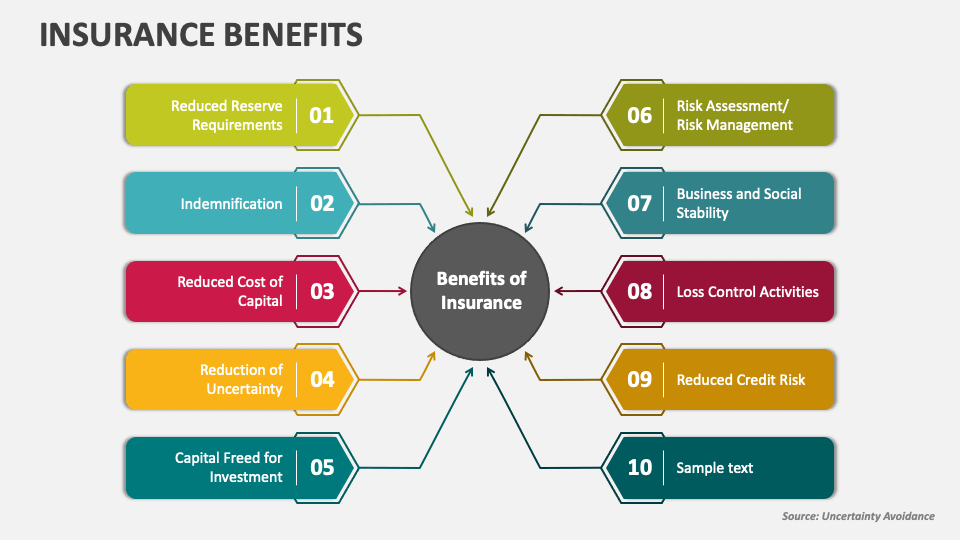

Insurance benefits and features are crucial for financial security, offering protection against unforeseen events. Understanding the various types of insurance—health, life, auto, and home—and their associated benefits is essential for informed decision-making. This exploration delves into policy features like deductibles, premiums, and co-pays, clarifying their significance in managing risk and cost. We’ll also examine optional riders, the claims process, and the long-term financial implications of securing the right coverage.

This comprehensive guide aims to equip you with the knowledge to navigate the complexities of insurance, empowering you to choose plans that align with your individual needs and financial goals. From comparing different policy types to understanding the value proposition of various coverage options, we strive to provide a clear and accessible understanding of this critical aspect of personal finance.

Types of Insurance Benefits

Insurance provides a financial safety net against unforeseen events. Understanding the various types of insurance and their associated benefits is crucial for effective risk management and financial security. Different policies offer protection across a wide spectrum of potential losses, from health emergencies to property damage.

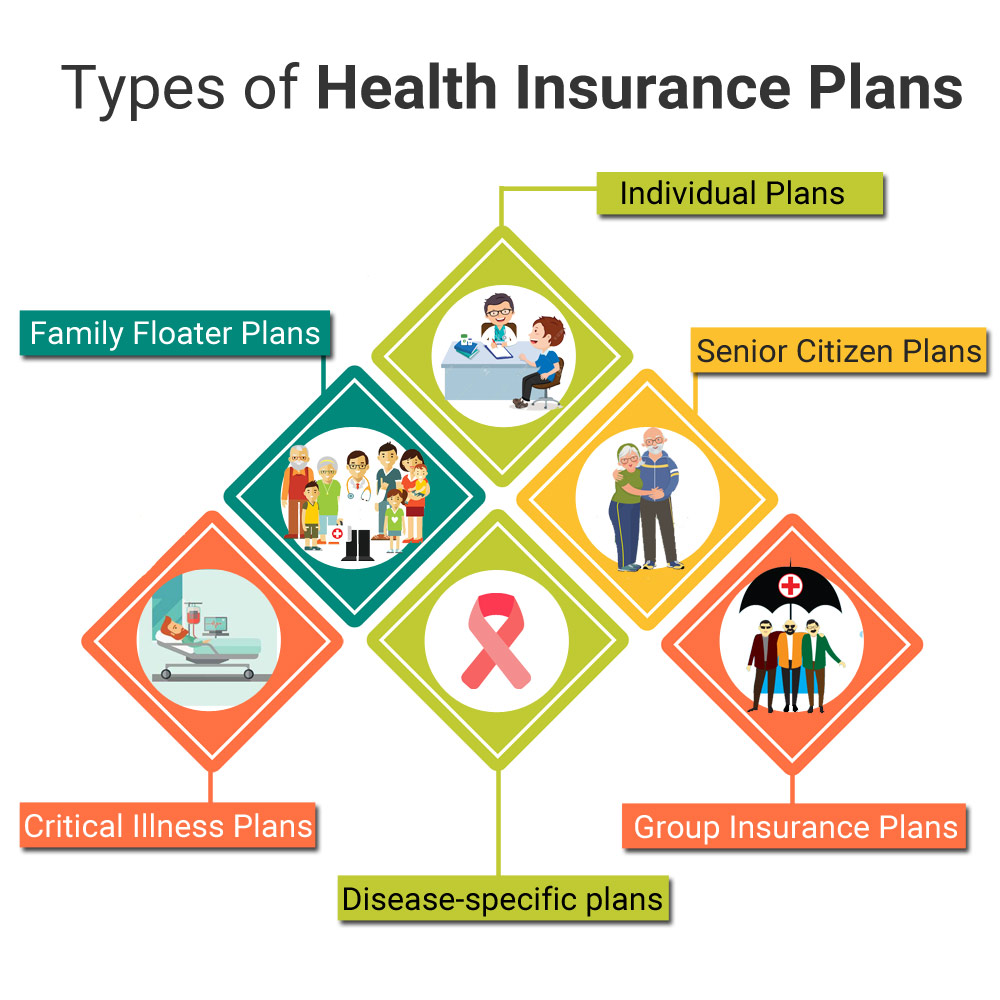

Health Insurance Benefits

Health insurance covers medical expenses, helping individuals and families manage the costs of illness or injury. Common benefits include doctor visits, hospital stays, surgeries, prescription drugs, and diagnostic tests. Some plans also offer preventative care, such as annual checkups and vaccinations, to help maintain good health and avoid costly future treatments. Dental and vision coverage are often included as supplemental benefits within comprehensive health plans.

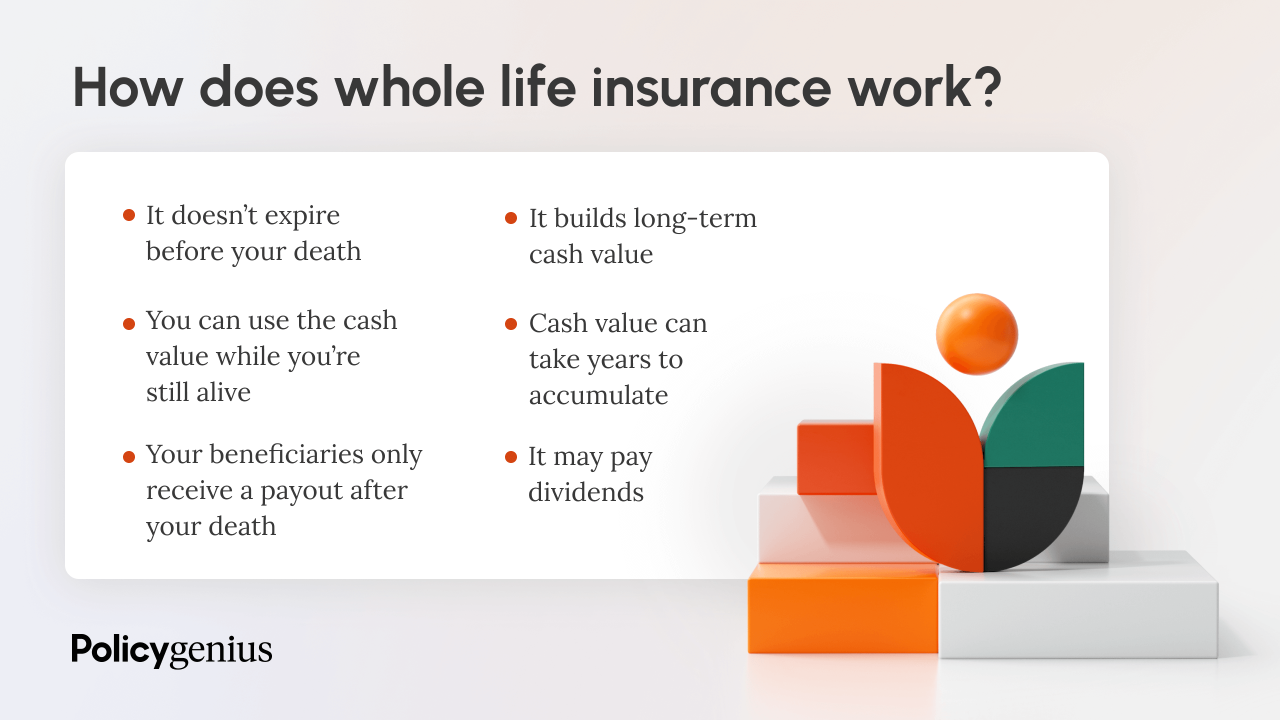

Life Insurance Benefits

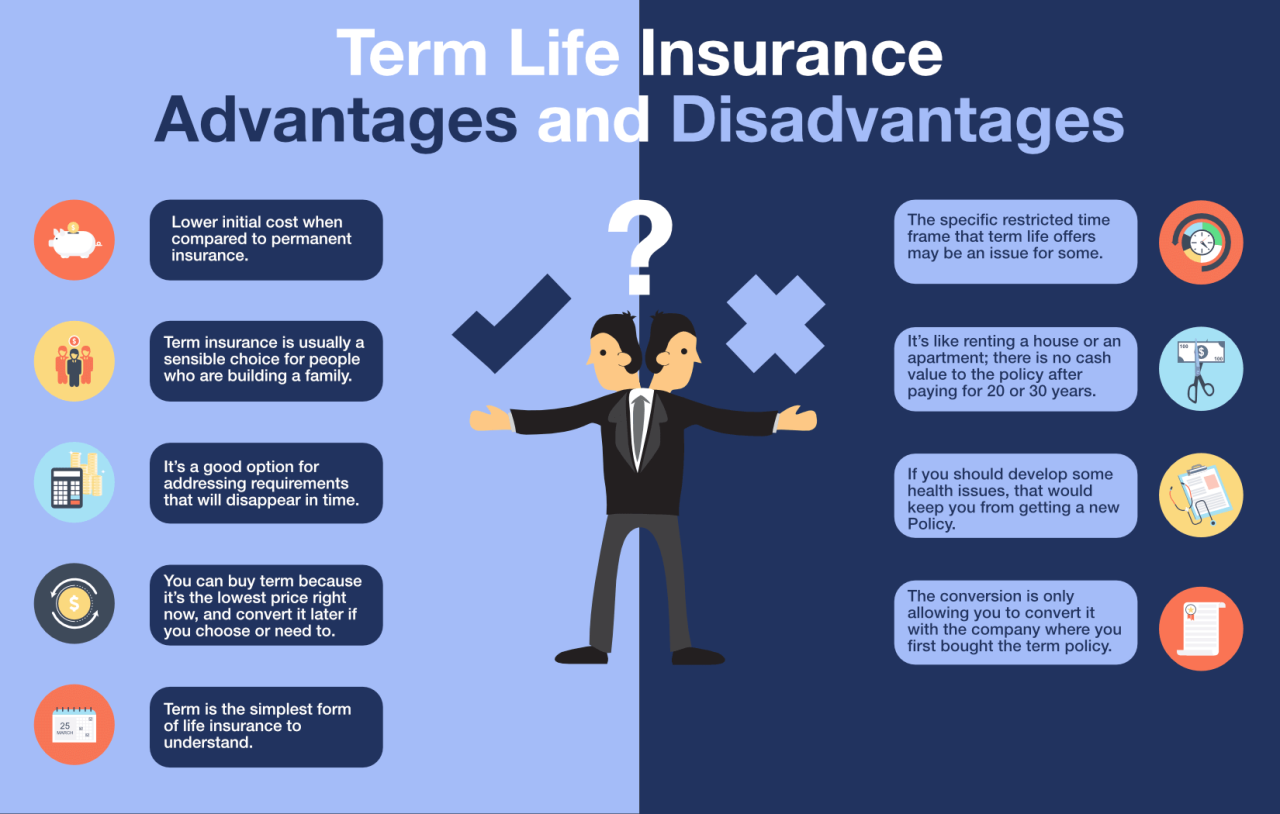

Life insurance provides a financial payout upon the death of the insured individual. This payout, also known as a death benefit, can help cover funeral expenses, outstanding debts, and provide financial support for surviving dependents. There are various types of life insurance, including term life insurance (covering a specific period), whole life insurance (offering lifelong coverage), and universal life insurance (providing flexibility in premium payments and death benefit amounts). Some policies also include additional riders offering benefits like accidental death coverage or long-term care benefits.

Auto Insurance Benefits

Auto insurance protects against financial losses resulting from car accidents. Common benefits include coverage for vehicle repairs or replacement, medical expenses for injuries sustained in an accident, and liability coverage to pay for damages caused to other people or their property. Comprehensive coverage may extend to damage from events such as theft, vandalism, or natural disasters. Uninsured/underinsured motorist coverage protects against drivers without sufficient insurance.

Home Insurance Benefits

Home insurance protects homeowners from financial losses related to damage or destruction of their property. This typically includes coverage for damage caused by fire, storms, vandalism, or other unforeseen events. Liability coverage protects against lawsuits if someone is injured on the homeowner’s property. Some policies also offer additional benefits such as coverage for personal belongings, temporary living expenses if the home becomes uninhabitable, and loss of use coverage.

Comparison of Health Insurance Plans

Understanding the differences between various health insurance plans is key to choosing the right coverage. The following table compares three major types: HMO (Health Maintenance Organization), PPO (Preferred Provider Organization), and POS (Point of Service).

| Feature | HMO | PPO | POS |

|---|---|---|---|

| Network | Restricted network of doctors and hospitals | Larger network of doctors and hospitals | Combination of HMO and PPO; larger network than HMO, but with some restrictions |

| Cost | Generally lower premiums, but higher out-of-pocket costs if you go outside the network | Generally higher premiums, but more flexibility and lower out-of-pocket costs within the network | Premiums and out-of-pocket costs fall between HMO and PPO |

| Referrals | Usually require referrals from primary care physician to see specialists | Generally do not require referrals | May require referrals depending on the plan and provider |

| Flexibility | Less flexibility in choosing doctors and hospitals | More flexibility in choosing doctors and hospitals | Moderate flexibility |

Understanding Policy Features

Insurance policies, while sometimes complex, are built upon a foundation of key components that determine your coverage and costs. Understanding these features is crucial for making informed decisions and ensuring you have the right protection. This section will clarify the typical components of an insurance policy and explain the significance of key terms.

Policy Components

A standard insurance policy typically includes a declarations page summarizing your coverage details, a definitions section clarifying key terms used throughout the policy, a description of your coverage, outlining what is and isn’t covered, and a section detailing exclusions and limitations. The policy will also include information about how to file a claim, and contact details for your insurer. Finally, it will contain conditions and stipulations that must be met for coverage to be valid. Failure to comply with these conditions can impact your ability to receive benefits.

Deductibles, Premiums, and Co-pays

Deductibles, premiums, and co-pays are fundamental elements influencing the cost and coverage of your insurance. The premium is the regular payment you make to maintain your insurance coverage. The deductible is the amount you must pay out-of-pocket before your insurance coverage begins to pay for claims. A higher deductible typically results in a lower premium, and vice versa. A co-pay is a fixed amount you pay for a covered healthcare service at the time of service. For example, a $25 co-pay for a doctor’s visit means you pay $25, and your insurance covers the remaining costs.

Term Life Insurance versus Whole Life Insurance

Term life insurance and whole life insurance offer distinct features catering to different needs. Term life insurance provides coverage for a specific period (the term), such as 10, 20, or 30 years. It is generally more affordable than whole life insurance, making it a suitable option for those needing temporary coverage, such as paying off a mortgage. Whole life insurance, conversely, provides lifelong coverage, accumulating cash value that grows over time. While more expensive than term life insurance, it offers both death benefit protection and a savings component. The choice depends on your financial goals and risk tolerance.

Auto Insurance Coverage Comparison

The following table Artikels key differences between common types of auto insurance coverage:

| Coverage Type | What it Covers | Typical Deductible | Notes |

|---|---|---|---|

| Liability | Damages to others’ property or injuries to others caused by you | Varies by policy | Legally required in most jurisdictions |

| Collision | Damage to your vehicle in an accident, regardless of fault | Varies by policy | Often optional, but highly recommended |

| Comprehensive | Damage to your vehicle from non-collision events (e.g., theft, vandalism, hail) | Varies by policy | Often optional, but useful for protecting against unforeseen damage |

| Uninsured/Underinsured Motorist | Injuries or damages caused by an uninsured or underinsured driver | Varies by policy | Protects you in accidents involving at-fault drivers without sufficient coverage |

Benefits and Riders

Insurance policies offer core benefits, but their coverage can often be enhanced through the addition of riders. These optional add-ons provide extra protection against specific risks, tailoring the policy to individual needs and circumstances. Understanding the benefits and limitations of riders is crucial for maximizing the value of your insurance coverage.

Types of Insurance Riders

Numerous riders are available, depending on the type of insurance policy. Common examples include accidental death and dismemberment riders (for life insurance), critical illness riders (for life insurance and health insurance), and waiver of premium riders (for various insurance types). The availability of specific riders will vary by insurer and policy.

Benefits of Adding Riders

Adding riders significantly expands the scope of your insurance coverage. For example, a critical illness rider provides a lump-sum payment upon diagnosis of a specified critical illness, offering financial assistance during a difficult time. A waiver of premium rider ensures that your premiums are waived if you become disabled, preventing policy lapse due to unforeseen circumstances. This enhanced protection offers peace of mind and financial security.

Limitations of Adding Riders

While riders enhance coverage, they come with an additional cost. The premium for your policy will increase when you add a rider. Also, riders typically have specific terms and conditions, including exclusions and limitations on coverage. It’s essential to carefully review the rider’s terms and conditions before adding it to your policy to understand the extent of the added coverage and any potential limitations.

Illustrative Scenario: The Value of a Waiver of Premium Rider

Imagine a scenario where Sarah, a 35-year-old teacher, purchases a life insurance policy with a waiver of premium rider. Unfortunately, a year later, Sarah is involved in an accident that leaves her permanently disabled. Without the waiver of premium rider, Sarah would be unable to continue paying her life insurance premiums, potentially leading to the lapse of her policy. However, because of the rider, her premiums are waived, ensuring her family maintains the crucial life insurance coverage throughout her disability. This demonstrates the significant value a seemingly small addition like a rider can provide during unexpected hardship.

Claims Process and Procedures: Insurance Benefits And Features

Filing an insurance claim can seem daunting, but understanding the process can significantly ease the experience. This section Artikels the steps involved, necessary documentation, effective communication strategies, and examples of common claim scenarios. Remember, prompt and accurate communication is key to a smooth claims resolution.

Step-by-Step Claim Filing Guide

The claims process typically involves several key steps. Following these steps diligently will help ensure your claim is processed efficiently.

- Report the Incident: Immediately report the incident to your insurance company, usually via phone or online portal. Note the claim reference number provided.

- Gather Necessary Documentation: Compile all relevant documents, such as police reports (for accidents), medical records (for health claims), repair estimates (for property damage), and photos of the damage.

- Submit Your Claim: Submit your claim using the designated method (online portal, mail, or fax). Ensure all required documentation is included.

- Follow Up: Follow up on your claim’s progress with your insurance company after a reasonable timeframe. Keep records of all communication.

- Review the Settlement: Carefully review the settlement offer from your insurance company and negotiate if necessary. Understand your policy coverage and limitations.

Required Documentation for Different Claim Types

The type of claim directly impacts the necessary documentation. Failing to provide complete documentation can delay the process.

- Auto Accident Claims: Police report, photos of vehicle damage, driver’s licenses and insurance information of all parties involved, medical records (if injuries occurred).

- Homeowners Claims (e.g., fire, theft): Police report (for theft or vandalism), photos and videos of damage, repair estimates, proof of ownership.

- Health Insurance Claims: Medical bills, doctor’s notes, explanation of benefits (EOB) from the healthcare provider.

- Travel Insurance Claims: Flight itinerary, hotel confirmation, medical records (if applicable), police report (if applicable), receipts for expenses incurred.

Effective Communication with the Insurance Company, Insurance benefits and features

Maintaining clear and consistent communication is crucial. This includes promptly responding to requests for information and keeping accurate records.

Be polite and professional in all your interactions. Clearly and concisely explain the situation, referencing your claim number in all correspondence. Keep copies of all documents submitted and maintain a detailed record of all phone calls and emails.

Examples of Common Claim Scenarios and Resolutions

Understanding common claim scenarios and their resolutions can help manage expectations.

Scenario 1: Minor Car Accident with Minimal Damage: A fender bender with no injuries might only require a police report and photos of the damage. The insurance company might process the claim quickly, leading to a straightforward repair or settlement.

Scenario 2: Major Home Fire with Significant Damage: A house fire would require extensive documentation, including a police report, photos/videos of the damage, detailed inventory of lost possessions, and multiple repair estimates. This claim will likely take longer to process due to the complexity and scale of the damage.

Scenario 3: Denied Health Insurance Claim: A denied health insurance claim might require additional documentation, such as clarification from the healthcare provider regarding the procedure’s necessity or medical necessity documentation. Appealing the denial may involve further communication with the insurance company and potentially an independent review.

Cost and Value of Insurance Benefits

Choosing an insurance plan involves careful consideration of both cost and coverage. Understanding the relationship between premiums, benefits, and long-term financial security is crucial for making informed decisions. This section explores the various factors influencing insurance costs and illustrates the potential financial value of insurance protection.

Factors Influencing Insurance Premiums

Several factors contribute to the overall cost of insurance premiums. These include the type of coverage, the amount of coverage, the insured’s age and health status, location, and claims history. For example, a comprehensive health insurance plan with low deductibles will generally be more expensive than a high-deductible plan with a lower premium. Similarly, individuals living in areas with high healthcare costs or those with pre-existing health conditions may face higher premiums. Driving history significantly impacts auto insurance premiums; a driver with multiple accidents or traffic violations will pay considerably more than a driver with a clean record.

Comparison of Insurance Plan Costs

The cost of insurance varies significantly depending on the plan’s coverage level. Below is a simplified comparison of three hypothetical health insurance plans:

| Plan Type | Monthly Premium | Annual Deductible | Out-of-Pocket Maximum |

|---|---|---|---|

| Bronze Plan (High Deductible) | $200 | $6,000 | $8,000 |

| Silver Plan (Moderate Deductible) | $400 | $3,000 | $5,000 |

| Gold Plan (Low Deductible) | $600 | $1,000 | $3,000 |

Note: These are hypothetical examples and actual costs will vary based on location, provider, and individual circumstances.

Potential Cost Savings of Insurance

Insurance provides a financial safety net against unexpected events. The table below illustrates potential cost savings in various scenarios:

| Scenario | Cost Without Insurance | Cost With Insurance (Gold Plan Example) | Savings |

|---|---|---|---|

| Minor Car Accident (Damage: $1,500) | $1,500 | $500 (deductible) | $1,000 |

| Major Medical Emergency (Hospitalization: $50,000) | $50,000 | $3,000 (out-of-pocket maximum) | $47,000 |

| Home Fire Damage ($20,000) | $20,000 | Assumes coverage, cost varies depending on policy specifics | Potentially $20,000 or more depending on coverage |

Note: This table provides illustrative examples. Actual costs and savings will depend on the specifics of the insurance policy and the nature of the event.

Long-Term Financial Value of Insurance Benefits

The long-term financial value of insurance lies in its ability to mitigate significant financial risks. For example, a long-term disability insurance policy can replace a portion of your income if you become unable to work due to illness or injury, preventing financial ruin. Life insurance provides financial security for your dependents in the event of your death, allowing them to maintain their lifestyle and cover expenses like mortgages and education costs. Similarly, comprehensive health insurance protects against the potentially crippling costs of major illnesses or accidents, allowing you to focus on recovery rather than financial burden. The peace of mind offered by knowing you are financially protected against unforeseen events is a significant long-term benefit.

Impact of Insurance on Financial Planning

Insurance plays a crucial role in bolstering overall financial security and achieving long-term financial goals. By mitigating the risk of unexpected financial burdens, insurance provides a safety net that allows individuals and families to navigate life’s uncertainties with greater confidence. A comprehensive insurance plan is a cornerstone of a robust financial strategy.

Insurance benefits contribute significantly to overall financial security by offering protection against a wide range of potential financial losses. This protection allows individuals and families to maintain their financial stability even in the face of unforeseen events, such as accidents, illnesses, or property damage. The peace of mind provided by insurance allows for better focus on long-term financial planning without the constant worry of catastrophic financial setbacks.

Protection Against Unexpected Financial Burdens

Unexpected events, such as serious illnesses, accidents, or natural disasters, can lead to substantial financial burdens. Medical expenses alone can quickly deplete savings and leave individuals and families facing significant debt. Homeowner’s insurance protects against property damage from fire, theft, or natural disasters, preventing the devastating financial consequences of rebuilding or replacing a home. Similarly, auto insurance covers liability and damages in accidents, preventing financial ruin from lawsuits or repair costs. Life insurance provides a financial safety net for dependents in the event of the policyholder’s death, ensuring their continued financial support. Disability insurance replaces a portion of lost income during periods of disability, ensuring financial stability during a time of reduced earning capacity.

Support for Long-Term Financial Goals

Insurance can actively support the achievement of long-term financial goals. For example, life insurance can ensure that children’s education expenses are covered even after the death of a parent. Long-term care insurance can protect assets from being depleted by the high cost of long-term care, allowing individuals to maintain their financial independence in their later years. Having adequate insurance coverage frees up financial resources that can be allocated towards other goals, such as retirement savings, investments, or paying off debt, fostering a more proactive and efficient approach to financial planning.

Risk Mitigation Through Insurance

Insurance operates fundamentally by mitigating risk. Risk is the possibility of an adverse event causing financial loss. Insurance transfers that risk from the individual to the insurance company, who pools risk across many policyholders to manage and distribute potential losses. This transfer of risk reduces the impact of unforeseen events on the individual’s financial well-being. By paying premiums, individuals gain access to a safety net that protects them from the potentially catastrophic financial consequences of various risks, allowing for a more secure financial future. The cost of insurance premiums is generally far less than the potential cost of the insured event, making it a financially prudent decision for most individuals and families.

Choosing the Right Insurance Plan

Selecting the appropriate insurance plan is a crucial decision impacting your financial well-being and security. A thoughtful approach, considering various factors and carefully comparing options, is essential to ensure you receive adequate coverage at a reasonable cost. This section will guide you through the process of making an informed choice.

Key Factors in Insurance Plan Selection

Several critical factors must be considered when choosing an insurance plan. These factors often interact, requiring a holistic assessment of your individual needs and circumstances. Understanding these elements empowers you to make a well-informed decision.

- Coverage Needs: Determine the level of coverage required for your specific circumstances. This includes factors like the amount of life insurance needed based on dependents and outstanding debts, the desired health insurance coverage considering pre-existing conditions and medical history, or the property value and liability considerations for homeowner’s or renter’s insurance.

- Budget and Affordability: Insurance premiums vary widely depending on factors like age, health status, location, and coverage level. Establish a realistic budget and compare premiums from different providers to find plans within your financial capabilities. Consider the trade-off between premium cost and coverage amount.

- Policy Terms and Conditions: Carefully review the policy documents, paying close attention to exclusions, limitations, and waiting periods. Understanding these aspects ensures you are aware of any potential gaps in coverage.

- Reputation and Financial Stability of the Insurer: Research the financial strength and reputation of the insurance company. Check independent rating agencies’ assessments to gauge their long-term viability and ability to pay claims.

- Customer Service and Claims Process: A responsive and efficient claims process is vital. Investigate the insurer’s customer service reputation and the ease of filing and processing claims.

Questions to Ask When Comparing Insurance Options

Before committing to an insurance plan, it’s vital to thoroughly investigate your options. Asking the right questions will help you identify the best fit for your needs.

- What specific benefits and coverages are included in the plan?

- What are the premiums, and how are they calculated?

- Are there any exclusions or limitations on coverage?

- What is the claims process, and how long does it typically take to process a claim?

- What is the insurer’s financial stability rating?

- What are the customer service options available?

- What are the policy renewal terms and conditions?

- Are there any discounts or special offers available?

Understanding Policy Language and Terminology

Insurance policies often contain complex terminology. Familiarizing yourself with common terms will enhance your understanding and ability to make informed decisions.

For example, a deductible is the amount you pay out-of-pocket before your insurance coverage begins. A copay is a fixed amount you pay for a covered healthcare service, while coinsurance is the percentage of costs you share with your insurer after meeting your deductible. Understanding these terms is crucial for accurately assessing the overall cost of a policy.

Influence of Needs and Circumstances on Insurance Choices

Individual circumstances significantly influence insurance choices. For example, a young, healthy individual might opt for a high-deductible health plan to save on premiums, while a family with young children might prioritize comprehensive coverage despite higher costs. Similarly, a homeowner in a high-risk area might require higher liability coverage compared to someone in a low-risk area. A person with a significant amount of debt might need a larger life insurance policy than someone with minimal debt.

Final Wrap-Up

Ultimately, understanding insurance benefits and features empowers individuals to make informed choices that safeguard their financial well-being. By carefully considering the various types of coverage, policy features, and the claims process, individuals can build a robust financial plan that mitigates risk and protects against unforeseen circumstances. Proactive planning and a clear understanding of insurance options are key to achieving long-term financial security.

Q&A

What is a deductible?

A deductible is the amount you pay out-of-pocket before your insurance coverage kicks in.

What is a premium?

A premium is the regular payment you make to maintain your insurance coverage.

What is a co-pay?

A co-pay is a fixed amount you pay for a covered healthcare service.

How long does a claim typically take to process?

Processing times vary depending on the insurer and the complexity of the claim, but it can range from a few days to several weeks.

What if I disagree with my insurance company’s decision on a claim?

Most insurance policies Artikel an appeals process. You should contact your insurer and review your policy for details.