- Introduction

- Understanding Life Insurance

- Benefits of Life Insurance

- Factors Affecting Life Insurance Premiums

- Breaking Down Life Insurance Policies

- Conclusion

-

FAQ about Life Insurance Information

- What is life insurance?

- What are the different types of life insurance?

- How much life insurance do I need?

- Who should get life insurance?

- How do I apply for life insurance?

- What is the underwriting process?

- How long does it take to get approved for life insurance?

- What are the benefits of life insurance?

- What are the drawbacks of life insurance?

- How do I choose a life insurance company?

Introduction

Hey readers, welcome to the ultimate guide to all things life insurance. Whether you’re a seasoned pro or a curious newbie, you’re bound to find valuable insights within these paragraphs. So, grab a cup of coffee, sit back, and let’s dive into the wonderful world of life insurance information.

Understanding Life Insurance

What Is Life Insurance?

Life insurance is a financial product that provides a death benefit to your designated beneficiaries upon your passing. It’s designed to protect your loved ones from unexpected financial hardship if the unthinkable happens.

Types of Life Insurance

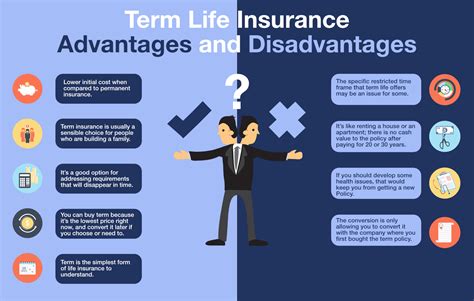

There are two main types of life insurance: term life insurance and whole life insurance. Term life insurance provides coverage for a specific number of years, while whole life insurance offers lifelong coverage and includes a cash value component that grows over time.

Benefits of Life Insurance

Financial Security for Your Beneficiaries

Life insurance ensures that your loved ones inherit a financial safety net upon your death. This can be used to cover expenses such as funeral costs, mortgage payments, or outstanding debts.

Peace of Mind

Knowing that your family’s financial future is secure can provide immense peace of mind. Life insurance takes the burden off their shoulders and allows them to focus on grieving and healing.

Factors Affecting Life Insurance Premiums

Health and Age

Your overall health and age play a significant role in determining your life insurance premiums. Individuals with good health and a younger age are generally eligible for lower rates.

Lifestyle Choices

Certain lifestyle choices, such as smoking or engaging in extreme sports, can increase your life insurance premiums. This is because these activities are associated with higher risks.

Coverage Amount

The amount of coverage you need will impact your premiums. Typically, the higher the coverage amount, the higher your premiums will be.

Breaking Down Life Insurance Policies

| Policy Type | Coverage Period | Cash Value | Premiums |

|---|---|---|---|

| Term Life Insurance | Specific number of years | No | Lower |

| Whole Life Insurance | Lifelong | Yes | Higher |

| Universal Life Insurance | Flexible premiums and coverage | Yes | Adjustable |

| Variable Life Insurance | Cash value invested in the stock market | Yes | Variable |

Conclusion

Readers, we’ve scratched the surface of the vast topic of life insurance information. Now that you’re equipped with this newfound knowledge, explore our other articles on specific life insurance providers and policies. Remember, life insurance is not just a financial product but a testament to the love and care you have for your family. By securing their financial future, you’re ensuring their peace of mind and well-being for years to come.

FAQ about Life Insurance Information

What is life insurance?

Life insurance provides financial protection for your loved ones in the event of your death. It pays out a death benefit that can be used to cover expenses such as funeral costs, outstanding debts, and income replacement.

What are the different types of life insurance?

There are two main types of life insurance: term life insurance and permanent life insurance. Term life insurance provides coverage for a specific period of time, while permanent life insurance provides coverage for the rest of your life.

How much life insurance do I need?

The amount of life insurance you need will depend on a number of factors, including your income, debts, family size, and future financial goals. It’s a good idea to consult with a financial advisor to determine the appropriate coverage amount for you.

Who should get life insurance?

Anyone who has dependents or financial obligations should consider getting life insurance. This includes people with spouses, children, mortgages, or other debts.

How do I apply for life insurance?

You can apply for life insurance through a life insurance company or an agent. The application process typically involves answering a series of questions about your health, lifestyle, and financial situation.

What is the underwriting process?

Underwriting is the process of assessing your risk as an insurance applicant. The insurance company will consider factors such as your age, health, and lifestyle to determine your insurance premium.

How long does it take to get approved for life insurance?

The approval process for life insurance can take a few weeks or longer. The underwriting process can take longer if you have a complex medical history or other factors that require additional review.

What are the benefits of life insurance?

Life insurance provides a number of benefits, including:

- Financial protection for your loved ones

- Peace of mind knowing that your family will be taken care of in the event of your death

- Potential tax savings

What are the drawbacks of life insurance?

Life insurance can be expensive, especially if you need a large amount of coverage. There are also some restrictions on how you can use the death benefit.

How do I choose a life insurance company?

When choosing a life insurance company, it’s important to consider factors such as the company’s financial stability, customer service, and product offerings. It’s also a good idea to compare quotes from multiple companies to find the best rates.