Hedging Forex, a strategic approach to managing currency risk, empowers traders and investors to navigate the volatile world of foreign exchange markets. Whether you’re an individual planning a trip abroad, a business engaging in international trade, or an investor seeking to diversify your portfolio, understanding forex hedging can significantly impact your financial well-being. This guide delves into the concept, strategies, and practical applications of forex hedging, providing you with the knowledge to make informed decisions and potentially mitigate losses in the face of fluctuating exchange rates.

Forex hedging involves taking a position that offsets potential losses from an existing position in a different currency. Think of it as an insurance policy against unfavorable currency movements. By employing hedging strategies, traders can minimize the impact of currency fluctuations on their profits or investments. This can be particularly valuable in times of economic uncertainty or when dealing with currencies that are known for their volatility.

Understanding Forex Hedging

Forex hedging is a strategy employed by traders to mitigate potential losses arising from fluctuations in exchange rates. It involves taking an offsetting position in the forex market to counterbalance the risk associated with an existing position. In essence, hedging aims to minimize the impact of adverse price movements, providing a safety net for traders.

Reasons for Hedging Forex Positions

Traders engage in forex hedging for several reasons:

- Risk Management: Hedging is a fundamental risk management tool in forex trading. By taking an opposite position, traders can limit their potential losses if the market moves against their initial trade. This strategy helps control risk and protect profits.

- Speculation: While primarily used for risk mitigation, hedging can also be employed for speculative purposes. Traders may hedge a portion of their position to lock in profits or limit losses, while simultaneously speculating on further price movements in the market.

- Protecting Profits: Hedging allows traders to protect their existing profits from adverse price fluctuations. By taking an offsetting position, traders can secure their gains and prevent potential losses from eroding their earnings.

- Reducing Volatility: Hedging can help reduce the overall volatility of a trading portfolio. By taking opposite positions, traders can minimize the impact of extreme price swings, resulting in a smoother trading experience.

Examples of Forex Hedging in Real-World Scenarios

Here are a few real-world examples of how forex hedging is applied:

- Exporting Business: A company exporting goods to a foreign country faces exchange rate risk. If the foreign currency weakens against the exporter’s domestic currency, the company will receive less revenue. To mitigate this risk, the exporter can hedge their foreign currency exposure by selling the foreign currency forward. This guarantees a fixed exchange rate, protecting the company’s profits.

- Importing Business: Similarly, an importer facing exchange rate risk can hedge their exposure by buying the foreign currency forward. This locks in a fixed exchange rate, protecting the importer from rising import costs if the foreign currency strengthens.

- Investment Portfolio: Investors with foreign currency holdings can hedge their exposure to exchange rate fluctuations by taking an offsetting position in the forex market. This strategy can help preserve the value of their investment portfolio.

Forex Hedging Strategies

Forex hedging strategies involve minimizing potential losses from unfavorable currency fluctuations. Hedging helps protect profits or limit losses by offsetting the risk associated with currency movements.

Types of Forex Hedging Strategies

The most common forex hedging strategies are:

- Forward Contracts: These are agreements to buy or sell a specific currency at a predetermined exchange rate on a future date. Forward contracts lock in a specific exchange rate, eliminating the risk of currency fluctuations. For example, a business expecting to receive EUR payments in the future can enter into a forward contract to sell EUR at a specific rate, guaranteeing a fixed amount of USD received.

- Futures Contracts: Similar to forward contracts, futures contracts are standardized agreements to buy or sell a specific currency at a predetermined exchange rate on a future date. They are traded on exchanges, offering greater liquidity and transparency.

- Options Contracts: Options give the holder the right, but not the obligation, to buy or sell a currency at a predetermined price on or before a specific date. Call options give the right to buy, while put options give the right to sell. Options offer flexibility, as they can be used to limit losses or profit from favorable currency movements. For example, a business expecting to receive USD payments can buy a put option on USD, limiting potential losses if the USD depreciates.

- Currency Swaps: These involve simultaneous exchange of two currencies for a specified period, with an agreement to reverse the exchange at a future date. Currency swaps can be used to hedge against interest rate risk or to manage exposure to multiple currencies.

Comparison of Forex Hedging Strategies

| Strategy | Risk Profile | Potential Returns | Advantages | Disadvantages |

|---|---|---|---|---|

| Forward Contracts | Low | Limited | Predictable exchange rate, eliminates currency risk | Lack of flexibility, may miss out on potential gains if currency moves favorably |

| Futures Contracts | Moderate | Moderate | Liquidity, transparency, standardized contracts | Margin requirements, potential for losses if market moves against the position |

| Options Contracts | High | High | Flexibility, limited downside risk | Premium costs, potential for losses if the option expires worthless |

| Currency Swaps | Moderate | Moderate | Hedge against interest rate risk, manage exposure to multiple currencies | Complex transactions, may require specialized expertise |

Advantages and Disadvantages of Forex Hedging

- Advantages:

- Reduced Risk: Hedging minimizes potential losses from unfavorable currency fluctuations, protecting profits or limiting losses.

- Increased Predictability: Hedging helps businesses forecast future cash flows with greater accuracy, improving financial planning.

- Improved Competitiveness: Hedging allows businesses to operate in foreign markets with greater confidence, reducing currency-related uncertainties.

- Disadvantages:

- Cost: Hedging strategies involve costs, such as premiums for options or fees for forward contracts, which can reduce potential profits.

- Complexity: Implementing and managing hedging strategies can be complex, requiring specialized knowledge and expertise.

- Limited Returns: Hedging strategies aim to minimize losses, not maximize profits. They may limit potential gains if the currency moves favorably.

Tools and Techniques for Forex Hedging

Forex hedging involves using various tools and techniques to mitigate the risk of adverse price movements in foreign exchange markets. By employing these strategies, traders and investors can protect their existing positions or investments from potential losses.

Derivative Instruments for Forex Hedging

Derivative instruments are financial contracts whose value is derived from an underlying asset, such as a currency. These instruments can be used to hedge forex positions by offsetting potential losses.

- Forwards: Forward contracts are agreements to buy or sell a specific amount of currency at a predetermined exchange rate on a future date. This allows traders to lock in a specific exchange rate, mitigating the risk of unfavorable price fluctuations. For example, an importer who needs to pay for goods in Euros can enter into a forward contract to buy Euros at a fixed rate on a future date, ensuring they don’t lose money if the Euro appreciates against their local currency.

- Futures: Futures contracts are similar to forwards but are standardized and traded on exchanges. They offer more liquidity and transparency than forwards, but they also come with margin requirements. Futures contracts can be used to hedge against currency fluctuations in the same way as forwards.

- Options: Options contracts give the holder the right, but not the obligation, to buy or sell a specific amount of currency at a predetermined price on or before a specific date. Options offer flexibility, allowing traders to profit from favorable price movements while limiting losses during unfavorable movements. For example, an exporter who expects the US dollar to depreciate against the Japanese yen can buy call options on the USD/JPY pair, giving them the right to buy USD at a specific price, even if the USD weakens.

Technical and Fundamental Analysis for Hedging Opportunities

Identifying potential hedging opportunities requires a combination of technical and fundamental analysis.

- Technical analysis involves studying historical price data, patterns, and indicators to predict future price movements. Technical analysts use tools like moving averages, support and resistance levels, and trendlines to identify potential hedging opportunities. For example, if a currency pair is approaching a strong resistance level, a trader might consider hedging their existing position by buying a put option.

- Fundamental analysis focuses on economic factors, such as interest rates, inflation, and government policies, that can influence currency values. By analyzing economic data and news releases, traders can identify potential currency movements and adjust their hedging strategies accordingly. For example, if a central bank is expected to raise interest rates, the corresponding currency is likely to appreciate, and traders might consider hedging their long positions by selling a forward contract.

Risk Management Techniques in Conjunction with Hedging

Hedging strategies are often used in conjunction with risk management techniques to minimize potential losses.

- Stop-loss orders: Stop-loss orders are used to automatically close a position when the price reaches a predetermined level, limiting potential losses. For example, a trader might place a stop-loss order on a long position in a currency pair, ensuring that they exit the trade if the price falls below a certain level.

- Position sizing: Position sizing involves determining the appropriate amount of capital to allocate to a trade, taking into account risk tolerance and account size. Hedging strategies should be implemented with appropriate position sizing to manage overall risk.

- Diversification: Diversification involves spreading investments across different assets, including different currency pairs. This helps to reduce the impact of adverse price movements in any single currency.

Hedging Forex Risk

Hedging in forex involves using financial instruments to offset potential losses from unfavorable currency movements. This practice aims to manage and mitigate risks associated with fluctuations in exchange rates, thereby safeguarding your investment and maintaining profitability.

Types of Forex Risks Mitigated Through Hedging

Hedging in forex is crucial for managing various risks associated with currency fluctuations. These risks can significantly impact your trading profits and overall portfolio performance. Here’s a breakdown of the most common forex risks that hedging can effectively address:

- Exchange Rate Risk: This is the most fundamental risk in forex trading, stemming from the potential for a currency’s value to fluctuate against another. Hedging strategies can help minimize losses arising from unexpected currency movements. For example, if you are holding a long position in the EUR/USD pair, you can hedge against potential losses by selling a EUR/USD forward contract. This will lock in a future exchange rate, protecting you from unfavorable movements in the EUR/USD exchange rate.

- Political Risk: Political events, such as elections, policy changes, and social unrest, can significantly impact currency valuations. Hedging strategies can help mitigate losses caused by unforeseen political developments. For instance, if you are concerned about the impact of an upcoming election on the British Pound, you can hedge by selling a GBP/USD forward contract. This will protect your position against potential depreciation of the Pound.

- Economic Risk: Economic indicators, such as inflation, interest rates, and GDP growth, can influence currency values. Hedging strategies can help manage losses associated with economic uncertainty. For example, if you are worried about the impact of rising inflation on the Japanese Yen, you can hedge by buying a JPY/USD call option. This will give you the right, but not the obligation, to buy JPY at a predetermined rate, protecting you from potential losses due to Yen depreciation.

Forex Risk Categories and Hedging Strategies

The following table categorizes common forex risks and the corresponding hedging strategies employed to manage them:

| Forex Risk Category | Hedging Strategies |

|---|---|

| Exchange Rate Risk | Forward Contracts, Futures Contracts, Options |

| Political Risk | Forward Contracts, Options, Currency Swaps |

| Economic Risk | Forward Contracts, Options, Currency Swaps |

| Liquidity Risk | Stop-Loss Orders, Limit Orders, Diversification |

| Counterparty Risk | Using reputable brokers, Diversification, Margin Requirements |

Impact of Hedging on Profitability and Trading Performance

While hedging can protect against losses, it can also impact profitability and trading performance in several ways:

- Reduced Potential Profits: Hedging strategies typically involve a cost, such as premium payments for options or fees for forward contracts. This cost can reduce the potential profits from your forex trades. However, this reduction in profit potential is offset by the protection against losses.

- Increased Trading Costs: Hedging strategies often involve additional transaction costs, such as brokerage fees and commissions. These costs can erode your trading profits, especially for frequent traders.

- Limited Flexibility: Hedging strategies can restrict your flexibility to take advantage of market opportunities. For example, a forward contract locks in a specific exchange rate, limiting your ability to profit from favorable currency movements.

- Increased Complexity: Hedging strategies can increase the complexity of your trading operations, requiring a deeper understanding of financial instruments and market dynamics. This can be challenging for novice traders.

Practical Applications of Forex Hedging: Hedging Forex

Forex hedging is a powerful tool that can be used to protect against currency fluctuations in various situations. It can help individuals and businesses mitigate risks associated with international trade, investment, and travel.

Hedging in International Trade

International trade involves exchanging goods and services across borders, often requiring payments in different currencies. Currency fluctuations can significantly impact a company’s profitability, especially when dealing with large transactions. Forex hedging can help businesses mitigate these risks by locking in an exchange rate for future transactions.

For example, a US-based company exporting goods to Europe may need to receive payment in euros. If the euro weakens against the US dollar, the company will receive fewer dollars for its goods, reducing its profits. By hedging its euro exposure, the company can ensure it receives a predetermined amount of dollars, regardless of currency fluctuations. This can be achieved through various hedging strategies, such as forward contracts or options.

Hedging in Investment

Currency fluctuations can also impact investment returns, particularly for investors with international portfolios. For example, an investor holding shares in a Japanese company may experience losses if the Japanese yen weakens against the US dollar. By hedging their yen exposure, investors can protect their investments from currency risk.

Hedging strategies for investments can include using currency futures, options, or ETFs. These instruments allow investors to take positions that offset potential losses from currency fluctuations.

Hedging in Travel

Even for individuals traveling abroad, currency fluctuations can affect the cost of their trip. By hedging their foreign currency exposure, travelers can minimize the impact of exchange rate volatility on their travel expenses.

For example, a traveler planning a trip to Europe can hedge their euro exposure by purchasing euros in advance at a fixed exchange rate. This can help them avoid paying higher prices for goods and services due to a weakening euro.

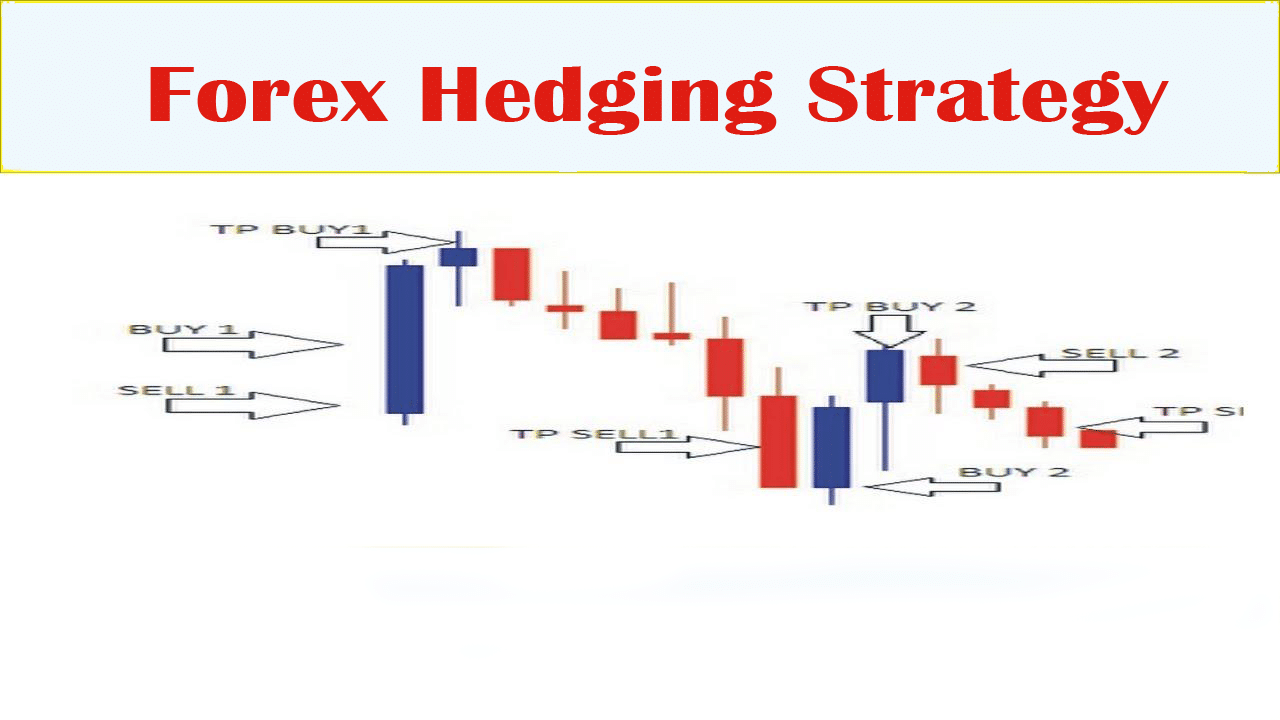

Implementing a Forex Hedging Strategy

Implementing a forex hedging strategy involves a series of steps:

- Identify Currency Exposure: The first step is to determine the specific currencies and amounts you need to hedge. This involves analyzing your financial transactions and identifying potential currency risks.

- Choose a Hedging Strategy: Once you’ve identified your currency exposure, you need to choose a suitable hedging strategy. There are various options available, each with its own risks and rewards.

- Select a Hedging Instrument: After choosing a strategy, you need to select a specific hedging instrument, such as forward contracts, options, or futures.

- Execute the Hedge: Once you’ve selected your instrument, you can execute the hedge by entering into a contract with a financial institution.

- Monitor and Adjust: After implementing the hedge, it’s crucial to monitor its performance and adjust the strategy as needed. Market conditions can change, and your hedging needs may evolve over time.

Real-World Case Studies, Hedging forex

There are numerous real-world examples of companies successfully using forex hedging to mitigate currency risk. For instance, a large multinational corporation might hedge its exposure to the euro by entering into forward contracts, allowing it to lock in an exchange rate for future transactions. This can help the company stabilize its earnings and protect its bottom line from currency fluctuations.

Another example is a small business exporting goods to Canada. The business might use options to hedge its exposure to the Canadian dollar, giving it the right but not the obligation to buy Canadian dollars at a predetermined exchange rate. This provides the business with flexibility and allows it to benefit from favorable currency movements while limiting its losses during unfavorable movements.

Ultimate Conclusion

Mastering forex hedging is an essential skill for anyone involved in international finance. It empowers you to take control of your currency risk, protect your investments, and navigate the complexities of the global marketplace. By understanding the various strategies, tools, and techniques discussed in this guide, you can make informed decisions, mitigate potential losses, and ultimately enhance your trading or investment success.

Expert Answers

What are the different types of forex hedging strategies?

Common strategies include forward contracts, futures contracts, options, and currency swaps. Each strategy has its own risk profile and potential return, so choosing the right one depends on your specific needs and goals.

How does forex hedging impact profitability?

While hedging can reduce losses, it can also limit potential profits. It’s a trade-off between risk and reward. You need to carefully consider your risk tolerance and the potential impact of hedging on your overall trading performance.

Is forex hedging suitable for all traders?

Hedging is not always necessary or appropriate for all traders. If you’re comfortable with currency risk and are willing to accept potential losses, you may not need to hedge. However, if you’re risk-averse or have significant exposure to foreign currencies, hedging can provide valuable protection.