- Life Insurance Price: Breaking Down the Factors That Affect It

-

FAQ about Life Insurance Price

- What factors affect life insurance premiums?

- How can I get the best rate on life insurance?

- Why is life insurance more expensive for women than men?

- Can I get life insurance without a medical exam?

- What is a guaranteed universal life (GUL) policy?

- What is the difference between term and permanent life insurance?

- Can I use my life insurance policy as collateral for a loan?

- What happens if I stop paying my life insurance premiums?

- What is a life insurance rider?

- Can I buy life insurance on someone else?

Life Insurance Price: Breaking Down the Factors That Affect It

Introduction

Hey there, readers! Welcome to our ultimate guide on life insurance prices. We know life insurance can be a bit of a mystery, but we’re here to shed some light on how much it might cost you.

Life insurance is an essential part of financial planning. It provides a safety net for your loved ones in case something happens to you. But how do you know how much you need and what it will cost? That’s where this guide comes in.

Section 1: Factors that Affect Life Insurance Price

The cost of your life insurance premium depends on several factors, including:

Age

The younger you are, the cheaper your premiums will be. This is because you’re less likely to have health problems that could lead to a higher risk of death.

Health

Your health is also a major factor in determining your premium. If you have a chronic illness or a history of health problems, your premiums will be higher.

Occupation

Your occupation can also affect your premium. Jobs that are considered high-risk, such as construction or firefighting, can lead to higher premiums.

Smoking

Smokers pay higher premiums than non-smokers. This is because smoking is a major risk factor for several health problems, including heart disease and cancer.

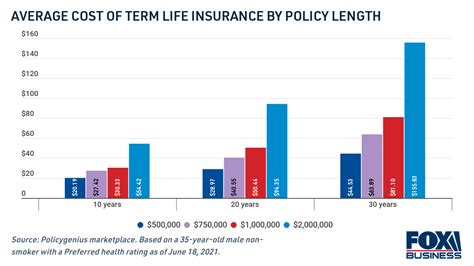

Amount of Coverage

The amount of coverage you need will also affect your premium. The more coverage you need, the higher your premium.

Section 2: Types of Life Insurance

There are two main types of life insurance:

Term Life Insurance

Term life insurance is a temporary policy that provides coverage for a specific period of time, such as 10 or 20 years. It’s typically the most affordable type of life insurance.

Permanent Life Insurance

Permanent life insurance provides coverage for your entire life. It’s more expensive than term life insurance, but it also builds cash value over time.

Section 3: Getting the Best Life Insurance Price

Here are some tips for getting the best life insurance price:

- Compare quotes from multiple insurers. Don’t just go with the first insurer you find. Shop around and compare quotes to find the best deal.

- Consider your needs. How much coverage do you need? What type of policy is right for you? Consider your individual circumstances and needs before you make a decision.

- Be honest on your application. Don’t try to hide or downplay any health problems or risk factors. This could lead to a higher premium or even a policy denial.

- Maintain a healthy lifestyle. The healthier you are, the lower your premiums will be. Quit smoking, eat healthy, and get regular exercise.

- Review your coverage regularly. As your life circumstances change, so should your life insurance policy. Review your coverage every few years to make sure you have the right amount of coverage and the best possible price.

Section 4: Life Insurance Price Table Breakdown

Age | Average Monthly Premium

——- | —–

20 | $20

30 | $30

40 | $40

50 | $50

60 | $60

Conclusion

Life insurance is an important part of financial planning. It provides peace of mind knowing that your loved ones will be financially protected if something happens to you. By understanding the factors that affect life insurance prices and by following these tips, you can get the best possible price on your policy.

Be sure to check out our other articles for more information on life insurance and other important financial topics!

FAQ about Life Insurance Price

What factors affect life insurance premiums?

Answer: Age, health, gender, smoking status, and amount of coverage.

How can I get the best rate on life insurance?

Answer: Compare quotes from multiple insurers, improve your health and lifestyle habits, and consider opting for a smaller death benefit.

Why is life insurance more expensive for women than men?

Answer: Statistically, women live longer than men, which means they are more likely to collect on their policies, resulting in higher premiums.

Can I get life insurance without a medical exam?

Answer: Yes, some insurers offer simplified issue or no-exam policies, but these typically come with lower coverage limits and higher premiums.

What is a guaranteed universal life (GUL) policy?

Answer: A GUL policy is a type of permanent life insurance that provides a guaranteed death benefit, regardless of the policyholder’s age or health, as long as the premiums are paid.

What is the difference between term and permanent life insurance?

Answer: Term life insurance provides coverage for a specific period, while permanent life insurance covers the policyholder for their entire lifetime.

Can I use my life insurance policy as collateral for a loan?

Answer: Yes, you can borrow against your life insurance policy’s cash value to access funds, but it typically comes with interest charges and can reduce the death benefit.

What happens if I stop paying my life insurance premiums?

Answer: If you miss multiple premium payments, your life insurance policy may lapse, and you will lose your coverage.

What is a life insurance rider?

Answer: A rider is an optional add-on to a life insurance policy that provides additional coverage, such as accidental death or disability benefits.

Can I buy life insurance on someone else?

Answer: Yes, but you must have a legitimate insurable interest in the person, which usually means you are financially dependent on them.