- Life Insurance and Mortgage Insurance: A Comprehensive Guide

- Life Insurance: The Ultimate Protection

- Mortgage Insurance: Safeguarding Your Investment

- The Difference Between Life Insurance and Mortgage Insurance

- Comparison Table: Life Insurance vs. Mortgage Insurance

- Conclusion:

-

FAQ about Life Insurance and Mortgage Insurance

- What is life insurance?

- What is mortgage insurance?

- Do I need both life insurance and mortgage insurance?

- How much life insurance do I need?

- How much mortgage insurance do I need?

- When should I purchase life insurance?

- When should I purchase mortgage insurance?

- How do I purchase life insurance?

- How do I purchase mortgage insurance?

- What are the benefits of life insurance?

Life Insurance and Mortgage Insurance: A Comprehensive Guide

Introduction:

Hey readers, welcome to our in-depth guide on life insurance and mortgage insurance. In this article, we’ll delve into the details of both insurance types, providing you with a clear understanding of their importance, benefits, and differences.

Life insurance offers a financial safeguard for your loved ones in the unfortunate event of your untimely demise. Mortgage insurance, on the other hand, protects against the risk of defaulting on your mortgage payments. Understanding the roles of both insurance policies is crucial for ensuring the financial well-being of yourself and your family.

Life Insurance: The Ultimate Protection

What is Life Insurance?

Life insurance is an agreement between you and an insurance provider where you pay regular premiums in exchange for a death benefit. Upon your death, the death benefit is paid to your designated beneficiaries, providing them with financial support during a distressing time.

Why Life Insurance is Important

Life insurance serves as a safety net for your loved ones, ensuring they have financial stability even in your absence. It can help cover expenses such as funeral costs, outstanding debts, and ongoing living expenses, reducing the burden on your family during a difficult period.

Mortgage Insurance: Safeguarding Your Investment

What is Mortgage Insurance?

Mortgage insurance is a protection measure that safeguards lenders against the risk of default on mortgage payments. If you fail to make your mortgage payments, mortgage insurance ensures that the lender recovers the outstanding balance on the loan.

The Types of Mortgage Insurance

There are two primary types of mortgage insurance: private mortgage insurance (PMI) and government-backed mortgage insurance (FHA/VA). PMI is typically required for borrowers with a down payment of less than 20%, while government-backed insurance is available for specific loan programs.

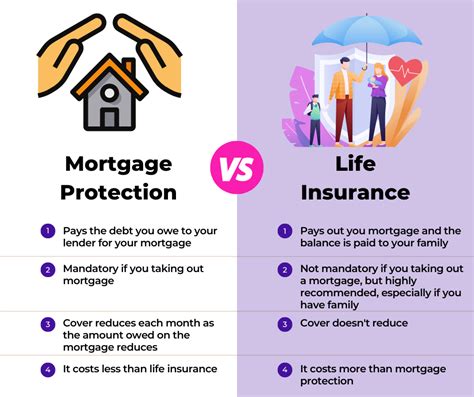

The Difference Between Life Insurance and Mortgage Insurance

Nature of Coverage

Life insurance provides protection against the death of the insured individual, while mortgage insurance safeguards against default on a mortgage loan.

Beneficiaries

Life insurance benefits are paid to the designated beneficiaries, who may include family members, loved ones, or even businesses. Mortgage insurance benefits are paid to the lender as compensation for the unpaid mortgage balance.

Tax Treatment

Life insurance death benefits are generally tax-free for beneficiaries. Mortgage insurance premiums are often tax-deductible for the homeowner.

Comparison Table: Life Insurance vs. Mortgage Insurance

| Feature | Life Insurance | Mortgage Insurance |

|---|---|---|

| Protection Type | Death of the insured | Default on mortgage payments |

| Beneficiaries | Designated individuals | Lender |

| Premiums | Paid by the policyholder | Paid by the borrower |

| Tax Treatment | Death benefits usually tax-free | Premiums often tax-deductible |

| Required | Not mandatory | May be required for loans with less than 20% down payment |

Conclusion:

Hey readers, we hope our comprehensive guide has shed light on the crucial roles of life insurance and mortgage insurance. Remember, understanding these insurance policies is paramount for safeguarding your loved ones and protecting your financial investments.

We encourage you to explore other informative articles on our website to further enhance your knowledge on insurance and financial planning topics. Stay informed and make wise decisions to secure your future and the well-being of your family.

FAQ about Life Insurance and Mortgage Insurance

What is life insurance?

Life insurance is a financial product that provides a death benefit to your beneficiaries. This death benefit can be used to pay for your final expenses, such as funeral costs and medical bills, or to provide financial support to your loved ones.

What is mortgage insurance?

Mortgage insurance is a type of insurance that protects the lender in the event that you default on your mortgage. If you can’t make your mortgage payments, the insurance company will pay the lender the outstanding balance on your loan.

Do I need both life insurance and mortgage insurance?

Whether or not you need both life insurance and mortgage insurance depends on your individual circumstances. If you have dependents who rely on your income, then you may want to consider purchasing life insurance. Mortgage insurance is typically required by lenders if you make a down payment of less than 20%.

How much life insurance do I need?

The amount of life insurance you need depends on a number of factors, including your income, your debts, and your family’s needs. A general rule of thumb is to purchase coverage that is equal to 10-15 times your annual income.

How much mortgage insurance do I need?

The amount of mortgage insurance you need depends on the amount of your loan and the type of insurance you purchase. Private mortgage insurance (PMI) is typically required for loans with a down payment of less than 20%. FHA loans require mortgage insurance premiums (MIP) for the life of the loan.

When should I purchase life insurance?

You should purchase life insurance as soon as you have dependents who rely on your income. If you have a mortgage, you may also want to consider purchasing life insurance to protect your family from financial hardship in the event of your death.

When should I purchase mortgage insurance?

You will typically need to purchase mortgage insurance if you make a down payment of less than 20%. PMI can be cancelled once you have paid down your loan to 80% of the original value. MIP cannot be cancelled.

How do I purchase life insurance?

You can purchase life insurance from a variety of sources, including insurance companies, banks, and credit unions. You can also purchase life insurance online.

How do I purchase mortgage insurance?

You can purchase mortgage insurance from your lender. The cost of mortgage insurance will be included in your monthly mortgage payment.

What are the benefits of life insurance?

Life insurance provides a number of benefits, including:

- Peace of mind: Knowing that your family will be financially protected in the event of your death can give you peace of mind.

- Financial security: Life insurance can provide your family with financial security, even if you are no longer there to provide for them.

- Tax benefits: Life insurance proceeds are generally tax-free for your beneficiaries.