A Forex free demo account is a powerful tool that allows you to explore the exciting world of foreign exchange trading without risking your own capital. Whether you’re a novice trader taking your first steps or an experienced investor looking to test new strategies, a demo account provides a safe and simulated environment to hone your skills and build confidence.

This virtual trading platform replicates real-market conditions, offering access to a range of currency pairs, trading tools, and educational resources. You can experiment with different trading strategies, analyze market trends, and learn to manage your risk effectively, all without the pressure of real financial consequences.

What is a Forex Free Demo Account?

A Forex free demo account is a risk-free way to learn and practice trading Forex without using real money. It provides you with a virtual trading environment that simulates real market conditions, allowing you to test your trading strategies, understand market dynamics, and gain experience before risking your own capital.

Benefits of a Forex Free Demo Account

A Forex free demo account offers numerous benefits for both novice and seasoned traders.

- Risk-Free Trading: Practice trading without risking any real money. This allows you to experiment with different strategies, learn from mistakes, and develop confidence before committing actual funds.

- Learn Forex Trading Fundamentals: Master the basics of Forex trading, including technical analysis, fundamental analysis, risk management, and order execution, in a safe and controlled environment.

- Test Trading Strategies: Develop and refine your trading strategies without the pressure of real-time market fluctuations. You can experiment with different indicators, timeframes, and trading styles to identify what works best for you.

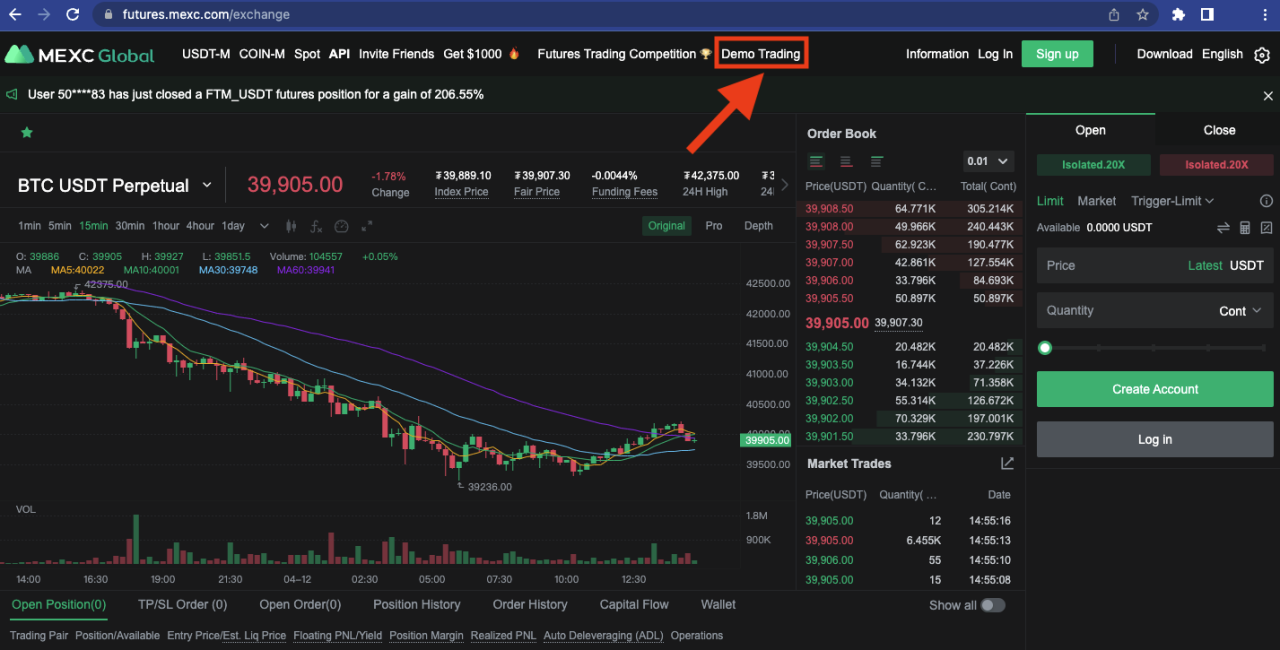

- Familiarize Yourself with Trading Platforms: Get acquainted with the features and functionalities of various Forex trading platforms before using them with real money. This ensures you are comfortable with the platform’s interface and tools before making actual trades.

- Build Confidence and Experience: Gain valuable experience and confidence in your trading abilities before risking real capital. This helps you make more informed trading decisions and reduces the likelihood of costly mistakes.

Features of a Forex Free Demo Account

Forex free demo accounts typically include several features designed to enhance your learning and trading experience.

- Virtual Funds: Demo accounts provide you with a pre-loaded amount of virtual currency, usually in US dollars, to practice trading. You can use this virtual money to execute trades and monitor your account balance without any financial risk.

- Trading Platforms: Demo accounts often offer access to the same trading platforms used for live trading. This allows you to familiarize yourself with the platform’s interface, features, and tools, providing a seamless transition to live trading.

- Real-Time Market Data: Demo accounts typically provide access to real-time market data, including price charts, news feeds, and economic indicators. This helps you stay updated on market trends and make informed trading decisions.

- Educational Resources: Some Forex brokers offer educational resources, such as tutorials, webinars, and articles, specifically tailored for demo account users. These resources can provide valuable insights and guidance on Forex trading concepts and strategies.

Why Choose a Forex Free Demo Account?

A Forex free demo account is a valuable tool for traders of all levels, offering a risk-free environment to learn, practice, and hone their trading skills. It allows you to experiment with different strategies, manage your risk tolerance, and build confidence before entering the real market.

Benefits of Using a Forex Free Demo Account

A Forex free demo account provides several advantages that can significantly enhance your trading journey. Here are some key benefits:

- Risk-Free Trading Environment: A demo account allows you to trade with virtual funds, eliminating the risk of losing real money. This is particularly important for beginners who are still learning the ropes of Forex trading.

- Practice Trading Strategies: A demo account provides a safe space to experiment with various trading strategies without any financial repercussions. You can test different indicators, chart patterns, and trading techniques to find what works best for you.

- Develop Trading Skills: By practicing on a demo account, you can improve your understanding of market dynamics, develop your trading psychology, and enhance your risk management skills. This will prepare you for the challenges of real-world trading.

- Manage Risk Tolerance: A demo account helps you understand your risk appetite and develop appropriate risk management strategies. You can experiment with different position sizes and stop-loss orders to find a comfortable balance between potential profits and risk.

- Build Confidence: As you gain experience and confidence through practice, you’ll be better prepared to transition to live trading. A demo account allows you to build your trading skills gradually, reducing the anxiety and uncertainty associated with entering the real market.

Finding the Right Forex Free Demo Account

Navigating the world of Forex trading can be daunting, especially for beginners. Thankfully, Forex brokers offer free demo accounts, providing a risk-free environment to learn the ropes and test trading strategies. But with numerous brokers offering demo accounts, choosing the right one can be a challenge.

Key Factors to Consider

Selecting a Forex free demo account requires careful consideration of several factors. These factors will help you find a demo account that aligns with your trading needs and preferences, ultimately enhancing your learning experience and preparing you for real-world trading.

- Platform Compatibility: The trading platform is your interface with the Forex market. It’s crucial to choose a demo account that uses a platform you are comfortable with. Some popular platforms include MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader. Consider the platform’s user interface, charting tools, order execution speed, and available indicators.

- Asset Availability: Forex demo accounts should offer a wide range of tradable assets, mirroring the real market. Look for demo accounts that include major currency pairs like EUR/USD, GBP/USD, and USD/JPY, as well as other assets like commodities, indices, and cryptocurrencies. The availability of these assets will allow you to test different trading strategies and explore various market opportunities.

- Educational Resources: A good Forex free demo account should provide educational resources to help you learn the basics of Forex trading. These resources can include tutorials, webinars, market analysis, and economic calendars. The quality and depth of these resources will directly impact your learning curve and trading success.

- Simulating Real-Market Conditions: A crucial aspect of a demo account is its ability to simulate real-market conditions. Look for demo accounts that offer realistic market data, including real-time price feeds and order execution delays. This will provide a more accurate representation of the actual trading environment and prepare you for the challenges of real-world trading.

Comparing Forex Brokers, Forex free demo account

Once you have identified the key factors for your demo account, it’s time to compare different Forex brokers. Consider the following aspects:

- Broker Reputation: Choose a reputable Forex broker with a proven track record and positive reviews from other traders. Look for brokers regulated by reputable financial authorities, ensuring a safe and secure trading environment.

- Account Types and Features: Explore the different account types offered by the broker and the features included in each. Some brokers offer demo accounts with varying levels of functionality and features, catering to different trading styles and experience levels.

- Customer Support: A responsive and helpful customer support team is essential, especially for beginners. Check the broker’s customer support channels, response time, and availability. This will ensure you have access to assistance when needed.

- Demo Account Duration: While most brokers offer unlimited demo accounts, some may have time limits. Ensure the demo account duration is sufficient to practice your trading strategies and gain a solid understanding of the Forex market.

Additional Tips for Choosing a Demo Account

- Start with a Simple Demo Account: Begin with a basic demo account to familiarize yourself with the platform and trading mechanics. Once you feel comfortable, you can explore more advanced features and account types.

- Experiment with Different Strategies: Use the demo account to test various trading strategies, including scalping, day trading, and swing trading. This will help you identify your preferred trading style and refine your strategies before venturing into real-world trading.

- Record Your Trades: Keep a detailed record of your trades on the demo account, including entry and exit points, profit and loss, and reasons for your decisions. This will help you analyze your performance and identify areas for improvement.

How to Use a Forex Free Demo Account Effectively

A Forex free demo account is a powerful tool for aspiring traders. It allows you to learn the ins and outs of Forex trading without risking any real money. By utilizing a demo account effectively, you can develop your trading skills, test strategies, and gain confidence before entering the live market.

Steps to Effectively Utilize a Forex Free Demo Account

A well-structured approach is essential for maximizing the benefits of a Forex free demo account. By following these steps, you can create a learning environment that promotes skill development and prepares you for real-world trading.

- Choose a Reputable Broker: Select a Forex broker with a user-friendly platform and a reliable demo account. Look for brokers with a good reputation and a wide range of trading instruments and features.

- Familiarize Yourself with the Trading Platform: Spend time exploring the trading platform, understanding its interface, order types, and charting tools. Practice navigating the platform to become comfortable with its functionalities.

- Start with a Simple Strategy: Begin with a straightforward trading strategy that you can easily understand and execute. Focus on mastering the basics before moving on to more complex strategies.

- Develop a Trading Plan: Create a comprehensive trading plan that Artikels your trading objectives, risk management strategy, and entry/exit criteria. Stick to your plan and avoid impulsive decisions.

- Manage Your Risk: Practice proper risk management techniques, such as using stop-loss orders and limiting your position size. Learn to calculate your risk per trade and avoid risking more than you can afford to lose.

- Keep a Trading Journal: Record your trades, including entry and exit points, reasons for taking the trade, and the outcome. Analyze your journal to identify areas for improvement and refine your trading strategy.

- Practice Consistently: Dedicate regular time to practice trading on your demo account. The more you practice, the more confident and proficient you will become.

Implementing Trading Strategies and Techniques

A demo account provides a safe environment to experiment with various trading strategies and techniques. Here are some examples:

- Trend Following: Identify and trade in the direction of the prevailing trend using indicators like moving averages or MACD.

- Support and Resistance: Learn to identify key support and resistance levels on charts and trade accordingly.

- Breakout Trading: Enter trades when price breaks through significant support or resistance levels, indicating a potential change in trend.

- Scalping: Aim for small profits by taking advantage of short-term price fluctuations.

- News Trading: Analyze market reactions to economic news releases and trade based on the expected impact on currency pairs.

Tips and Best Practices for Maximizing Benefits

- Simulate Real Market Conditions: Set realistic trading hours and use a demo account with live market data to mimic the real trading environment.

- Avoid Overtrading: Resist the temptation to take too many trades, especially when you are still learning. Focus on quality over quantity.

- Be Patient: Trading takes time and practice. Don’t expect to become a profitable trader overnight.

- Learn from Mistakes: View every trade as a learning opportunity. Analyze your mistakes and identify areas where you can improve.

- Stay Updated: Keep abreast of market news, economic events, and Forex trading strategies to enhance your knowledge and adapt to changing market conditions.

The Transition from Demo to Live Trading

The transition from a Forex free demo account to live trading can be both exciting and daunting. While a demo account provides a risk-free environment to practice trading strategies and familiarize yourself with the platform, live trading involves real money and the potential for real losses. To ensure a smooth transition and minimize the risks, it is essential to carefully consider the differences between demo and live trading environments and prepare a comprehensive plan for your live trading journey.

Checklist for Transitioning to Live Trading

A checklist can help you navigate the transition from a demo to a live account and ensure a smooth start to your live trading journey.

- Define your trading goals and risk tolerance: Determine your financial goals and the level of risk you are willing to take. This will help you choose a suitable trading strategy and allocate capital accordingly.

- Develop a trading plan: Create a detailed plan outlining your trading strategy, entry and exit points, risk management rules, and profit targets. This will provide structure and discipline to your trading decisions.

- Choose a reputable broker: Select a regulated broker with a strong track record, competitive trading conditions, and reliable customer support. Research different brokers and compare their offerings before making a decision.

- Fund your live account: Deposit funds into your live account, starting with a small amount that you are comfortable losing. It’s crucial to avoid overtrading and manage your capital effectively.

- Start with a small trading size: Begin with a smaller trading size than you used in your demo account. This will allow you to adapt to the real market environment and minimize potential losses.

- Monitor your performance and adjust your strategy: Regularly review your trading performance, identify areas for improvement, and adjust your strategy accordingly. Be prepared to adapt to changing market conditions.

Differences Between Demo and Live Trading

There are significant differences between demo and live trading environments that you need to be aware of when transitioning to live trading.

| Feature | Demo Trading | Live Trading |

|---|---|---|

| Risk | No financial risk | Real financial risk |

| Emotions | Limited emotional impact | High emotional impact |

| Market Conditions | Simulated market data | Real-time market data |

| Slippage and Gaps | No slippage or gaps | Slippage and gaps can occur |

| Trading Costs | No trading costs | Commissions, spreads, and other fees apply |

Risk Management and Emotional Control

Proper risk management and emotional control are crucial during the transition to live trading.

“Risk management is the process of identifying, assessing, and controlling threats to an organization’s assets and earnings.” – Investopedia

- Set stop-loss orders: Use stop-loss orders to limit potential losses on your trades. These orders automatically close your position when the price reaches a predetermined level.

- Avoid overtrading: Do not trade more than you can afford to lose. Start with a small trading size and gradually increase it as you gain experience and confidence.

- Manage your emotions: Trading can be emotionally challenging, especially during periods of market volatility. Avoid making impulsive decisions based on fear or greed. Stick to your trading plan and remain disciplined.

- Take breaks and seek support: If you are feeling overwhelmed or stressed, take a break from trading and seek support from a trusted mentor or financial advisor.

Last Word

A Forex free demo account is an invaluable resource for anyone interested in trading currencies. It empowers you to learn, practice, and refine your trading skills before venturing into the live market. By taking advantage of this risk-free opportunity, you can build a solid foundation, develop a winning strategy, and increase your chances of success in the dynamic world of Forex trading.

Commonly Asked Questions

What is the difference between a demo account and a live account?

A demo account uses virtual funds and does not involve real money, while a live account uses your own capital for actual trading.

How long can I use a Forex free demo account?

The duration of a demo account varies by broker, but most offer indefinite access.

Can I use a demo account to test automated trading systems?

Yes, many demo accounts allow you to test and backtest automated trading strategies.

Are there any limitations to using a demo account?

Demo accounts may have limitations on the number of trades, order types, or available instruments.