Life insurance, a cornerstone of financial planning, provides a safety net for loved ones in the event of unexpected loss. Understanding its nuances is crucial, as it encompasses various types, each tailored to specific needs and financial goals. This guide explores the complexities of life insurance, from policy selection and application to beneficiary designation and understanding policy clauses.

Navigating the world of life insurance can feel overwhelming, with numerous policy types and considerations. However, by breaking down the key elements—types of policies, premium factors, application processes, and beneficiary designations—we aim to equip you with the knowledge necessary to make informed decisions about securing your family’s future.

Beneficiaries and Death Benefit Distribution

Choosing beneficiaries and determining how the death benefit will be distributed are crucial aspects of life insurance planning. These decisions ensure your loved ones receive the financial support you intend, minimizing potential complications and disputes after your passing. Careful consideration of these factors will provide peace of mind knowing your wishes are clearly articulated.

Beneficiary Designation

Designating beneficiaries involves specifying who will receive the death benefit upon your death. This can be a single individual, multiple individuals, or even a trust. The process typically involves completing a beneficiary designation form provided by your insurance company. It’s important to provide accurate and complete information, including the beneficiary’s full legal name, date of birth, and relationship to you. You can also specify percentages for multiple beneficiaries, ensuring a fair distribution according to your preferences. Regularly reviewing and updating your beneficiary designations is essential, especially after significant life events like marriage, divorce, or the birth of a child, to reflect your current wishes.

Death Benefit Distribution Options, Life insurance

Life insurance policies offer several options for death benefit distribution. The most common is a lump-sum payment, where the entire death benefit is paid out to the beneficiary(ies) at once. This provides immediate access to funds for expenses like funeral costs, debt repayment, or other immediate financial needs. Alternatively, the death benefit can be paid out in installments, either as a fixed amount over a specific period or as an annuity, providing a regular income stream. This option can be beneficial for beneficiaries who prefer a more structured and predictable income flow. Another option might involve a combination of lump sum and installments, allowing for flexibility in managing the funds.

Impact of Beneficiary Designations

Different beneficiary designations significantly impact how the death benefit is distributed. For example, naming a single primary beneficiary ensures they receive the entire death benefit. If you name multiple primary beneficiaries with equal shares, the death benefit is divided equally among them. However, if you name a primary beneficiary and a contingent beneficiary, the primary beneficiary receives the death benefit if they are alive; otherwise, the contingent beneficiary inherits it. Furthermore, naming a trust as a beneficiary allows for more complex distribution arrangements, potentially offering greater control over how and when the funds are distributed, and often providing asset protection for beneficiaries. For instance, a trust can stipulate that funds be used for a child’s education or distributed over a specific timeframe.

Death Benefit Distribution Flowchart

The following describes a flowchart illustrating the process of death benefit distribution. Imagine a flowchart with distinct boxes and arrows.

* Box 1: Insured’s Death: This is the starting point, indicating the death of the policyholder.

* Arrow 1: Points from Box 1 to Box 2.

* Box 2: Notification of Death: The insurance company is notified of the death. Documentation such as a death certificate is required.

* Arrow 2: Points from Box 2 to Box 3.

* Box 3: Beneficiary Verification: The insurance company verifies the designated beneficiary(ies) information.

* Arrow 3: Points from Box 3 to Box 4 (for a single beneficiary) or Box 5 (for multiple beneficiaries).

* Box 4: Single Beneficiary Payment: The death benefit is paid to the single designated beneficiary according to the chosen payment option (lump sum or installments).

* Arrow 4: Points from Box 4 to Box 6.

* Box 5: Multiple Beneficiary Payment: The death benefit is divided among the multiple beneficiaries according to the specified percentages or equal shares.

* Arrow 5: Points from Box 5 to Box 6.

* Box 6: Distribution Complete: The process is concluded, with the death benefit successfully distributed.

Understanding Policy Clauses and Exclusions

Life insurance policies, while designed to provide financial security for your loved ones, often contain clauses and exclusions that limit coverage. Understanding these limitations is crucial to ensure you choose a policy that meets your specific needs and expectations. Failing to understand these aspects can lead to unexpected complications when a claim is filed.

Common Exclusions in Life Insurance Policies

Several common exclusions exist within most life insurance policies. These are specific events or circumstances for which the insurance company will not pay a death benefit. Understanding these exclusions is vital to making an informed decision about your coverage.

Suicide and Pre-existing Conditions

Suicide and pre-existing conditions are two significant areas where policy exclusions frequently apply. Typically, life insurance policies include a suicide clause, often with a waiting period (usually one or two years) before the death benefit is payable if the death is by suicide. This clause protects the insurance company from immediate fraudulent claims. Regarding pre-existing conditions, policies may exclude coverage for deaths directly resulting from a known health issue before the policy’s inception. The insurer may require specific medical disclosures during the application process to assess risk accurately.

Examples of Situations Where Policy Exclusions Might Apply

Consider a scenario where an individual dies from a pre-existing condition within the first year of their policy. If that condition was not disclosed during the application process, the claim might be denied, or the payout reduced. Similarly, if someone engages in dangerous activities, such as skydiving without informing their insurer, and suffers a fatal accident, the claim could be partially or fully denied depending on the policy’s terms. Another example involves engaging in illegal activities. Death resulting from participation in a criminal act is typically excluded from coverage.

Summary of Common Exclusions and Their Implications

| Exclusion | Explanation |

|---|---|

| Suicide (with waiting period) | Death by suicide is typically excluded within a specified period (e.g., one or two years) after policy inception. After the waiting period, the death benefit is usually paid. |

| Pre-existing Conditions | Deaths directly caused by pre-existing medical conditions, undisclosed during the application process, may not be covered. The extent of coverage depends on the policy’s specific terms and the disclosure made during the application. |

| Dangerous Activities (e.g., skydiving, mountaineering) | Death resulting from participation in high-risk activities not disclosed to the insurer may be excluded or result in a reduced payout. Policies often have specific clauses outlining activities that may void or limit coverage. |

| Illegal Activities | Death resulting from participation in illegal activities is generally excluded from coverage. This is a crucial exclusion to prevent fraudulent claims and maintain the integrity of the insurance system. |

| War or Military Service (depending on policy) | Some policies exclude or limit coverage for death during wartime or active military service, unless specific riders are added to the policy. |

Final Review: Life Insurance

Securing adequate life insurance is a critical step in responsible financial planning. This guide has provided a framework for understanding the different types of policies, influencing factors on premiums, and the process of securing coverage. Remember to carefully consider your individual needs and circumstances, seeking professional advice when necessary to ensure you choose the policy that best protects your family’s financial well-being. Proactive planning today translates to peace of mind for tomorrow.

Common Queries

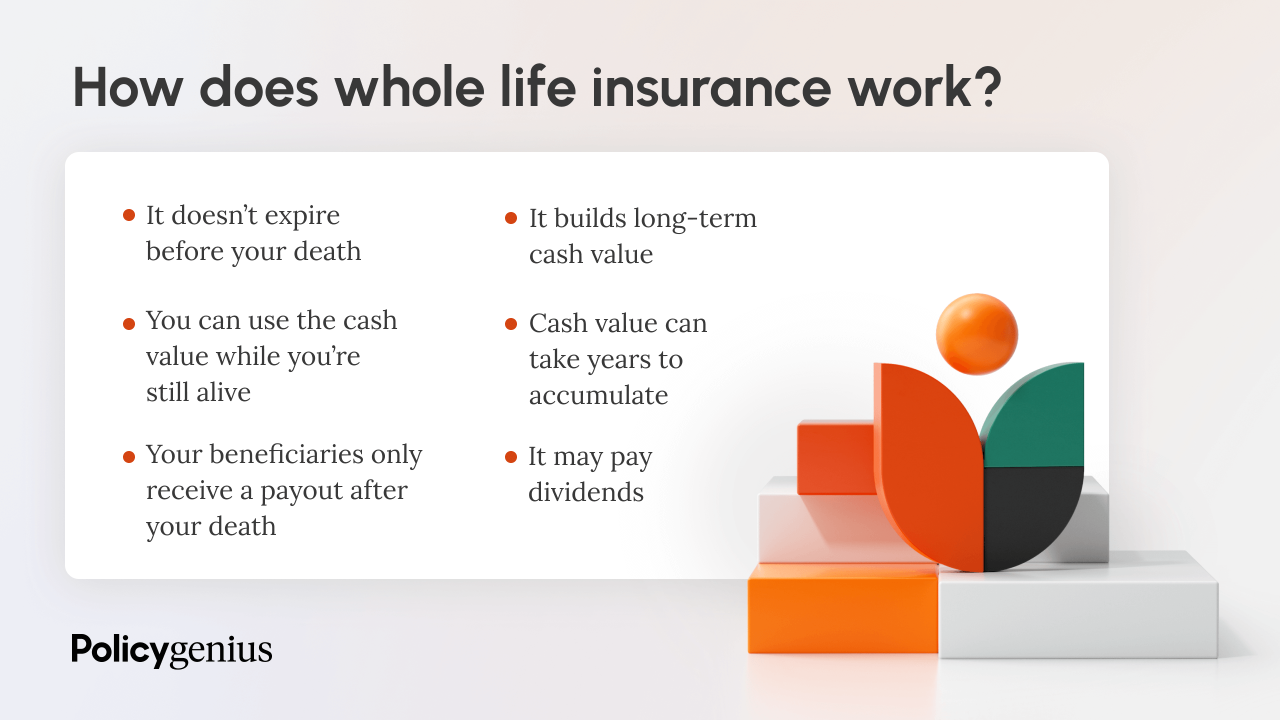

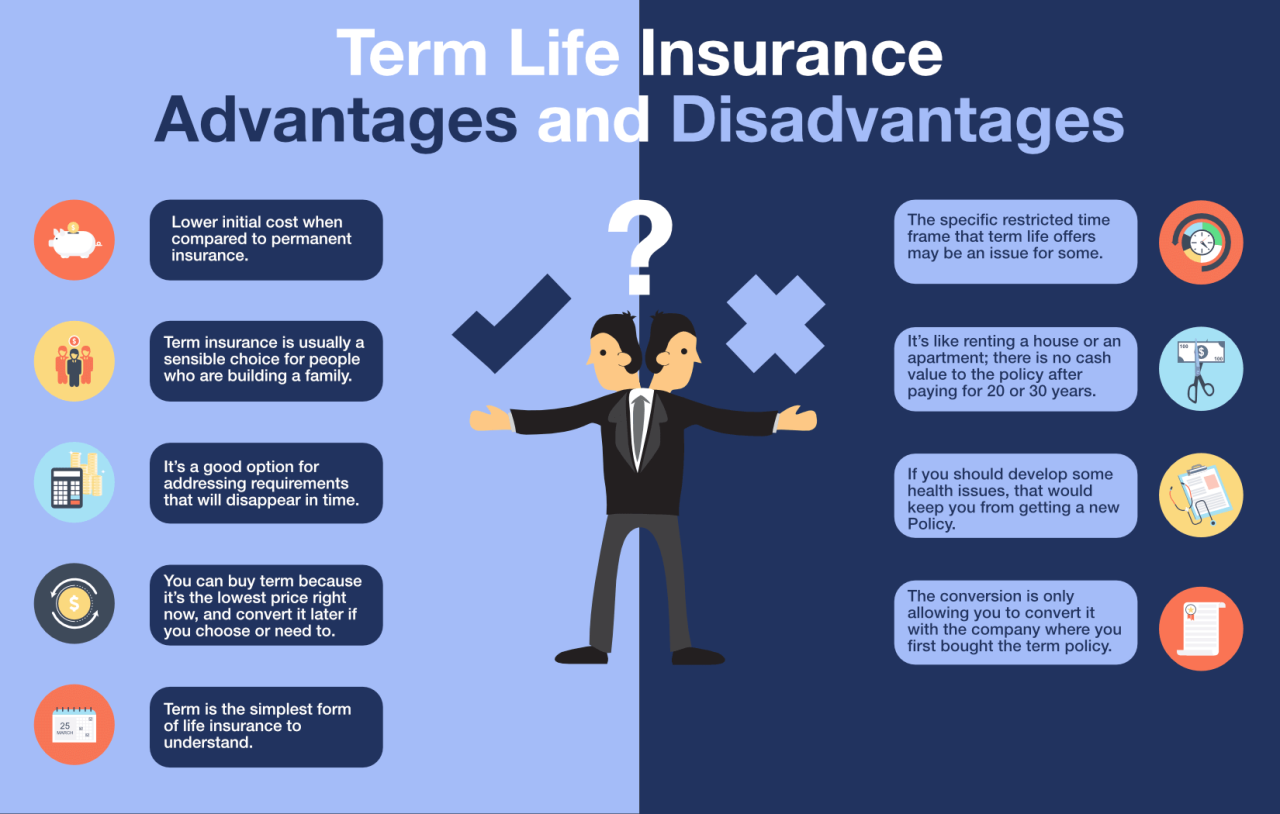

What is the difference between term and whole life insurance?

Term life insurance provides coverage for a specific period (term), while whole life insurance offers lifelong coverage and builds cash value.

How much life insurance do I need?

The amount depends on your income, debts, dependents, and desired lifestyle for your family after your passing. Financial advisors can help determine this.

Can I change my beneficiaries?

Yes, most policies allow you to change beneficiaries as needed. Check your policy documents for specific instructions.

What happens if I don’t pay my premiums?

Failure to pay premiums can lead to policy lapse, meaning your coverage ends. Grace periods and reinstatement options may be available depending on your policy.