- Life Insurance S: A Comprehensive Guide to Understanding Life Insurance Policies and Payouts

- Types of Life Insurance Policies

- Factors to Consider When Choosing a Life Insurance Policy

- Table: Types of Life Insurance Payouts

- Premium Considerations

- Conclusion

-

FAQ about Life Insurance

- What is life insurance?

- Why do I need life insurance?

- How much life insurance do I need?

- What types of life insurance policies are available?

- How much does life insurance cost?

- What are the tax implications of life insurance?

- What is a rider?

- What is the underwriting process?

- Can I get life insurance if I have a pre-existing condition?

- What happens if I cancel my life insurance policy?

Life Insurance S: A Comprehensive Guide to Understanding Life Insurance Policies and Payouts

Introduction

Welcome, readers! Today, we’re diving into the world of life insurance s, an essential yet often misunderstood topic that can significantly impact your financial plans. Life insurance offers peace of mind and financial protection for the ones you love in the event of your unforeseen departure.

Over the course of this comprehensive guide, we’ll explore the various types of life insurance policies available, their unique characteristics and benefits, and the crucial factors to consider when making a decision. We’ll also delve into the details of premiums, beneficiaries, and settlement options to provide you with a well-rounded understanding of this indispensable financial tool.

Types of Life Insurance Policies

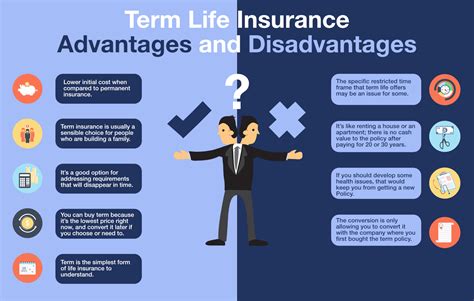

Term Life Insurance

Term life insurance offers a straightforward and affordable option for those who seek temporary coverage over a predetermined period, typically ranging from 10 to 30 years. The premiums remain fixed throughout the term, and if the policyholder passes away within the term, the beneficiaries receive the death benefit.

Whole Life Insurance

Whole life insurance provides lifelong coverage, as long as the premiums are paid on time. It also has a savings component known as a cash value, which accumulates over time and can be accessed through policy loans or withdrawals. Whole life premiums are generally higher than term life insurance but offer the potential for long-term financial gains.

Universal Life Insurance

Universal life insurance combines the flexibility of term life and the savings potential of whole life. It offers a guaranteed death benefit, while the premiums and cash value accumulation rates are variable and can be adjusted based on the policyholder’s needs and financial circumstances.

Factors to Consider When Choosing a Life Insurance Policy

Age and Health

Your age and health status significantly influence the cost and availability of life insurance. Younger and healthier individuals typically qualify for lower premiums and more comprehensive policies. Pre-existing medical conditions may affect policy eligibility, premiums, and coverage amounts.

Coverage Amount

Determining the appropriate coverage amount is crucial to ensure that your loved ones are adequately protected in the event of your passing. Consider your income, debts, funeral expenses, and any potential financial obligations your beneficiaries may face.

Beneficiaries

Designating beneficiaries who will receive the death benefit is a vital part of purchasing life insurance. Ensure that your beneficiaries are clearly identified and that their wishes are considered when choosing the method of payout.

Table: Types of Life Insurance Payouts

| Payout Method | Description |

|---|---|

| Lump Sum | Beneficiaries receive the entire death benefit in one payment. |

| Installments | Beneficiaries receive the death benefit in regular installments over a specific period. |

| Trust | The death benefit is placed into a trust, which manages the funds according to the policyholder’s instructions. |

| Annuity | The death benefit is invested in an annuity, which provides a steady income stream to the beneficiaries. |

Premium Considerations

Life insurance premiums are typically based on multiple factors, including:

- Age and health

- Coverage amount

- Type of policy (term, whole, universal)

- Length of coverage (for term life)

- Lifestyle factors (such as smoking or high-risk activities)

Conclusion

Understanding life insurance s is essential for planning a secure future for your loved ones. By considering the various types of policies, selecting the appropriate coverage amount and beneficiaries, and carefully reviewing premium options, you can make an informed decision that meets your unique needs and financial goals.

Don’t forget to explore our other articles for further insights on insurance, financial planning, and personal finance. Knowledge is power, especially when it comes to protecting what matters most in life.

FAQ about Life Insurance

What is life insurance?

Life insurance is a contract between an insurance company and an individual (the life insured) where the insurance company agrees to pay a sum of money (the death benefit) to a designated beneficiary upon the death of the life insured.

Why do I need life insurance?

Life insurance provides financial protection for your loved ones in the event of your untimely death. It can help cover expenses such as funeral costs, outstanding debts, and living expenses.

How much life insurance do I need?

The amount of life insurance you need depends on your income, family size, and future financial obligations. A financial advisor can help you determine the appropriate amount of coverage.

What types of life insurance policies are available?

There are two main types of life insurance policies: term life insurance and whole life insurance. Term life insurance provides coverage for a specific period, while whole life insurance provides coverage for the entire life of the insured.

How much does life insurance cost?

The cost of life insurance varies depending on factors such as your age, health, and smoking habits. Typically, younger and healthier individuals pay lower premiums.

What are the tax implications of life insurance?

Death benefits from life insurance policies are generally tax-free. However, if you take out a policy on your own life and designate yourself as the beneficiary, the cash value may be taxed.

What is a rider?

A rider is an optional addition to a life insurance policy that provides additional coverage or benefits, such as accidental death or dismemberment benefit or a waiver of premium.

What is the underwriting process?

Underwriting is the process by which an insurance company evaluates your risk of death and determines your premium. This process typically involves a medical exam and a review of your health history.

Can I get life insurance if I have a pre-existing condition?

Yes, it is possible to get life insurance if you have a pre-existing condition. However, the insurance company may require you to pay higher premiums or limit your coverage.

What happens if I cancel my life insurance policy?

If you cancel your life insurance policy, you will no longer be covered for death benefits. You may also be subject to a cancellation fee.