- Forex Trading Basics

- Pepperstone

- Pepperstone’s Trading Platform and Tools

- Pepperstone’s Account Types and Fees

- Pepperstone’s Customer Support and Resources

- Pepperstone’s Security and Regulation: Forex Pepperstone

- Pepperstone’s Trading Products and Instruments

- Pepperstone’s Client Testimonials and Reviews

- Pepperstone’s Social Responsibility and Sustainability

- Pepperstone’s Future Outlook and Industry Trends

- Wrap-Up

- Question & Answer Hub

Forex Pepperstone is a leading forex broker that empowers traders of all levels with a comprehensive suite of tools and resources. From beginners navigating the world of currency trading to seasoned professionals seeking advanced strategies, Pepperstone offers a user-friendly platform, competitive pricing, and exceptional customer support. The broker’s commitment to transparency and regulation ensures a secure and reliable trading environment.

Whether you’re interested in understanding the basics of forex trading, exploring Pepperstone’s platform features, or delving into the nuances of account types and fees, this guide will provide you with the essential information you need to make informed decisions.

Forex Trading Basics

Forex trading involves buying and selling currencies in the global foreign exchange market, the largest and most liquid financial market in the world. It’s a dynamic marketplace where traders capitalize on fluctuations in currency exchange rates.

Types of Forex Orders

Different types of orders allow traders to execute trades based on their desired price and risk tolerance.

- Market Orders: These orders are executed immediately at the best available market price. They are suitable for traders who prioritize speed and certainty of execution, but may not get the desired price.

- Limit Orders: These orders are executed only when the market reaches a specific price level or better. They offer more control over entry and exit points, but may not be executed if the market doesn’t reach the desired price.

- Stop-Loss Orders: These orders are used to limit potential losses on a trade by automatically closing a position when the market reaches a predefined price level. They help manage risk and protect against adverse price movements.

Forex Trading Strategies

Forex trading strategies encompass various approaches to analyze market trends and make trading decisions.

- Scalping: This strategy focuses on profiting from small price fluctuations in the short term. Scalpers use technical analysis and rapid order execution to capitalize on fleeting opportunities.

- Day Trading: Day traders open and close positions within the same trading day, aiming to profit from short-term price movements. They rely heavily on technical analysis and market news.

- Swing Trading: Swing traders hold positions for several days or weeks, capturing larger price swings in the market. They use technical and fundamental analysis to identify trends and potential reversals.

Pepperstone

Pepperstone is a leading global Forex broker known for its advanced trading platforms, competitive pricing, and commitment to customer satisfaction. Established in 2010, Pepperstone has grown into a trusted and reputable name in the Forex trading industry.

Pepperstone’s History, Mission, and Core Values

Pepperstone’s journey began with a simple mission: to empower traders of all levels with the tools and resources they need to succeed in the dynamic Forex market. The company’s core values reflect this commitment:

- Transparency: Pepperstone believes in providing clear and concise information to its clients, fostering trust and confidence.

- Innovation: Continuously striving to enhance its trading platforms and services, Pepperstone embraces technological advancements to deliver a seamless and efficient trading experience.

- Client Focus: Pepperstone prioritizes the needs of its clients, offering exceptional customer support and personalized solutions to cater to diverse trading styles.

Pepperstone’s Regulatory Licenses and Commitment to Transparency

Pepperstone holds regulatory licenses from reputable financial authorities, including:

- Australian Securities and Investments Commission (ASIC): Pepperstone is regulated by ASIC, ensuring compliance with strict financial regulations and investor protection standards.

- Financial Conduct Authority (FCA): Pepperstone’s FCA license further strengthens its commitment to regulatory compliance and transparency, providing clients with an additional layer of security.

- CySEC: Pepperstone is also regulated by CySEC, a leading financial regulator in Cyprus, reinforcing its commitment to providing a safe and secure trading environment.

Pepperstone’s regulatory licenses demonstrate its dedication to operating with integrity and adhering to industry best practices. This commitment to transparency builds trust and confidence among its clients.

Key Features and Benefits of Using Pepperstone

Pepperstone offers a comprehensive suite of features and benefits designed to enhance the trading experience for its clients:

- Advanced Trading Platforms: Pepperstone provides access to industry-leading trading platforms, including MetaTrader 4 (MT4) and MetaTrader 5 (MT5), empowering traders with advanced charting tools, technical indicators, and order execution capabilities.

- Competitive Pricing: Pepperstone offers competitive spreads and low trading commissions, allowing traders to maximize their potential profits.

- Multiple Account Types: Pepperstone caters to a wide range of traders by offering different account types, each tailored to specific needs and trading styles.

- Exceptional Customer Support: Pepperstone provides responsive and dedicated customer support, available 24/5 through multiple channels, including phone, email, and live chat.

- Educational Resources: Pepperstone offers a wealth of educational resources, including webinars, articles, and video tutorials, to help traders enhance their knowledge and skills.

These features and benefits make Pepperstone a compelling choice for traders seeking a reliable, transparent, and user-friendly Forex broker.

Pepperstone’s Trading Platform and Tools

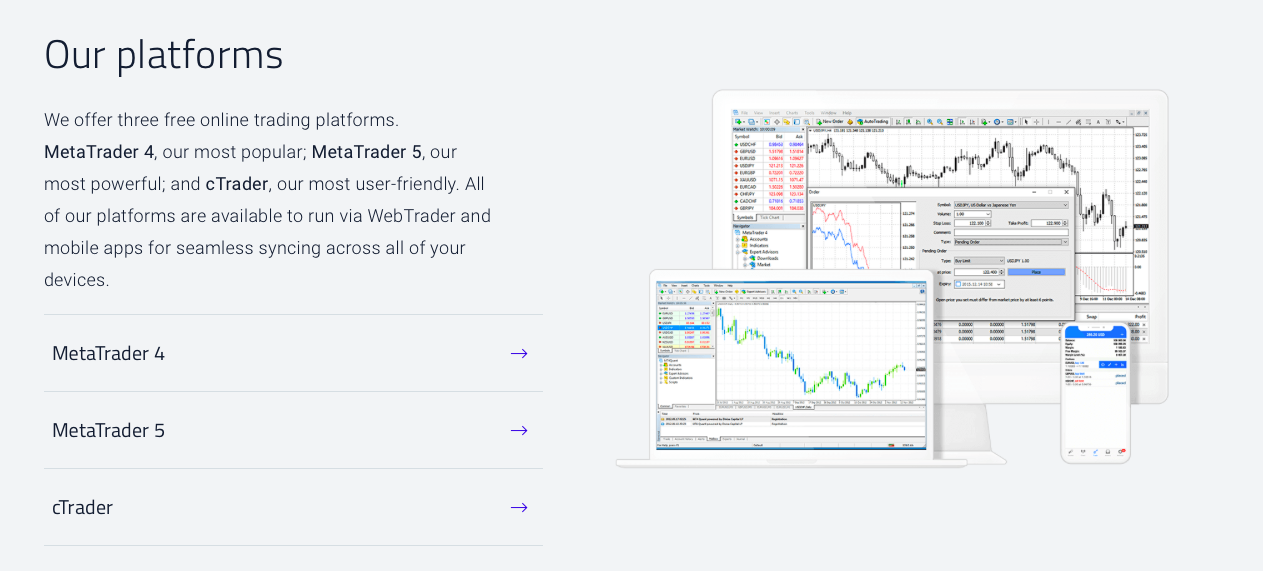

Pepperstone offers a comprehensive trading platform with intuitive user interfaces, advanced charting tools, and a range of resources to support traders of all levels. Their platform is designed to cater to both novice and experienced traders, providing access to a wide array of tools and resources.

Pepperstone’s Trading Platform

Pepperstone’s trading platform is available as a desktop, web, and mobile application. The platform is known for its user-friendly interface and seamless integration with various trading tools. The platform offers a variety of features, including:

- Real-time market data: Provides traders with up-to-the-minute information on market movements, enabling them to make informed trading decisions.

- Advanced charting tools: Offers various charting options and technical indicators, allowing traders to analyze price trends and identify potential trading opportunities.

- Multiple order types: Provides traders with various order types, including market, limit, stop-loss, and take-profit orders, allowing them to execute trades according to their preferred strategies.

- Trading alerts: Notifies traders of significant market events or price movements, allowing them to react promptly to opportunities or risks.

- Account management features: Enables traders to manage their accounts, deposit and withdraw funds, and view trading history.

Trading Tools and Resources

Pepperstone offers a suite of trading tools and resources designed to enhance traders’ decision-making abilities and overall trading experience.

Charting Tools

Pepperstone’s charting tools are powered by advanced technology and offer a wide range of features, including:

- Multiple chart types: Provides traders with various chart types, including line, bar, candlestick, and Heiken Ashi charts, allowing them to choose the best representation for their analysis.

- Technical indicators: Offers a comprehensive library of technical indicators, such as moving averages, MACD, RSI, and Bollinger Bands, enabling traders to identify trends, momentum, and potential support and resistance levels.

- Drawing tools: Provides traders with various drawing tools, including trend lines, Fibonacci retracements, and support and resistance lines, allowing them to visualize price patterns and identify potential trading opportunities.

- Customizable layouts: Enables traders to customize their chart layouts according to their preferences, including adding or removing indicators, changing color schemes, and adjusting timeframes.

Economic Calendar

Pepperstone’s economic calendar provides traders with a comprehensive overview of upcoming economic events and their potential impact on the market. The calendar features:

- Scheduled economic releases: Displays a list of scheduled economic releases, including GDP data, inflation reports, and interest rate decisions.

- Impact levels: Indicates the potential impact of each economic release on different currency pairs and markets.

- Historical data: Provides access to historical economic data, allowing traders to analyze past trends and patterns.

Educational Materials

Pepperstone provides a wealth of educational resources to support traders of all levels, including:

- Beginner’s guides: Offers comprehensive guides for new traders, covering fundamental concepts, trading strategies, and risk management.

- Video tutorials: Provides video tutorials on various trading topics, including technical analysis, fundamental analysis, and trading psychology.

- Webinars and seminars: Hosts regular webinars and seminars led by experienced traders and market analysts, providing insights and strategies for successful trading.

- Glossary of terms: Offers a comprehensive glossary of trading terms, definitions, and concepts.

Comparison to Other Platforms

Pepperstone’s trading platform is considered to be one of the most comprehensive and user-friendly platforms available in the Forex market. It compares favorably to other popular Forex trading platforms, such as MetaTrader 4 (MT4) and MetaTrader 5 (MT5), in terms of its features, functionality, and user experience.

- User interface: Pepperstone’s platform offers a more intuitive and user-friendly interface than MT4 and MT5, making it easier for traders to navigate and find the information they need.

- Trading tools: Pepperstone provides a wider range of trading tools and resources than MT4 and MT5, including advanced charting tools, economic calendars, and educational materials.

- Customer support: Pepperstone offers excellent customer support, with multiple channels available to assist traders with any queries or issues.

Pepperstone’s Account Types and Fees

Pepperstone offers a variety of account types to cater to different trader needs and experience levels. Each account type has its own unique features, minimum deposit requirements, and fee structure. Understanding these differences can help you choose the best account type for your trading style.

Account Types

Pepperstone offers four main account types: Standard, Razor, Plus, and Islamic. Each account type has its own unique features, minimum deposit requirements, and fee structure.

- Standard Account: The Standard account is a good option for beginner traders. It has a minimum deposit requirement of $200 and offers spreads from 1.0 pips. It is a commission-free account, meaning that the spread is the only fee you will pay.

- Razor Account: The Razor account is designed for experienced traders who want to pay lower spreads. It has a minimum deposit requirement of $200 and offers spreads from 0.0 pips. However, it does charge a commission of $3.50 per lot traded.

- Plus Account: The Plus account is a commission-free account with a minimum deposit requirement of $500 and offers spreads from 1.0 pips. It is a good option for traders who want the convenience of a commission-free account but are willing to pay slightly higher spreads than the Razor account.

- Islamic Account: The Islamic account is a swap-free account that is compliant with Islamic law. It has a minimum deposit requirement of $200 and offers spreads from 1.0 pips. It is a good option for traders who want to avoid paying swap fees.

Fees

Pepperstone’s fee structure is transparent and competitive. The main fees you will pay include spreads, commissions, and inactivity fees.

- Spreads: Spreads are the difference between the bid and ask price of a currency pair. Pepperstone offers tight spreads, especially on its Razor account. The spreads are dynamic and can fluctuate depending on market conditions.

- Commissions: Commissions are charged on the Razor account and are a fixed amount per lot traded. The commission rate is $3.50 per lot.

- Inactivity Fees: Pepperstone charges an inactivity fee of $10 per month if your account has been inactive for 12 months.

Comparison to Other Brokers

Pepperstone’s pricing and fees are competitive compared to other Forex brokers. However, it is important to compare different brokers and their fees to find the best deal for your trading needs. Some brokers may offer lower spreads but higher commissions, while others may offer higher spreads but lower commissions. It is important to consider all the fees and charges when choosing a Forex broker.

Pepperstone’s Customer Support and Resources

Pepperstone offers a comprehensive range of customer support and educational resources to assist traders of all levels. Whether you are a seasoned professional or just starting out, Pepperstone provides the support you need to succeed in the forex market.

Customer Support Channels

Pepperstone offers a variety of ways to reach their customer support team, ensuring traders can get help when they need it.

- Live Chat: Pepperstone provides 24/5 live chat support, allowing traders to connect with a customer support representative in real-time. This is a convenient option for quick questions or urgent issues.

- Email: For more detailed inquiries or non-urgent matters, traders can contact Pepperstone via email. The email address is provided on their website.

- Phone: Pepperstone offers phone support in multiple languages, allowing traders to speak directly with a representative. The phone numbers are available on their website.

Quality and Responsiveness of Customer Support

Pepperstone is known for its high-quality and responsive customer support. Numerous reviews and testimonials praise the company’s ability to provide prompt and helpful assistance.

“Pepperstone’s customer support is excellent. They are always available to help and are very knowledgeable about their products and services.” – A satisfied Pepperstone customer

Educational Resources

Pepperstone provides a wide range of educational resources to help traders learn about forex trading and improve their skills. These resources are designed to cater to different levels of experience and include:

- Webinars: Pepperstone hosts regular webinars on various forex trading topics, led by experienced professionals. These webinars cover fundamental and technical analysis, trading strategies, and market insights.

- Tutorials: Pepperstone offers a library of video tutorials covering various aspects of forex trading. These tutorials provide step-by-step guidance on topics such as account setup, platform navigation, and trading strategies.

- Articles: Pepperstone publishes regular articles on its website, covering a wide range of forex-related topics. These articles provide insights into market trends, trading strategies, and fundamental analysis.

Pepperstone’s Security and Regulation: Forex Pepperstone

When choosing a forex broker, security and regulation are paramount. Pepperstone prioritizes both, offering robust security measures and operating under a reputable regulatory framework. This ensures the safety of your funds and the integrity of your trading experience.

Security Measures

Pepperstone employs several security measures to protect your funds and personal information.

- Two-factor authentication (2FA): This adds an extra layer of security by requiring you to enter a unique code generated by your phone or authenticator app in addition to your password when logging in. This prevents unauthorized access to your account, even if your password is compromised.

- Negative balance protection: This ensures you can’t lose more money than you have in your account. If your trades result in a negative balance, Pepperstone will cover the shortfall, providing peace of mind for traders.

- Secure data encryption: Pepperstone uses industry-standard encryption protocols to protect your data during transmission and storage, making it difficult for unauthorized parties to intercept or access your information.

Regulatory Framework

Pepperstone is regulated by several reputable financial authorities, ensuring compliance with industry standards and client protection.

- The Australian Securities and Investments Commission (ASIC): ASIC is the primary regulator for financial services in Australia, and Pepperstone is licensed and regulated by ASIC. This means Pepperstone adheres to strict financial reporting and capital adequacy requirements, providing an additional layer of security for clients.

- The Financial Conduct Authority (FCA): Pepperstone is also regulated by the FCA in the UK, ensuring compliance with UK financial regulations. This provides further assurance to clients that Pepperstone operates within a reputable regulatory framework.

- The Cyprus Securities and Exchange Commission (CySEC): Pepperstone is licensed and regulated by CySEC, ensuring compliance with EU financial regulations. This allows Pepperstone to offer its services to clients across the European Union, with the assurance of a robust regulatory environment.

Track Record

Pepperstone has a strong track record in terms of security and reliability. The broker has never experienced a major security breach, and its regulatory compliance ensures a safe and transparent trading environment. Pepperstone’s commitment to security and regulation is evident in its consistent adherence to industry standards and its proactive approach to client protection.

Pepperstone’s Trading Products and Instruments

Pepperstone offers a wide range of trading instruments across different asset classes, catering to the diverse needs of its clients. These instruments provide opportunities for traders to capitalize on market movements and potentially earn profits.

Pepperstone’s diverse selection of trading instruments allows traders to build diversified portfolios and potentially manage risk effectively. The platform offers access to global markets, providing traders with a comprehensive view of financial opportunities.

Currency Pairs, Forex pepperstone

Currency pairs are the most traded instruments on the Forex market. Each pair represents the exchange rate between two currencies.

- Major Currency Pairs: These pairs involve the US dollar (USD) and other major currencies, such as the euro (EUR), Japanese yen (JPY), British pound (GBP), Australian dollar (AUD), and Swiss franc (CHF). Examples include EUR/USD, GBP/USD, and USD/JPY.

- Minor Currency Pairs: These pairs involve two currencies that are not major currencies. Examples include EUR/GBP, AUD/NZD, and GBP/CHF.

- Exotic Currency Pairs: These pairs involve a major currency and a currency from a developing or emerging market. Examples include USD/TRY (Turkish lira), USD/ZAR (South African rand), and USD/HKD (Hong Kong dollar).

The Forex market is the largest and most liquid financial market globally, offering traders significant opportunities for potential profits.

Commodities

Commodities are raw materials that are traded on exchanges.

- Precious Metals: Gold (XAUUSD), silver (XAGUSD), and platinum (XPTUSD) are popular commodities that are often used as safe haven assets during times of economic uncertainty.

- Energy: Crude oil (USOIL) and natural gas (NG) are traded based on supply and demand dynamics, influenced by factors such as global economic growth, geopolitical events, and weather conditions.

- Agricultural Commodities: Coffee (KC), sugar (SB), and wheat (ZW) are traded based on factors such as weather patterns, production levels, and global demand.

Commodities can be volatile, but they can also provide significant potential returns.

Indices

Indices represent the performance of a group of stocks or other assets.

- Major Stock Indices: The S&P 500 (US500), Dow Jones Industrial Average (US30), and NASDAQ 100 (NAS100) are popular indices that reflect the performance of large US companies.

- International Stock Indices: The FTSE 100 (UK100), DAX 30 (DE30), and CAC 40 (FR40) are indices that represent the performance of major companies in the UK, Germany, and France, respectively.

Trading indices allows traders to gain exposure to the overall performance of a particular market or sector.

Shares

Shares, also known as stocks, represent ownership in a company.

- Individual Stocks: Traders can buy and sell shares of individual companies, such as Apple (AAPL), Microsoft (MSFT), and Amazon (AMZN).

- Exchange-Traded Funds (ETFs): ETFs are investment funds that track the performance of a specific index or sector. They provide a convenient way to diversify a portfolio.

Shares offer the potential for high returns but also carry significant risk.

Pepperstone’s Approach to Market Liquidity and Execution Speed

Pepperstone provides access to a deep pool of liquidity from multiple tier-one banks and institutional providers. This ensures that traders can execute orders quickly and efficiently, even during periods of high market volatility. The platform utilizes advanced technology to minimize slippage and ensure that orders are filled at the best available prices.

Pepperstone’s Client Testimonials and Reviews

Pepperstone, a prominent Forex broker, has garnered a significant number of client testimonials and reviews across various platforms, providing valuable insights into the company’s services and reputation. These reviews offer a diverse perspective from traders with varying experiences, showcasing both positive and negative aspects of Pepperstone’s offerings.

Analysis of Common Themes in Testimonials

Client testimonials and reviews on Pepperstone consistently highlight several key themes.

- Positive Feedback: Many clients praise Pepperstone’s user-friendly trading platform, competitive pricing, and responsive customer support. Traders often commend the platform’s intuitive design, comprehensive features, and seamless execution. Pepperstone’s competitive spreads and low trading fees are frequently cited as key advantages. Additionally, the broker’s dedication to providing responsive and helpful customer support is consistently praised.

- Areas of Criticism: While Pepperstone generally receives positive feedback, some reviews point to areas for improvement. Occasionally, traders express concerns about occasional platform glitches or slow execution speeds during high-volume trading periods. Some also note that Pepperstone’s educational resources could be more extensive. Furthermore, a small percentage of clients report challenges with account verification processes.

Pepperstone’s Reputation and Credibility in the Forex Community

Based on the analysis of client testimonials and reviews, Pepperstone enjoys a strong reputation and high level of credibility within the Forex community. The broker consistently ranks among the top-rated Forex brokers, with numerous awards and recognitions for its services. Pepperstone’s commitment to transparency, regulatory compliance, and client satisfaction has contributed to its positive image. The company’s strong track record and robust security measures instill confidence in traders. However, it’s important to acknowledge that every broker faces occasional challenges, and Pepperstone is no exception. It’s crucial to conduct thorough research and consider multiple perspectives before choosing a Forex broker.

Pepperstone’s Social Responsibility and Sustainability

Pepperstone recognizes the importance of operating ethically and sustainably, contributing to a positive impact on society and the environment. Their commitment to social responsibility and sustainability is reflected in their various initiatives and partnerships.

Pepperstone’s Philanthropic Activities and Partnerships

Pepperstone actively engages in philanthropic activities and partnerships with non-profit organizations. This demonstrates their dedication to making a positive difference in the world.

- Pepperstone supports various charitable organizations through financial contributions and volunteer work.

- They partner with organizations focused on education, healthcare, and environmental conservation.

- Pepperstone also encourages employee volunteering, fostering a culture of giving back to the community.

Pepperstone’s Environmental Impact and Sustainability Efforts

Pepperstone is committed to minimizing its environmental impact and promoting sustainable practices.

- They have implemented energy-efficient measures in their offices, reducing their carbon footprint.

- Pepperstone uses recycled materials and promotes paperless communication to minimize waste.

- They actively support environmental initiatives and partner with organizations dedicated to sustainability.

Pepperstone’s Future Outlook and Industry Trends

Pepperstone, a leading Forex broker, has established itself as a significant player in the global financial markets. As the Forex industry continues to evolve, Pepperstone is strategically positioned to navigate these changes and maintain its competitive edge. This section will explore Pepperstone’s future outlook, focusing on its strategic goals, industry trends, and potential adaptations to future market dynamics.

Pepperstone’s Strategic Goals and Future Plans

Pepperstone’s strategic goals are driven by a commitment to innovation, client satisfaction, and expansion into new markets. The company aims to:

- Enhance Trading Platform Functionality: Pepperstone continuously invests in improving its trading platform, Pepperstone’s cTrader, with advanced features like automated trading tools, real-time market analysis, and personalized dashboards. This will enhance the trading experience for existing clients and attract new ones.

- Expand Product Offerings: Pepperstone plans to broaden its range of trading instruments, including cryptocurrency trading and other alternative assets. This will cater to the growing demand for diversified investment options among its clients.

- Global Market Expansion: Pepperstone seeks to expand its reach into emerging markets, particularly in Asia and Latin America, by offering localized services and language support. This will increase its customer base and strengthen its global presence.

- Strengthen Client Relationships: Pepperstone prioritizes client satisfaction by providing exceptional customer support, educational resources, and personalized trading strategies. This focus on client relationships will foster loyalty and drive long-term growth.

Industry Trends and Challenges

The Forex industry is constantly evolving, driven by technological advancements, regulatory changes, and shifting market dynamics. Pepperstone is actively monitoring these trends and challenges to remain competitive. Some of the key trends include:

- Increased Automation and Artificial Intelligence: The use of AI-powered trading algorithms and automated trading platforms is growing rapidly. This allows traders to execute trades faster and more efficiently, reducing human error and maximizing profit potential. Pepperstone is investing in AI technologies to enhance its trading platform and offer advanced trading tools to its clients.

- Regulatory Landscape: The Forex industry is subject to increasing regulatory scrutiny worldwide. Pepperstone is committed to compliance with regulatory standards, ensuring a secure and transparent trading environment for its clients.

- Rise of Mobile Trading: Mobile trading has become increasingly popular, with traders accessing financial markets from their smartphones and tablets. Pepperstone is optimizing its trading platform for mobile devices, providing a seamless and user-friendly experience for its clients.

- Growing Interest in Cryptocurrencies: The popularity of cryptocurrencies is on the rise, with investors seeking exposure to this emerging asset class. Pepperstone is exploring ways to incorporate cryptocurrency trading into its platform, catering to the growing demand from its clients.

Pepperstone’s Adaptation to Future Market Changes

To navigate the changing landscape of the Forex industry, Pepperstone will need to adapt its strategies and offerings. Some key areas of focus include:

- Technological Innovation: Pepperstone will continue to invest in cutting-edge technologies, such as AI, blockchain, and cloud computing, to enhance its trading platform, improve security, and offer more efficient and personalized trading solutions.

- Regulatory Compliance: Pepperstone will maintain its commitment to regulatory compliance, ensuring a secure and transparent trading environment for its clients. This will involve staying abreast of evolving regulations and adapting its operations accordingly.

- Diversification of Product Offerings: Pepperstone will expand its range of trading instruments to include alternative assets, such as cryptocurrencies, commodities, and indices. This will cater to the growing demand for diversified investment options among its clients.

- Enhanced Customer Experience: Pepperstone will prioritize customer satisfaction by providing exceptional support, educational resources, and personalized trading strategies. This will involve investing in its customer support infrastructure, developing innovative educational tools, and offering personalized trading advice.

Wrap-Up

In conclusion, Pepperstone emerges as a formidable player in the forex brokerage landscape. With its robust platform, diverse account options, and commitment to client satisfaction, Pepperstone caters to the needs of both novice and experienced traders. By understanding the broker’s offerings and its approach to the market, you can equip yourself with the knowledge to navigate the dynamic world of forex trading with confidence.

Question & Answer Hub

What is the minimum deposit required to open a Pepperstone account?

The minimum deposit requirement varies depending on the account type you choose. For instance, the Standard account requires a minimum deposit of $200, while the Razor account requires a minimum deposit of $200.

Does Pepperstone offer educational resources for beginners?

Yes, Pepperstone provides a wealth of educational resources, including webinars, tutorials, and articles, designed to guide traders of all levels. These resources cover various topics, from forex basics to advanced trading strategies.

Is Pepperstone regulated and secure?

Yes, Pepperstone is regulated by reputable financial authorities, including the Australian Securities and Investments Commission (ASIC) and the Financial Conduct Authority (FCA). They employ robust security measures, such as two-factor authentication and negative balance protection, to safeguard client funds.