Forex trading platform best: Entering the world of forex trading can be both exciting and overwhelming. Choosing the right platform is crucial, as it will be your gateway to accessing the global currency market and executing trades. Navigating the plethora of available platforms can feel like a daunting task, especially for newcomers.

This guide aims to equip you with the knowledge and tools needed to make an informed decision. We’ll delve into the essential features to consider, explore platforms tailored for various trading styles, and provide a step-by-step approach to selecting the platform that aligns with your individual needs.

Introduction to Forex Trading Platforms: Forex Trading Platform Best

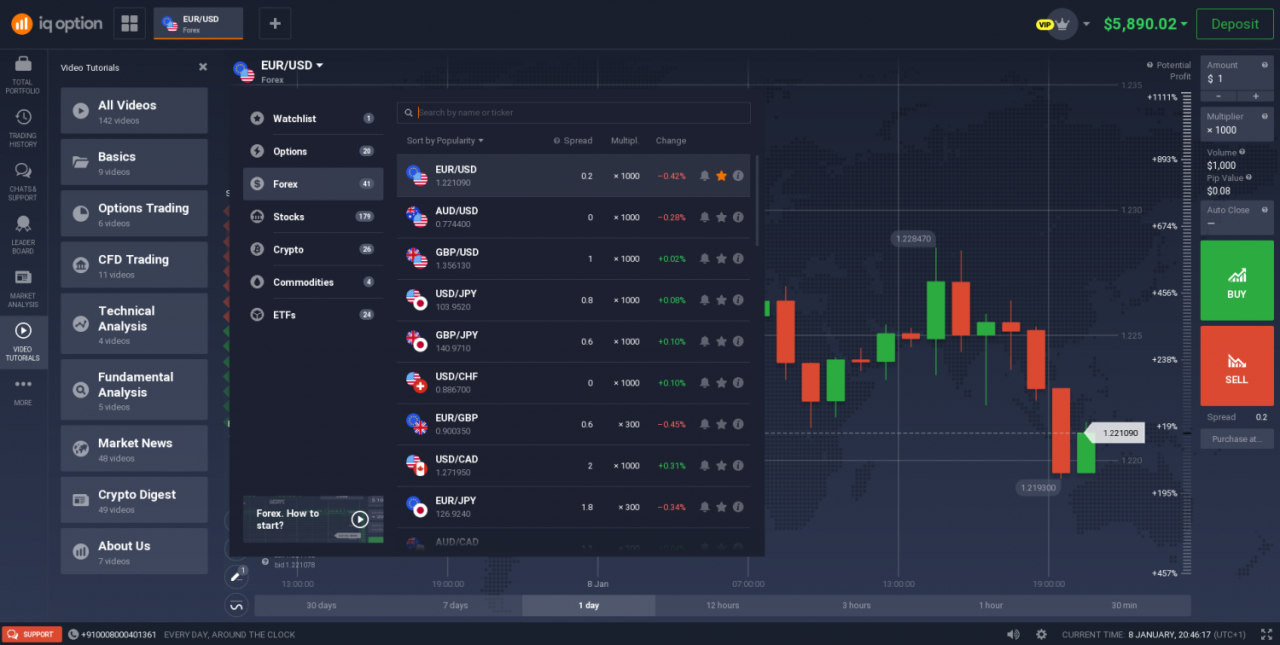

Forex trading platforms are essential tools for traders who participate in the foreign exchange market. They provide a user interface and the necessary functionalities to execute trades, manage accounts, and analyze market data. Choosing the right platform is crucial for a successful forex trading experience.

Features and Functionalities of Forex Trading Platforms, Forex trading platform best

A comprehensive forex trading platform should offer a range of features and functionalities to cater to the needs of different traders. These features can be broadly categorized as follows:

- Trading Execution: This includes placing orders, managing existing positions, and setting stop-loss and take-profit levels. Modern platforms often provide advanced order types like market orders, limit orders, and stop orders.

- Account Management: Forex platforms enable traders to deposit and withdraw funds, view account balances, and track trading history. Some platforms may offer additional features like margin management and risk management tools.

- Market Analysis: Access to real-time market data, including price charts, economic indicators, and news feeds, is essential for informed trading decisions. Platforms may provide various technical analysis tools, such as moving averages, oscillators, and trend lines.

- Educational Resources: Some platforms offer educational resources, such as trading tutorials, webinars, and market analysis reports, to help traders improve their skills and knowledge.

- Customer Support: Reliable customer support is crucial for addressing any technical issues or inquiries. Platforms may provide phone, email, or live chat support.

Types of Forex Trading Platforms

Forex trading platforms come in various forms, each with its advantages and disadvantages. The most common types include:

- Desktop Platforms: These platforms are typically downloaded and installed on a computer. They offer advanced functionalities and customization options. Examples include MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

- Web-Based Platforms: These platforms can be accessed through a web browser, eliminating the need for downloads. They are convenient for traders who prefer to trade from multiple devices. Examples include cTrader and TradingView.

- Mobile Applications: Mobile trading apps allow traders to access their accounts and trade from their smartphones or tablets. They offer a simplified interface and are ideal for traders on the go.

Epilogue

Selecting the best forex trading platform is a crucial step in your trading journey. By understanding your trading goals, experience level, and preferences, you can narrow down your options and choose a platform that empowers you to navigate the dynamic forex market effectively. Remember, continuous learning and adapting your approach are essential for success in this exciting and challenging realm.

Query Resolution

What are the minimum deposit requirements for forex trading platforms?

Minimum deposit requirements vary widely among platforms. Some platforms cater to beginners with low minimums, while others require substantial deposits. It’s essential to research and choose a platform that aligns with your budget.

Are there any free forex trading platforms available?

While many platforms offer free demo accounts for practice, most require a minimum deposit to access live trading. However, some platforms may offer free trials or limited access to their services.

What are the best forex trading platforms for scalping?

Scalping involves making numerous short-term trades to capitalize on small price fluctuations. Platforms with fast order execution speeds, low latency, and access to real-time market data are ideal for scalping strategies.

How do I choose the best forex trading platform for mobile trading?

Look for platforms with user-friendly mobile apps, a wide range of trading instruments, real-time charting capabilities, and robust security features.