Forex vs Options sets the stage for a fascinating exploration of two popular financial markets. Both offer opportunities for profit, but their unique characteristics, trading mechanisms, and risk profiles make them appealing to different types of traders. Understanding the core differences between Forex and options is crucial for any investor looking to navigate these markets effectively.

Forex, short for foreign exchange, is the world’s largest and most liquid financial market, where currencies are traded against each other. Options trading, on the other hand, involves contracts that give the buyer the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specific timeframe. Both markets offer diverse opportunities, but their complexity requires careful consideration of trading strategies, risk management, and regulatory frameworks.

Introduction

This section delves into the world of Forex and options trading, outlining their core concepts, similarities, and differences.

Forex Trading

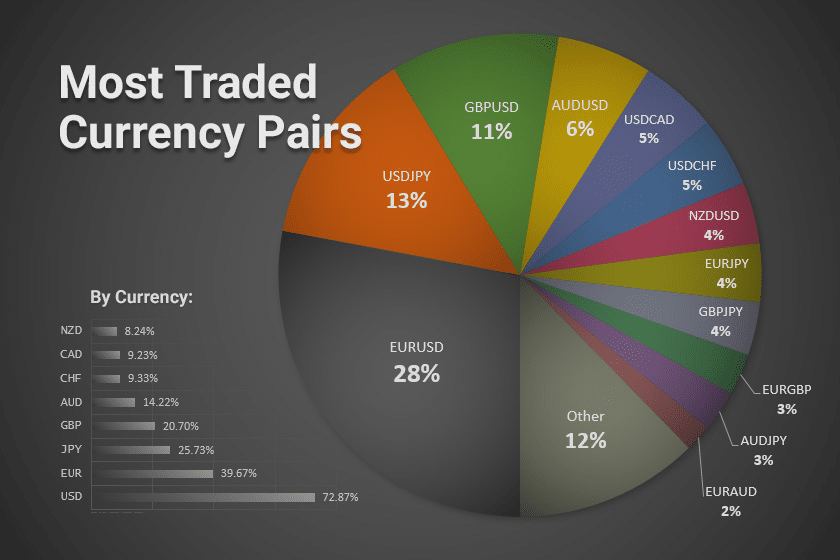

Forex trading, short for foreign exchange trading, involves buying and selling currencies to profit from fluctuations in their exchange rates. It is the largest and most liquid financial market globally, with trillions of dollars traded daily.

The fundamental principle behind Forex trading is to capitalize on the difference in value between two currencies. For instance, if you believe the Euro will strengthen against the US Dollar, you would buy Euros and sell US Dollars. Conversely, if you anticipate the Euro weakening, you would sell Euros and buy US Dollars.

Options Trading

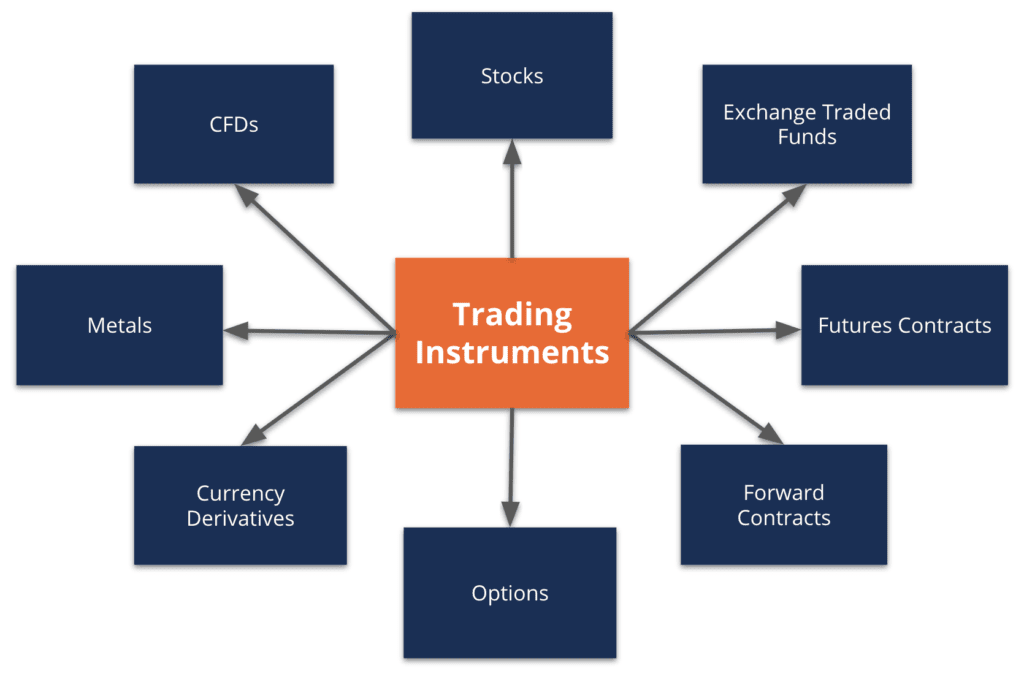

Options trading involves contracts that grant the holder the right, but not the obligation, to buy or sell an underlying asset at a specific price within a predetermined time frame. This underlying asset can be a stock, commodity, index, or even a currency.

Options are categorized into two main types:

- Call options: Grant the holder the right to buy the underlying asset at a specific price (strike price).

- Put options: Grant the holder the right to sell the underlying asset at a specific price (strike price).

The value of an option is influenced by various factors, including the underlying asset’s price, time until expiration, volatility, and interest rates.

Similarities and Differences, Forex vs options

Both Forex and options trading involve speculating on price movements. However, they differ in their underlying assets, contract structures, and risk profiles.

- Underlying Assets: Forex trading focuses on currency pairs, while options trading encompasses a broader range of assets, including stocks, commodities, indices, and currencies.

- Contract Structures: Forex trades are typically executed on a spot basis, meaning the exchange of currencies happens immediately. Options contracts, on the other hand, have a defined expiration date, giving the holder time to decide whether to exercise their rights.

- Risk Profiles: Forex trading is generally considered more leveraged than options trading. This means that traders can control larger positions with smaller amounts of capital. However, leverage also amplifies potential losses. Options trading offers various strategies for managing risk, including buying and selling options, and establishing various spreads.

Trading Mechanics

Forex and options trading involve distinct mechanisms, each with unique characteristics that cater to different trading styles and risk appetites. Understanding these differences is crucial for traders to make informed decisions about their trading strategies.

Order Types

The order types available in Forex and options markets provide traders with varying degrees of control over their trades.

- Forex:

- Market Orders: Execute immediately at the best available price.

- Limit Orders: Execute only when the price reaches a specified level.

- Stop Orders: Trigger an order when the price reaches a specified level, often used to limit losses or lock in profits.

- Trailing Stop Orders: A type of stop order that automatically adjusts its trigger price based on the price movement of the underlying asset.

- Options:

- Market Orders: Execute immediately at the best available price.

- Limit Orders: Execute only when the price reaches a specified level.

- Stop Orders: Trigger an order when the price reaches a specified level, often used to limit losses or lock in profits.

- Trailing Stop Orders: A type of stop order that automatically adjusts its trigger price based on the price movement of the underlying asset.

- Option Orders: Specific to options trading, these orders allow traders to buy or sell options contracts with specific strike prices and expiry dates.

Execution Methods

The way orders are executed in Forex and options markets differs significantly.

- Forex:

- Electronic Trading Platforms: Orders are executed electronically through trading platforms, often with instant execution.

- Dealing Desks: Some brokers offer dealing desks, where traders interact with a broker to execute orders.

- Options:

- Exchanges: Options contracts are traded on organized exchanges, such as the Chicago Board Options Exchange (CBOE), with standardized contracts and transparent pricing.

- Over-the-Counter (OTC): Some options contracts are traded directly between two parties, often involving customized terms.

Risk Management Tools

Both Forex and options trading offer a range of risk management tools to help traders mitigate potential losses.

- Forex:

- Stop-Loss Orders: Automatically close a position when the price reaches a specified level, limiting potential losses.

- Take-Profit Orders: Automatically close a position when the price reaches a specified level, locking in profits.

- Margin Trading: Leverage allows traders to control larger positions with a smaller initial investment, but also amplifies potential losses.

- Options:

- Options Premium: The price of an option contract, which represents the maximum potential loss for the buyer.

- Option Strategies: Various strategies, such as covered calls and protective puts, can be used to manage risk and potential returns.

Trading Platforms and Tools

The platforms and tools used for Forex and options trading often differ in their functionalities and features.

- Forex:

- MetaTrader 4 (MT4): A popular platform with a wide range of technical indicators, charting tools, and automated trading features.

- MetaTrader 5 (MT5): An updated version of MT4 with advanced features, including multi-asset trading and a wider range of order types.

- cTrader: A platform known for its fast execution speeds, advanced charting capabilities, and customizable user interface.

- Options:

- Interactive Brokers: A platform that provides access to multiple exchanges, including options exchanges, with advanced charting tools and order types.

- TD Ameritrade: A platform with a user-friendly interface, extensive educational resources, and options trading tools.

- Thinkorswim: A platform known for its intuitive interface, advanced charting capabilities, and options analysis tools.

Risk and Reward: Forex Vs Options

Both Forex and options trading offer the potential for significant profits, but they also carry substantial risks. Understanding the risk-reward profile of each market is crucial for making informed trading decisions.

Risk Profiles

The risk profiles of Forex and options trading differ significantly. Forex trading, while potentially volatile, is generally considered less risky than options trading. This is primarily because Forex is a highly liquid market with numerous participants, making it less susceptible to sudden price swings. Options, on the other hand, are derivative instruments whose value is derived from the underlying asset. This inherent connection to the underlying asset exposes options traders to greater volatility and risk.

Potential Rewards and Losses

The potential rewards and losses in Forex and options trading are directly related to the leverage and margin requirements associated with each market.

Forex

- Forex trading offers the potential for significant profits due to leverage. Leverage allows traders to control a larger position with a smaller initial investment. For example, a trader with a $1,000 account and a leverage of 1:100 can control a $100,000 position. This magnification effect can amplify both profits and losses.

- The potential for losses in Forex trading is also amplified by leverage. A small price movement against the trader’s position can result in significant losses.

Options

- Options trading offers the potential for high returns with limited risk. Options contracts allow traders to control a large position with a relatively small premium payment. The potential for profit is unlimited, while the maximum loss is limited to the premium paid.

- However, options trading also carries a high risk of losing the entire premium paid. This risk is amplified by the time decay of options contracts, which means that the value of an option decreases over time.

Leverage and Margin Requirements

Leverage and margin requirements play a significant role in the risk and reward profiles of both Forex and options trading.

Forex

- Forex brokers typically offer leverage ratios ranging from 1:10 to 1:500 or higher. This means that a trader can control a position worth 10 to 500 times their initial investment.

- Margin requirements in Forex trading refer to the amount of money that traders need to deposit with their broker to open and maintain a position. The margin requirement is typically a percentage of the total position size.

- The leverage and margin requirements in Forex trading can significantly amplify both profits and losses. A small price movement against the trader’s position can lead to margin calls, which require the trader to deposit additional funds to maintain their position.

Options

- Options trading involves margin requirements that are determined by the type of option contract and the underlying asset.

- The margin requirement for options trading is typically lower than Forex trading, but it can still be significant, depending on the contract size and leverage used.

- Options traders need to carefully consider the margin requirements and leverage used to avoid margin calls and potential losses.

Trading Strategies

Both Forex and options trading offer a variety of strategies, each tailored to different risk appetites and investment objectives. Understanding the nuances of each strategy is crucial for maximizing returns and mitigating potential losses.

Forex Trading Strategies

Forex trading strategies primarily focus on exploiting price movements in currency pairs. Here are some common strategies:

- Trend Trading: This strategy involves identifying and riding the prevailing trend in a currency pair. Trend traders utilize technical indicators like moving averages and MACD to confirm the trend direction and entry points. For example, a trader might buy EUR/USD if the price is consistently breaking above resistance levels, indicating an uptrend.

- Range Trading: This strategy focuses on trading within a defined price range. Traders identify support and resistance levels, expecting the price to bounce between these levels. They enter buy orders near support and sell orders near resistance. For instance, a trader might sell GBP/USD if the price reaches the upper resistance level, anticipating a reversal back down.

- Scalping: This strategy involves profiting from small price fluctuations. Scalpers use high leverage and quick trades to capitalize on short-term price movements. They employ technical indicators like stochastic oscillators and Bollinger Bands to identify entry and exit points. For example, a scalper might buy USD/JPY when the price breaks above the Bollinger Band’s upper limit, aiming to sell quickly when the price retraces.

- News Trading: This strategy involves capitalizing on market reactions to economic news releases. Traders analyze economic calendars and anticipate the potential impact of news events on currency prices. For instance, a trader might buy AUD/USD before a positive Australian economic report, expecting the Australian dollar to appreciate.

Options Trading Strategies

Options trading strategies provide flexibility and leverage, allowing traders to profit from both rising and falling prices. Here are some common strategies:

- Covered Call: This strategy involves selling a call option on an underlying asset the trader owns. The trader receives a premium for selling the option and profits if the price of the underlying asset stays below the strike price at expiration. For example, a trader owning 100 shares of Apple stock might sell a call option with a strike price of $150. If the price of Apple stock remains below $150 at expiration, the trader keeps the premium and the stock. However, if the price rises above $150, the trader is obligated to sell the stock at the strike price, limiting potential gains but protecting against losses.

- Protective Put: This strategy involves buying a put option on an underlying asset the trader owns. The put option provides downside protection, limiting potential losses if the price of the underlying asset declines. For example, a trader owning 100 shares of Tesla stock might buy a put option with a strike price of $700. If the price of Tesla stock falls below $700 at expiration, the trader can exercise the put option and sell the stock at the strike price, mitigating losses. However, if the price remains above $700, the put option expires worthless, and the trader only pays the premium.

- Straddle: This strategy involves buying both a call and a put option on the same underlying asset with the same strike price and expiration date. This strategy benefits from large price movements in either direction. For example, a trader might buy a straddle on Amazon stock with a strike price of $3,000. If the price of Amazon stock rises significantly, the call option will become profitable. If the price falls significantly, the put option will become profitable. However, if the price remains near the strike price, both options will expire worthless, and the trader loses the premium paid.

- Strangle: This strategy involves buying both a call and a put option on the same underlying asset, but with different strike prices. The call option has a higher strike price than the put option. This strategy benefits from large price movements in either direction but has a lower risk than a straddle. For example, a trader might buy a strangle on Google stock with a call option strike price of $2,500 and a put option strike price of $2,000. If the price of Google stock rises above $2,500, the call option will become profitable. If the price falls below $2,000, the put option will become profitable. However, if the price remains between $2,000 and $2,500, both options will expire worthless, and the trader loses the premium paid.

Suitability of Strategies for Different Risk Profiles and Trading Goals

The suitability of a trading strategy depends on factors such as the trader’s risk tolerance, investment goals, and trading experience.

- Risk-Averse Traders: Risk-averse traders often prefer strategies that limit potential losses, such as protective puts and covered calls. These strategies provide downside protection, ensuring that losses are capped.

- High-Risk Tolerance Traders: Traders with a high risk tolerance may opt for strategies that offer higher potential returns, such as scalping, news trading, and straddles. These strategies involve greater risk but can potentially generate significant profits.

- Short-Term Traders: Traders focusing on short-term profits may choose strategies like scalping and news trading, which capitalize on short-term price movements. These strategies require frequent monitoring and quick decision-making.

- Long-Term Traders: Traders with a long-term perspective may prefer strategies like trend trading and range trading, which focus on capturing sustained price trends. These strategies require patience and discipline.

Technical Indicators and Fundamental Analysis Techniques

Both Forex and options trading rely on technical and fundamental analysis to identify trading opportunities.

- Technical Analysis: This approach uses historical price data and charts to identify patterns and trends. Technical indicators, such as moving averages, MACD, Bollinger Bands, and RSI, are commonly used to generate trading signals. Technical analysis is particularly useful for short-term trading strategies.

- Fundamental Analysis: This approach examines economic data, political events, and company news to assess the underlying value of an asset. Fundamental analysis is essential for long-term trading strategies and for understanding the potential impact of news events on market prices. For example, a trader might analyze economic data releases to predict the direction of interest rate changes, which could affect currency valuations.

Regulation and Legality

Both Forex and options trading are subject to regulations designed to protect investors and ensure market integrity. However, the regulatory frameworks differ significantly, with Forex trading generally being less regulated than options trading.

Regulatory Frameworks

The regulatory landscape for Forex trading is fragmented, with different jurisdictions having different rules and oversight. Some countries have dedicated Forex regulators, while others rely on general securities regulators to oversee the market. For example, the National Futures Association (NFA) in the United States regulates Forex brokers operating within the country, while the Financial Conduct Authority (FCA) in the United Kingdom regulates Forex brokers operating in the UK. In contrast, options trading is typically regulated by dedicated exchanges and clearinghouses, such as the Chicago Board Options Exchange (CBOE) and the Chicago Mercantile Exchange (CME).

Legal Considerations and Compliance Requirements

Traders need to be aware of the legal considerations and compliance requirements specific to their jurisdiction. This includes understanding:

- Tax implications: Profits from Forex and options trading are generally considered taxable income. Traders need to keep accurate records of their transactions for tax purposes.

- Know Your Client (KYC) and Anti-Money Laundering (AML) regulations: Forex and options brokers are required to verify the identity of their clients and comply with AML regulations to prevent money laundering and terrorist financing.

- Trading restrictions: Some jurisdictions may restrict certain types of Forex or options trading, such as leveraged trading or trading certain underlying assets.

Reputable Brokers and Platforms

Choosing a reputable broker is crucial for both Forex and options trading. Look for brokers that are regulated by reputable authorities, have a good track record, and offer competitive trading conditions. Some reputable brokers for Forex trading include:

- FXTM

- AvaTrade

- XM

For options trading, some reputable brokers include:

- Interactive Brokers

- TD Ameritrade

- Schwab

Traders should carefully consider the features and fees of different platforms before choosing one.

Suitability for Different Traders

Choosing between Forex and options trading depends heavily on your trading style, risk tolerance, and financial goals. Each market caters to specific trader profiles, offering unique advantages and disadvantages.

Forex Traders

Forex trading suits traders who:

- Prefer high liquidity: The Forex market is the world’s largest and most liquid financial market, offering ample opportunities to enter and exit trades quickly with minimal slippage.

- Are comfortable with leverage: Forex trading allows for high leverage, enabling traders to control large positions with relatively small capital. However, leverage amplifies both profits and losses, requiring careful risk management.

- Embrace short-term trading: Forex trading is often characterized by short-term strategies, including scalping, day trading, and swing trading, where traders aim to capitalize on small price fluctuations.

- Focus on fundamental analysis: Fundamental analysis plays a significant role in Forex trading, considering economic data, political events, and central bank policies that influence currency valuations.

- Are willing to manage risk meticulously: Forex trading involves inherent risks, and traders must employ strict risk management techniques to protect their capital and avoid significant losses.

Options Traders

Options trading is a suitable choice for traders who:

- Seek limited risk exposure: Options contracts provide defined risk profiles, allowing traders to control their potential losses while potentially benefiting from significant gains.

- Prefer long-term strategies: Options trading can be employed for both short-term and long-term strategies, with traders using options for hedging, speculation, or generating income.

- Are comfortable with complex instruments: Options contracts are complex financial instruments with various pricing factors, requiring a thorough understanding of options trading mechanics and strategies.

- Are willing to pay premiums: Options buyers pay a premium for the right to buy or sell an underlying asset at a predetermined price, which represents the cost of acquiring the option.

- Focus on technical analysis: Technical analysis is often employed in options trading, analyzing price charts and patterns to identify trading opportunities and manage risk.

Real-World Scenarios

- Scenario 1: Day Trader Seeking Quick Profits: A day trader aiming to generate quick profits from small price fluctuations would likely prefer Forex trading due to its high liquidity and short-term trading opportunities. They could employ scalping or day trading strategies to capitalize on market volatility.

- Scenario 2: Investor Hedging Portfolio Risk: An investor seeking to hedge against potential losses in their stock portfolio might utilize options contracts. They could purchase put options on their stock holdings, providing protection against price declines.

- Scenario 3: Speculator Anticipating Market Direction: A speculator anticipating a significant price movement in a specific asset might utilize options contracts to amplify potential gains. They could purchase call options if they expect the price to rise or put options if they expect it to fall.

Final Thoughts

Ultimately, the choice between Forex and options trading depends on individual risk tolerance, trading goals, and experience. Forex might be suitable for those seeking a highly liquid market with potential for consistent returns, while options trading offers flexibility and leverage, appealing to traders seeking higher potential profits but accepting greater risk. By carefully evaluating your needs and understanding the nuances of each market, you can make informed decisions and embark on a successful trading journey.

Common Queries

What are the advantages of Forex trading?

Forex offers high liquidity, low trading costs, and a 24/5 trading environment. It’s also a market where you can leverage your investment, potentially amplifying your profits but also losses.

What are the advantages of options trading?

Options trading provides flexibility and leverage, allowing you to control a large position with a smaller investment. It also offers limited risk potential, as your maximum loss is the premium paid for the option.

Which market is better for beginners?

Forex is generally considered more accessible for beginners due to its simpler trading mechanics and lower entry barriers. However, options trading can be more complex and requires a deeper understanding of financial derivatives.