A Forex trader demo account sets the stage for your trading journey, providing a risk-free environment to learn the ropes and hone your skills. This virtual trading platform mirrors real-time market conditions, allowing you to experiment with strategies, analyze charts, and gain valuable experience before venturing into the live market.

Whether you’re a novice trader seeking a foundation or an experienced trader exploring new strategies, a demo account offers a wealth of benefits. It provides a platform to practice your trading techniques, test different indicators, and develop a solid understanding of market dynamics without the pressure of real money.

What is a Forex Trader Demo Account?

A Forex trader demo account is a simulated trading environment that allows you to practice trading foreign exchange (Forex) without risking any real money. It’s like a virtual playground where you can learn the ropes of Forex trading and test your strategies before venturing into the real market.

Purpose of a Forex Demo Account

A Forex demo account serves as a stepping stone for both beginners and experienced traders, offering a safe and controlled space to:

- Learn the basics of Forex trading: Understand the concepts of currency pairs, pips, leverage, and other essential terms.

- Experiment with different trading strategies: Try out various trading techniques, including scalping, day trading, and swing trading, without risking real capital.

- Test your trading psychology: Practice managing your emotions and avoiding impulsive decisions in a pressure-free environment.

- Familiarize yourself with trading platforms: Gain hands-on experience using the features and tools available on popular Forex trading platforms.

- Develop a trading plan: Define your trading goals, risk tolerance, and entry/exit strategies before using real funds.

Features of a Typical Forex Demo Account

Forex demo accounts typically come equipped with a range of features designed to mimic the real trading environment, including:

- Virtual funds: Demo accounts provide a predetermined amount of virtual money, allowing you to trade without using your own funds.

- Real-time market data: You’ll have access to live Forex quotes, charts, and technical indicators, providing a realistic trading experience.

- Trading platforms: Demo accounts usually offer the same trading platforms used in live trading, giving you the opportunity to become familiar with their features and functionality.

Benefits of Using a Forex Demo Account

Whether you’re a beginner or an experienced trader, a Forex demo account can offer numerous advantages:

- Risk-free learning: Practice your trading skills without risking your own capital.

- Improved trading skills: Gain confidence and expertise by honing your strategies in a safe environment.

- Reduced trading errors: Identify and rectify mistakes before they impact your real trading account.

- Enhanced trading psychology: Develop emotional discipline and control in a stress-free environment.

- Better trading plan development: Test and refine your trading strategies and risk management techniques before going live.

How to Choose the Right Forex Demo Account

A Forex demo account is an essential tool for any aspiring trader, allowing you to practice your skills and strategies without risking real money. However, with so many different demo accounts available, choosing the right one can be overwhelming. This guide will provide you with the factors to consider when selecting a Forex demo account that aligns with your trading goals and experience level.

Factors to Consider When Choosing a Forex Demo Account

Selecting the right Forex demo account is crucial for your learning journey. Several factors influence your decision, and understanding these factors will help you choose the best demo account for your needs.

- Broker Reputation: Choose a reputable broker with a proven track record of reliability and transparency. Look for brokers with a good regulatory history, positive client reviews, and strong security measures. A reputable broker will ensure your trading experience is safe and secure.

- Platform Features: The trading platform should be user-friendly, intuitive, and offer the features you need for your trading style. Consider factors like charting tools, technical indicators, order types, and real-time market data. A comprehensive platform will empower you to practice different trading strategies effectively.

- Trading Instruments: The demo account should offer access to the trading instruments you are interested in, such as currency pairs, commodities, indices, and cryptocurrencies. Ensure the demo account provides a diverse range of assets to practice your strategies across different markets.

- Account Funding: Some demo accounts offer a pre-funded virtual balance, while others require you to set your own starting capital. Consider your preferred approach and the amount of virtual capital you need for your trading practice.

- Demo Account Validity: Some demo accounts have a limited lifespan, while others are permanent. Consider your learning goals and the timeframe you need for practice when choosing a demo account. A longer validity period will allow you to develop your skills without the pressure of time constraints.

Types of Forex Demo Accounts

Forex demo accounts come in different variations, each catering to specific needs and trading styles. Understanding these types will help you choose the best fit for your learning objectives.

- Standard Demo Accounts: These are the most common type of demo account and offer a realistic trading environment with virtual funds. They allow you to practice your trading strategies, get familiar with the trading platform, and experiment with different market conditions.

- Funded Demo Accounts: Some brokers offer funded demo accounts, where you receive a specific amount of virtual capital to trade with. This type of demo account can be beneficial for testing trading strategies and managing risk without the financial risk of real money.

- Demo Accounts with Specific Trading Strategies: Some brokers provide demo accounts tailored to specific trading strategies, such as scalping, day trading, or swing trading. These demo accounts can be helpful for beginners who want to focus on a particular trading style and develop their skills in that area.

Recommendations for Choosing a Forex Demo Account, Forex trader demo account

Your trading goals and experience level play a significant role in choosing the right Forex demo account. Here are some recommendations based on different scenarios:

- Beginners: If you are new to Forex trading, start with a standard demo account that offers a comprehensive platform, a wide range of trading instruments, and a generous virtual balance. This will allow you to familiarize yourself with the basics of Forex trading and develop your skills without risking real money.

- Experienced Traders: If you have some experience in Forex trading, consider a demo account that offers advanced features like charting tools, technical indicators, and real-time market data. You can also explore demo accounts with specific trading strategies to fine-tune your skills in a particular area.

Using a Forex Demo Account Effectively

A Forex demo account is a valuable tool for aspiring and experienced traders alike. It allows you to practice trading in a risk-free environment, explore different strategies, and familiarize yourself with the intricacies of the Forex market. By utilizing a demo account effectively, you can enhance your trading skills, develop a robust risk management approach, and gain confidence before venturing into live trading.

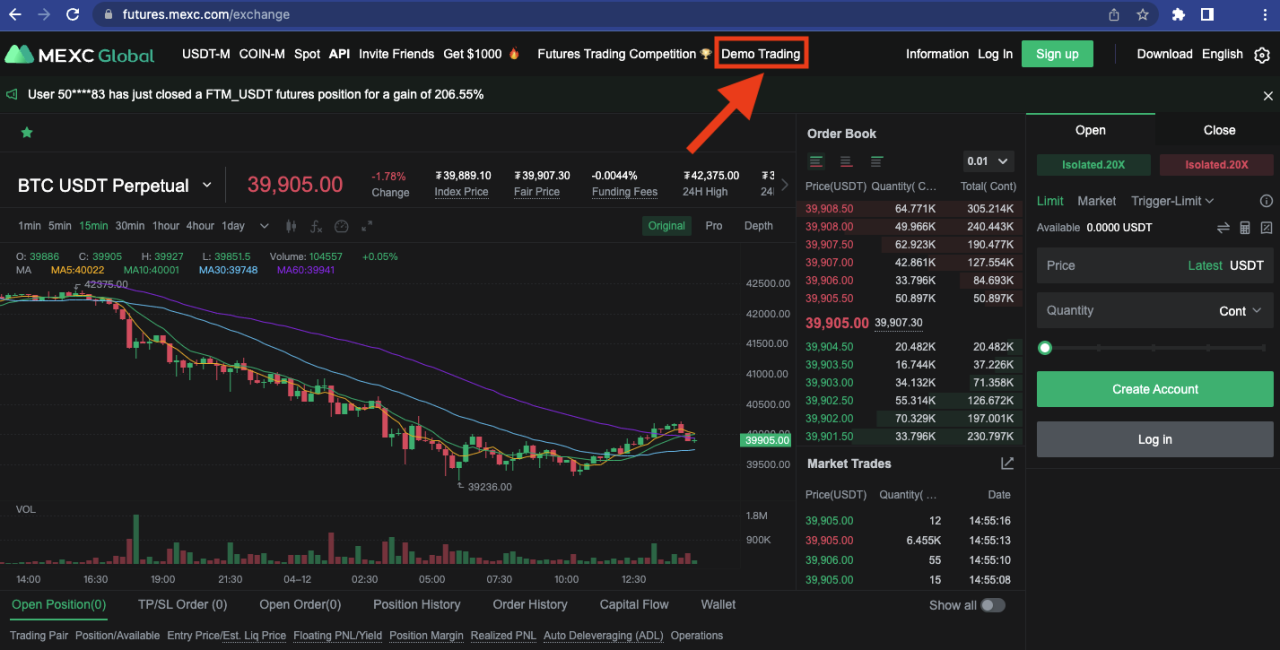

Setting Up and Using a Forex Demo Account

Before you start trading, it is crucial to understand the steps involved in setting up and using a Forex demo account. This process is straightforward and usually involves the following steps:

- Choose a reputable Forex broker that offers a demo account. Many brokers provide demo accounts with realistic market conditions and features, allowing you to simulate real-world trading experiences.

- Register for a demo account with the chosen broker. This typically involves providing basic personal information, such as your name, email address, and phone number.

- Download and install the trading platform provided by the broker. This platform will allow you to access the demo account and execute trades.

- Fund your demo account with virtual currency. The broker will usually provide a predetermined amount of virtual funds, which you can use to practice trading.

- Start practicing by placing trades on various currency pairs. Experiment with different trading strategies, order types, and risk management techniques.

Tips and Strategies for Maximizing the Benefits of a Demo Account

Once you have set up your demo account, it is essential to utilize it effectively to enhance your trading skills. Here are some tips and strategies to maximize the benefits of a demo account:

- Test Trading Strategies: A demo account provides a safe space to experiment with different trading strategies without risking real capital. You can test various technical indicators, fundamental analysis techniques, and trading systems to identify those that suit your trading style and risk tolerance.

- Develop Risk Management Skills: Risk management is a crucial aspect of Forex trading. A demo account allows you to practice and refine your risk management skills without risking real money. Experiment with different stop-loss orders, position sizing techniques, and risk-reward ratios to develop a robust risk management approach.

- Get Familiar with the Trading Platform: The trading platform is your primary tool for accessing the Forex market. A demo account allows you to familiarize yourself with the platform’s features, including order placement, order management, charting tools, and other functionalities. Understanding the platform’s interface and functionalities will make your live trading experience smoother and more efficient.

- Practice Consistent Trading: Consistent practice is essential for developing trading skills. Dedicate regular time to trading on your demo account, even if it’s just for a few hours each day. This will help you build muscle memory and improve your decision-making abilities in real-time market conditions.

- Simulate Realistic Trading Scenarios: A demo account allows you to simulate realistic trading scenarios, such as market volatility, sudden price movements, and unexpected news events. This will help you prepare for the challenges and opportunities that you may encounter in live trading.

Transitioning from a Demo Account to Live Trading

The demo account is a valuable tool for learning the ropes of Forex trading. However, it’s just a simulation. When you move to a live account, you’ll be trading with real money, and this introduces a whole new set of challenges and considerations.

Key Differences Between Demo and Live Trading

The transition from a demo account to a live account is a significant step for any trader. While demo accounts offer a risk-free environment to practice trading strategies, they lack the emotional and financial pressure of real-money trading.

- Real Money Impact: In a demo account, losses are not real, and profits don’t translate to actual gains. When you trade with real money, every decision carries weight. Losing trades can lead to financial losses, while winning trades can bring tangible rewards.

- Emotional Factors: Trading with real money can evoke strong emotions, such as fear, greed, and anxiety. These emotions can cloud judgment and lead to impulsive decisions. In a demo account, emotions are less intense because the financial stakes are not real.

Preparing for Live Trading

Before making the leap to live trading, it’s crucial to prepare thoroughly. This involves a comprehensive understanding of trading risks, realistic expectations, and a solid trading plan.

- Understanding Trading Risks: Forex trading is inherently risky. It’s essential to understand the potential for losses and develop risk management strategies to protect your capital. This includes setting stop-loss orders and limiting your position size.

- Setting Realistic Expectations: It’s important to be realistic about your trading goals. Avoid unrealistic expectations of quick riches. Forex trading requires patience, discipline, and a long-term perspective.

- Developing a Trading Plan: A well-defined trading plan Artikels your trading strategy, risk management rules, and entry and exit points. It serves as a roadmap to guide your trading decisions and help you stay disciplined.

Managing the Psychological Transition

The psychological transition from simulated trading to real-money trading can be challenging. The fear of losing real money can lead to overthinking, hesitation, and emotional trading.

- Start Small: Begin with a small amount of capital that you are comfortable losing. This allows you to gain experience in live trading without risking a significant amount of money.

- Practice Patience: Avoid impulsive decisions and stick to your trading plan. Remember that consistent profits take time and effort.

- Learn from Mistakes: Every trade, whether profitable or not, provides valuable lessons. Analyze your trades to identify areas for improvement and refine your trading strategy.

Examples of Forex Demo Accounts: Forex Trader Demo Account

Demo accounts are a valuable tool for learning and practicing forex trading without risking real money. They offer a risk-free environment to experiment with different trading strategies, analyze market trends, and get familiar with the trading platform. There are many forex brokers that provide demo accounts, each with its own unique features and benefits.

Comparison of Popular Forex Demo Account Providers

The following table compares and contrasts the features and benefits of some popular forex demo account providers:

| Broker | Trading Platform | Available Instruments | Maximum Leverage | Special Features | Website |

|---|---|---|---|---|---|

| MetaTrader 4 (MT4) | MetaTrader 4 | Forex, CFDs, Metals, Energies | 1:500 | Advanced charting tools, Expert Advisors (EAs), and a wide range of indicators | https://www.metatrader4.com/ |

| XM | MetaTrader 4 and MetaTrader 5 | Forex, CFDs, Metals, Energies, Indices | 1:888 | Zero commission trading, negative balance protection, and educational resources | https://www.xm.com/ |

| FXTM | MetaTrader 4 and MetaTrader 5 | Forex, CFDs, Metals, Energies, Indices | 1:1000 | Multiple account types, including a demo account with a virtual balance of $100,000 | https://www.forextime.com/ |

| FBS | MetaTrader 4 and MetaTrader 5 | Forex, CFDs, Metals, Energies, Indices | 1:3000 | Free educational resources, webinars, and a dedicated customer support team | https://www.fbs.com/ |

Conclusive Thoughts

Mastering the art of Forex trading requires practice, discipline, and a deep understanding of the market. A demo account serves as your training ground, empowering you to refine your skills, build confidence, and prepare for the challenges of live trading. As you progress, you’ll transition from simulated trading to real-money trading with a solid foundation and a strategic mindset, ready to navigate the exciting and potentially lucrative world of Forex.

Clarifying Questions

How long should I use a demo account?

There’s no set time frame. Use it until you feel confident in your trading strategies and risk management skills.

Can I make real money with a demo account?

No, demo accounts use virtual funds. The purpose is to practice and learn, not to earn profits.

Are demo accounts free?

Most demo accounts are free, but some brokers may have limitations or require registration.

What happens to my progress on a demo account if I close it?

Your progress is usually reset when you close a demo account. You can always open a new one to start fresh.