Forex Rates Oanda sets the stage for this exploration of the global currency market, offering a comprehensive look at how Oanda, a leading Forex broker, facilitates trading and provides valuable resources for traders of all levels.

From understanding the fundamental principles of Forex rates and their influence on global finance to navigating Oanda’s platforms, trading tools, and data resources, this guide will equip you with the knowledge needed to make informed trading decisions.

Introduction to Forex Rates

Forex rates, also known as foreign exchange rates, are the prices at which one currency can be exchanged for another. They play a crucial role in global finance, facilitating international trade, investment, and travel.

Forex rates constantly fluctuate, influenced by a complex interplay of economic, political, and market factors. Understanding these factors is essential for anyone involved in international transactions or Forex trading.

Factors Influencing Forex Rates

The value of a currency is determined by the forces of supply and demand. Several factors influence these forces, leading to fluctuations in Forex rates.

- Economic Indicators: Economic data releases, such as inflation rates, interest rates, and GDP growth, provide insights into the health of an economy. Strong economic performance tends to boost a currency’s value, while weak performance weakens it.

- Political Events: Political stability and government policies significantly impact currency values. Political turmoil, changes in government, or significant policy shifts can cause volatility in Forex markets.

- Market Sentiment: Investor confidence and market sentiment play a vital role in Forex trading. Positive market sentiment can lead to increased demand for a currency, driving its value higher. Conversely, negative sentiment can lead to a decrease in demand, resulting in a weaker currency.

Currency Pairs

Forex trading involves exchanging one currency for another. This exchange is represented through currency pairs, where the first currency is called the “base currency” and the second currency is called the “quote currency.”

For example, the EUR/USD currency pair represents the exchange rate between the euro (EUR) and the US dollar (USD).

The Forex rate for a currency pair indicates how much of the quote currency is needed to buy one unit of the base currency.

- EUR/USD = 1.1000: This means that 1 euro (EUR) can be exchanged for 1.1000 US dollars (USD).

Oanda as a Forex Broker

Oanda is a globally recognized and respected Forex broker, known for its commitment to transparency, innovation, and cutting-edge technology. Established in 1996, Oanda has earned a strong reputation within the financial industry, attracting both novice and experienced traders.

Oanda’s History and Reputation

Oanda’s journey began as a pioneer in online currency exchange, providing accurate and reliable Forex rates to individuals and businesses. This early focus on transparency and data accuracy laid the foundation for its future success as a Forex broker. Over the years, Oanda has consistently expanded its offerings, introducing innovative trading platforms, advanced research tools, and educational resources, all aimed at empowering traders of all levels.

Oanda’s commitment to regulatory compliance and ethical practices has also contributed to its positive reputation. It is regulated by multiple financial authorities worldwide, including the Financial Conduct Authority (FCA) in the UK, the Australian Securities and Investments Commission (ASIC) in Australia, and the Commodity Futures Trading Commission (CFTC) in the US. This robust regulatory framework ensures that Oanda operates within a transparent and accountable environment, providing traders with a secure and reliable trading environment.

Types of Forex Trading Accounts

Oanda offers a variety of Forex trading accounts tailored to meet the diverse needs of its clients. Here’s a breakdown of the key account types:

- Standard Account: This account is ideal for beginners and those looking for a straightforward trading experience. It offers competitive spreads and access to a wide range of currency pairs.

- Premium Account: This account is designed for experienced traders seeking tighter spreads and advanced trading features. It offers access to premium research tools and personalized support from dedicated account managers.

- Pro Account: This account caters to high-volume traders and institutional clients who require ultra-low spreads and advanced order execution capabilities. It provides direct access to Oanda’s institutional-grade trading platform and dedicated account managers.

Oanda’s Trading Platforms and Tools

Oanda offers a range of trading platforms and tools designed to enhance the trading experience for both beginners and seasoned professionals.

- Oanda Trade: This web-based platform is user-friendly and accessible from any device with an internet connection. It provides a comprehensive suite of trading tools, including real-time charting, technical indicators, and order management features.

- Oanda fxTrade: This desktop platform is available for Windows and macOS. It offers advanced charting capabilities, customizable layouts, and access to a wider range of technical indicators and analysis tools.

- Oanda Mobile App: This mobile app allows traders to manage their accounts and execute trades on the go. It offers real-time market data, charting tools, and order management features, providing seamless trading from any location.

Oanda’s platforms and tools are renowned for their intuitive design, robust functionality, and reliability. They provide traders with the necessary resources to analyze market trends, execute trades efficiently, and manage their risk effectively.

Understanding Oanda’s Forex Rates

Oanda is known for its transparent and competitive forex rates, which are crucial for traders seeking to maximize profits. To understand how Oanda’s pricing model works, it’s important to delve into the key factors that influence their rates.

Oanda’s Pricing Model

Oanda utilizes a variable spread pricing model, meaning that the difference between the bid and ask prices fluctuates based on market conditions. This approach contrasts with fixed spread models, where the spread remains constant regardless of market volatility. Oanda’s variable spread model allows for tighter spreads during periods of low market activity and wider spreads during periods of high volatility.

The Difference Between Bid and Ask Rates

The bid rate is the price at which Oanda is willing to buy a currency, while the ask rate is the price at which Oanda is willing to sell a currency. The difference between the bid and ask rates is known as the spread.

For example, if the EUR/USD bid rate is 1.1000 and the ask rate is 1.1005, the spread is 5 pips (points in percentage). This spread represents the profit margin for Oanda, and it is essential to understand how spreads impact trading costs.

Examples of Oanda’s Forex Rates Compared to Other Brokers

Oanda’s forex rates are generally competitive compared to other brokers, especially during periods of low market volatility. For instance, during normal market conditions, Oanda’s EUR/USD spread might be around 0.5 pips, while other brokers might offer spreads of 1.0 pip or higher.

However, during periods of high volatility, spreads can widen significantly across all brokers, including Oanda. It’s important to compare forex rates from multiple brokers to ensure you’re getting the best possible deal, especially during volatile market conditions.

Using Oanda’s Forex Rates for Trading

Oanda’s Forex rates can be a valuable tool for traders looking to identify potential trading opportunities. By analyzing the current market conditions and historical data, traders can use Oanda’s rates to make informed decisions about when to buy or sell currencies.

Identifying Trading Opportunities, Forex rates oanda

Oanda’s platform provides real-time Forex rates, historical data, and various analytical tools that traders can use to identify trading opportunities. These tools can help traders analyze market trends, spot potential price reversals, and determine optimal entry and exit points for their trades.

- Technical Analysis: Traders can use technical indicators such as moving averages, MACD, and Bollinger Bands to identify potential trading signals based on price action and volume. These indicators can help traders determine support and resistance levels, identify trends, and spot potential breakout or breakdown opportunities.

- Fundamental Analysis: Traders can analyze economic news releases, central bank announcements, and other fundamental factors that can influence currency prices. For example, a positive economic report may lead to an increase in demand for a particular currency, resulting in a rise in its value.

- Price Action Analysis: Traders can analyze price patterns and candlestick formations to identify potential trading opportunities. For example, a “double top” pattern may suggest a potential reversal in the price of a currency.

Benefits and Risks of Trading Forex with Oanda

Trading Forex with Oanda offers several benefits, including:

- Competitive Forex Rates: Oanda is known for its competitive Forex rates, which can help traders maximize their profits. Oanda’s rates are often very close to the interbank rates, which are the rates at which banks trade currencies with each other.

- Reliable and Secure Platform: Oanda’s platform is known for its reliability and security. The platform is regulated by multiple financial authorities, and Oanda has a strong track record of protecting its clients’ funds.

- Advanced Trading Tools: Oanda offers a wide range of trading tools and resources, including charting tools, technical indicators, and market analysis reports. These tools can help traders make informed trading decisions and improve their trading performance.

- Educational Resources: Oanda provides a wealth of educational resources, including tutorials, webinars, and articles, that can help traders learn about Forex trading and improve their trading skills.

However, trading Forex with Oanda also comes with risks, including:

- Market Volatility: The Forex market is highly volatile, meaning that prices can fluctuate rapidly and unexpectedly. This volatility can lead to significant losses for traders who are not prepared for it.

- Leverage: Oanda allows traders to use leverage to increase their potential profits. However, leverage can also amplify losses, so it is important to use it responsibly.

- Counterparty Risk: When trading with a broker, there is always a risk that the broker may default on its obligations. This is known as counterparty risk.

Forex Trading Strategies with Oanda’s Rates

There are many different Forex trading strategies that can be used with Oanda’s rates. Some popular strategies include:

- Scalping: This strategy involves taking advantage of small price movements in the market. Scalpers typically open and close trades quickly, aiming to make small profits on multiple trades.

- Day Trading: This strategy involves opening and closing trades within the same trading day. Day traders typically use technical analysis to identify short-term trading opportunities.

- Swing Trading: This strategy involves holding trades for several days or weeks. Swing traders typically use a combination of technical and fundamental analysis to identify medium-term trading opportunities.

- Trend Trading: This strategy involves identifying and trading in the direction of the overall market trend. Trend traders typically use technical indicators and price action analysis to determine the direction of the trend.

Oanda’s Forex Data and Resources

Oanda offers a comprehensive suite of Forex data and resources to empower traders with valuable insights and tools for informed decision-making. These resources cover a wide range of aspects, from real-time market data and historical charts to educational materials and support services.

Oanda’s Forex Data

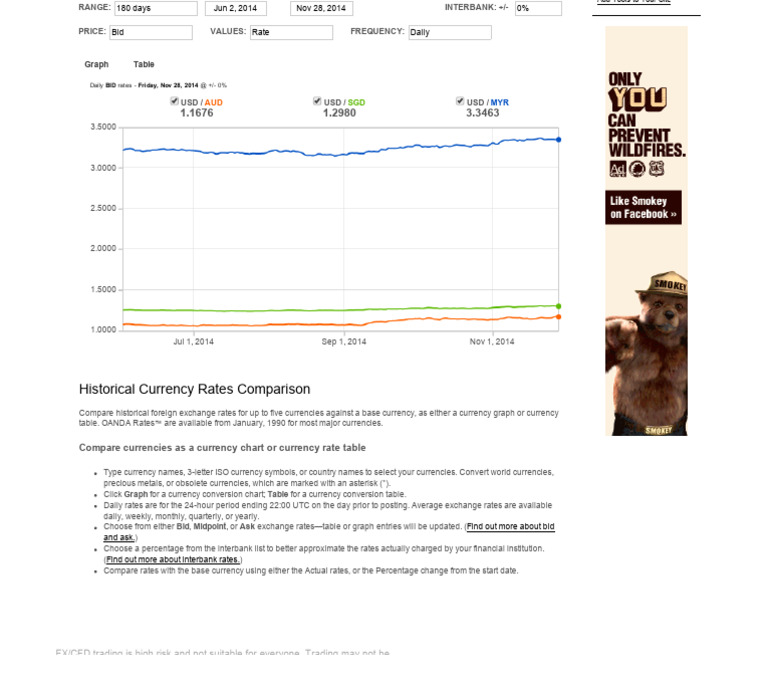

Oanda provides access to a vast library of Forex data, including real-time quotes, historical prices, and economic indicators. This data is crucial for understanding market trends, identifying trading opportunities, and developing trading strategies.

- Real-time Forex Quotes: Oanda’s platform displays real-time Forex quotes for major currency pairs, offering up-to-the-minute information on price movements and market volatility.

- Historical Forex Prices: Access to historical Forex prices allows traders to analyze past market trends and patterns, helping them identify potential future price movements and develop trading strategies based on historical data.

- Economic Indicators: Oanda provides access to a wide range of economic indicators, including inflation rates, unemployment data, and interest rate decisions. These indicators can influence currency valuations and provide valuable insights into market sentiment and future price movements.

Oanda’s Forex Charts

Oanda offers advanced charting tools that enable traders to visualize Forex data, identify trends, and analyze market behavior. These charts are customizable, allowing traders to adjust the time frame, indicators, and other parameters to suit their analysis needs.

- Multiple Chart Types: Oanda’s charting platform supports various chart types, including line charts, bar charts, candlestick charts, and Heikin-Ashi charts, each offering a unique perspective on market data.

- Technical Indicators: Oanda provides a wide range of technical indicators that can be added to charts to help traders identify trends, support and resistance levels, and potential trading opportunities. Popular indicators include moving averages, MACD, RSI, and Bollinger Bands.

- Drawing Tools: Oanda’s charting platform includes drawing tools that enable traders to annotate charts with lines, shapes, and other elements to highlight key price levels, trends, and patterns.

Oanda’s Educational Materials

Oanda offers a variety of educational materials designed to help traders learn about Forex trading, develop their trading skills, and improve their understanding of market dynamics.

- Forex Trading Courses: Oanda provides comprehensive Forex trading courses that cover topics such as fundamental analysis, technical analysis, risk management, and trading psychology.

- Trading Articles and Guides: Oanda offers a wealth of articles and guides on various aspects of Forex trading, providing insights into market trends, trading strategies, and best practices.

- Trading Webinars: Oanda hosts regular webinars led by experienced Forex traders, covering current market trends, trading strategies, and technical analysis techniques.

Oanda’s Support Services

Oanda provides dedicated support services to assist Forex traders with any questions or issues they may encounter.

- Customer Support: Oanda offers 24/5 customer support through phone, email, and live chat, providing assistance with account inquiries, platform issues, and trading-related questions.

- Trading Education: Oanda’s support team can provide guidance and resources to help traders improve their understanding of Forex trading and develop their skills.

Closing Notes: Forex Rates Oanda

Oanda’s commitment to transparency, competitive pricing, and comprehensive resources makes it a valuable platform for both seasoned traders and those new to the Forex market. By understanding Oanda’s Forex rates, trading tools, and data resources, you can confidently navigate the exciting world of Forex trading and potentially achieve your financial goals.

FAQ Corner

What is the minimum deposit required to open a trading account with Oanda?

The minimum deposit requirement varies depending on the account type you choose. It’s best to check Oanda’s website for the most up-to-date information.

Does Oanda offer educational resources for Forex traders?

Yes, Oanda provides a variety of educational resources, including articles, tutorials, webinars, and a dedicated learning center.

What are the trading hours for Forex on Oanda?

Forex markets are generally open 24 hours a day, five days a week, except for weekends and holidays.

Is Oanda regulated?

Yes, Oanda is regulated by multiple financial authorities worldwide, including the Financial Conduct Authority (FCA) in the UK and the Commodity Futures Trading Commission (CFTC) in the US.

How do I contact Oanda customer support?

Oanda offers various support channels, including live chat, email, and phone. You can find their contact information on their website.