- Introduction to Forex Trading Platforms

- Key Features of Forex Trading Platforms

- Types of Forex Trading Platforms

- Choosing the Right Forex Trading Platform

- Forex Trading Platform Functionality

- Forex Trading Platform Security and Regulation

- The Future of Forex Trading Platforms

- Conclusive Thoughts: Forex Trading Platforms

- Commonly Asked Questions

Forex trading platforms are the digital gateways to the world’s largest financial market, offering individuals and institutions access to trade currencies around the clock. These platforms provide a range of tools and features that facilitate trading activities, from placing orders to analyzing market trends.

The forex market is a dynamic and complex environment, requiring sophisticated technology to navigate its intricacies. Forex trading platforms play a crucial role in enabling traders to execute trades, manage risk, and stay informed about market developments.

Introduction to Forex Trading Platforms

The foreign exchange market, commonly known as Forex, is the largest and most liquid financial market globally. It involves the trading of currencies against each other, with traders aiming to profit from fluctuations in exchange rates. Forex trading platforms serve as the crucial intermediary between traders and the market, providing the tools and infrastructure necessary to execute trades.

Forex trading platforms play a vital role in facilitating trading activities by offering a user-friendly interface, real-time market data, order execution capabilities, and analytical tools. These platforms streamline the trading process, enabling traders to access and interact with the global Forex market efficiently.

Types of Forex Trading Platforms

The Forex trading platform landscape is diverse, with platforms catering to various trader profiles and trading styles. Here’s an overview of the most common types:

- Desktop Platforms: These platforms are typically downloaded and installed on a computer, offering comprehensive features and advanced functionalities. They provide a robust trading environment with extensive charting capabilities, technical indicators, and order management tools. Popular examples include MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

- Web-Based Platforms: Web-based platforms are accessible through a web browser, eliminating the need for downloads. They offer a streamlined experience, making them suitable for traders who prefer flexibility and convenience. These platforms are often simpler in terms of features compared to desktop platforms but provide access to essential trading tools.

- Mobile Platforms: Mobile platforms are designed for trading on smartphones and tablets, offering on-the-go access to the Forex market. They provide a user-friendly interface and core trading functionalities, enabling traders to monitor market movements and execute trades from anywhere.

- Proprietary Platforms: Some brokers develop their own proprietary platforms, offering unique features and functionalities tailored to their specific offerings. These platforms often integrate advanced trading tools, research resources, and personalized support.

Key Features of Forex Trading Platforms

Choosing the right Forex trading platform is crucial for success in the market. A reliable platform offers a wide range of features that enhance trading efficiency, security, and overall user experience.

Security and Regulatory Compliance

Security is paramount in Forex trading, as traders entrust platforms with their financial information and funds. Robust security measures are essential to protect against unauthorized access, data breaches, and financial fraud. Regulatory compliance ensures that platforms adhere to industry standards and operate within legal frameworks, fostering a trustworthy and transparent trading environment.

- Encryption: Platforms should utilize strong encryption protocols, such as SSL/TLS, to secure data transmission between the user’s device and the platform’s servers. This prevents unauthorized access to sensitive information during online transactions.

- Two-Factor Authentication (2FA): Implementing 2FA adds an extra layer of security by requiring users to provide two separate forms of authentication, typically a password and a code generated by a mobile app or email, before granting access to accounts. This effectively mitigates unauthorized login attempts.

- Regulation: Reputable Forex trading platforms operate under the oversight of financial regulatory bodies, such as the Financial Conduct Authority (FCA) in the UK or the Securities and Exchange Commission (SEC) in the US. These regulatory bodies ensure compliance with industry standards, promote transparency, and provide recourse for traders in case of disputes.

User-Friendly Interfaces and Advanced Charting Tools

A user-friendly interface simplifies the trading process, making it accessible to both beginners and experienced traders. Advanced charting tools provide insightful data visualization, enabling traders to analyze market trends and identify potential trading opportunities.

- Intuitive Navigation: A well-designed interface should be easy to navigate, allowing traders to quickly access key features, place orders, and monitor their positions. Clear labeling, logical organization, and consistent design elements contribute to a positive user experience.

- Customizable Layouts: Traders have different preferences and trading styles. Customizable layouts allow traders to personalize their platform’s appearance, arrange trading windows, and display the information they need most prominently.

- Advanced Charting Tools: Sophisticated charting tools are essential for technical analysis. These tools allow traders to overlay various indicators, draw trend lines, and customize chart settings to identify patterns and predict market movements. Features like real-time data updates, historical data analysis, and multiple chart types (candlestick, line, bar) enhance the overall trading experience.

Order Execution Speed and Slippage

In Forex trading, speed is crucial, especially in volatile markets. Fast order execution ensures that trades are filled promptly at the desired price, minimizing potential losses due to market fluctuations. Slippage, however, can occur when the actual execution price differs from the intended price, often due to market volatility or order volume.

- Order Execution Speed: A reliable Forex trading platform prioritizes fast order execution, minimizing delays between placing an order and its execution. This is especially important during volatile market conditions, where prices can fluctuate rapidly. Platforms with robust infrastructure and efficient algorithms ensure swift order processing.

- Slippage Management: Slippage is an unavoidable aspect of Forex trading, particularly during high-volume trading periods. Platforms with advanced slippage management mechanisms, such as guaranteed stop-loss orders or order types that prioritize execution speed, can mitigate the impact of slippage on trading outcomes. Transparency regarding slippage is also important, as platforms should clearly communicate potential slippage scenarios to traders.

Types of Forex Trading Platforms

Forex trading platforms are the digital tools that connect traders to the global foreign exchange market, facilitating the buying and selling of currencies. These platforms provide traders with the essential tools to analyze market data, place orders, manage trades, and access real-time information. There are various types of Forex trading platforms available, each catering to specific needs and preferences.

Desktop Platforms

Desktop platforms are software programs downloaded and installed on a computer, offering a comprehensive and feature-rich trading environment. These platforms are known for their stability, speed, and advanced functionalities, making them popular among experienced traders who demand high performance and customization options.

- Advantages:

- Enhanced Stability and Performance: Desktop platforms are generally more stable and offer faster execution speeds compared to web-based platforms, as they operate directly on the user’s computer.

- Advanced Features and Customization: They provide a wider range of charting tools, indicators, and analysis features, allowing traders to tailor their trading environment to their specific needs.

- Offline Access: Some desktop platforms allow traders to access certain functionalities even when they are not connected to the internet.

- Disadvantages:

- Limited Portability: Desktop platforms are restricted to the specific computer they are installed on, limiting access from other devices.

- Installation and Updates: They require installation and regular updates, which can be time-consuming and sometimes inconvenient.

- System Requirements: Desktop platforms often have specific system requirements, which may not be compatible with all computers.

Examples of Popular Desktop Platforms:

- MetaTrader 4 (MT4): Widely regarded as the industry standard, MT4 offers a robust trading platform with advanced charting, technical indicators, and automated trading capabilities. It is compatible with various brokers and provides a wide range of features for both beginners and experienced traders.

- MetaTrader 5 (MT5): The successor to MT4, MT5 features a more advanced trading engine, enhanced charting tools, and a broader range of order types. It is also compatible with a wider range of financial instruments, including stocks, futures, and options.

- NinjaTrader: NinjaTrader is a popular platform among scalpers and day traders, known for its speed, advanced charting capabilities, and real-time market data feeds. It also offers a range of programming tools for automated trading strategies.

Web-Based Platforms

Web-based platforms are accessed through a web browser, eliminating the need for downloads or installations. They are accessible from any device with an internet connection, making them convenient for traders on the go.

- Advantages:

- Accessibility: Web-based platforms are accessible from any device with an internet connection, making them highly portable and convenient for traders who need to access their accounts from multiple locations.

- Easy Setup: They do not require installation or updates, making them easy to set up and use.

- Regular Updates: Web-based platforms are constantly updated with new features and improvements, ensuring that traders have access to the latest technology.

- Disadvantages:

- Limited Functionality: Web-based platforms often have fewer features and functionalities compared to desktop platforms, as they are limited by browser capabilities.

- Slower Performance: Web-based platforms can experience slower execution speeds and lag, especially during peak trading hours, as they rely on internet connectivity.

- Security Concerns: Web-based platforms are susceptible to security risks, as they rely on internet connections and browser security.

Examples of Popular Web-Based Platforms:

- cTrader: cTrader is a popular web-based platform known for its advanced charting tools, real-time market data feeds, and customizable trading environment. It also offers a range of order types and automated trading capabilities.

- TradingView: While primarily a charting platform, TradingView offers a powerful web-based trading interface that integrates with various brokers. It is known for its real-time data, social trading features, and customizable charting tools.

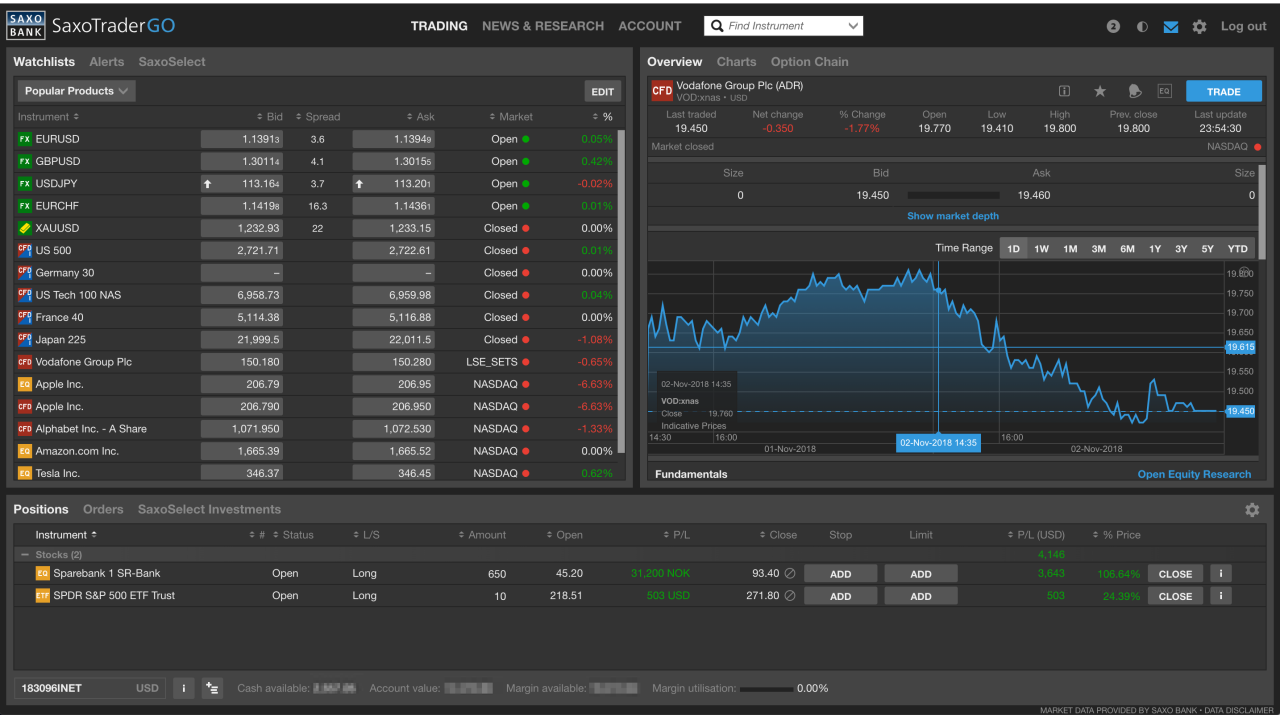

- SaxoTraderGO: SaxoTraderGO is a web-based platform offered by Saxo Bank, known for its user-friendly interface, comprehensive trading tools, and access to a wide range of financial instruments.

Mobile Apps

Mobile apps are designed for smartphones and tablets, offering traders access to their accounts and trading functionalities on the go. They provide a simplified and user-friendly interface, making it easy to monitor markets, place orders, and manage trades from anywhere.

- Advantages:

- Portability: Mobile apps are accessible from anywhere with an internet connection, making them highly portable and convenient for traders who need to monitor their accounts and place orders while on the move.

- User-Friendly Interface: Mobile apps are designed with a simplified and intuitive interface, making them easy to use even for novice traders.

- Real-Time Updates: Mobile apps provide real-time market updates and notifications, keeping traders informed of market movements.

- Disadvantages:

- Limited Functionality: Mobile apps often have fewer features and functionalities compared to desktop and web-based platforms, as they are constrained by screen size and mobile device limitations.

- Security Concerns: Mobile apps are susceptible to security risks, as they rely on mobile device security and internet connectivity.

- Slower Performance: Mobile apps can experience slower execution speeds and lag, especially during peak trading hours, due to network limitations and device processing power.

Examples of Popular Mobile Apps:

- MetaTrader 4 (MT4): MT4 is available as a mobile app for both Android and iOS devices, offering a simplified version of the desktop platform with access to essential trading features and real-time market data.

- MetaTrader 5 (MT5): MT5 is also available as a mobile app, offering a more advanced version of the desktop platform with a wider range of order types and trading features.

- Thinkorswim: Thinkorswim is a popular mobile app offered by TD Ameritrade, known for its advanced charting tools, real-time market data feeds, and customizable trading environment.

Choosing the Right Forex Trading Platform

Choosing the right Forex trading platform is crucial for success in the market. It’s like choosing the right tools for any job; the wrong platform can make your trading experience difficult and potentially lead to losses. A well-suited platform provides the necessary features, tools, and support to help you execute trades effectively and manage your risk.

Evaluating Platform Features

Platform features are critical for a seamless and efficient trading experience. You need to assess whether the platform offers the tools and functionalities you need to analyze markets, place orders, and manage your positions effectively.

- Trading Tools: Look for platforms that provide a range of technical indicators, charting tools, and analytical resources to help you make informed trading decisions. This includes features like real-time quotes, customizable charts, technical indicators, and economic calendars.

- Order Types: Different platforms offer various order types, including market orders, limit orders, stop-loss orders, and take-profit orders. Make sure the platform supports the order types you need to execute your trading strategies effectively.

- Trading Platform Interface: Choose a platform with an intuitive and user-friendly interface that allows you to navigate easily and access the information you need quickly. A well-designed interface is essential for a smooth trading experience.

- Mobile Trading App: If you prefer to trade on the go, ensure the platform offers a robust mobile trading app that provides access to all the essential features of the desktop platform.

Evaluating Fees and Costs

Trading platforms typically charge fees for various services, such as trading commissions, account maintenance fees, and inactivity fees. It’s crucial to understand the fee structure and ensure it aligns with your trading style and budget.

- Trading Commissions: Some platforms charge commissions on each trade you execute, while others offer commission-free trading. Compare the commission rates of different platforms to find the most cost-effective option.

- Spreads: Spreads represent the difference between the bid and ask prices of a currency pair. Platforms with tighter spreads offer better trading opportunities, as you pay less for each trade.

- Other Fees: Consider other fees like account maintenance fees, inactivity fees, and withdrawal fees. These fees can add up over time, so it’s important to be aware of them upfront.

Evaluating Customer Support

Reliable customer support is crucial when trading Forex, as you may need assistance with account issues, platform problems, or technical questions.

- Availability: Ensure the platform offers customer support through multiple channels, such as phone, email, and live chat, and that they are available 24/5.

- Responsiveness: Check the platform’s response times and the quality of their support. Look for platforms that offer prompt and helpful assistance.

- Resources: Evaluate the platform’s educational resources, such as tutorials, articles, and webinars, which can help you learn about Forex trading and navigate the platform effectively.

Forex Trading Platform Functionality

Forex trading platforms provide a wide range of functionalities that enable traders to access and execute trades, manage their accounts, and analyze market data. These functionalities are designed to enhance the trading experience and empower traders to make informed decisions.

Opening and Managing Trading Accounts

The process of opening and managing a trading account is typically straightforward. It involves the following steps:

- Choosing a Forex Broker: Select a reputable broker that meets your trading needs and preferences. Consider factors such as regulation, trading fees, account types, and available trading instruments.

- Account Registration: Complete the online registration form, providing your personal details and financial information.

- Account Verification: Verify your identity and address by submitting required documents, such as a passport or driver’s license.

- Funding the Account: Deposit funds into your trading account using various payment methods, such as bank transfers, credit cards, or e-wallets.

- Account Management: Once your account is funded, you can manage your trading activities, including monitoring your account balance, trading history, and account settings.

Placing and Managing Trades

Forex trading platforms offer intuitive tools for placing and managing trades, including:

- Order Types: Different order types allow traders to specify the price and conditions for executing trades. Common order types include market orders, limit orders, stop orders, and trailing stop orders.

- Stop-Loss Orders: These orders are used to limit potential losses by automatically closing a trade when the price reaches a predetermined level.

For example, if you buy a currency pair at 1.1000 and set a stop-loss order at 1.0950, the trade will be automatically closed if the price falls to 1.0950.

- Take-Profit Orders: These orders are used to lock in profits by automatically closing a trade when the price reaches a predetermined level.

For example, if you buy a currency pair at 1.1000 and set a take-profit order at 1.1050, the trade will be automatically closed if the price rises to 1.1050.

- Trade Management Tools: Platforms provide features for monitoring open positions, managing risk, and adjusting orders as needed.

Real-Time Market Data and Analytical Tools

Access to real-time market data and analytical tools is crucial for informed trading decisions. Forex trading platforms offer the following:

- Real-Time Quotes: Display live currency prices and other market data, such as bid/ask spreads, trading volume, and order book information.

- Charting Tools: Allow traders to visualize price movements, identify trends, and analyze patterns using various chart types, indicators, and drawing tools.

- Technical Analysis Indicators: Provide insights into price movements and potential future trends based on historical data. Popular indicators include moving averages, MACD, RSI, and Bollinger Bands.

- Fundamental Analysis Tools: Offer access to economic news, financial reports, and other fundamental data that can influence currency prices.

Forex Trading Platform Security and Regulation

In the dynamic world of Forex trading, safeguarding your funds and personal information is paramount. Choosing a Forex trading platform that prioritizes security and operates under stringent regulatory oversight is essential. This section delves into the crucial aspects of Forex trading platform security and regulation, emphasizing the importance of robust security measures and the role of regulatory bodies in ensuring a secure and transparent trading environment.

Security Measures, Forex trading platforms

A secure Forex trading platform implements various measures to protect user data and funds from unauthorized access and cyber threats. These measures are vital to ensure the integrity and confidentiality of your financial transactions.

- Encryption: Forex trading platforms employ encryption technologies to safeguard sensitive data, such as login credentials, trading history, and personal information, during transmission and storage. Encryption transforms data into an unreadable format, rendering it inaccessible to unauthorized individuals. This is a fundamental security measure that protects against data breaches and ensures the confidentiality of your information.

- Two-Factor Authentication (2FA): 2FA adds an extra layer of security by requiring users to provide two distinct forms of authentication, typically a password and a one-time code generated by a mobile app or email. This multi-step verification process significantly reduces the risk of unauthorized access, even if someone gains access to your password.

- Secure Socket Layer (SSL) Certificates: SSL certificates establish a secure connection between your web browser and the Forex trading platform’s servers, ensuring that all data transmitted is encrypted. Look for the padlock icon in your browser’s address bar, which indicates a secure connection.

- Firewalls and Intrusion Detection Systems: Forex trading platforms typically deploy firewalls and intrusion detection systems to prevent unauthorized access and detect malicious activities. These security tools act as barriers to block unwanted connections and identify potential threats.

Regulatory Bodies

Regulatory bodies play a crucial role in overseeing the Forex trading industry, ensuring that platforms adhere to strict standards and regulations. These bodies establish rules and guidelines to protect investors, maintain market integrity, and prevent fraud.

- Financial Conduct Authority (FCA) – UK: The FCA is a leading regulatory body that oversees Forex trading platforms operating in the United Kingdom. The FCA sets high standards for financial services firms, including Forex brokers, ensuring that they operate fairly, honestly, and transparently.

- Australian Securities and Investments Commission (ASIC) – Australia: ASIC is the primary regulatory body for the financial services industry in Australia, including Forex trading platforms. ASIC aims to protect investors, ensure market integrity, and promote financial literacy.

- Cyprus Securities and Exchange Commission (CySEC) – Cyprus: CySEC is a regulatory body that oversees Forex trading platforms operating in Cyprus. CySEC’s mission is to ensure a fair, transparent, and efficient financial market, protecting investors and promoting financial stability.

- National Futures Association (NFA) – USA: The NFA is a self-regulatory organization (SRO) that oversees the futures and options industry in the United States. The NFA establishes rules and regulations for Forex brokers operating in the US, promoting investor protection and market integrity.

Reputable Forex Trading Platforms

Numerous reputable Forex trading platforms operate under strict regulatory oversight and employ robust security measures to protect user data and funds. Here are a few examples:

- MetaTrader 4 (MT4) and MetaTrader 5 (MT5): These popular trading platforms are widely recognized for their security features, including encryption, 2FA, and regulatory compliance. MT4 and MT5 are regulated by various financial authorities, including the FCA, ASIC, and CySEC.

- eToro: eToro is a regulated Forex and CFD trading platform known for its social trading features and advanced security protocols. eToro is regulated by the FCA and CySEC, adhering to strict regulatory requirements.

- FXTM: FXTM is a globally regulated Forex broker that offers a wide range of trading instruments and advanced security measures. FXTM is regulated by the FCA, CySEC, and the Financial Sector Conduct Authority (FSCA) in South Africa.

The Future of Forex Trading Platforms

The Forex trading landscape is constantly evolving, driven by technological advancements and changing trader preferences. Emerging trends and technologies are shaping the future of Forex trading platforms, creating opportunities for enhanced trading experiences and greater efficiency.

Artificial Intelligence and Machine Learning

Artificial intelligence (AI) and machine learning (ML) are poised to revolutionize Forex trading platforms. AI algorithms can analyze vast amounts of data, including market trends, economic indicators, and news events, to identify patterns and predict future price movements. This can help traders make more informed decisions and improve their trading strategies.

- AI-powered trading robots can automate trading decisions based on pre-defined parameters, freeing up traders to focus on other aspects of their trading activities.

- ML algorithms can personalize trading experiences by learning individual trader preferences and risk tolerances, recommending suitable trading instruments and strategies.

- AI-powered chatbots can provide instant customer support and answer traders’ questions in real-time, enhancing the overall user experience.

Blockchain Technology

Blockchain technology, known for its secure and transparent nature, has the potential to transform Forex trading platforms. Decentralized exchanges (DEXs) built on blockchain platforms can offer traders greater control over their funds and eliminate the need for intermediaries.

- Blockchain can enhance security by reducing the risk of fraud and hacking, providing a more secure environment for trading.

- Smart contracts on blockchain platforms can automate trading processes, such as order execution and settlement, improving efficiency and reducing transaction costs.

- Blockchain can facilitate cross-border payments, allowing traders to access global markets with greater ease and lower fees.

Future Direction of Forex Trading Platform Development

Forex trading platforms are expected to become more sophisticated and user-friendly, incorporating advanced features and functionalities to meet the evolving needs of traders.

- Enhanced Data Analytics: Platforms will offer advanced data analytics tools to help traders identify market trends, analyze trading performance, and make better decisions.

- Personalized Trading Experiences: Platforms will personalize trading experiences by learning individual trader preferences, risk tolerances, and trading styles.

- Mobile-First Trading: Mobile trading will become increasingly important, with platforms offering seamless and intuitive mobile experiences.

- Integration with Social Media: Forex trading platforms will integrate with social media platforms to provide traders with access to market insights, news updates, and community discussions.

- Increased Focus on Education: Platforms will offer comprehensive educational resources to help traders learn about Forex trading, improve their skills, and manage their risk.

Conclusive Thoughts: Forex Trading Platforms

Choosing the right forex trading platform is a critical decision for any trader. By understanding the key features, functionalities, and security measures of these platforms, traders can make informed choices that align with their trading goals and risk tolerance. As the forex market continues to evolve, so too will the technology that powers it, with emerging trends and innovations shaping the future of forex trading platforms.

Commonly Asked Questions

What are the best forex trading platforms for beginners?

Several platforms cater to beginners, offering user-friendly interfaces, educational resources, and demo accounts for practice. Some popular options include MetaTrader 4 (MT4), TradingView, and eToro.

How do I choose a forex trading platform that suits my needs?

Consider factors like platform features, fees, security, regulatory compliance, customer support, and the availability of educational resources. Research and compare different platforms before making a decision.

Are forex trading platforms safe?

Reputable platforms prioritize security measures to protect user data and funds. Look for platforms that employ encryption, two-factor authentication, and regulatory oversight.

What are the risks associated with forex trading?

Forex trading involves inherent risks, including market volatility, leverage, and potential for losses. It’s essential to understand these risks and manage them effectively.

How do I learn more about forex trading?

Numerous online resources, educational materials, and courses are available to help you learn about forex trading. Many platforms also offer educational content and tutorials.