The forex trading market is the largest and most liquid financial market in the world, facilitating the exchange of currencies between individuals, businesses, and governments. This global marketplace operates 24 hours a day, five days a week, providing traders with ample opportunities to capitalize on currency fluctuations.

Forex trading involves buying and selling currency pairs, with the aim of profiting from changes in their relative values. The market’s constant activity is driven by a complex interplay of economic indicators, political events, and market sentiment, making it a dynamic and challenging environment for traders of all experience levels.

Introduction to the Forex Trading Market

The foreign exchange market, commonly known as forex, is the largest and most liquid financial market globally. It facilitates the exchange of currencies, enabling businesses and individuals to conduct international transactions. Forex trading plays a crucial role in the global economy, influencing exchange rates and impacting international trade and investment flows.

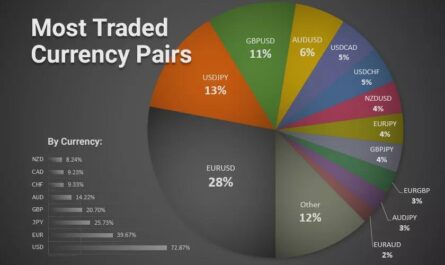

Understanding Currency Pairs

Currency pairs form the foundation of forex trading. They represent the value of one currency against another. For example, the EUR/USD pair indicates the value of the euro (EUR) in relation to the US dollar (USD). When you buy a currency pair, you are essentially buying the base currency (the first currency listed) and selling the quote currency (the second currency listed). The exchange rate between these currencies fluctuates constantly, creating opportunities for traders to profit from price movements.

The History of the Forex Market

The forex market has a long and fascinating history, evolving from a decentralized network of banks to a sophisticated, electronically-driven global marketplace. Its origins can be traced back to the 19th century, with the development of international trade and the need for currency conversion. The Bretton Woods Agreement in 1944 established a fixed exchange rate system, but the market transitioned to a floating exchange rate system in the 1970s, leading to the emergence of modern forex trading.

Evolution of the Forex Market, Forex trading market

The forex market has undergone significant evolution over the years, driven by technological advancements and changing market dynamics. The introduction of electronic trading platforms in the 1990s revolutionized the market, making it more accessible to individual investors. Today, forex trading is conducted electronically through online platforms, offering real-time quotes and execution speeds. The market’s growth has also been fueled by increased globalization, the rise of emerging markets, and the development of new trading strategies.

Key Participants in the Forex Market

The forex market is a global marketplace where currencies are traded. It is the largest and most liquid financial market in the world, with trillions of dollars changing hands every day. This vast market is populated by a diverse range of participants, each with their own unique motivations and strategies. Understanding the key players in the forex market is crucial for comprehending market dynamics and navigating the complexities of currency trading.

Central Banks

Central banks play a pivotal role in the forex market. They are responsible for managing a country’s monetary policy and influencing the value of its currency.

- Setting Interest Rates: Central banks adjust interest rates to control inflation and stimulate economic growth. Higher interest rates attract foreign investment, increasing demand for the currency and strengthening its value. Conversely, lower interest rates can weaken a currency.

- Intervention in the Forex Market: Central banks can intervene in the forex market by buying or selling their own currency to influence its value. This intervention is often undertaken to stabilize the currency or to prevent excessive fluctuations.

- Providing Liquidity: Central banks act as lenders of last resort, providing liquidity to the financial system during times of stress. This ensures the smooth functioning of the forex market and prevents disruptions.

Commercial Banks

Commercial banks are major players in the forex market, facilitating currency exchange for their clients and participating in trading activities.

- Foreign Exchange Transactions: Commercial banks provide foreign exchange services to their clients, including individuals, businesses, and other financial institutions. They facilitate currency conversions and international payments.

- Trading for Profit: Commercial banks also engage in forex trading to generate profits. They may buy and sell currencies based on market forecasts or to hedge against currency risk in their other business activities.

- Providing Liquidity: Commercial banks contribute to the liquidity of the forex market by providing quotes and facilitating trades. Their presence helps ensure the smooth functioning of the market.

Hedge Funds

Hedge funds are investment funds that employ sophisticated strategies to generate returns for their investors. They often use leverage and derivatives to amplify their positions and capitalize on market opportunities.

- Speculative Trading: Hedge funds engage in speculative trading, buying and selling currencies based on their assessment of market trends and economic fundamentals. They may profit from short-term price fluctuations or long-term trends.

- Currency Arbitrage: Hedge funds may exploit price discrepancies between different forex markets to generate profits. They may buy a currency in one market and sell it in another where it is priced higher.

- Market Volatility: Hedge funds often thrive in volatile markets, where they can profit from large price swings. Their presence can amplify market movements and contribute to volatility.

Retail Traders

Retail traders are individuals who trade currencies on their own account. They may use a variety of trading platforms and strategies to profit from currency movements.

- Individual Investors: Retail traders typically have smaller account sizes than institutional investors and may be more susceptible to market fluctuations. They may use technical analysis, fundamental analysis, or a combination of both to make trading decisions.

- Online Trading Platforms: Retail traders often use online trading platforms that provide access to real-time market data, charting tools, and trading execution capabilities.

- High-Frequency Trading: Some retail traders engage in high-frequency trading, using algorithms to execute trades at lightning speed. This strategy is typically employed by sophisticated traders with access to advanced technology.

Closure

Navigating the forex trading market requires a blend of knowledge, discipline, and a sound risk management strategy. Understanding the fundamentals of currency valuation, mastering technical analysis techniques, and utilizing appropriate trading tools are essential for success. While the market offers significant potential for profit, it’s crucial to approach it with a realistic understanding of the inherent risks and to trade within your comfort zone.

Detailed FAQs: Forex Trading Market

What are the benefits of trading forex?

Forex trading offers potential benefits like high liquidity, round-the-clock trading, and the opportunity to diversify investment portfolios.

How can I learn more about forex trading?

There are numerous online resources, educational materials, and courses available to help you learn about forex trading.

Is forex trading suitable for beginners?

Forex trading can be challenging for beginners, so it’s crucial to start with a thorough understanding of the market and practice with a demo account before risking real money.