- Life Insurance Estimate: A Comprehensive Guide to Calculating Your Coverage Needs

-

FAQ about Life Insurance Estimate

- What is a life insurance estimate?

- Why do I need a life insurance estimate?

- How do I get an estimate?

- What information do I need to provide?

- How accurate are life insurance estimates?

- How can I increase my life insurance estimate?

- What are the benefits of getting a life insurance estimate?

- What are the risks of getting a life insurance estimate?

- Do I need to purchase life insurance after getting an estimate?

- What are some tips for getting a good life insurance estimate?

Life Insurance Estimate: A Comprehensive Guide to Calculating Your Coverage Needs

Hey there, readers!

Life insurance is a crucial financial tool that provides peace of mind and ensures financial security for your loved ones in the event of your untimely demise. While it’s essential to have life insurance, determining the right amount of coverage can be a bit overwhelming. This comprehensive guide will help you estimate your life insurance needs and make an informed decision. Let’s dive right in!

Section 1: Understanding Life Insurance Coverage

Life insurance is a contract between you and an insurance provider. Upon your death, the policy pays out a death benefit to your beneficiaries, who can use it to cover expenses like funeral costs, outstanding debts, and future financial needs. There are two main types of life insurance policies: term life insurance and permanent life insurance. Term life insurance provides coverage for a specific period, while permanent life insurance provides lifelong coverage and typically includes a savings component known as the cash value.

Section 2: Factors to Consider in Estimating Coverage

To estimate your life insurance needs, you need to consider several factors, including:

- Income and Earning Potential: Calculate your annual income and estimate how much your family would need to cover their expenses if you were no longer there to provide for them.

- Debts and Liabilities: Determine your outstanding debts, including mortgages, car loans, and credit card balances. Your life insurance should be sufficient to cover these liabilities and prevent your family from inheriting financial burdens.

- Funeral and Burial Expenses: Factor in the costs associated with your funeral, burial, and other end-of-life expenses.

- Family Expenses: Consider future expenses such as education, childcare, and mortgage payments that your family will need to cover without your income.

- Goals and Aspirations: Think about your financial goals and aspirations, such as buying a house or saving for retirement. Your life insurance should provide a buffer to help your family achieve these goals even if you’re not around.

Section 3: Calculation Methods for Life Insurance Estimate

There are several methods you can use to estimate your life insurance needs:

- Income Replacement Approach: Multiply your annual income by 10-15 years to estimate the amount of coverage needed to replace your lost income.

- Debt Coverage Approach: Add up all your outstanding debts and factor in funeral expenses to determine the minimum amount of coverage you need.

- Goal-Based Approach: Calculate the specific financial goals you want to achieve for your family, such as paying for your children’s education or providing a down payment on a house, and determine the amount of coverage needed to meet those goals.

- Online Life Insurance Calculators: Several online life insurance calculators are available that can help you estimate your coverage needs based on your specific circumstances.

Table: Life Insurance Estimate Factors

| Factor | Description |

|---|---|

| Annual Income | Your pre-tax annual income |

| Number of Dependents | The number of people relying on your income |

| Estimated Funeral Expenses | The anticipated costs of your funeral and burial |

| Outstanding Debts | The total amount of your debts, including mortgages, car loans, and credit card balances |

| Family Expenses | Future expenses such as education, childcare, and mortgage payments that your family will need to cover |

| Financial Goals | Specific financial goals you want to achieve for your family, such as paying for your children’s education or providing a down payment on a house |

Section 4: Additional Considerations

- Inflation: Consider the impact of inflation on future expenses. Your life insurance coverage should be sufficient to maintain its value over time.

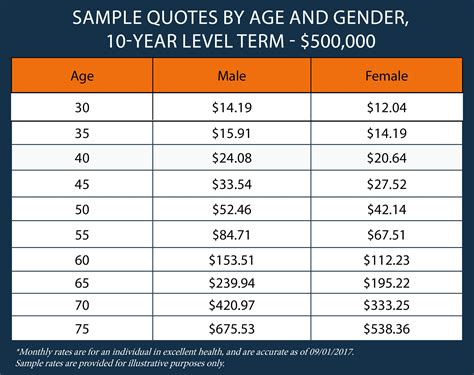

- Age and Health: Your age and health status can affect the cost and availability of life insurance. Younger and healthier individuals typically qualify for lower premiums.

- Beneficiaries: Clearly identify the beneficiaries who will receive the death benefit from your life insurance policy.

- Riders: Consider adding riders to your life insurance policy for additional coverage, such as accidental death benefit or waiver of premium.

Conclusion

Estimating your life insurance needs is a crucial step towards securing financial protection for your loved ones. By understanding the factors to consider, calculation methods available, and additional considerations, you can make an informed decision about the right amount of coverage for your situation. Remember to check out our other articles for more in-depth information on life insurance and other financial planning topics.

FAQ about Life Insurance Estimate

What is a life insurance estimate?

An estimate is an approximate calculation of how much life insurance you may need.

Why do I need a life insurance estimate?

An estimate can help you determine the right amount of coverage for your needs and budget.

How do I get an estimate?

You can get an estimate online, from an insurance agent, or by using a life insurance calculator.

What information do I need to provide?

To get an estimate, you typically provide information about your age, health, income, dependents, and lifestyle.

How accurate are life insurance estimates?

Estimates are generally not exact. They can be affected by factors such as your age, health, and occupation.

How can I increase my life insurance estimate?

You can increase your estimate by increasing your income, reducing your expenses, or taking on additional life insurance policies.

What are the benefits of getting a life insurance estimate?

Getting an estimate can help you make an informed decision about the right amount of coverage for your needs.

What are the risks of getting a life insurance estimate?

There are no risks associated with getting an estimate.

Do I need to purchase life insurance after getting an estimate?

No, you are not obligated to purchase life insurance after getting an estimate.

What are some tips for getting a good life insurance estimate?

To get a good estimate, be honest about your information, and consider your future financial needs.