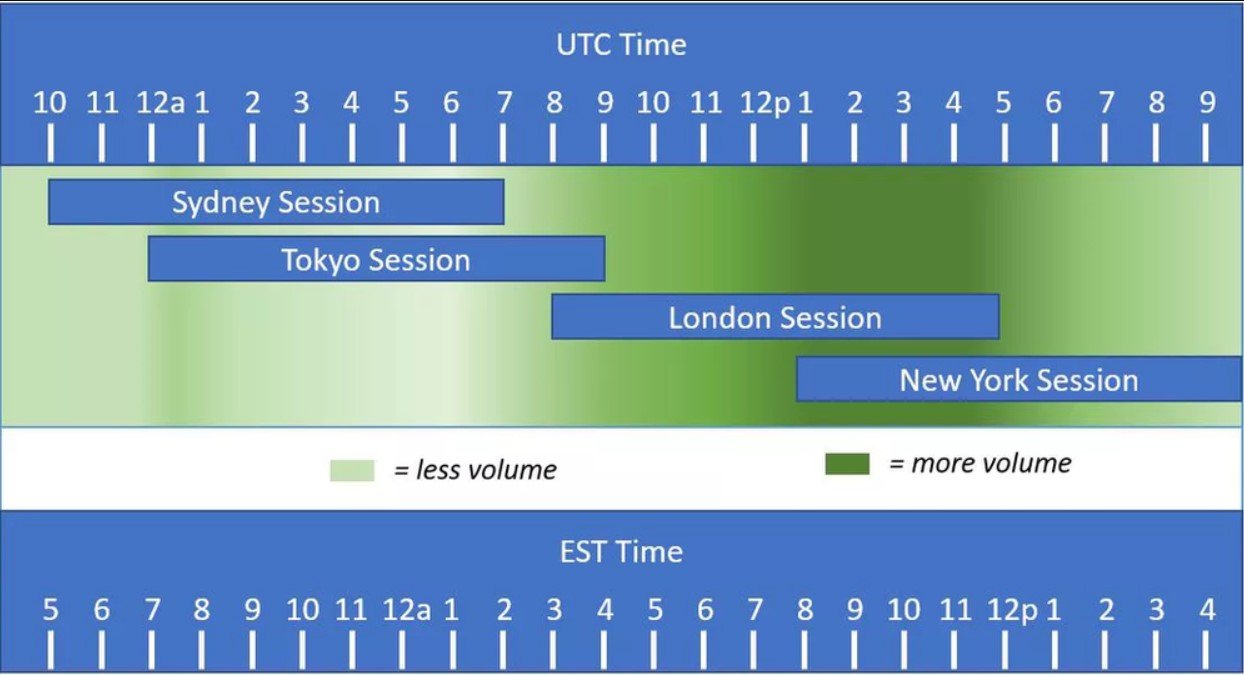

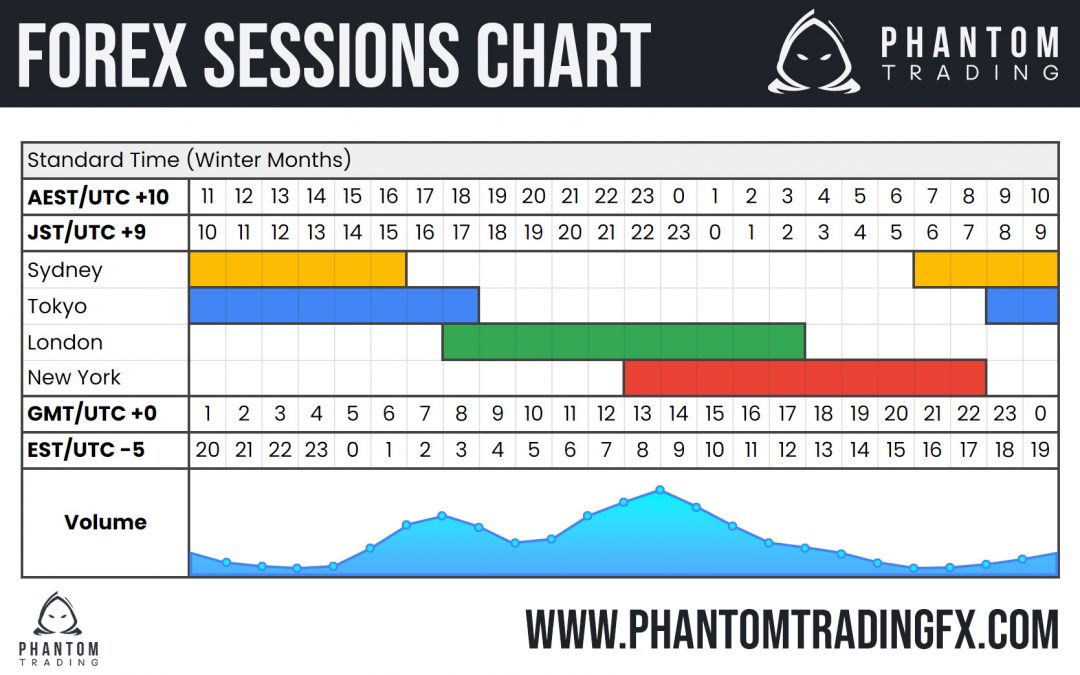

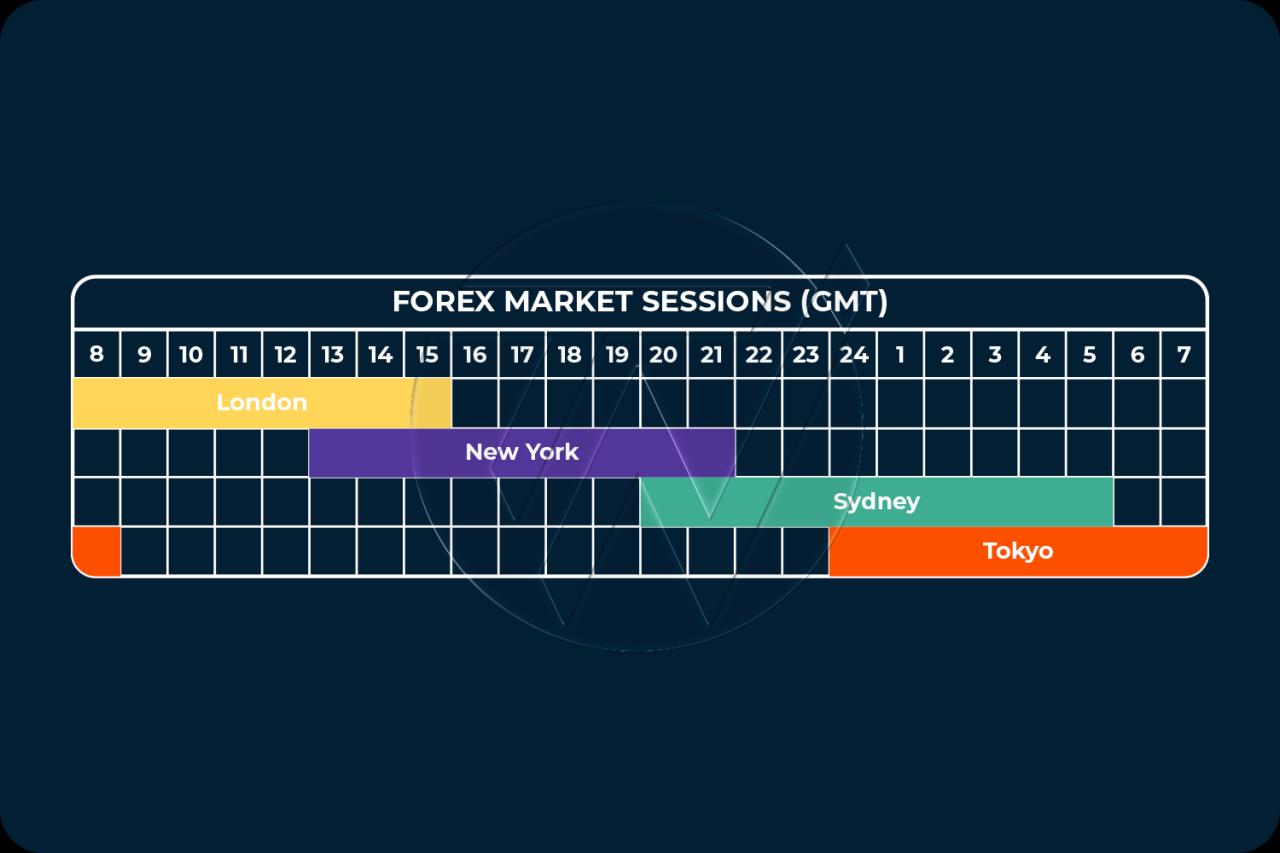

Forex trading time zones are crucial for maximizing profits and navigating the global financial markets. The forex market operates 24/5, and understanding the different time zones allows traders to capitalize on market liquidity and volatility, as well as identify key economic releases that can impact currency prices.

Time zones play a significant role in forex trading, as they influence market liquidity, trading opportunities, and the timing of economic releases. By understanding how time zones affect the forex market, traders can develop strategies to maximize their potential for success.

Tools and Resources for Time Zone Trading

Successfully navigating the Forex market requires a deep understanding of time zones and their impact on market activity. Trading across multiple time zones can be complex, but with the right tools and resources, you can gain a significant advantage.

Time Zone Tracking Tools

Time zone tracking tools are essential for Forex traders, helping them stay organized and manage their trading activities across different time zones. These tools allow traders to visualize market openings and closings, identify periods of high volatility, and coordinate their trading strategies accordingly.

- World Time Zone Converters: These online tools convert time between different time zones, ensuring accurate tracking of market openings and closings. Examples include:

- World Time Buddy: This comprehensive website provides a visual representation of time zones, including current time, sunrise/sunset, and daylight saving time adjustments.

- Time and Date: This website offers a user-friendly interface for time zone conversions and provides detailed information on different time zones worldwide.

- Trading Platform Time Zone Features: Many trading platforms incorporate time zone features directly into their interface, simplifying the process of tracking market openings and closings.

- MetaTrader 4 (MT4): This popular trading platform offers a built-in time zone converter, allowing traders to easily view market hours in different locations.

- TradingView: This charting and analysis platform includes a time zone feature that displays market hours for various financial instruments across different time zones.

- Dedicated Time Zone Apps: Several mobile applications are specifically designed to help traders manage time zones.

- World Clock: This app provides a comprehensive list of time zones and allows users to set custom time zone profiles for different locations.

- Time Zone Converter: This app offers a simple and intuitive interface for converting time between different time zones.

Market Data Platforms

Market data platforms provide real-time information about financial markets, including price quotes, charts, and economic indicators. Some platforms offer time zone-specific market data, allowing traders to analyze market behavior based on the time zone of a particular trading session.

- Bloomberg Terminal: This professional financial data platform offers comprehensive time zone-specific market data, including real-time price quotes, news feeds, and economic indicators. It provides a detailed view of market activity across different time zones, allowing traders to identify trends and opportunities.

- Refinitiv Eikon: This platform offers similar features to Bloomberg Terminal, providing access to real-time market data, news, and economic indicators, segmented by time zone. It allows traders to track market movements and identify potential trading opportunities based on the time zone of a particular market.

Economic Calendars, Forex trading time zones

Economic calendars are crucial tools for Forex traders, providing a schedule of upcoming economic releases and events that can significantly impact market sentiment. Time zone trading requires a deep understanding of how economic releases affect markets in different time zones.

- Trading Economics: This platform offers a comprehensive economic calendar with a user-friendly interface. It provides details on economic releases, including time, impact, and historical data. Traders can filter releases by time zone, allowing them to identify events that may affect markets during specific trading sessions.

- Investing.com: This website provides a comprehensive economic calendar with detailed information on economic releases, including time, impact, and historical data. Traders can filter releases by time zone, allowing them to identify events that may affect markets during specific trading sessions.

Time Zone Considerations for Different Trading Styles

Understanding time zones is crucial for forex traders, as it directly influences market activity and trading opportunities. Different time zones affect trading styles, creating unique advantages and disadvantages depending on the trader’s approach.

Scalping and Time Zones

Scalping involves making quick profits from small price movements. Time zones play a significant role in scalping strategies, as market liquidity and volatility tend to be higher during specific time periods.

- Overlap Zones: The most active periods for scalping are when major financial centers like London, New York, and Tokyo overlap. This overlap creates increased trading volume and volatility, offering more opportunities for scalpers. For instance, when London opens, it coincides with the closing hours of New York, leading to a surge in trading activity.

- Early Market Openings: Scalpers often capitalize on the initial price movements when markets open. For example, traders in the US can take advantage of the Asian market opening, as price fluctuations are typically higher during these periods.

- Economic Releases: Major economic releases, such as non-farm payroll data or interest rate decisions, can significantly impact market sentiment. Scalpers monitor these releases, anticipating potential price movements and executing trades accordingly.

Final Review

Mastering forex trading time zones is a key skill for traders of all levels. By understanding the different trading sessions, their corresponding time zones, and the advantages of trading during specific periods, traders can develop effective strategies to navigate the global financial markets and achieve their trading goals. Whether you are a scalper, a swing trader, or a long-term investor, understanding the impact of time zones on forex trading is essential for success.

Common Queries: Forex Trading Time Zones

How do time zones affect market liquidity?

When multiple major financial centers are open, there is more market activity, leading to higher liquidity. This means that traders can execute orders at better prices with less slippage.

What are the best time zones to trade forex?

There is no single “best” time zone to trade. The optimal time zone depends on your trading style, risk tolerance, and the specific currency pairs you are trading.

How can I use an economic calendar to my advantage?

Economic calendars provide a schedule of upcoming economic releases that can impact currency prices. By understanding the potential impact of these releases, traders can adjust their strategies and take advantage of market movements.