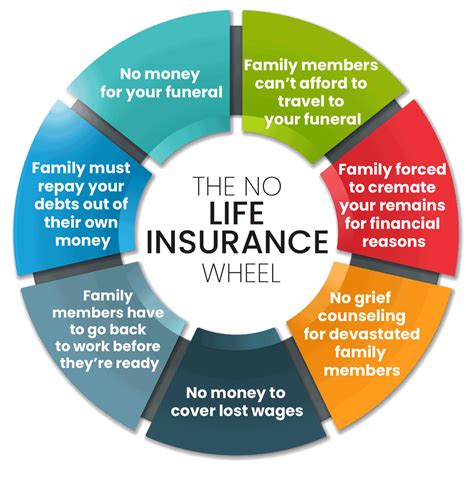

Why do I need life insurance?

- Life insurance provides financial protection for your loved ones after you’re gone. It can help pay for expenses such as funeral costs, debt, and income replacement.

How much life insurance do I need?

- The amount of life insurance you need depends on factors such as your income, debts, family responsibilities, and savings.

What types of life insurance are available?

- There are two main types of life insurance: term life insurance and permanent life insurance. Term life insurance provides coverage for a specific period, while permanent life insurance provides coverage for your entire life.

How much does life insurance cost?

- The cost of life insurance depends on factors such as your age, health, gender, and smoking status.

What are the benefits of life insurance?

- Life insurance provides peace of mind knowing that your loved ones will be financially protected if something happens to you. It can also help pay for end-of-life expenses and minimize taxes.

What are the disadvantages of life insurance?

- Life insurance can be expensive, and you may need to undergo a medical exam to get coverage.

How do I get life insurance?

- You can get life insurance through an insurance agent, online, or through your employer.

What should I look for when choosing a life insurance company?

- When choosing a life insurance company, you should consider factors such as financial stability, customer service, and policy options.

How can I make sure my beneficiaries receive my death benefit?

- To ensure your beneficiaries receive your death benefit, you should keep your policy up to date and make sure your beneficiaries are aware of the policy and how to claim the benefit.