Is Forex market open now? The Forex market, often referred to as the foreign exchange market, operates 24 hours a day, five days a week, making it a truly global marketplace. This constant activity is fueled by the continuous flow of currency transactions between individuals, businesses, and governments worldwide. This non-stop trading environment offers both opportunities and challenges for traders, as they navigate the complexities of global market dynamics.

Understanding the intricacies of Forex market hours is crucial for traders, as it directly impacts trading strategies, liquidity levels, and overall market volatility. This article delves into the details of Forex market hours, providing insights into trading sessions, liquidity variations, and the impact of these factors on trading decisions.

Forex Market Basics: Is Forex Market Open Now

The Forex market, also known as the foreign exchange market, is the largest and most liquid financial market in the world. It is a global marketplace where currencies are traded, enabling individuals, businesses, and governments to exchange one currency for another. The Forex market operates 24 hours a day, five days a week, making it accessible to traders from all around the globe.

The 24-Hour Nature of the Forex Market

The Forex market’s continuous operation is due to its decentralized nature. It is not located in a single physical location, but rather exists as a network of banks, financial institutions, and individual traders connected electronically. This global network ensures that there is always someone ready to buy or sell a currency, regardless of the time of day.

Trading Sessions and Their Respective Time Zones

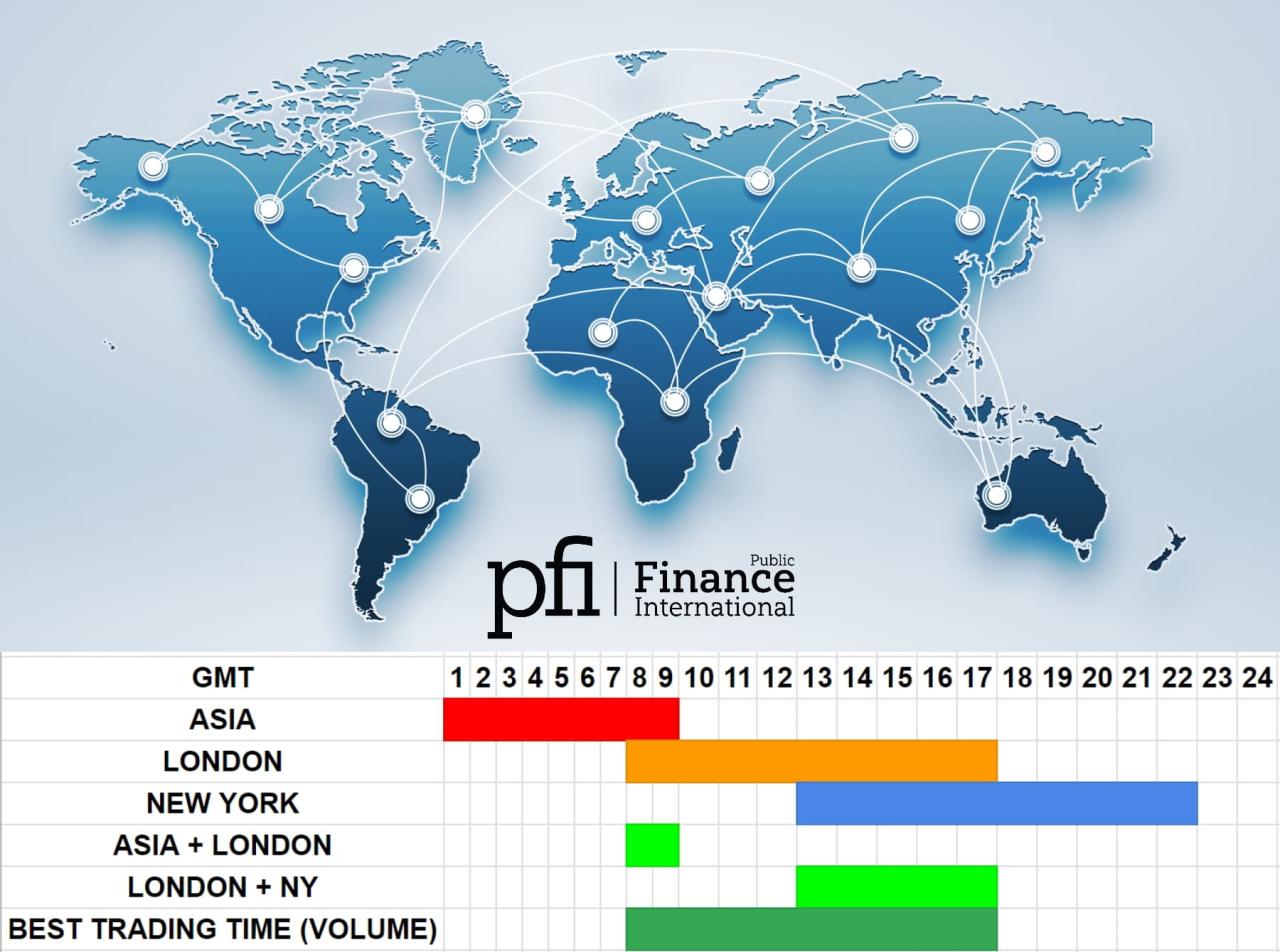

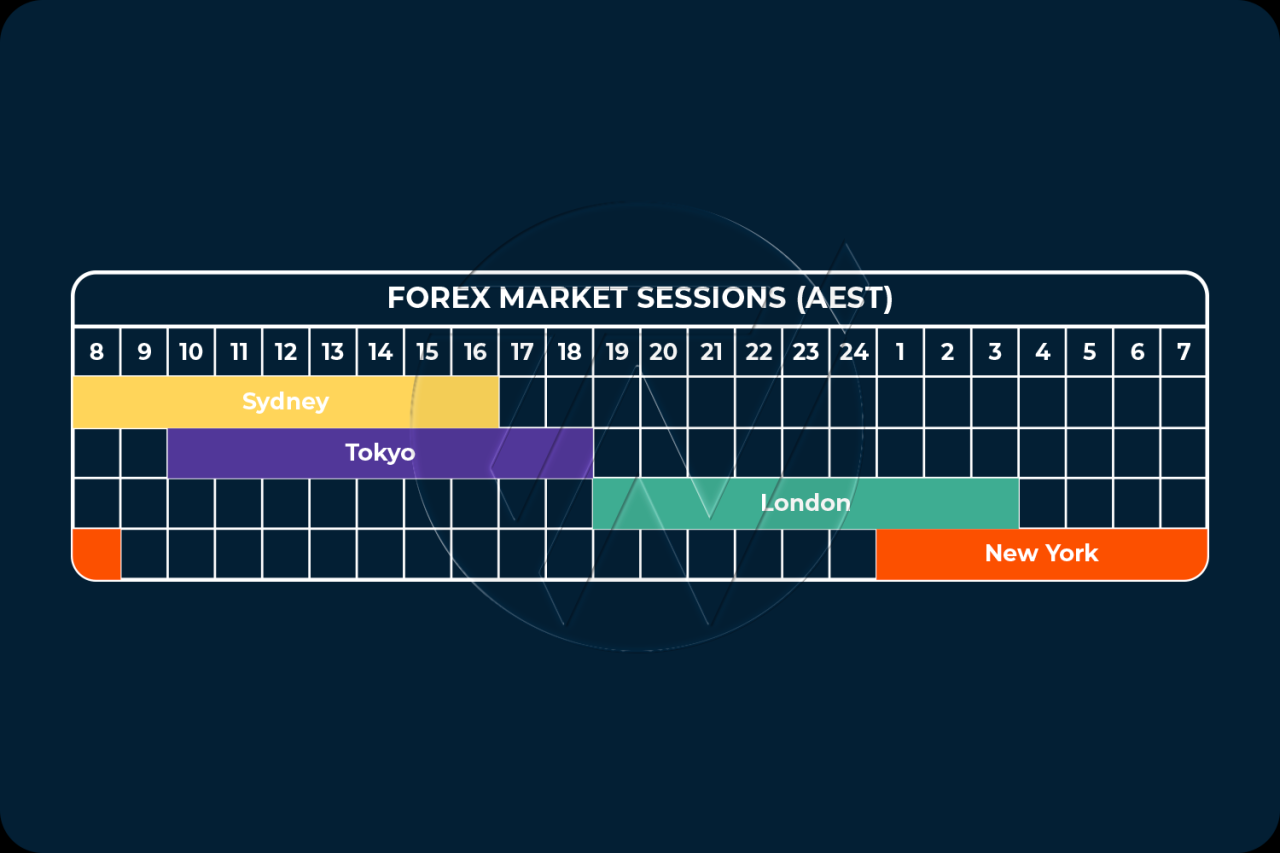

The Forex market can be divided into different trading sessions, each corresponding to the business hours of major financial centers around the world. These sessions are:

- Sydney Session: The Sydney session is the first to open, starting at 5:00 PM EST on Sunday and ending at 2:00 AM EST on Monday. It is influenced by the economic activities of Australia and New Zealand.

- Tokyo Session: The Tokyo session opens at 7:00 PM EST on Sunday and closes at 4:00 AM EST on Monday. It is driven by the economic activities of Japan and other Asian countries.

- London Session: The London session is the most active and influential session, opening at 3:00 AM EST and closing at 12:00 PM EST. It is driven by the economic activities of the United Kingdom and Europe.

- New York Session: The New York session overlaps with the London session and opens at 8:00 AM EST and closes at 5:00 PM EST. It is driven by the economic activities of the United States and North America.

The overlap between these sessions creates opportunities for traders to capitalize on price movements driven by various global events and economic data releases.

Trading Hours

The Forex market is open 24 hours a day, five days a week, from Sunday evening to Friday evening. This global nature of the Forex market means that it is always open somewhere in the world. The trading hours of the major Forex markets are determined by the business days and hours of the financial institutions located in those regions.

Trading Hours of Major Forex Markets, Is forex market open now

The following table summarizes the trading hours of the major Forex markets:

| Market | Trading Hours |

|—|—|

| Sydney | Sunday 5:00 PM – Friday 4:00 PM (GMT) |

| Tokyo | Monday 1:00 AM – Friday 12:00 PM (GMT) |

| London | Monday 8:00 AM – Friday 5:00 PM (GMT) |

| New York | Monday 1:00 PM – Friday 8:00 PM (GMT) |

Factors Influencing Trading Hours

Several factors influence the opening and closing times of the Forex market.

- Business Hours of Financial Institutions: The trading hours of the Forex market are largely determined by the business hours of the financial institutions located in the major trading centers. For example, the New York Forex market typically opens when the New York Stock Exchange opens and closes when the New York Stock Exchange closes.

- Market Liquidity: The Forex market is most liquid when multiple major trading centers are open. This is because there are more buyers and sellers active in the market, making it easier to execute trades.

- Economic News Releases: Major economic news releases, such as employment reports and interest rate decisions, can significantly impact the Forex market. These releases often occur during the trading hours of the major trading centers, which can increase trading activity and volatility.

Market Holidays

Market holidays can significantly impact trading hours. When a major trading center is closed for a holiday, the Forex market may be less active or even closed altogether. For example, the New York Forex market is closed on US federal holidays, such as Thanksgiving and Christmas.

Market Liquidity

Market liquidity is a crucial aspect of forex trading, representing the ease with which traders can buy or sell a currency pair at the current market price. It directly influences the ability to execute trades quickly and efficiently, impacting both profit potential and risk management.

Relationship Between Market Liquidity and Trading Hours

Market liquidity is closely tied to trading hours. During periods of high trading activity, like the overlap between major trading sessions, liquidity is generally high. Conversely, during periods of low trading activity, such as weekends or holidays, liquidity tends to be lower.

Liquidity Levels During Different Trading Sessions

- London Session (GMT: 8:00 AM – 4:00 PM): This session typically sees high liquidity due to the presence of major European banks and institutional investors.

- New York Session (GMT: 1:00 PM – 9:00 PM): The New York session overlaps with the London session, resulting in a significant increase in liquidity as major US banks and institutions join the market.

- Tokyo Session (GMT: 7:00 PM – 4:00 AM): While the Tokyo session has lower liquidity compared to the London and New York sessions, it still attracts a considerable volume of trading activity from Asian institutions and retail traders.

- Asian Session (GMT: 7:00 PM – 4:00 AM): This session, encompassing countries like Japan, Australia, and Singapore, experiences lower liquidity compared to the London and New York sessions.

Impact of Low Liquidity on Trading Strategies

Low liquidity can pose challenges for traders.

- Wider Spreads: With fewer market participants, the difference between the bid and ask price (spread) can widen, increasing trading costs.

- Slippage: Slippage occurs when a trade is executed at a price different from the expected price due to a lack of available orders at the desired price level.

- Difficulty in Entering and Exiting Trades: It may be challenging to enter or exit positions quickly, especially during periods of low liquidity.

- Increased Volatility: Low liquidity can lead to amplified price fluctuations as even small orders can have a significant impact on the market.

Impact on Trading

Knowing the Forex market hours is crucial for making informed trading decisions. It influences your trading strategies, risk management, and overall approach to the market.

Trading Strategies Leveraging Different Market Sessions

Understanding the different market sessions and their characteristics can be leveraged to develop effective trading strategies.

- Scalping: This strategy focuses on profiting from small price fluctuations, often during periods of high volatility like the London and New York sessions overlap. Scalpers aim for quick profits by entering and exiting trades frequently.

- News Trading: Major economic announcements, like interest rate decisions or employment data, can significantly impact currency prices. Traders often capitalize on the volatility during these events, but it requires careful analysis and risk management.

- Swing Trading: This strategy involves holding positions for a few days or weeks, aiming to capture larger price swings. Swing traders often focus on the Asian session, which tends to be less volatile and allows for longer-term trend identification.

Market Volatility and Trading Hours

Market volatility varies significantly across different sessions.

- High Volatility: The London and New York sessions, with their high trading volume and participation from major financial institutions, typically experience greater volatility. This can present opportunities for scalping or news trading but also increases the risk of sudden price movements.

- Lower Volatility: The Asian session, with fewer active traders and lower volume, often exhibits lower volatility. This can be advantageous for swing traders seeking to identify long-term trends and reduce risk.

It’s essential to understand that market volatility is a double-edged sword. While it can offer profitable trading opportunities, it also increases the risk of significant losses.

Resources for Market Information

Staying informed about the Forex market is crucial for making sound trading decisions. Real-time market information helps you understand current trends, market sentiment, and potential trading opportunities.

Reputable Websites and Tools

Numerous resources provide real-time Forex market information. Here are some reputable websites and tools you can utilize:

- Trading Platforms: Most reputable Forex brokers offer advanced trading platforms that provide real-time market data, charts, news feeds, and analytical tools.

- Financial News Websites: Websites like Bloomberg, Reuters, and Investing.com provide up-to-the-minute news, analysis, and market data. These websites often have dedicated Forex sections with detailed information on currency pairs, economic indicators, and market sentiment.

- Economic Calendars: Economic calendars, such as those found on Trading Economics or Forex Factory, list upcoming economic releases, which can significantly impact currency movements. These calendars often include forecasts and past data, allowing you to analyze potential market reactions.

- Forex Market Data Providers: Specialized Forex data providers like FXCM, Dukascopy, and FXStreet offer comprehensive market data, including live quotes, charts, technical indicators, and historical data.

Wrap-Up

The Forex market’s continuous operation presents a unique trading landscape. By understanding the intricacies of trading hours, liquidity fluctuations, and market volatility, traders can make informed decisions and capitalize on the opportunities offered by this global marketplace. Armed with the knowledge of Forex market hours, traders can navigate the complexities of this dynamic environment and maximize their trading potential.

FAQs

What is the best time to trade Forex?

The best time to trade Forex depends on your individual trading strategy and risk tolerance. Some traders prefer high-volume periods like the London and New York sessions, while others favor the quieter Asian sessions.

What are the major Forex trading sessions?

The major Forex trading sessions are the Sydney, Tokyo, London, and New York sessions, each with its own unique characteristics and trading volumes.

How can I find real-time Forex market information?

You can find real-time Forex market information from reputable sources like TradingView, FXStreet, and Investing.com. These platforms provide charts, news, and analysis tools to help you stay informed.