- Understanding Forex High Leverage Brokers

- Choosing a Forex High Leverage Broker

- Trading Strategies for High Leverage Forex

- The Psychology of High Leverage Trading

- Legal and Regulatory Considerations

- Case Studies and Real-World Examples

- Responsible Trading Practices

- Final Thoughts

- Top FAQs: Forex High Leverage Broker

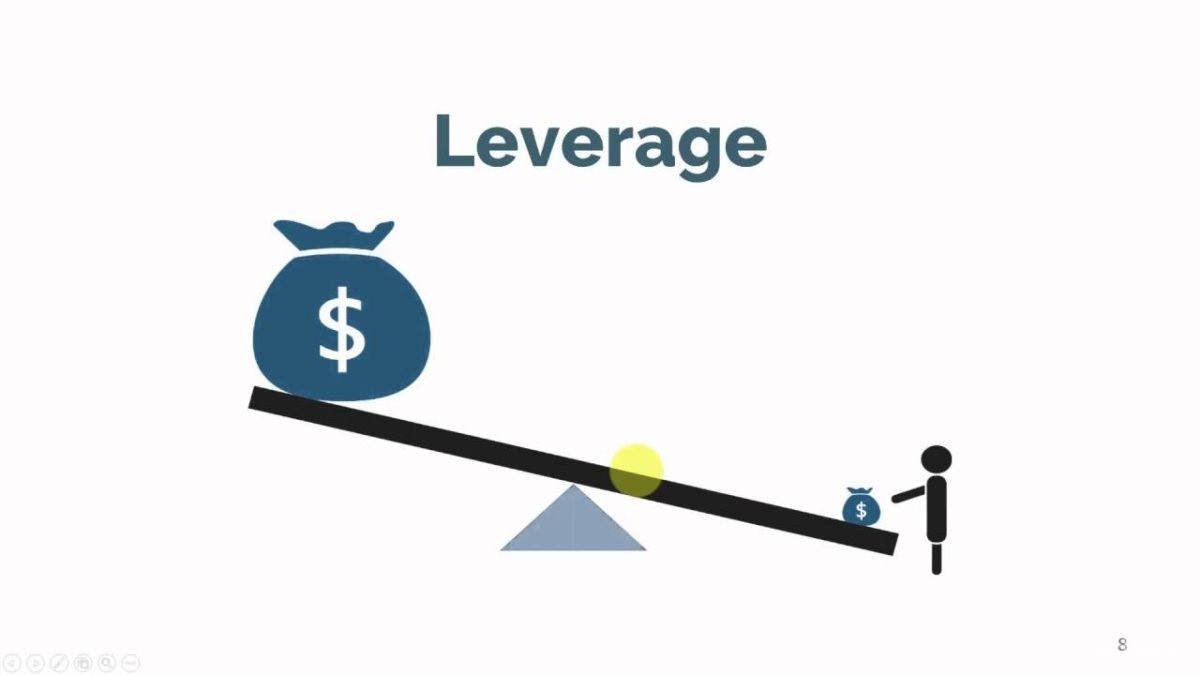

Forex high leverage brokers offer traders the potential to amplify their profits, but they also come with significant risks. Leverage allows traders to control larger positions with a smaller initial investment, magnifying both gains and losses.

Understanding the nuances of leverage is crucial for navigating the Forex market effectively. This guide explores the benefits and risks associated with high leverage, provides insights into choosing the right broker, and delves into responsible trading practices to mitigate potential losses.

Understanding Forex High Leverage Brokers

Leverage is a powerful tool that can amplify both profits and losses in Forex trading. It allows traders to control a larger position in the market with a smaller initial investment. Forex high leverage brokers offer traders the ability to leverage their trades at significantly higher ratios than standard leverage brokers.

Leverage in Forex Trading

Leverage in Forex trading refers to the ability to control a larger position in the market with a smaller initial investment. It is expressed as a ratio, such as 1:100, meaning that for every $1 you deposit, you can control $100 worth of currency.

Benefits of High Leverage

- Amplified Profits: High leverage allows traders to potentially earn larger profits on smaller price movements. For example, if you trade $100 with 1:100 leverage, a 1% price movement will result in a $10 profit. However, it’s crucial to remember that losses can also be amplified.

- Reduced Entry Costs: High leverage enables traders to enter the market with a smaller initial investment, making it more accessible to those with limited capital.

- Greater Flexibility: High leverage provides traders with more flexibility in managing their trades, allowing them to adjust their positions more easily.

Risks of High Leverage

- Amplified Losses: The same leverage that amplifies profits can also amplify losses. A small price movement against your position can result in significant losses, potentially exceeding your initial investment.

- Margin Calls: With high leverage, brokers may require traders to deposit additional funds (margin calls) to maintain their positions if the market moves against them. Failure to meet margin calls can lead to the liquidation of your position.

- Increased Volatility: High leverage can make your trading account more volatile, making it difficult to manage risk effectively.

High Leverage Brokers vs. Standard Leverage Brokers

High leverage brokers typically offer leverage ratios ranging from 1:100 to 1:500 or even higher. Standard leverage brokers, on the other hand, offer lower leverage ratios, usually between 1:10 and 1:50.

| Feature | High Leverage Brokers | Standard Leverage Brokers |

|---|---|---|

| Leverage Ratios | 1:100 to 1:500 or higher | 1:10 to 1:50 |

| Profit Potential | Higher potential for amplified profits | Lower potential for amplified profits |

| Risk | Higher risk of amplified losses and margin calls | Lower risk of amplified losses and margin calls |

| Suitability | Suitable for experienced traders with a high risk tolerance | Suitable for beginners and traders with a lower risk tolerance |

Impact of Leverage on Trading Outcomes

Real-World Scenario 1: Profit Amplification

Imagine you trade $100 with 1:100 leverage, buying 1,000 units of EUR/USD at 1.1000. The price rises to 1.1100, a 1% increase. With leverage, your profit would be $100 (1% of $10,000), significantly higher than a $1 profit without leverage.

Real-World Scenario 2: Loss Amplification

In the same scenario, if the price drops to 1.0900, a 1% decrease, your loss would be $100 (1% of $10,000). This illustrates the potential for amplified losses with high leverage.

Choosing a Forex High Leverage Broker

Selecting the right forex broker is crucial, especially when dealing with high leverage. High leverage can amplify both profits and losses, making it essential to choose a broker that aligns with your trading goals and risk tolerance. This section will delve into the key factors to consider when choosing a high leverage broker, comparing and contrasting their features and discussing the importance of regulatory oversight.

Trading Platforms

The trading platform is the interface you use to execute trades, access market data, and manage your account. Choosing a platform that is user-friendly, offers a range of features, and integrates seamlessly with your trading style is essential.

- Ease of Use: A good platform should be intuitive and easy to navigate, even for novice traders.

- Features: Look for platforms that offer advanced charting tools, technical indicators, real-time market data, order types, and alerts.

- Mobile Accessibility: Mobile trading apps allow you to monitor and manage your trades from anywhere.

- Security: Ensure the platform uses encryption and other security measures to protect your account and personal information.

Spreads

The spread is the difference between the bid and ask prices of a currency pair. A lower spread translates to lower trading costs, which is particularly important when using high leverage, as even small differences in spreads can significantly impact your profits.

- Variable vs. Fixed Spreads: Variable spreads fluctuate based on market volatility, while fixed spreads remain constant. Fixed spreads offer predictable trading costs, but they might be wider than variable spreads during periods of high volatility.

- Competitive Spreads: Compare spreads across different brokers to find the most competitive rates for the currency pairs you trade.

Customer Support

Reliable customer support is essential, especially when dealing with high leverage trading. You need a broker that provides responsive and knowledgeable support to assist you with any questions or issues you might encounter.

- Availability: Check the broker’s support channels, such as live chat, email, and phone, and their availability hours.

- Responsiveness: Evaluate the speed and quality of their responses to inquiries.

- Knowledge: The support team should be knowledgeable about forex trading, platform features, and regulatory requirements.

Regulatory Oversight and Licensing

Regulatory oversight is crucial for ensuring the safety and security of your funds. Choosing a broker regulated by a reputable financial authority can provide greater peace of mind.

- Reputable Regulators: Look for brokers regulated by bodies such as the Financial Conduct Authority (FCA) in the UK, the Australian Securities and Investments Commission (ASIC) in Australia, or the National Futures Association (NFA) in the US.

- Licensing: Ensure the broker holds the necessary licenses to operate in your region.

- Client Funds Protection: Check if the broker segregates client funds from its own operating funds and has mechanisms in place to protect client assets in case of insolvency.

Checklist of Questions to Ask Potential Brokers

Before opening an account with a high leverage broker, consider asking the following questions:

- What is your trading platform and its features?

- What are your spreads and how do they vary?

- What types of leverage do you offer?

- What are your margin requirements and how are they calculated?

- What are your deposit and withdrawal methods and fees?

- What are your account minimums and maximums?

- Do you offer educational resources and trading tools?

- What is your customer support availability and contact information?

- What are your regulatory licenses and oversight?

- What are your risk management policies and procedures?

Trading Strategies for High Leverage Forex

High leverage trading can be a double-edged sword, offering the potential for substantial profits but also exposing traders to significant risks. It’s crucial to understand the strategies and risk management techniques associated with high leverage trading to navigate this complex landscape effectively.

Trading Strategies for High Leverage Forex

High leverage can amplify both profits and losses, making it essential to choose strategies that align with this characteristic. Here are some strategies commonly employed by high leverage traders:

- Scalping: This strategy involves opening and closing trades quickly, aiming to capitalize on small price fluctuations. Scalpers typically use tight stop-loss orders and aim for a high frequency of trades.

- News Trading: This strategy involves capitalizing on market volatility driven by economic news releases. Traders analyze economic data and news events to identify potential trading opportunities, often using high leverage to amplify their positions.

- Day Trading: Day traders open and close positions within a single trading day, aiming to profit from short-term price movements. High leverage can enhance potential profits but also increase risk.

Risk Management for High Leverage Trading

High leverage magnifies both potential profits and losses, making risk management an absolute necessity. Here are some crucial risk management techniques:

- Strict Stop-Loss Orders: Stop-loss orders automatically close a trade when the price reaches a predetermined level, limiting potential losses. This is especially critical for high leverage trading, as even small price movements can result in significant losses.

- Position Sizing: Position sizing involves determining the appropriate amount of capital to allocate to each trade. High leverage requires careful position sizing to manage risk effectively. Traders should consider their risk tolerance and the potential impact of losses on their overall trading capital.

- Diversification: Diversifying your trading portfolio across different currency pairs and asset classes can help reduce risk. This strategy aims to mitigate losses by spreading capital across various investments.

Potential Pitfalls and Challenges of High Leverage Trading

While high leverage offers the potential for significant gains, it also presents several challenges and pitfalls:

- Margin Calls: A margin call occurs when the equity in your trading account falls below the required margin level. This can lead to forced liquidation of your positions, potentially resulting in significant losses.

- Emotional Trading: High leverage can amplify emotions, leading to impulsive decisions and poor risk management. It’s crucial to maintain discipline and avoid trading based on fear or greed.

- Limited Timeframe: High leverage often requires frequent trading, limiting the time available for thorough analysis and research. This can lead to hasty decisions and increased risk.

Importance of Strict Stop-Loss Orders and Position Sizing

Strict stop-loss orders are essential for high leverage trading. They serve as a safety net, limiting potential losses and protecting your trading capital.

Stop-loss orders should be set at a level that is comfortable for you, considering your risk tolerance and the market’s volatility.

Position sizing is equally crucial. It involves determining the appropriate amount of capital to allocate to each trade, considering your risk tolerance and the potential impact of losses on your overall trading capital.

For example, if you have a $10,000 trading account and are using a 100:1 leverage, you can control a position worth $1 million. However, if the market moves against you by just 1%, you could lose $10,000, wiping out your entire account. Proper position sizing can help mitigate this risk.

The Psychology of High Leverage Trading

High leverage trading, while potentially rewarding, can also be a double-edged sword. The ability to control large positions with a small initial investment can amplify both profits and losses, making it crucial to understand the psychological factors at play.

Emotional Biases in High Leverage Trading

Emotional biases can significantly influence trading decisions, particularly in high leverage environments. The potential for amplified gains can lead to overconfidence, while the risk of substantial losses can trigger fear and panic.

- Overconfidence Bias: High leverage can create an illusion of control, leading traders to believe they can consistently predict market movements. This can result in taking on excessive risk and neglecting proper risk management strategies.

- Fear of Missing Out (FOMO): The allure of quick profits can lead to impulsive trading decisions, driven by the fear of missing out on potential gains. This can lead to chasing trends and entering trades without proper analysis.

- Confirmation Bias: Traders may selectively seek information that confirms their existing beliefs, ignoring contradictory evidence. This can lead to holding losing trades for too long or entering new trades based on flawed assumptions.

- Loss Aversion: The pain of losing money is often perceived as greater than the pleasure of gaining the same amount. This can lead to holding losing trades longer than necessary in the hope of recovering losses, further amplifying losses.

Strategies for Managing Trading Emotions

Managing trading emotions is crucial for maintaining discipline and making rational decisions in high leverage environments.

- Develop a Trading Plan: A well-defined trading plan Artikels entry and exit points, risk management strategies, and emotional triggers. It provides a framework for making objective decisions and helps to avoid impulsive trading.

- Use Stop-Loss Orders: Stop-loss orders automatically close a trade when a predetermined price level is reached, limiting potential losses. This helps to manage risk and prevents emotional decisions from impacting trading outcomes.

- Practice Mindfulness: Mindfulness techniques, such as meditation or deep breathing exercises, can help to calm the mind and reduce emotional reactivity. This allows traders to approach decisions with a clear and rational perspective.

- Keep a Trading Journal: Regularly documenting trades, including the rationale behind decisions and emotional state, provides valuable insights into trading patterns and helps to identify areas for improvement. It can also help to track progress and build confidence.

Avoiding Common Psychological Pitfalls

High leverage trading is inherently risky, and understanding common psychological pitfalls can help traders avoid costly mistakes.

- Avoid Revenge Trading: After experiencing a loss, some traders may seek to recoup losses by taking on even more risk. This can lead to a vicious cycle of losses and further emotional distress.

- Don’t Chase Losses: Holding losing trades in the hope of recovering losses can lead to further losses. It’s essential to acknowledge losses, cut them short, and move on to new opportunities.

- Recognize the Power of Compounding: High leverage can amplify both profits and losses. It’s crucial to focus on building wealth gradually through consistent and disciplined trading, rather than seeking quick gains.

- Remember the Importance of Risk Management: High leverage trading requires meticulous risk management. Never risk more than you can afford to lose, and always use appropriate stop-loss orders to limit potential losses.

Legal and Regulatory Considerations

High leverage Forex trading, while offering the potential for substantial profits, also comes with significant risks. Understanding the legal and regulatory landscape is crucial for both brokers and traders to ensure responsible and compliant trading practices. This section explores the legal and regulatory frameworks governing high leverage Forex trading in different jurisdictions, the implications of leverage restrictions, and the importance of staying informed about evolving legal requirements.

Jurisdictional Variations in Regulation

The legal and regulatory frameworks governing Forex trading, particularly high leverage trading, vary significantly across different jurisdictions. These variations stem from the diverse regulatory approaches adopted by different countries and regions.

Here are some examples:

- The European Union (EU): The EU has implemented the Markets in Financial Instruments Directive (MiFID) and its revised version, MiFID II, to regulate financial markets, including Forex trading. These directives impose stringent capital requirements on brokers, restrict leverage levels, and mandate client protection measures.

- The United States (US): The US has a complex regulatory landscape for Forex trading, with the Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA) overseeing the industry. The CFTC regulates Forex brokers and requires them to register and comply with specific rules, including leverage restrictions.

- Australia: The Australian Securities and Investments Commission (ASIC) regulates Forex brokers in Australia, setting capital requirements, leverage limits, and client protection standards.

- Japan: The Financial Services Agency (FSA) regulates Forex trading in Japan, including high leverage brokers. The FSA has implemented regulations that aim to protect retail investors from excessive risk and promote fair market practices.

Implications of Leverage Restrictions and Regulations

Leverage restrictions and regulations have a significant impact on both Forex brokers and traders.

- For Brokers: Leverage restrictions can limit the potential profits of brokers, as they can charge lower fees and commissions on smaller trading volumes. However, these restrictions also protect brokers from excessive risk and potential financial losses.

- For Traders: Leverage restrictions can limit the potential profits of traders, as they can trade with smaller position sizes. However, these restrictions also protect traders from excessive risk and potential losses.

Recent Regulatory Changes Impacting High Leverage Brokers, Forex high leverage broker

Recent years have seen significant regulatory changes impacting high leverage Forex brokers.

- EU’s MiFID II: The revised MiFID II directive introduced stricter capital requirements for brokers, reduced leverage levels, and mandated enhanced client protection measures.

- US’s CFTC Regulations: The CFTC has tightened regulations for Forex brokers, including increased scrutiny of their capital adequacy and client protection practices.

- ASIC’s Leverage Limits: ASIC has implemented leverage limits for retail Forex traders, reducing the maximum leverage available to 1:30.

Staying Informed About Evolving Legal and Regulatory Requirements

The legal and regulatory landscape for Forex trading is constantly evolving.

- Staying informed: It is crucial for both brokers and traders to stay informed about the latest legal and regulatory requirements in their respective jurisdictions. This includes monitoring regulatory updates, consulting with legal professionals, and attending industry events.

- Compliance: Brokers and traders must ensure they comply with all applicable regulations and laws to avoid legal penalties and reputational damage.

Case Studies and Real-World Examples

The world of forex trading is full of stories, both triumphant and cautionary. High leverage, a double-edged sword, can amplify gains but also magnify losses. This section delves into real-world examples, showcasing the potential of high leverage while emphasizing the importance of responsible trading practices.Successful High Leverage Trading Experiences

These case studies highlight how traders effectively utilized high leverage to achieve significant returns.

- The Currency Trader Who Caught a Trend: A trader with a keen eye for market trends identified a potential surge in the Euro against the US dollar. Leveraging a 1:500 ratio, they opened a substantial position, profiting from the subsequent price appreciation. The high leverage amplified their gains, allowing them to capitalize on the trend effectively. However, it’s crucial to note that this success was built upon thorough analysis, risk management, and a disciplined approach to trading.

- The Scalper Who Made Micro-Profits Count: Scalping, a strategy involving frequent, short-term trades, thrives on small price movements. A trader employing a 1:200 leverage ratio skillfully executed numerous trades, accumulating modest profits on each. The high leverage amplified these micro-profits, generating a substantial overall return. This case emphasizes the potential of high leverage in high-frequency trading, where small gains can be magnified. However, it’s vital to recognize the increased risk associated with this strategy and the need for exceptional speed and precision.

Unsuccessful High Leverage Trading Experiences

These examples illustrate the potential pitfalls of high leverage, emphasizing the need for caution and discipline.

- The Trader Who Overleveraged: A trader, lured by the promise of quick profits, leveraged their account at a 1:1000 ratio, exceeding their risk tolerance. A sudden market shift resulted in substantial losses, exceeding their initial investment. This case highlights the danger of overleveraging, where even small price fluctuations can lead to significant losses. It’s crucial to remember that leverage amplifies both profits and losses, making responsible risk management paramount.

- The Trader Who Lacked a Stop-Loss: A trader, neglecting the importance of stop-loss orders, opened a leveraged position without setting a limit on potential losses. A sudden market reversal resulted in a significant drawdown, exceeding their account balance. This case underscores the critical role of stop-loss orders in mitigating risk. High leverage amplifies potential losses, making stop-loss orders essential to protect against unexpected market volatility.

Lessons Learned from Real-World Examples

These case studies provide valuable insights into the dynamics of high leverage trading.

- Understanding Your Risk Tolerance: High leverage can be a powerful tool, but it’s imperative to understand your risk tolerance. Leveraging beyond your comfort zone can lead to emotional decisions and impulsive actions, ultimately hindering your trading success.

- The Importance of Risk Management: Stop-loss orders, position sizing, and diversification are essential components of a robust risk management strategy. High leverage necessitates a disciplined approach to managing risk, as even small market fluctuations can significantly impact your trading outcomes.

- Discipline and Patience: High leverage trading requires discipline and patience. Avoid impulsive decisions driven by emotions or market noise. Stick to your trading plan and maintain a long-term perspective, focusing on consistent profitability rather than chasing quick gains.

Responsible Trading Practices

The allure of high leverage in Forex trading can be tempting, promising amplified returns. However, it’s crucial to understand that high leverage comes with significant risks. Responsible trading practices are paramount when dealing with high leverage to mitigate potential losses and ensure a sustainable trading journey.Understanding Risk Appetite

Your risk appetite plays a pivotal role in determining the appropriate leverage level for your trading. Risk appetite refers to your tolerance for potential losses. If you are a risk-averse trader, you may opt for lower leverage to minimize potential losses. Conversely, traders with a higher risk tolerance might choose higher leverage to potentially amplify their profits.

Setting Realistic Trading Goals

Setting realistic trading goals is essential for responsible trading. High leverage can lead to unrealistic expectations of quick and substantial profits. It’s crucial to approach trading with a long-term perspective and set achievable goals based on your trading strategy, risk appetite, and market conditions. Avoid chasing unrealistic returns or falling prey to get-rich-quick schemes.

Managing Expectations

High leverage amplifies both profits and losses. It’s essential to manage expectations and understand that losses are an inherent part of trading. Avoid overtrading or chasing losses, as this can lead to further losses. Remember that trading is a marathon, not a sprint. Focus on developing a sound trading strategy and managing your risk effectively.

Prioritizing Education and Research

Continuous learning and research are essential for successful Forex trading, especially when using high leverage. Stay updated on market trends, economic indicators, and geopolitical events that can impact currency movements. Engage in ongoing education, attend webinars, and read reputable financial publications to enhance your understanding of Forex trading and risk management.

Final Thoughts

Trading with high leverage can be a double-edged sword. While it offers the potential for substantial profits, it also carries a higher risk of significant losses. By understanding the intricacies of leverage, choosing a reputable broker, and employing sound risk management strategies, traders can navigate the world of high leverage Forex trading with greater confidence and a higher chance of success.

Top FAQs: Forex High Leverage Broker

What is the difference between high leverage and standard leverage?

High leverage brokers typically offer leverage ratios of 1:500 or higher, allowing traders to control a larger position with a smaller initial investment. Standard leverage brokers usually offer ratios between 1:100 and 1:200.

How do I choose the right forex high leverage broker?

Consider factors like regulatory oversight, trading platform features, spreads, customer support, and the broker’s reputation. It’s essential to choose a broker that aligns with your trading style and risk tolerance.

What are some risks associated with high leverage trading?

High leverage magnifies both profits and losses, meaning that even small market movements can result in significant gains or losses. It’s crucial to have a solid risk management plan in place to protect your capital.