- Introduction to Forex Trading Demo Accounts

- Key Features of a Forex Trading Demo Account

- How to Use a Forex Trading Demo Account Effectively

- Advantages of Using a Forex Trading Demo Account

- Limitations of Forex Trading Demo Accounts

- Transitioning from a Demo Account to a Live Account

- Ultimate Conclusion: Forex Trading Demo Account

- Top FAQs

Forex trading demo accounts are invaluable tools for aspiring and experienced traders alike. They offer a risk-free environment to practice trading strategies, learn the intricacies of the forex market, and build confidence before venturing into live trading. Whether you’re a beginner exploring the world of forex or a seasoned trader seeking to refine your skills, a demo account provides a safe and controlled space to experiment and grow.

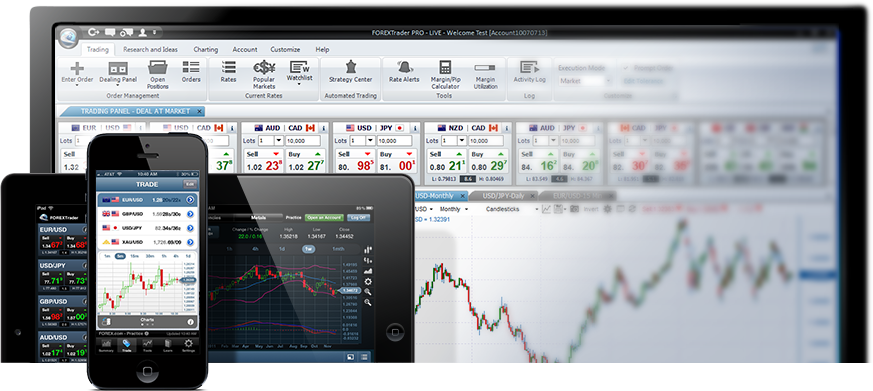

These accounts are typically powered by forex brokers and replicate the real-time market conditions, allowing you to execute trades with virtual funds. This hands-on experience enables you to understand the nuances of market movements, analyze charts, and develop your trading techniques without risking any real capital.

Introduction to Forex Trading Demo Accounts

A forex trading demo account is a virtual trading environment that allows you to practice forex trading without risking any real money. It is a simulated version of a live trading account, providing access to the same trading platform, market data, and trading tools. This allows you to familiarize yourself with the platform, test different trading strategies, and gain experience before investing real capital.

Demo accounts are an essential tool for forex traders, both beginners and experienced ones. They offer numerous benefits that can significantly enhance your trading journey.

Benefits of Using a Demo Account

Demo accounts provide a safe and risk-free environment for learning and practicing forex trading. Here are some of the key benefits:

- Risk-Free Trading: Demo accounts allow you to trade without risking any real money, giving you the freedom to experiment with different strategies and learn from your mistakes without financial consequences. This is particularly valuable for beginners who are still developing their trading skills and understanding of the market.

- Familiarization with Trading Platforms: Each forex broker offers its own trading platform, which may have unique features and functionalities. Demo accounts allow you to explore the platform, understand its features, and become comfortable with its interface before using it for real trading. This can save you time and frustration when you transition to live trading.

- Testing Trading Strategies: Demo accounts provide an ideal environment for testing and refining your trading strategies. You can simulate real market conditions, execute trades, and analyze the results without risking real capital. This allows you to identify profitable strategies and optimize your trading approach.

- Developing Trading Discipline: Forex trading requires discipline, risk management, and emotional control. Demo accounts allow you to develop these crucial skills in a risk-free environment. You can learn to manage your emotions, stick to your trading plan, and avoid impulsive decisions.

- Understanding Market Dynamics: Forex markets are complex and constantly evolving. Demo accounts allow you to observe market movements, analyze price patterns, and gain a deeper understanding of market dynamics. This knowledge is essential for making informed trading decisions.

Real-World Examples of Demo Account Usage

Demo accounts are widely used by traders of all experience levels for various purposes:

- Beginners: New traders often use demo accounts to learn the basics of forex trading, understand how trading platforms work, and experiment with different trading strategies before risking real capital. This allows them to gain confidence and experience before entering the live market.

- Experienced Traders: Even experienced traders can benefit from using demo accounts to test new strategies, refine existing ones, and practice their trading skills. They can simulate different market conditions and scenarios to assess the effectiveness of their trading approaches without risking real capital.

- Testing Automated Trading Systems: Traders who use automated trading systems, such as expert advisors (EAs), can use demo accounts to test their systems in a risk-free environment. This allows them to identify any bugs or inefficiencies in their systems before deploying them in live trading.

- Practicing Risk Management: Demo accounts provide a safe space for traders to practice their risk management techniques. They can experiment with different stop-loss and take-profit levels, learn to manage their position sizes, and develop a solid risk management strategy before trading with real money.

Key Features of a Forex Trading Demo Account

A Forex trading demo account is a powerful tool for traders of all levels. It provides a risk-free environment to learn the intricacies of Forex trading, practice trading strategies, and experiment with different trading platforms.

Virtual Trading Environment

A demo account simulates real market conditions, allowing you to trade with virtual funds. This provides a realistic trading experience without risking your actual capital. You can test your trading strategies, analyze market movements, and develop your trading skills without financial consequences.

Access to Real-Time Market Data

Demo accounts offer access to real-time market data, including live price feeds, charts, and economic indicators. This allows you to stay up-to-date with market trends and make informed trading decisions.

Variety of Trading Instruments

Demo accounts typically offer a wide range of trading instruments, including currency pairs, commodities, indices, and CFDs. This allows you to explore different markets and discover your trading preferences.

Trading Platform Features

Demo accounts often provide access to the same trading platform features as live accounts. This includes order types, charting tools, technical indicators, and other functionalities. You can familiarize yourself with the platform’s interface and features before transitioning to live trading.

Educational Resources

Some Forex brokers offer educational resources alongside their demo accounts, such as tutorials, webinars, and trading guides. These resources can help you enhance your trading knowledge and understanding.

Key Features Comparison

| Feature | Advantage |

|---|---|

| Virtual Trading Environment | Risk-free trading experience, practice strategies, and develop skills without financial consequences. |

| Real-Time Market Data | Access to live price feeds, charts, and economic indicators for informed trading decisions. |

| Variety of Trading Instruments | Explore different markets and discover trading preferences. |

| Trading Platform Features | Familiarize yourself with the platform’s interface and functionalities before live trading. |

| Educational Resources | Enhance trading knowledge and understanding with tutorials, webinars, and guides. |

How to Use a Forex Trading Demo Account Effectively

A forex trading demo account is a powerful tool for learning and practicing forex trading without risking real money. It provides a simulated trading environment where you can experiment with different strategies, analyze market movements, and gain valuable experience. To maximize the benefits of a demo account, it’s crucial to use it effectively.

Setting Up and Using a Demo Account

To set up a demo account, you’ll typically need to choose a forex broker that offers demo accounts and follow their registration process. This usually involves providing some basic information, such as your name, email address, and phone number. Once your account is set up, you’ll be given a virtual balance of funds to trade with. The amount of virtual money you receive may vary depending on the broker.

The process of using a demo account is similar to trading with a live account. You’ll be able to access the same trading platform, market data, and trading tools. However, instead of trading with real money, you’ll be using virtual funds. This allows you to make mistakes and learn from them without financial consequences.

Strategies for Maximizing Learning

To maximize your learning experience with a demo account, consider these strategies:

- Focus on Specific Skills: Identify areas where you need improvement, such as technical analysis, risk management, or order execution, and practice these skills specifically on your demo account.

- Experiment with Different Strategies: Test various trading strategies, including scalping, day trading, and swing trading, to see which ones suit your trading style and risk tolerance.

- Simulate Real-World Trading Conditions: Set realistic trading goals, manage your virtual funds responsibly, and trade during market hours to mimic real-world trading scenarios.

- Analyze Your Trades: Keep a trading journal to track your trades, analyze your performance, and identify areas for improvement. This helps you understand what works and what doesn’t, and allows you to refine your trading strategy.

- Stay Up-to-Date with Market News: Keep abreast of current events and economic data that can impact forex markets. Use your demo account to practice trading based on real-time news and market analysis.

Common Mistakes to Avoid, Forex trading demo account

While a demo account offers a risk-free environment, it’s essential to avoid certain common mistakes that can hinder your learning process:

- Trading with Excessive Leverage: Leverage can amplify profits but also losses. It’s crucial to understand the risks associated with leverage and use it responsibly. Avoid using excessive leverage in your demo account, as this can lead to unrealistic expectations and losses when you switch to a live account.

- Ignoring Risk Management: Even in a demo account, it’s essential to implement risk management strategies. Set stop-loss orders to limit potential losses and avoid chasing losses by adding to losing trades.

- Overtrading: Demo accounts can lead to overtrading as there are no financial consequences for making mistakes. It’s crucial to develop a disciplined trading approach and avoid making impulsive trades.

- Not Taking it Seriously: Treat your demo account as a serious learning tool. Avoid trading with a reckless attitude and focus on developing sound trading habits.

- Not Graduating to a Live Account: After gaining sufficient experience and confidence on a demo account, it’s important to transition to a live account to test your skills in real-world conditions. However, start with a small amount of capital and gradually increase your trading size as you become more experienced.

Advantages of Using a Forex Trading Demo Account

A forex trading demo account offers a valuable opportunity for traders of all levels to hone their skills and develop their trading strategies without risking real money. It provides a safe and controlled environment to experiment, learn, and gain confidence before entering the live market.

Benefits for Beginners

The benefits of a demo account are particularly significant for beginners who are new to forex trading. It allows them to familiarize themselves with the trading platform, understand market dynamics, and experiment with different trading strategies without the pressure of financial loss.

- Risk-free trading: The most significant advantage of a demo account is the ability to trade without risking any real money. This allows beginners to make mistakes and learn from them without incurring financial losses.

- Familiarization with the platform: Demo accounts provide a realistic simulation of a live trading environment, enabling beginners to learn the intricacies of the trading platform, including order placement, market analysis tools, and account management features.

- Understanding market dynamics: By observing price movements and analyzing market data in a demo account, beginners can gain a better understanding of how the forex market operates and the factors that influence currency prices.

- Developing trading strategies: Demo accounts provide a safe space to test different trading strategies and identify those that suit their risk tolerance and trading style.

- Building confidence: As beginners gain experience and achieve success in a demo account, they build confidence in their abilities and prepare themselves for the real market.

Benefits for Experienced Traders

Experienced traders can also benefit significantly from using a demo account. It allows them to test new trading strategies, explore different markets, and practice their trading skills without risking their capital.

- Testing new strategies: Experienced traders can use a demo account to test new trading strategies or variations of existing strategies before deploying them in a live trading environment.

- Exploring new markets: Demo accounts provide an opportunity to explore different forex markets and currencies without risking capital.

- Practicing trading skills: Even experienced traders can benefit from practicing their trading skills in a demo account, particularly in volatile market conditions or when implementing new trading techniques.

- Improving risk management: Demo accounts allow traders to practice risk management strategies and test their effectiveness in a controlled environment.

Comparison of Demo and Live Accounts

The following table highlights the key differences between a demo account and a live account:

| Feature | Demo Account | Live Account |

|---|---|---|

| Trading capital | Virtual money | Real money |

| Risk | No risk | Real risk |

| Market conditions | Simulates live market conditions | Actual market conditions |

| Emotions | No emotional impact | Emotional impact |

| Learning curve | Steeper learning curve | Slower learning curve |

| Profit and loss | No real profit or loss | Real profit or loss |

Limitations of Forex Trading Demo Accounts

While forex demo accounts offer a valuable learning environment, they have limitations that can impact your trading experience and may not accurately reflect real-world trading conditions. It is crucial to understand these limitations before relying solely on demo accounts for trading decisions.

Differences Between Demo and Live Accounts

Demo accounts simulate real-time market conditions but do not replicate the full spectrum of factors that influence live trading. Understanding these differences is essential to prepare for the transition to live trading.

- Emotional Factors: Demo accounts lack the emotional pressure and financial consequences associated with real-money trading. This can lead to overtrading, impulsive decisions, and a lack of risk management, which are crucial in live trading.

- Market Conditions: While demo accounts strive to mimic real-time market conditions, they may not capture the full volatility and rapid price movements that can occur in live markets. This can create a false sense of security and lead to unrealistic expectations.

- Slippage and Execution: Demo accounts typically have instant execution, which is not always the case in live trading. Slippage, the difference between the expected price and the actual execution price, is a common occurrence in live markets and can significantly impact profits.

- Real-Time Data and News: Demo accounts may not provide access to real-time news and economic data that influence market sentiment. This can hinder your ability to make informed trading decisions, especially during periods of high volatility.

- Trading Psychology: Live trading involves emotional factors such as fear, greed, and anxiety, which are not present in demo accounts. This can lead to poor decision-making and impact trading performance.

Transitioning from a Demo Account to a Live Account

The transition from a demo account to a live account is a crucial step for any aspiring Forex trader. It marks the shift from a risk-free environment to the real world of trading, where your capital is at stake. This transition requires careful planning, strategic execution, and a disciplined approach to ensure a smooth and successful journey.

Important Considerations for a Successful Transition

The transition from a demo account to a live account involves several key considerations that can significantly impact your trading success. These considerations ensure you are adequately prepared for the challenges and opportunities that come with live trading.

- Define Your Trading Goals: Clearly articulate your trading objectives, such as profit targets, risk tolerance, and time commitment. Having a well-defined goal provides direction and helps you stay focused on your trading strategy.

- Determine Your Trading Capital: Establish a realistic trading capital that aligns with your risk tolerance and financial situation. Avoid overextending yourself, and start with a manageable amount that allows you to learn and grow without jeopardizing your financial stability.

- Choose the Right Broker: Select a reputable and regulated Forex broker that offers competitive trading conditions, reliable platform, and excellent customer support. Research and compare different brokers to find one that meets your specific needs and preferences.

- Refine Your Trading Strategy: Optimize your trading strategy based on your experience in the demo account. Identify your strengths and weaknesses, adjust your risk management parameters, and refine your entry and exit points to maximize profitability and minimize losses.

- Develop a Risk Management Plan: Implement a robust risk management plan that defines your stop-loss orders, position sizing, and overall risk exposure. This plan helps you protect your capital and prevents significant losses even when trades go against your expectations.

- Practice Emotional Control: The transition to live trading can be emotionally challenging, as real money is involved. Develop strategies to manage your emotions, such as taking breaks, avoiding overtrading, and sticking to your pre-defined plan.

Strategies for a Smooth Transition

Transitioning from a demo account to a live account involves a systematic approach to minimize the learning curve and maximize your chances of success.

- Start Small: Begin with a smaller trading capital than you would use in a demo account to gradually acclimate to the real trading environment. This allows you to test your strategies and adjust your risk management approach without exposing yourself to significant losses.

- Simulate Live Trading: Before going live, simulate live trading conditions in your demo account by using realistic market data and trading volumes. This helps you adapt to the real-time pressures and market fluctuations that you will encounter in live trading.

- Record and Analyze Your Trades: Maintain a detailed trading journal that records your trades, entry and exit points, and the rationale behind each decision. Analyze your trading performance regularly to identify patterns, areas for improvement, and adjust your strategy accordingly.

- Seek Feedback and Guidance: Connect with experienced traders or join online forums to seek feedback and guidance on your trading strategies and risk management practices. This can provide valuable insights and help you avoid common mistakes.

- Embrace Continuous Learning: Forex trading is a dynamic and ever-evolving field. Stay updated with market news, economic indicators, and trading techniques to enhance your knowledge and skills.

Managing Risk and Emotions

One of the most critical aspects of transitioning from a demo account to a live account is managing risk and emotions.

- Stick to Your Risk Management Plan: Adhere to your pre-defined risk management plan, regardless of market conditions or emotional impulses. This helps you avoid impulsive decisions that could lead to significant losses.

- Take Breaks When Necessary: When emotions start to cloud your judgment, take a step back from trading and allow yourself time to regain composure. This prevents emotional trading and helps you make more rational decisions.

- Avoid Overtrading: Overtrading can lead to impulsive decisions and increased risk exposure. Stick to your trading plan and avoid entering trades solely based on emotions or market noise.

- Learn from Your Mistakes: Mistakes are an inevitable part of the learning process. Analyze your losses and identify the underlying reasons to prevent similar errors in the future.

- Focus on the Long Term: Remember that Forex trading is a long-term game. Avoid chasing quick profits and focus on building a sustainable trading strategy that generates consistent returns over time.

Ultimate Conclusion: Forex Trading Demo Account

Mastering the forex market requires a combination of knowledge, skills, and discipline. A demo account provides the ideal platform to cultivate these essential elements. By embracing the learning opportunities presented by a demo account, you can gain a solid foundation, refine your strategies, and prepare yourself for the exciting world of live forex trading.

Top FAQs

What is the difference between a demo account and a live account?

A demo account uses virtual funds and simulates real-time market conditions, while a live account uses real money and directly interacts with the forex market.

How long should I use a demo account before switching to a live account?

There’s no fixed timeframe. It depends on your individual learning pace and confidence level. Focus on mastering your strategies and achieving consistent profitability in the demo environment before transitioning to live trading.

Can I use a demo account to test different trading platforms?

Yes, many forex brokers offer demo accounts for their various trading platforms. This allows you to compare features, user interfaces, and functionalities before choosing a platform for live trading.